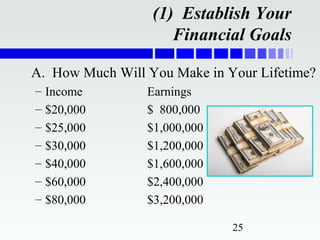

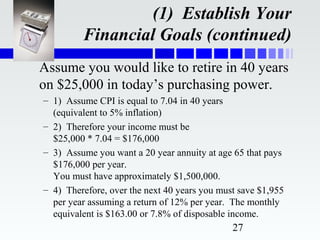

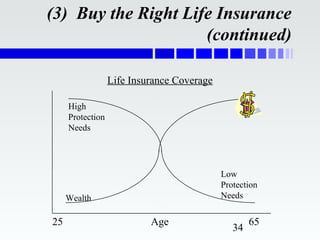

This document provides an overview of establishing an investment program and personal financial planning. It discusses assessing current financial conditions through a personal balance sheet and income statement. It also covers establishing financial and investment goals, factors like return, risk and taxes, and providing liquidity. Specific investment goals are quantified. Historical data on incomes, taxes and home costs from 1960-2002 are presented. The power of compound interest is discussed through examples. Risks and red flags for various industries are also outlined. Steps for managing personal finances like establishing goals, saving, insurance, taxes and investing are presented.