NewBase Special 25 February 2015

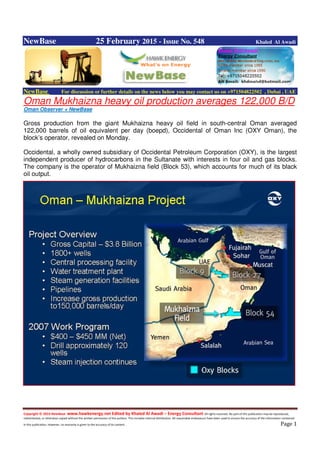

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 25 February 2015 - Issue No. 548 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oman Mukhaizna heavy oil production averages 122,000 B/D Oman Observer + NewBase Gross production from the giant Mukhaizna heavy oil field in south-central Oman averaged 122,000 barrels of oil equivalent per day (boepd), Occidental of Oman Inc (OXY Oman), the block’s operator, revealed on Monday. Occidental, a wholly owned subsidiary of Occidental Petroleum Corporation (OXY), is the largest independent producer of hydrocarbons in the Sultanate with interests in four oil and gas blocks. The company is the operator of Mukhaizna field (Block 53), which accounts for much of its black oil output.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 In a SEC filing on Monday, Occidental said it had drilled more than 2,400 new wells by the end of 2014, while pressing ahead with the implementation of a major steamflood project targeting Mukhaizna’s heavy oil reservoir. Gross daily production from the field averaged around 122,000 boepd, which was 15 times higher than the production rate in September 2005, when the company took over operation of the field under a production sharing agreement with the Omani government. Occidental’s share of production from Oman was approximately 76,000 boepd in 2014, it stated. Significantly, the 2014 output from Mukhaizna roughly matches the previous year’s production of 123,000 boepd. By end 2013, around 2,100 new wells had been drilled across the field, with a further 300 new wells added during the course of 2014. Mukhaizna hosts one of the world’s largest thermal Enhanced Oil Recovery (EOR) projects. At the core of the project is an oil treatment plant with a capacity of more than 180,000 barrels of oil per day and steam injection facilities of a capacity greater than 550,000 barrels of steam per day (bspd). With further engineering and construction, the plant’s steam generation capacity has the potential to be ramped up to over 600,000 bspd. In addition to its role as the operator of the Mukhaizna field, Occidental has a 45 per cent working interest in the block. The firm is also the operator of Block 9 and Block 27, with a 65 per cent working interest in each block. The latter blocks contain the Safah and Wadi Latham fields. In 2008, Occidental was awarded a 20-year Exploration and Production Sharing Agreement for Block 62 — also known as the Habiba Block in north Oman — with a 48 per cent working interest. The company has been pursuing development and exploration opportunities targeting gas and condensate resources within the 2,200 sq km concession. Last year, it announced the signing of a five year extension for the initial phase for the discovered non associated gas area (natural gas not in contact with crude oil in a reservoir) for Block 62. Sixteenth Investment Company LLC (an affiliate of Mubadala Petroleum of Abu Dhabi) has a 32 per cent interest in the block, with Oman Oil Company (a wholly Omani government owned energy investment vehicle) holding the balance 20 per cent.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 President Bouteflika calls to profit from all energy resources of country APS President of the Republic Abdelaziz Bouteflika on Tuesday has underlined the need to fructify the conventional and unconventional hydrocarbons as well as the renewable energies of the country and to profit from them while ensuring the protection of the population health and the environment. "Oil, conventional and shale gas as well as renewable energies are gifts from God. We have to fructify them and profit from them, for us and for future generations, while scrupulously ensuring the protection of the population health and the environment," stressed the Head of State in a message, read on his behalf in Arzew (Oran, 432 km west of Algiers) by the Adviser to the Presidency of the Republic, Mohamed Ali Boughazi, on the occasion of the double anniversary of the nationalization of hydrocarbons and the creation of the General Union of Algerian Workers (UGTA). President Bouteflika said that the historic decision to nationalize hydrocarbons was the culmination of independence through the recovery of the economic sovereignty. The nationalization has become, since then, "a major factor that allowed to make up for the economic backwardness resulting from over one century of colonial domination and to ensure a social development commensurate with the ideals of the glorious Revolution of 1 November 1954," said the Head of State in his message. The nationalization and the development of hydrocarbons has allowed to establish an industrial base, which has become today better integrated through the growing number of small and medium-sized companies and the creation of job opportunities, he said. While citing the achievements made in the sector of hydrocarbons since its nationalization in 1971, the President of the Republic underlined that more than 430 oil and gas discoveries have been made, two-thirds of them by the national hydrocarbon company SONATRACH, adding that the national hydrocarbon production has tripled.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 Tunisia:Mazarine Energy spuds onshore Chouchet El Atrous-1 (Cat-1) well Source: Mazarine Energy Mazarine Energy, a private international upstream oil and gas exploration and production company, has announced that its subsidiary, Mazarine Energy Tunisia, and partner ETAP (Entreprise Tunisienne d’Activités Pétrolières) have commenced a two-well drilling campaign in the Zaafrane permit in central Tunisia. The first well, Cat-1, was spudded on 10 February 2015. CTF (Compagnie Tunisienne de Forage) has been contracted for the drilling campaign. The wells, targeting the Ordovician, will be drilled to a depth of 3,900m. The campaign is expected to last up to six months. If the well encounters commercial hydrocarbons, Mazarine Energy plans to develop the field within two years. The Zaafrane permit spans an area of 5,168 km2 within a historically prolific oil and gas producing region. Mazarine Energy is the operator of the Zaafrane permit with ETAP and MEDEX as partners. 'Spudding the Cat-1 well within 12 months of acquiring the new 3D seismic is a major achievement,' said Mazarine Energy Executive Chairman Edward van Kersbergen. 'This milestone is a tribute to the hard work of Mazarine Energy’s Tunisian team and would not have been possible without the dedicated support of our partner ETAP.'

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 Egypt to receive first import of LNG cargo- due in March BY BLOOMBERG NEWS Egypt, with Africa's third-largest reserves of natural gas, plans to receive its first cargo of foreign liquefied fuel next month, a government official said The country is set to import at least 76 shipments of liquefied natural gas (LNG) to help meet domestic needs until it can boost its own gas production and restore exports after halting them last year, said Hamdy Abdel Aziz, head of the Petroleum Ministry's Media Department. He didn't identify the supplier of the shipment due in March at a floating regasification terminal in Ain al- Sokhna on the Gulf of Suez. "We expect that by 2020 we will stop importing gas," Abdel Aziz said in a phone interview on Monday from Cairo. "Depending on the needs of the local market and the diversity of its energy mix, we may resume exports after 2020 as major field development and exploration projects are under way. The North African country's gas output peaked in 2009 at 647 billion cubic feet, according to the United States Energy Information Administration. Exports dropped as the Arab world's most populous nation used more fuel in industries and homes and amid attacks on a gas pipeline to Israel and Jordan Egypt has signed 56 contracts for $12 billion in exploration investment since November 2013, according to the ministry. BP, RWE, Dana Gas, Edison and Total won licences this year. State- run Egyptian Natural Gas Holding is offering eight additional concessions in the Mediterranean Sea, the ministry said Second terminal The government has agreed to buy cargoes of LNG from Trafigura, Vitol, Noble Clean Fuels and Algeria's Sonatrach, according to the ministry's website. It's also in talks for shipments from BP and Gazprom The country will need to lease a second floating regasification terminal as imports increase, Abdel Aziz said. LNG is gas chilled to a liquid that tanker ships can transport to distant destinations not linked by pipelines Egypt has two LNG-exporting plants, with shipments from one of them, operated by Union Fenosa Gas, stopped since 2013. The other plant, run by BG Group, declared force majeure in

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 January 2014, citing 'ongoing diversions' of its gas supply to the local market, according to BG's website. "It's all but impossible for Egypt to return to regular gas exports by 2020, or any date really," Robin Mills, head of consulting at Manaar Energy in Dubai, said Monday in an e-mail. "Demand is still rising fast, and there is a big supply-demand gap to meet the needs of the power and industrial sectors." Overdue payments International companies began to invest again in Egypt to explore for and produce gas after receiving some of the overdue payments owed them for past production. The government halted the earlier payments amid political unrest that hurt official finances by curbing tourism and deterring investors Dana Gas plans to double gas output from its Egyptian concessions to 400 million cubic feet a day by the end of the decade, the company said. BP should produce 1.2 billion cubic feet a day of gas starting in 2017 at its North Alexandria concession, Abdel Aziz said. The latest contracts awarded include drilling rights in the Nile Delta and Western Desert and in offshore areas of the Mediterranean and Gulf of Suez. "For domestic production, there are some signs of hope, like progress with BP on North Alexandria," Mills said. "But gas prices for producers need to rise for the new, more difficult deep offshore fields, and subsidies for consumers need to be reduced further."

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 Iran to spend up to $4.8 bln from sovereign fund on oil development Reuters + NewBase Iran will withdraw up to $4.8 billion from its sovereign wealth fund to spend on developing its oil and gas fields next fiscal year under a proposal approved by parliament on Tuesday. The decision to dip into the National Development Fund underlines the heavy financial pressure which Iran faces from low oil prices and international economic sanctions over its disputed nuclear programme. The hard currency allocation, which will supplement other budgetary allocations for the sector, also shows the large sums which Iran needs to spend to modernise its ageing oil fields and crumbling energy infrastructure. "Members of parliament gave permission to the National Development Fund to pay $4.8 billion into bank deposits for use in expansion projects at combined oil and gas fields," state news agency IRNA reported on Tuesday. The money would be spent as part of the state budget for next fiscal year, which starts on March 21. The National Development Fund is estimated at about $62 billion, according to the Sovereign Wealth Fund Institute, which tracks the industry. Some of its assets may be frozen by the sanctions, which have blocked foreign investment in Iran's energy sector. After the plunge in oil prices over the last several months cut its oil revenues, Iran slashed the oil price assumption in next fiscal year's budget to $40 a barrel from $72. The government cut domestic fuel subsidies last April to save money, and government spokesman Mohammad Baqer Nobakht hinted on Tuesday that subsidies might be reduced further. Additional revenues "will come from correcting the prices of energy products", IRNA quoted him as saying, without giving details of the plan.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 US: Obama vetoes Keystone pipeline approval bill Source: Reuters via Yahoo! Finance President Barack Obama on Tuesday swiftly delivered on his vow to veto a Republican bill approving the Keystone XL oil pipeline from Canada, leaving the long-debated project in limbo for another indefinite period. The Senate received Obama's veto message and Senate Majority Leader Mitch McConnell immediately countered by announcing the Republican-led chamber would attempt to overturn the veto by March 3. Obama rejected the bill hours after it was sent to the White House. Republicans passed the bill to increase pressure on Obama to approve the pipeline, a move the president said would circumvent a State Department process that will determine whet her the project is in the U.S. national interest.

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 UK exploration activity hits record low Offshore Energy – Staff Oil and Gas UK, an industry body representing offshore oil and gas companies in the UK, has revealed that exploration activity in the UK last year dropped to its lowest levels since 1965. Exploration activity deteriorated more than expected in 2014, with only 14 of the expected 25 wells actually drilled. The number of drilled wells includes sidetracks. The downward trend has thus continued since 2009. To remind, there were 15 exploration wells drilled in the UK in 2013. The report reveals that inability to access capital was cited as the main reason for low exploration activity, which led to the discovery of just 50 million boe that has the potential to be commercially developed. In its activity survey, Oil & Gas UK paints a bleak outlook for the year ahead, exploration- wise. As few as 8 to 13 exploration wells are forecast to be drilled in 2015 as the lower oil price adds to existing barriers, such as uncertainty of capital and affordable rig availability, the industry body has sad. Eighteen appraisal wells were drilled,including sidetracks, This was 7 more than expected, but down from the 29 wells drilled in 2013. No more than 5 appraisal wells are forecast for 2015, a fall that is driven by poor exploration results over the last 4 years, Oil & Gas UK report has revealed. “This trend is of fundamental concern to all stakeholders and raises questions about the UKCS’ sustainability. It will require concerted effort by all parties to both understand the drivers that have depressed exploration activity and assess the factors that can most effectively lead to an improvement in the outlook,” Oil & Gas UK has said.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 Oil Price Drop Special Coverage Falling oil prices and its implications on Qatar’s economy By Dr Abdulaziz A Al-Ghorairi Following the decision in late 2014 by Opec not to cut oil production, the cost of a barrel of crude fell to its lowest in five years in mid-January this year. Although the price of oil has recovered marginally since then, it continues to trade significantly lower than its earlier peak. Low oil prices spells bad news for many countries. Stock markets around the world have taken a beating following the oil price crash, with oil exporters bearing most of the brunt. Decreasing oil prices are expected to strengthen the dollar and a corresponding relative decline in the currencies of a number of emerging market economies who are particularly dependent of commodity exports. The decline in financial assets tied to oil may lead to widespread defaults of companies and countries, which will in turn precipitate financial contagion, leading to global financial instability. Qatar, by contrast, appears almost immune to cheap oil. Whilst Qatar is a significant oil producer, it is predominantly a gas exporter and the price of its natural gas exports are only weakly correlated with oil. Qatar’s economic performance is expected to remain strong, thanks largely due to the solid expansion in non-hydrocarbon sector and wise fiscal planning. Whilst in nominal terms the economy grew by a slower rate of 5.2% over the first half of 2014 due to terms of-trade losses on sliding international oil prices, robust economic growth is still expected during 2014 to 2016. Despite the recent downtrend in oil prices, the Ministry of Development, Planning and Statistics kept 2014 GDP growth estimates unchanged at 6.3% in December 2014, while marginally reducing the 2015 forecast from 7.8% to 7.7%, making 2015 Qatar’s fastest year of expansion since 2011. Non-hydrocarbon activities continue to drive overall economic momentum in Qatar, propelled by investment spending and population growth. In 2015, the non-hydrocarbon sector will account for more than half of nominal GDP, with construction expected to record the strongest growth among all economic sectors as planned public investment projects and infrastructure projects related to the FIFA World Cup 2022 gain momentum. Qatar’s banking sector also remains robust and despite growth in deposits slowing down in recent quarters, positive loan growth momentum has continued.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 With adequate capital bases and liquidity buffers, Qatar’s banking sector is in a strong position to overcome the near term hurdles caused by the oil price declines. Manufacturing had a sluggish performance in 2013 and 2014, but growth rates will rebound somewhat in 2015 and continue to pick up in 2016, contributing 8.9% of real GDP. The service sector contributes heavily to Qatar’s GDP and will continue to rise in addition to manufacturing and construction sectors. In terms of the State budget, the government follows a conservative oil price approach for fiscal planning and Qatar also has huge fiscal reserves to cover any deficits in the near term. The fiscal balance for 2014/2015 targets an overall surplus of QAR7.2bn, considerably lower than 2013/2014 surplus of QAR108bn. Nevertheless, this indicates that Qatar is strong enough to face tumbling oil prices, especially when compared to its GCC peers. Lower oil and gas revenues are offset by higher investment income and Qatar has notably been accumulating substantial foreign assets through its sovereign investment vehicles. The accumulated value of Qatar’s current account surpluses over 2000 to 2014 amounts to $345.7bn, providing a strong cushion and resources to finance the budget and bear the near term hurdles of low oil prices. Looking to the future, there is much uncertainty around the fluctuation of the oil prices and it is difficult to comment on when prices will begin to move upwards again. At present, declining oil prices are generally considered to be a temporary phenomenon due to weaker demand in a sluggish global economy and higher supply from US shale producers. The majority of US shale producers have a break-even point at $60 per barrel and at current weaker prices shale producers may find their business unviable, leading to lower future supply and a rebound in oil prices when global demand increases in coming years. In Qatar, government estimates assume full indexation of gas revenue to oil prices, giving break-even oil prices of $42 and $55 in 2014 and 2015 respectively. However, the break-even price is expected to increase to about $71 in 2016, as government expenditure continues to grow, oil production declines and Qatar Petroleum’s financial surplus moderates. Qatar’s fiscal break-even oil price happily remains much below forecasted oil prices in 2015 and close to forecasted prices in 2016. Macroeconomic performance is expected to remain strong due to increased performance of the non- hydrocarbon sector and increased investment income, making Qatar’s break-even oil price much lower than our Opec peers. Although a future linked to oil prices (however loosely), is always uncertain, we believe Qatar will be able to comfortably sail through the hurdles caused by the recent fall in oil prices.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Oil market is stabilising, USD60 is OK for now - OPEC delegate Reuters + NewBase Oil prices have started to stabilise around current levels of $60 a barrel and demand is showing signs of improving in Asia and other regions, a senior Gulf OPEC delegate said on Tuesday. The comments indicate that the core Gulf members of the Organization of the Petroleum Exporting Countries are showing no sign of wavering in their strategy to focus on market share rather than cutting output, despite concerns from other members about falling oil revenue. "Oil prices seem to stabilise around the current level ... there are a lot of indications showing that demand is growing," the senior Gulf OPEC delegate told Reuters. "The market is stabilising as well as prices," the delegate said, adding that $60 a barrel is "okay for now." Oil traded higher near $60 a barrel on Tuesday, up more than 30 percent from a near six-year low close of $45 on Jan. 13. Prices collapsed from $115 in June due to oversupply, in a decline that deepened after OPEC refused to cut output. The delegate said oil demand was showing signs of recovering in Asia, emerging economies, Latin America and the United States. It is expected to grow more strongly in the second half of 2015 as the global economy picks up, helping to absorb excess crude supply in the market, he added. At OPEC's last meeting in November, Saudi Arabia and its Gulf allies argued that the group needed to ride out lower prices in order to defend market share against shale oil and other competing supply sources, rather than cut output. The price decline since last year has hurt the economies of smaller OPEC producers, whose budgets depend more on higher oil prices than the Gulf members, and some of them have continued to lobby for OPEC cuts.

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 In a sign of concern about the impact of the price collapse, Nigerian Oil Minister Diezani Alison- Madueke told the Financial Times she would call an emergency OPEC meeting if oil prices fell any further. But the senior Gulf delegate added OPEC was unlikely to meet before its next scheduled gathering in June, and defended its November decision not to cut output since non-OPEC countries did not offer to help. "It is unlikely to have an emergency meeting especially with the market and prices starting to stabilise," he said. "OPEC has to keep its market share and not to sacrifice for other producers outside the group. Russia and other non-OPEC producers still refuse to cooperate with OPEC."

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 25 February 2015 K. Al Awadi

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17