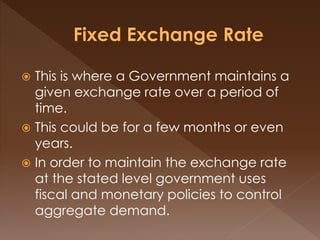

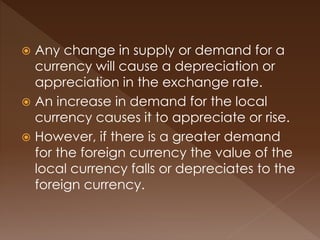

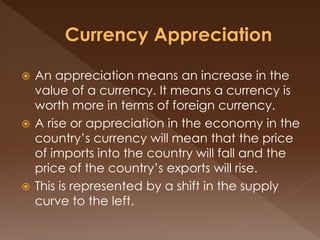

The document discusses exchange rates, defining them as the value of a nation's currency in terms of another currency, with three primary types: fixed, floating, and managed float. It highlights the implications of each system on trade, inflation, and economic stability, noting the advantages and drawbacks of maintaining certain exchange rate regimes. Additionally, it explains how appreciation and depreciation of a currency affect import and export prices, domestic demand, and overall economic growth.