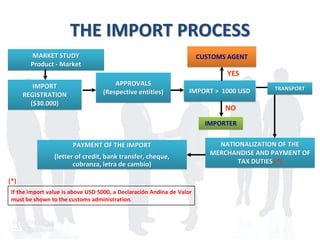

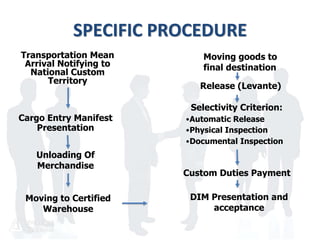

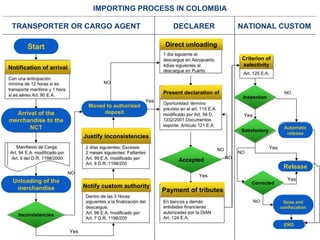

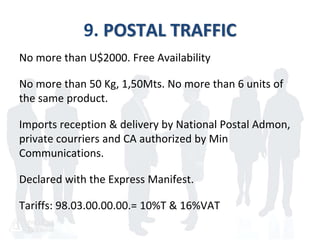

This document provides an overview of key concepts and processes related to international business and importing. It defines basic terms like imports and importing. It outlines reasons why companies import, such as raw material shortages or cost reduction. It then describes the typical steps in the import process, including market study, product identification, import registration, approvals, transport contracting, and import payment. It also covers import regimes like free imports, previous license imports, and forbidden imports. Finally, it details various import modes and provides examples of supporting import documents.