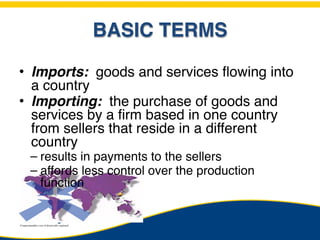

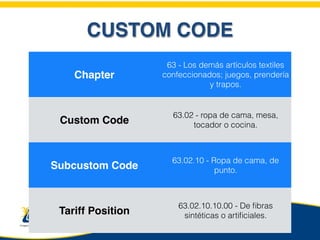

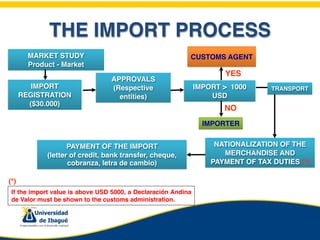

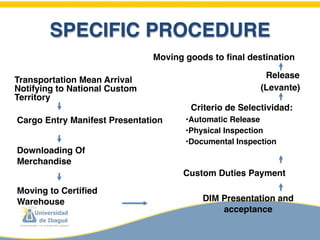

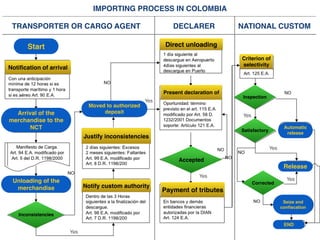

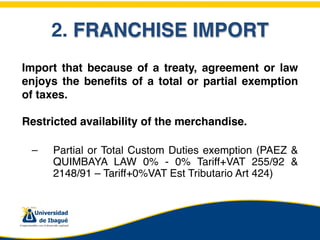

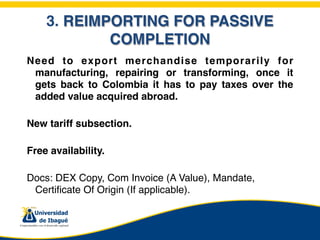

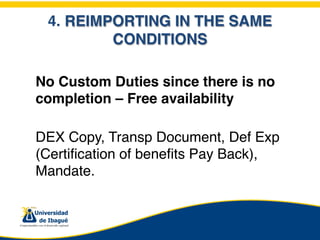

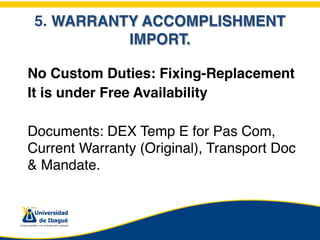

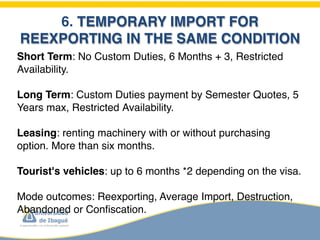

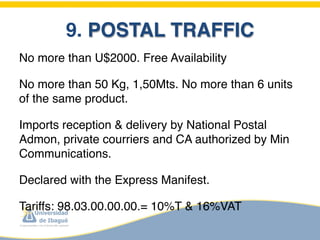

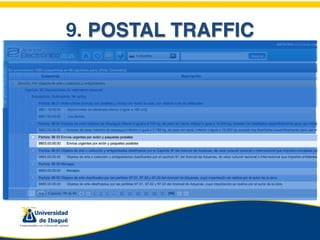

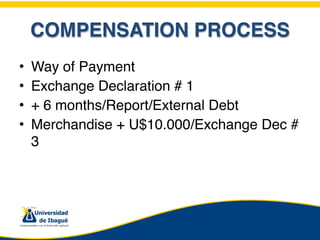

The document outlines the basic terms and process for importing goods into a country, including the various reasons for and steps in importing, different import regimes, and supporting documentation required. It also describes the specific import procedures that must be followed in Colombia, including interactions with customs agents and different import modes.