New base 19 november 2017 energy news issue 1102 by khaled al awadi

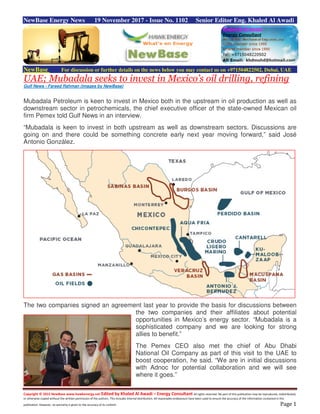

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 19 November 2017 - Issue No. 1102 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE; Mubadala seeks to invest in Mexico’s oil drilling, refining Gulf News - Fareed Rahman (images by NewBase) Mubadala Petroleum is keen to invest in Mexico both in the upstream in oil production as well as downstream sector in petrochemicals, the chief executive officer of the state-owned Mexican oil firm Pemex told Gulf News in an interview. “Mubadala is keen to invest in both upstream as well as downstream sectors. Discussions are going on and there could be something concrete early next year moving forward,” said José Antonio González. The two companies signed an agreement last year to provide the basis for discussions between the two companies and their affiliates about potential opportunities in Mexico’s energy sector. “Mubadala is a sophisticated company and we are looking for strong allies to benefit.” The Pemex CEO also met the chief of Abu Dhabi National Oil Company as part of this visit to the UAE to boost cooperation, he said. “We are in initial discussions with Adnoc for potential collaboration and we will see where it goes.”

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Mexico, one of the world’s largest producers of oil, has a current production of 2 million barrels per day of oil apart from 4 billion cubic feet of gas. “The production has gone down from 3 million barrels of oil per day because the fields have become old. We are working hard to replenish it and increase production.” Opec, non-Opec agreement The country is also part of the Opec and non-Opec production cut agreement that came into effect earlier this year. Mexico has not been reducing output as the production has been falling on its own, he said. “I think this agreement has given stability and certainty to the oil markets.” The Latin American country also undertook reforms in the energy sector in 2013, ending Pemex’s monopoly on the oil and natural gas sector and opening the industry to greater foreign investment. “Opening of the sector had a tremendous impact. We have attracted enormous amount of investment and the commitment in the hydrocarbon sector is $80 billion in the coming years with big names like BP, Eni, Total, Shell, Exxon Mobil.” Shale oil exists in Mexico because it is in the same basin as in the United States but due to some environmental regulations, the country has not been undertaking shale production, he said. “We are trying to get our production slowly back up with lot investments in the upstream. We are also trying to get our refinery to function as efficiently as possible. Right now we can process roughly half of our oil production. If we can maintain our refineries better and operate them better we could increase that up to 60 to 70 per cent of our production,” he added.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Oman: Musandam power plant to offer smart power solutions Oman Observer The Musandam Independent Power Project (IPP) power plant in northern Oman, supplied and built by the technology group Wärtsilä, will provide eco-friendly power generation solutions to the region, according to the equipment’s Finnish suppliers. High-level representatives from Wärtsilä attended the official inauguration of the project last week. The ceremony was attended by executives from the plant owners, Musandam Power Company (MPC). The 120 MW generating facility will contribute to the overall economic development of the Musandam Governorate. The Musandam Governorate is a rapidly developing region, and the Wärtsilä Smart Power Generation plant will provide much needed grid stability, the Finnish corporation said in a press statment. In addition to providing a sustainable and reliable electricity supply to support the region’s economic development, the plant will also provide significant environmental benefits by operating on associated gas from local oil wells, which would otherwise be flared into the atmosphere, it noted. The plant was delivered by Wärtsilä on a turnkey contract. Power is generated by 15 Wärtsilä 34DF dual- fuel engines running primarily on gas but capable of switching to light fuel oil if necessary. The efficient 34DF engines can reliably operate in high humidity and ambient temperatures that can reach 50 degrees C in the region. The Smart Power Generation plant also requires almost no water for cooling, which was an important consideration in the selection of the Wärtsilä solution. In officially opening the facility, Salim al Hashmi, Project Director, Musandam Power Company, stated: “This plant is a central part of the major integrated development of the Musandam Governorate. The project will play a significant role in meeting the power needs of the region’s current and upcoming industries, while at the same time benefiting the local community.” In his speech, Sushil Purohit, Vice-President, Middle East, Asia and Australia, Energy Solutions, said: “We are proud to showcase the capabilities of Wärtsilä’s Smart Power Generation in meeting the region’s strict grid code requirements. We are proud that we can also contribute to a cleaner environment by lowering CO2 emissions through our advanced technology. We congratulate MPC and the Omani authorities for their vision and foresight in developing and supporting this project.”

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Pakistan: Mitsui to participate in FSRU project in Pakistan Source: Mitsui Mitsui & Co has entered into an agreement with BW Group to form a joint venture and to acquire a 49% stake in the JV to jointly own the Floating Storage and Regasification Unit ('FSRU') BW Integrity. The deal is expected to close as soon as the payment for the acquisition is completed. This deal is the first FSRU project for Mitsui, and the first project for a Japanese company to participate in the LNG receiving infrastructure business in Pakistan. The JV will lease the FSRU to PGP Consortium ('PGPC') based on a long-term FSRU lease agreement and PGPC will provide LNG regasification services to Pakistan LNG Terminals Ltd ('PLTL'), a state-owned company. Pakistan began importing LNG in 2015 to cater to growing domestic demand for natural gas, and declining production of indigenous gas. The demand for imported LNG in Pakistan is expected to grow steadily and reach 20 million tons per annum by 2022. As Pakistan's second LNG receiving facility in the country, this project delivers a key energy infrastructure project of high national importance. BW Group is a major player in the maritime oil and gas industry, with a well-diversified fleet of over 150 vessels which includes LNG and LPG carriers, floating gas infrastructure, product tankers, FPSOs, dry bulkers, chemical tankers, and possesses a long- standing and best-in-class vessel management capabilities. This is BW's second FSRU project, with the first being a sister vessel, BW Singapore, which is currently based in Egypt on a five-year charter.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 UK: Angus Energy commences production from Lidsey-X2 Source: Angus Energy Angus Energy, a conventional oil and gas production and development company, has commenced production at the Lidsey oil field from the well, Lidsey-X2. Following the drilling and completion of the Lidsey-X2 horizontal production well, which was drilled on time and within budget, the Company is working through the production start-up and production has now been initiated. Initial start-up rates of production from the Great Oolite reservoir are coming in at forty barrels of 38.5 API of dry oil per day. The fluid column (oil) extends to 322m from surface (bottom hole depth of 1,009.3m) with a measured static bottom hole pressure of 764 psi. The Great Oolite is the first of three reservoirs with potential viability in Lidsey-X2 as per the Company RNS of 6 November 2017. Compared to pre-drill assessments set forth in the Competent Person's Report ('CPR') of the 7 November 2016 Admission Document, flow rates from the Great Oolite reservoir are below expectations, and work is continuing to clean up the well. The Company is investigating the new geological and borehole information to update its understanding of the reservoir. In addition, the Company is currently examining evidence that suggests a partial flow reduction is the result of a hole in the production tubing, therefore not allowing the well to be fully drawn down. The Company is conducting further analysis and if confirmed, the Company will undertake operations to repair the tubing which will allow maximum draw from the reservoir. This is the priority for the Company over the coming weeks. In addition to any necessary repair, industry information and technical guidance on analogous wells in the region suggest initial flow rates can be improved. Angus Energy believes its initial flow rates from Lidsey- X2 have similar potential for increased yield. Therefore, the Company is conducting a thorough study to optimise and enhance production levels from the Great Oolite.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Further to the Company RNS of 6 November 2017, Angus Energy will submit an FDP Addendum to the Oil and Gas Authority ('OGA') to begin production appraisal of the Kimmeridge and Oxford layers at Lidsey. Operations Update: Lidsey-X1 The Lidsey-X1 well, first drilled in 1987, will now resume production from the Great Oolite reservoir in addition to production from Lidsey-X2. The Company expects to achieve the historic production levels of 15-20 barrels of oil per day ('bopd') before the well was shut in nearly 2 years ago in January 2016. Given the encouraging geochemical analysis of Lidsey-X2's Kimmeridge and Oxford Layers, disclosed in the Company RNS of 6 November 2017, the above-mentioned FDP Addendum will include a submission to conduct analysis of the production potential from the Kimmeridge layer and Lias source rock from Lidsey- X1. The Lidsey-X1 exploration well was previously drilled through all the aforementioned layers. The Lias source rock, positioned beneath the Great Oolite, has a comparable composition to the interbedded limestones / shales found in the hybrid Kimmeridge reservoir at the Company's Brockham Oil Field, located on the northern end of the Weald Basin. The deeper depth of the Lias source rock in the Lidsey-X1 indicates an increased maturity as compared to layers above the Great Oolite such as the component Kimmeridge and Oxford layers of the Lidsey-X2, as outlined in the Company RNS of 6 November 2017. Paul Vonk, Manging Director of Angus Energy, commented: 'Production has now commenced from Lidsey-X2. This project was delivered on time and on budget. Even with these initial flow rates, Lidsey-X2 provides commercial production and cash flow. We will continue to optimise production from the Great Oolite reservoir at Lidsey as we work to increase flow rates and we look forward to developing its additional reservoirs to enhance long run value for our shareholders.'

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Norway Idea to Exit Oil Stocks Is ‘Shot Heard Around the World’ Bloomberg - Joe Ryan Norway’s $1 trillion sovereign wealth fund proposed an exit from nearly $35 billion in oil and gas stocks. Norway’s proposal to sell off $35 billion in oil and natural gas stocks brings sudden and unparalleled heft to a once-grassroots movement to enlist investors in the fight against climate change. The Nordic nation’s $1 trillion sovereign wealth fund said Thursday that it’s considering unloading its shares of Exxon Mobil Corp., Royal Dutch Shell Plc and other oil giants to diversify its holdings and guard against drops in crude prices. European oil stocks fell. Norges Bank Investment Management would not be the first institutional investor to back away from fossil fuels. But until now, most have been state pension funds, universities and other smaller players that have limited their divestments to coal, tar sands or some of the other dirtiest fossil fuels. Norway’s fund is the world’s largest equity investor, controlling about 1.5 percent of global stocks. If it follows through on its proposal, it would be the first to abandon the sector altogether. “This is an enormous change,” said Mindy Lubber, president of Ceres, a non-profit that advocates for sustainable investing. “It’s a shot heard around the world.” The proposal rattled equity markets. While Norwegian officials say the plan isn’t based on any particular view about future oil prices, it’s apt to ratchet up pressure on fossil fuel companies already struggling with the growth of renewable energy. Norway’s Finance Ministry, which oversees the fund, said it will study the proposal and will take at least a year to decide what to do. The fund has already sold off most of its coal stocks. “People are starting to recognize the risks of oil and gas,” said Jason Disterhoft of the Rainforest Action Network, which pushes banks to divest from fossil fuels.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 The fossil fuel divestment movement began on college campuses about five years ago and has gained momentum since. The argument is simple: climate change has exponentially increased the risk of backing coal, oil and gas, so investors should put their money elsewhere for the sake of both the planet and their own fortunes. The Rockefeller Family Fund announced in 2016 that it sold its stake in Exxon and would dump all other fossil-fuel investments. The California State Teachers’ Retirement System board voted to divest from U.S. coal companies. AXA SA, the French insurance giant, said it would sell 500 million euros ($589 million) in coal holdings. Norway’s fund dwarfs them all. “The divestment movement just got some new juice,” said Jamie Webster, a fellow at the Center on Global Energy Policy at Columbia University. While environmentalists heralded the fund’s proposal, the move has more to do with hedging risk than saving the planet. Norway derives about 20 percent of its economic output from oil and gas.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Finance officials have long debated whether reinvesting those profits back into petroleum producers leaves Norwegians overly exposed to the volatility of oil prices. “Our perspective here is to spread the risks for the state’s wealth,” Egil Matsen, the deputy governor at the central bank in charge of overseeing the fund, said in an interview in Oslo Thursday. “We can do that better by not adding oil price risk through the fund.” It won’t happen quickly, said Per Magnus Nysveen, senior partner and head of analysis at the Oslo-based consulting company Rystad Energy. Norway’s positions in oil companies are vast, and finance ministers will unload their shares gradually if they want to maximize returns, Nysveen said. “We are taking about years rather than months or quarters,” he said. “This has nothing to do with the environment. It is purely a financial debate.” That’s true, Lubber said. But the debate, she said, underscores that climate change has made fossil fuels increasingly risky investments -- even in the eyes of a petroleum giant like Norway. “It’s an enormously important statement,” Lubber said. “Once one major player does it, others will follow.”

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 US: Keystone pipeline spill pushes oil higher, fuels TransCanada opponents Reuters - Nia Williams, Kevin O'Hanlon A major oil spill on the Keystone pipeline in South Dakota helped push U.S. crude prices higher on Friday, while fueling opposition to another pipeline project by owner TransCanada Corp that faces a crunch decision in Nebraska next week. An aerial view shows the darkened ground of an oil spill which shut down the Keystone pipeline between Canada and the United States, located in an agricultural area near Amherst, South Dakota, U.S., in this photo provided November 18, 2017. The climb in U.S crude futures and slide in Canadian heavy crude prices, as well as TransCanada Corp shares, came the day after the 5,000 barrel spill, tied for this year’s largest pipeline leak in the United States. No date has been set for reopening Keystone, TransCanada said, adding that a media report that had identified a restart date was incorrect. The spill gave further ammunition to environmental groups and other U.S. opponents of another pipeline the company has proposed, the long- delayed Keystone XL. Keystone carries 590,000 barrels per day of crude from Alberta’s oil sands to markets in the United States. The state of Nebraska was set to decide on Monday whether to approve Keystone XL. On Thursday, Calgary, Alberta-based TransCanada said it had contained the leak in the town of Amherst, South Dakota, and was investigating the cause. It said the pipeline will be shut until it gets approval to restart from the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA). “It’s not a tiny spill by any means,” said Kim McIntosh, environmental scientist manager at the South Dakota Department of Environment and Natural Resources. McIntosh said it may take

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 longer than usual for the company to determine the extent of contamination, a process that usually takes days. The last Keystone pipeline spill recorded was about 400 barrels of oil in Hutchinson County, South Dakota, in April 2016. “The 2016 release took around 10 months to clean up; this will take longer,” said McIntosh. “I can’t predict whether it will take 20 months or 12 months.” In Nebraska, Keystone XL opponents seized on the spill as an example of its environmental risks. “Pipelines are basically plumbing; and plumbing leaks. It comes as no surprise,” said Tom Genung, who lives near the proposed Keystone XL route in Holt County, Nebraska. The Nebraska Public Service Commission, or PSC, is scheduled to announce a decision on Monday on Keystone XL. Its decision focuses narrowly on whether the pipeline is in the public interest, and not on environmental issues, which it is not allowed to consider. Art Tanderup’s family farm in Neligh, Nebraska, lies in the path of the 830,000 bpd Keystone XL project. He said the proposed XL pipeline would be built over huge swaths of porous, sand-like soil atop the Ogallala aquifer, putting farmers and ranchers at risk of water contamination if a spill occurs. ”We would have so much crud and chemicals in the Ogallala aquifer that we could never clean up,” he said. TransCanada shares closed down 0.9 percent on the Toronto Stock Exchange at C$62.54. The South Dakota spill ties with January’s spill from the Seaway pipeline near Trenton, Texas, for the largest U.S. crude oil pipeline spill in 2017, U.S. data showed. TransCanada spokesman Terry Cunha said the company is assisting with the storage of crude in Hardisty, where Keystone originates, and that it regrets the impact caused to customers. No date set yet for Keystone pipeline restart: TransCanada spokesman U.S. West Texas Intermediate crude ended up $1.41, or 2.6 percent, at $56.55 a barrel. Traders said the shut-in would add to bullish sentiment due to fewer barrels going into Cushing, Oklahoma, the delivery point of the WTI contract. The WTI prompt spread (CLc1-CLc2) narrowed by as much as 8 cents. If the pipeline is shut for a week, it would affect at least 2 million barrels of crude going into Cushing, according to estimates by traders. The pipeline also brings oil into Patoka, Illinois. Export pipeline shutdowns also pressure the price of Canadian crude because barrels get bottle-necked in Alberta. The discount for Western Canada Select for January delivery in Hardisty, Alberta, widened to $16.00 per barrel below the West Texas Intermediate benchmark, according to Shorcan Energy brokers. On Thursday, January barrels settled at $15.50 per barrel below U.S. crude.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase November 19 - 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil rises over 2 percent, but shows first weekly fall in six Reuters + NewBase + Bloomberg Oil rebounded more than 2 percent on Friday after falling for five straight session as a major U.S. crude pipeline was shut and traders anticipated an OPEC deal to extend curbs on production. Brent crude oil LCOc1 rose $1.36, or 2.2 percent, to settle at $62.72 a barrel while U.S. West Texas Intermediate crude (WTI) CLc1 ended $1.41, or 2.6 percent, at $56.55 a barrel. For the week, Brent was down 1.3 percent and WTI fell 0.3 percent. Prices, however, fell for the first week in six, pressured by rising U.S. output data and doubts that Russia would support an extension of the OPEC output cut deal. Prices rebounded after Thursday’s comments by Saudi Arabia’s energy minister signaled a willingness to extend output cuts when OPEC meets on Nov. 30. Oil price special coverage

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 “Obviously, the comments gave us guarantee that the extension is going to happen and was a driving story overnight,” said Phil Flynn, an analyst at Price Futures Group in Chicago. TransCanada Corp’s (TRP.TO) 590,000 barrel-per-day (bpd) Keystone pipeline remained shut after a leak in South Dakota on Thursday. Traders said the shut-in would add to bullish sentiment due to fewer barrels going into Cushing, Oklahoma, the delivery point of the WTI contract. The WTI prompt spread CLc1-CLc2 narrowed by as much as 7 cents in the day. Meanwhile, money managers raised their net long U.S. crude futures and options positions this week, with short positions at their lowest level since March. Prices fell this week as fears of oversupply remained after U.S. government data showed oil output C-OUT-T-EIA touching a record 9.65 million bpd last week. The International Energy Agency also said that the United States would account for 80 percent of the global increase in oil production over the next decade. “Market participants are closely watching the rising oil-production profile in the U.S., which will remain the predominant bearish factor,” said Abhishek Kumar, senior energy analyst at Interfax Energy’s Global Gas Analytics in London. U.S. energy companies kept the oil rig count unchanged this week, General Electric Co’s Baker Hughes energy services firm said on Friday. Some analysts expect a gradual decline in the fourth quarter. Signs of rising U.S. output have dampened the impact of output cuts by the Organization of the Petroleum Exporting Countries (OPEC), Russia and several other producers. Earlier this week, Russia’s Rosneft said an exit from the supply curb deal was a serious challenge, though added that it was committed to a deal. "Ahead of the OPEC meeting, we’re going to see a little bit of volatility," Gene McGillian, a market research manager at Tradition Energy in Stamford, Connecticut, said by phone. "Going forward, the market needs to keep seeing that the fundamental picture is continuing to tighten."

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Oil’s rally to the highest in more than two years last week faltered as Russia is said to be hesitant to commit to a decision on the cuts so soon, suggesting OPEC wait until closer to the deal’s expiration at the end of March. U.S. crude output gained this week to the highest in more than three decades, according to government data. Adding to the tension, the International Energy Agency said milder-than-normal winter weather is putting a brake on demand growth. West Texas Intermediate for December delivery settled $1.41 higher at $56.55 a barrel on the New York Mercantile Exchange. Doubts Loom on OPEC's Horizon After bullish bets on Brent crude hit a record and futures surged to two-year highs, hedge funds are pulling back with a sense that the rally reached its limit for now. Wagers on lower prices rose by the most since June as Middle East tensions took a backseat, while uncertainty looms over Saudi Arabia’s push to extend OPEC’s output curbs this month. "We’re at levels where the market appears to have crested," said Gene McGillian, a market research manager at Tradition Energy in Stamford, Connecticut. "Continuing to see supply draw- downs is probably what the next leg of the rally will be predicated on." Doubts over Russia’s willingness to go along with the Saudis, record production from America’s prolific shale fields and a worse outlook for demand from the International Energy Agency helped snap oil’s longest streak of weekly gains in a year. At the same time, concern over heightened geopolitical risks in the Middle East seems to have subsided, at least for now, said Rob Haworth, who helps oversee about $150 billion in assets at U.S. Bank Wealth Management in Seattle. "We haven’t seen more conflict," he said. "For prices to get a lot higher, you have to see a meaningful increase in disruptions -- and we haven’t."

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Hedge funds lowered their Brent net-long position -- the difference between bets on a price increase and wagers on a drop -- by 1 percent to 537,557 contracts in the week ended Nov. 14, according to data from ICE Futures Europe. Shorts surged 8.7 percent, while longs fell 0.1 percent. Meanwhile, the net-bullish position on West Texas Intermediate, the U.S. benchmark, rose 10 percent to 349,712 contracts over the same period, according to the Commodity Futures Trading Commission. The net-long position on benchmark U.S. gasoline rose 11 percent, and diesel net- longs rose 3.3 percent. But that optimism may be fading, too. WTI also fell from its recent highs, with American crude stockpiles rising by more than 4 million barrels in two weeks. Plus, there are real risks that OPEC may not be able to effectively extend cuts and will add to the overhang spurred by the U.S. shale surge, said Haworth. "It’s hard for me to make a case that we’re creating a new higher trading range," he said. "We’re still staying cautious here." Tesla Truck Could Threaten Big Chunk of Oil Demand, If It Works Tesla Inc.’s unveiling on Thursday of a new electric truck showed Elon Musk can match Steve Jobs’s ability to wow the tech crowd with a glimpse of the future. If he can equal the manufacturing prowess of Apple Inc.’s current Chief Executive Officer Tim Cook, he might just clobber the oil industry too. That’s a big if, given Tesla’s current inability to meet manufacturing targets on the mass-market Model 3 electric car. But if the company really can deliver a battery-powered big rig with a 500- mile range and lower lifetime costs than diesel vehicles, then a big chunk of future oil demand growth is in peril. Road freight accounts for about a fifth of world oil consumption, mostly diesel, according to the annual World Energy Outlook published by the International Energy Agency this week. Trucks are responsible for about 60 percent of the increase in global diesel demand since 2000, the report shows. Freight will be even more important to the oil market in the future. The IEA expects gasoline demand to start falling before 2040 -- in part because of the big increase in electric cars -- but it says road freight and aviation will have no choice but to keep using oil. Buses and trucks will drive a 2 million barrel-a- day increase in diesel demand from 2016 to 2040, and overall oil demand will keep growing, it said. Musk said his new truck “can transform into a robot, fight aliens and make one hell of a latte.” Showmanship aside, if the truck is a success, the IEA’s forecasts may prove wildly optimistic.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Special Coverage News Agencies News Release November 19-2017 Forgot About Keystone? Canada's Oil Majors Haven't By Liam Denning P H O T O G R A P H E R : A N D R E W B U R T O N Canada's oil means no disrespect -- it is Canadian -- but it would just like to get the hell out of Canada. The question is: Can it? I wrote here last week about logistical bottlenecks playing havoc with U.S. oil pricing. But Canada takes this to a new level. Most of the country's oil comes from Alberta. Heavier, higher in sulfur and far from the American refineries on the Gulf Coast optimized to take it, Western Canada Select crude oil tends to trade at a discount to West Texas Intermediate. It also trades at a discount to Mexican Maya crude, which is similarly tough to refine but much closer to the Gulf. In general, therefore, the discount of WCS versus Maya usually reflects the extra cost of piping those Canadian barrels south, roughly $7 to $10 a barrel. Recently, though, the spread has blown out: Heavy Canadian heavy oil usually trades at a discount to Mexican barrels because it has to travel further to market. But the spread is now well beyond pipeline costs This partly reflects some of those U.S. bottlenecks I mentioned. Meanwhile, production of heavy oil from Mexico -- and another regional supplier, Venezuela -- has been declining, and Saudi Arabia has been withholding barrels.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 But the bigger issue is that Alberta's production is outpacing its pipelines. And the problem will get worse before it gets better: Futures imply average spreads of about $17 a barrel over the next two years. Western Canada produced 3.9 million barrels a day in 2016, and that's set to reach almost 4.8 million a day in 2022, according to the Canadian Association of Petroleum Producers. That growth is front-loaded, too: Sand Storm New oil-sands projects are about to start up, boosting Alberta's production Note: Data after 2016 are projections. Local refineries can process about 525,000 barrels a day, and a new one starting up next year should run roughly another 40,000 a day. With about 3.3 million barrels a day of effective pipeline export capacity, that leaves about 330,000 barrels a day looking for a way out this year. That jumps to more than 600,000 a day next year and almost 700,000 a day by 2019. Oil that can't secure space on a pipe has to go by rail instead, which costs more like $13-$18 a barrel to get to the Gulf Coast. Hence the widening spreads in futures prices (and lower margins for producers). Three new pipelines are proposed. But getting pipelines built isn't straightforward these days -- one of the three is that Keystone XL project you might have heard about over the past decade. Even assuming they clear all their regulatory hurdles, secure customers and go smoothly, extra capacity wouldn't begin to show up until the second half of 2019:

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Coming Down The Pipe? Three proposed pipeline projects could eventually add another 1.5 million barrels a day of export capacity for western Canada's oil producers Note: Production data post-2016 are projections. Assumes local refinery utilization of 85 percent. Assumes existing- pipeline utilization of 80 percent; planned pipelines at 85 percent. Assumes Line 3 replacement enters service in 2H2019. For the next two years, at least, therefore, pricing will be a headwind for producers in western Canada, though not all equally. Imperial Oil Ltd. and Cenovus Energy Inc. are more exposed because they refine less of their own heavy oil production compared to, say, Canadian Natural Resources Ltd. and Suncor Energy Inc. On the flip-side, Canadian National Railway Co. and some of its peers should benefit as more barrels switch to rail: Rolling Along Canadian producers have started loading more barrels on to trains again as pipeline constraints start to bite Note: Trailing 12-month averages. U.S. refiners able to process Canadian barrels looking for a home could also benefit from cheaper raw materials (similar to what happened with Midwestern crude before the U.S. export ban was

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 lifted in late 2015). HollyFrontier Corp. and Phillips 66 should capture some of the discount on Canadian oil for themselves. Looking beyond 2019, though, it's worth remembering there's no guarantee all these pipelines get built. Besides regulatory hurdles, if they all show up, western Canada would flip quickly from a pipeline shortage to a surplus. The chart below shows what happens if Enbridge Inc.'s Line 3 replacement project -- the likeliest of the three -- goes ahead and neither, one, or both of the others get built: XL or Excess? There is clearly room for two new pipelines, but the addition of both Trans Mountain and Keystone XL after the Line 3 project would create a lot of surplus export capacity Note: Oil production projections as per CAPP figures noted in the accompanying column. Assumes local refinery utilization of 85 percent; existing pipeline utilization of 80 percent; new pipeline utilization of 85 percent. TransCanada Corp. told investors last week that if regulators in Nebraska give the go-ahead later this month, it has clients ready to support the Keystone XL project. Despite the apparent surplus this would entail, Canadian oil producers may well value an extra option. Two other pipeline proposals have died already -- including TransCanada's own Energy East proposal -- and there's no guarantee Kinder Morgan Canada Ltd.'s Trans Mountain expansion gets built. Spare capacity could also accommodate potential new oil-sands projects down the road. That last point still looks like a stretch, though. Besides the uncertainty around medium-term oil markets right now, heavy barrels like those from Alberta face a particular problem from 2020 onward. That's when tighter regulations for marine fuel kick in. Analysts at Tudor, Pickering, Holt & Co., a boutique energy bank, estimate this could result in at least 1.75 million barrels a day of high-sulfur fuel oil effectively flowing back onto the market as ships switch to cleaner options. Those barrels would compete closely with western Canada's output; another headwind to pricing. For all the puts and takes, two things are clear over the next few years. First, Albertan producers that also refine their output can weather the dislocations better. Second, it's a good time to own the exits. This column does not necessarily reflect the opinion of NewBase and its owners.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 27 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase November 2017 K. Al Awadi

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21