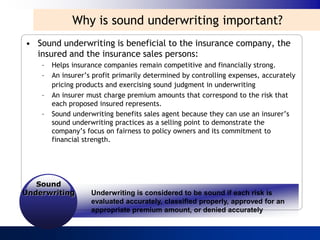

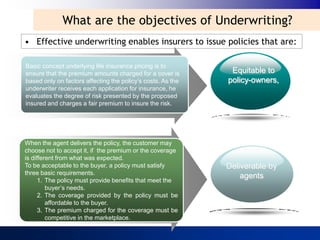

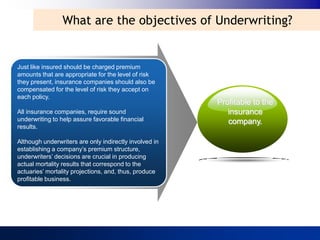

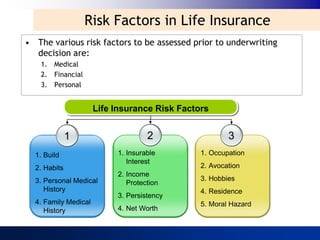

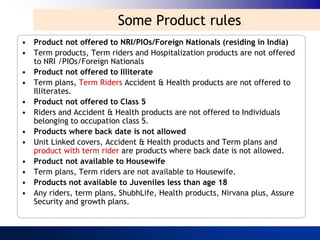

The document discusses the key objectives and process of underwriting in the insurance industry. It provides definitions of underwriting as examining and classifying risks to determine appropriate premiums. The objectives are outlined as providing equitable, profitable and deliverable insurance policies. Key aspects covered include risk factors considered, principles of utmost good faith and moral hazard, types of underwriters and their roles, and importance of sound underwriting. Rules for application forms and documentation requirements are also summarized.

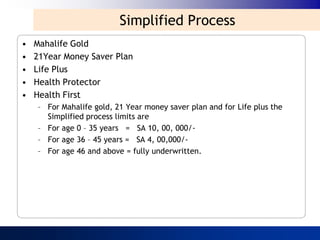

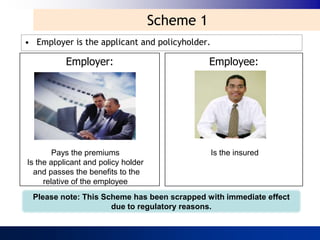

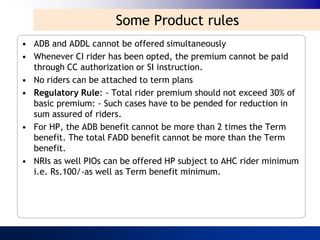

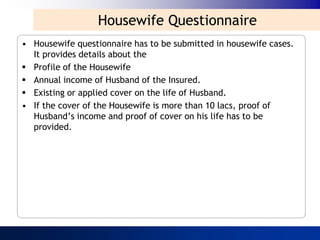

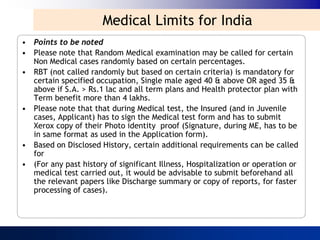

![Insurance Products

[Sum Assured: Rs. 100]

Risk Premium Risk Premium

[Rs. 25] [Rs. 5] [Rs. 5]

[Rs. 20]

Savings Premium

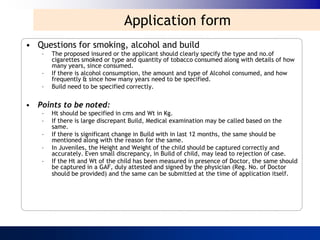

Typical Endowment Plan Typical Term Plan

[5 Year]](https://image.slidesharecdn.com/insurance-underwriting-130121062156-phpapp02/85/Insurance-underwriting-9-320.jpg)

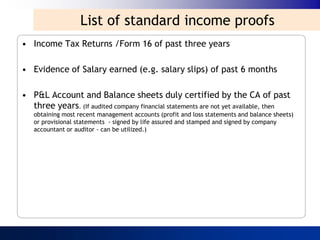

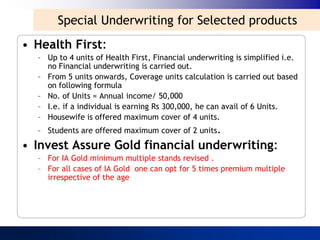

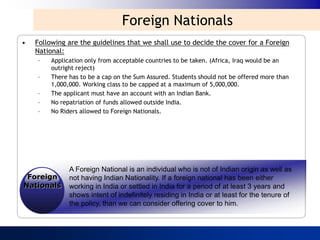

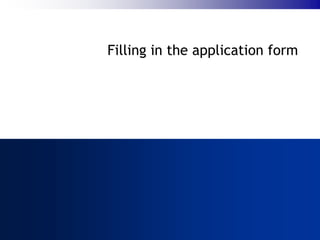

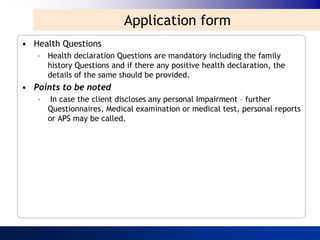

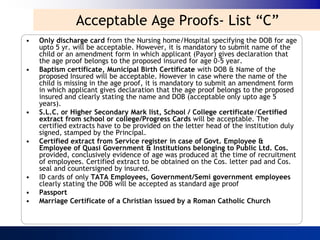

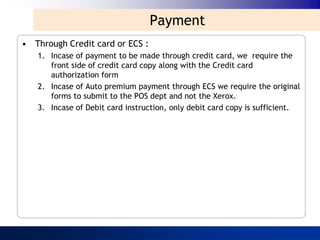

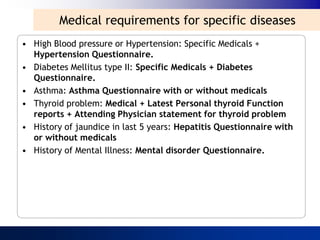

![Medical Table- Health First

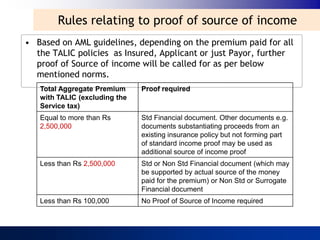

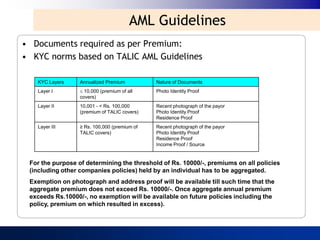

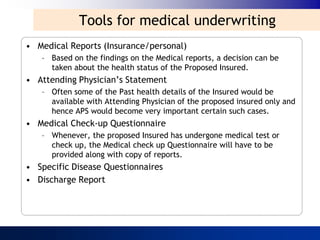

• The Non medical limit is 2 units subject to a maximum age of 55

years. Age 56 and beyond are subject to Medical requirements.

• The Medical requirements table for the FIH product is:

Medical Limits for India -FIH.

Age

Units 18 - 35 36 - 45 46 - 50 51 - 55 56 +

0-1 0 0 0 0 2

2 0 0 2 2 2

3-4 0 2 2 2 2

5-7 3 3 3 3 3

8-16 3 3 3 4 4

17-20 4 4 4 4 9

Medical Examination [ME] to be performed by AIA Panel Doctors.

HIV Testing Limit Rs 800,000. All Term cover to have HIV testing

0. Non Medical

1. Blood or Saliva test (HIV)

2. ME, BPA

3. ME, BPB

4. ME, BPC, ECG-R

5. ME (AIA), BPC, ECG-R, APS or Med Records, PFT or CXR

6. ME (AIA), BPC, ECG-R, APS or Med Records (if available), PFT or CXR, Abdominal

Ultrasound

7. ME

8. ME (AIA), Blood (BPC + PSA), ECG-R, APS or Med Records (if available), PFT or

CXR, Abdominal Ultrasound, ECG-EX

9. ME, BPC, ECG-R, APS OR MEDICAL RECORDS, PFT OR CXR, ECG-EX](https://image.slidesharecdn.com/insurance-underwriting-130121062156-phpapp02/85/Insurance-underwriting-76-320.jpg)

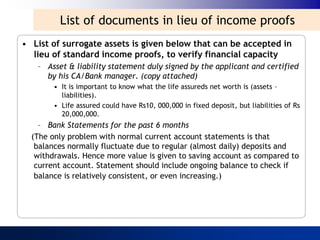

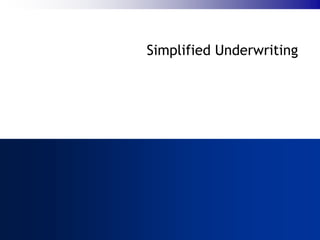

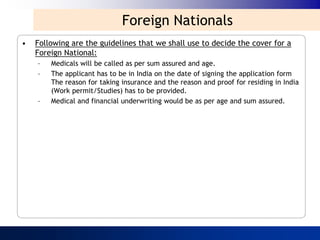

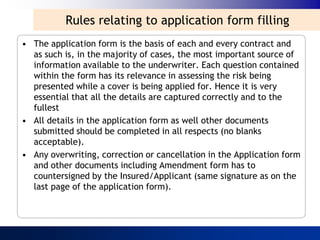

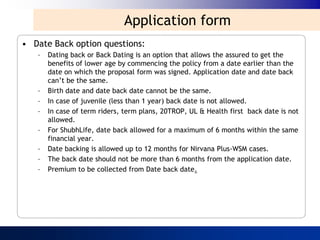

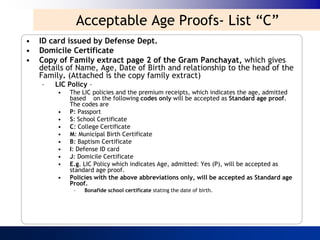

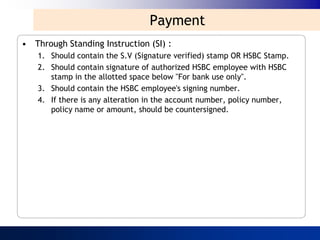

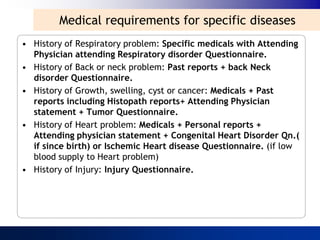

![Medical Table- Health First

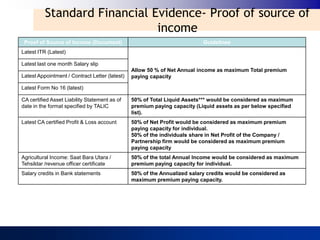

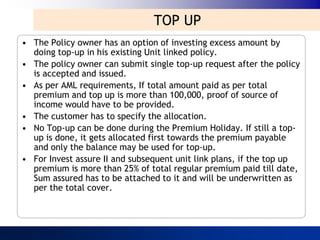

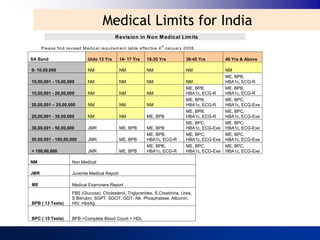

Blood Profile A Cholesterol, Triglycerides, Glucose, Creatinine,

[BPA] Urea, HbsAg, SGOT, SGPT, Alk Phos, Gamma GT,

Albumin.

Blood Profile B HIV, Cholesterol, Triglycerides, Glucose, Creatinine,

[BPB] Urea, HbsAg, SGOT, SGPT, Alk Phos, Gamma GT,

Albumin.

Blood Profile C CBP, HIV, Cholesterol, Triglycerides, HDL Chol,

[BPC] Glucose, Creatinine, Urea, HbsAg, SGOT, SGPT,

Gamma GT, Alk Phos, Albumin, AFP.

Term benefit and Total permanent Disability benefit of Health protector

would trigger medicals based on general life Medical table, whereas

Critical Illness or cancer benefit would trigger medicals based on Health

first Medical table (where different medical are required based the two

tables, higher medicals will be called).](https://image.slidesharecdn.com/insurance-underwriting-130121062156-phpapp02/85/Insurance-underwriting-77-320.jpg)

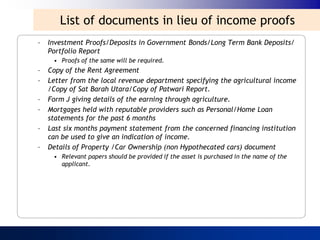

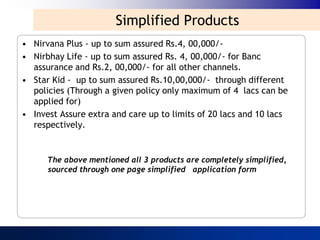

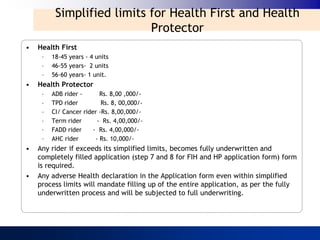

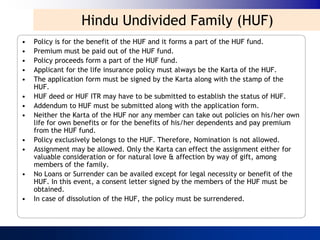

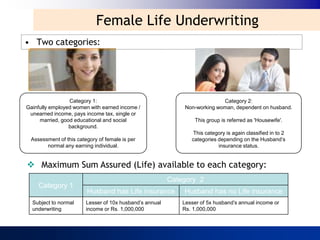

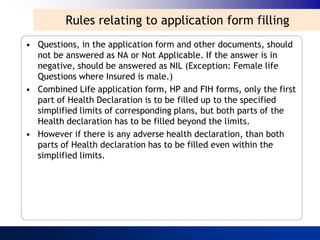

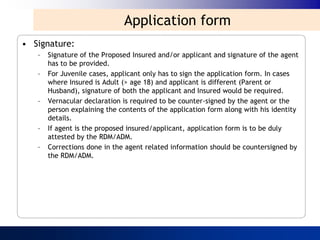

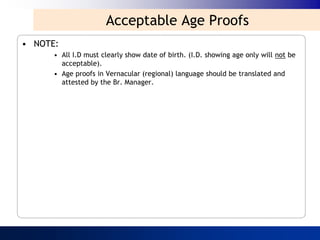

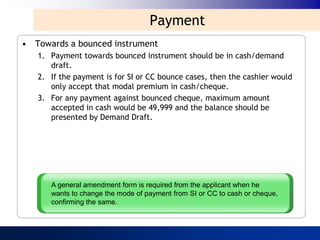

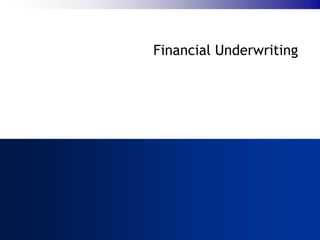

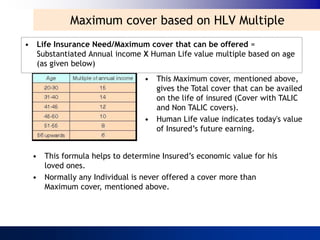

![Financial Limits

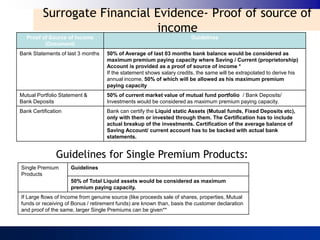

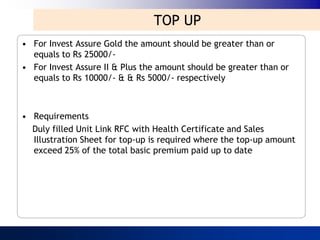

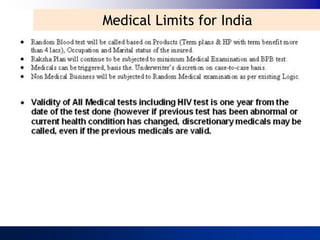

• Total Sum Assured for Financial Underwriting:

This includes the amount of Basic SA of all policies with TALIC (including pure

term plans) + Term rider of all policies with TALIC + CI rider of all the policies with

TALIC +1/2 of Payor benefit rider+ Top up sum assured + Non simplified Health

Protector {Term benefit (if more than 4 lacs) + CI benefit + TPD Benefit + Accident

Benefit} + Basic cover of all policies with other companies

• Financial Requirement grid:

Financial Limit Requirement

Up to Rs. 2,500,000/- Application Form

Rs. 2,500,001/- to Financial Questionnaire

5,000,000/-

Rs. 5,000,001/- to o Financial Questionnaire

10,000,000/- o Asset and Liability Statement [Refer annexure]

& Surrogates/Std Financials

Rs 10,000,001 and above o Financial Questionnaire

o Std Financials along with surrogates & Asset –

Liability statement](https://image.slidesharecdn.com/insurance-underwriting-130121062156-phpapp02/85/Insurance-underwriting-88-320.jpg)