New base 490 special 01 december 2014

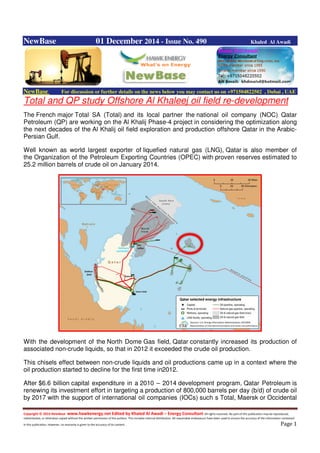

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 01 December 2014 - Issue No. 490 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Total and QP study Offshore Al Khaleej oil field re-development The French major Total SA (Total) and its local partner the national oil company (NOC) Qatar Petroleum (QP) are working on the Al Khalij Phase-4 project in considering the optimization along the next decades of the Al Khalij oil field exploration and production offshore Qatar in the Arabic- Persian Gulf. Well known as world largest exporter of liquefied natural gas (LNG), Qatar is also member of the Organization of the Petroleum Exporting Countries (OPEC) with proven reserves estimated to 25.2 million barrels of crude oil on January 2014. With the development of the North Dome Gas field, Qatar constantly increased its production of associated non-crude liquids, so that in 2012 it exceeded the crude oil production. This chisels effect between non-crude liquids and oil productions came up in a context where the oil production started to decline for the first time in2012. After $6.6 billion capital expenditure in a 2010 – 2014 development program, Qatar Petroleum is renewing its investment effort in targeting a production of 800,000 barrels per day (b/d) of crude oil by 2017 with the support of international oil companies (IOCs) such s Total, Maersk or Occidental

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 Petroleum Corporation (Oxy) to provide their expertise in the enhanced oil recovery technologies (EOR). In this perspective Total and QP renewed their production sharing agreement (PSA) in November 2012 for a period of 25 years starting in 2014 in continuation from the previous agreement signed in 1989. As a result, the working interest in Al Khalij PSA are shared such as: - Total 60% is the operator - Qatar Petroleum 40% From the previous agreement, Total discovered the Al Khalij oil field in 1991 and started the first production of crude oil on 1997. Located 130 kilometers east of Qatar peninsula, at the limit of the territorial waters with Iran, the Al Khaleej ranks in the fifth position of Qatar crude oil fields by number of barrels produced per day behind Al Shaheen, Dukhan, Idd Al-Shargi and Bul Hanine. Since its first oil in 1997, Total and QP managed to ramp the production of crude oil in Al Khaleej up to 50,000 b/d in 2005. Total and QP could maintain a plateau production of 40,000 b/d up to 2008. But since this period, the crude oil production started to decline to run around25,000 b/d currently leading Total and QP to renew their PSA in order to work on the re- development of Al Khalij until 2039. Currently Total and QP operate Al Khaleej with 60 wells and an offshore complex of eight platforms. To re-develop Al Khalij Total and QP may consider only to maintain the current production as a plateau along the next 25 years or to boost production on the first years. Simulation by digital oil field technologies will help to compare the different re-development scenarios in respect with the corresponding costs. Whatever is the selected option, Total and QP are planning to add production wells and offshore platforms on the next five years.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Search for GCC’s highest quality projects launched Saudi Gazette + NewBase The hunt is on to find the Gulf’s project of the year. The region’s leading business information source MEED has launched Sunday its fifth annual Quality Awards for Projects in association with Mashreq. The Awards recognize the best achievements in the region’s major projects industry. Currently some $2.7 trillion worth of projects are planned or underway in the GCC, laying the foundations for the long-term, sustainable development of the region that will support the ambitions of the Gulf’s future generations. MEED aims to support these ambitions by recognizing and celebrating the best achievements of the region’s projects industry through its annual MEED Quality Awards for Projects, run in association with Mashreq. Now in their fifth year, the MEED Quality Awards for Projects, in association with Mashreq, have established themselves as the leading stamp of quality and achievement for companies operating in the GCC projects sector. Previous winners of the coveted MEED Quality Project of the Year include the Burj Khalifa (UAE, 2011), Pearl GTL project (Qatar, 2012), Concourse A – Dubai International Airport (UAE, 2013), and Bahrain Petroleum Company’s (BAPCO) Install Refinery Wastewater Treatment Plant Project (Bahrain, 2014). “The awards not only recognize the construction element of project delivery but also consider the value and quality of a project throughout its entire life cycle, from the design concept through to engineering and construction and its wider contribution to society and to the environment,” said Richard Thompson, Editorial Director, MEED. Central to the success of the awards has been the authority provided by the core values of integrity, trust and transparency associated with MEED. ‘’The judging process evaluates and recognizes the key organizations behind successful project completion across the GCC – including contractors, engineers, architects, consultants, developers and project owners. We are delighted to partner with MEED for the third year to recognize the highest quality projects in the region,” said Julio Armando de Quesada, Group Head – Corporate Banking, Mashreq. Saudi Arabia emerged triumphant with three regional awards, including King Fahad National Library’s King Fahad National Library Project, nominated by Saudi Binladin Group & Gerber Architekten, which scooped the 2014 Social Project of the Year award; while the National Water Company’s Riyadh Water Supply Project won in the 2014 Water & Water Reuse Project of the

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 Year category. MARS Inc.’s MARS Chocolate Factory Project, nominated by Hyder Consulting Middle East Ltd, won the 2014 Small Project of the Year award. As oil prices continue to tumble, there is pressure on the Kingdom to cut oil production in order to maintain higher oil prices. Riyadh however appears reluctant to take this approach, preferring instead to maintain its share of global production. On the projects side, new contractors will be invited to work in the kingdom to take pressure off existing, overloaded players. The move is part of a broader initiative in the kingdom to open up the economy to foreign investment and participation. The awards program will recognize projects completed between January 2013 and December 2014 across several categories, including Oil and Gas Project of the Year, Industrial Project of the Year, Power and Water Project of the Year, Leisure and Tourism Project of the Year, Transport Project of the Year, Social Infrastructure Project of the Year, Building Project of the Year, Sustainable Project of the Year, Award for Innovation and Small Project of the Year. The deadline for submission of projects has been set for Dec. 17, 2014. Winners will be announced at the MEED Construction Leadership Summit taking place in May 26-27, 2015. The Summit is a high-end meeting place for the Gulf’s construction leaders and provides a much needed platform to promote open dialogue between the leading contractors, consultants and clients that examines the strategic direction of the region’s construction industry, the challenges threatening it’s performance and those leading it’s change. In 2014, the Kingdom is expected to award nearly $44 billion worth of projects, owing in large part to the Riyadh Metro project. That scheme, valued at about $22.5 billion, accounted for one quarter of the GCC’s total projects contract awards and about one half of Saudi Arabia’s total.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Oman’s L&T Heavy exports biggest boiler for gas plant Times News Services + NewBase Larsen & Toubro Heavy Engineering, a joint venture with The Zubair Corporation, has achieved a landmark of supplying the world's largest heat recovery boiler for gasification plant to Schmidtsche Schack, Arvos Group, Germany for Reliance pet coke gasification project. The project comprises 10 sets each of heat recovery boilers, high pre ssure steam drums and associated high pressure piping. The first lot of equipment was flagged off from the Sohar facility in the presence of a team from Schmidtsche Schack and the board members from L&T Heavy Engineering which is the first of ten such deliveries The equipment for the heat recovery for the gasification plant is leading the way in its field and is one of a kind in the industry. Schmidtsche Schack is the world leader for developing and fabricating process-critical heat transfer solutions and systems for the chemical and petrochemical industries besides offering waste heat recovery systems for the power industry Schmidtsche Schack holds a number of patents for the heat recovery equipment design and is being fabricated by Larsen & Toubro Heavy Engineering in Oman ably supported from Germany with the manufacturing and supply of the double tube system. The heat recovery boiler alone weighs over 630,000kg and is over 45 metres in length involving fabrication of material with various complex metallurgies The first phase of the project was successfully completed by implementing one of the most modern techniques in the world for fabrication coupled with modern project monitoring systems and the latest technologies for non-destructive testing. Indigenously developed automations for welding were the highlight during the execution and played a crucial role in the successful completion of the products. The delegation from Schmidtsche Schack led by project director Erik Ullrich remarked on the occasion reflecting on the experience through the manufacturing and stated this achievement shall be a lifetime memory for all contributors and stake holders. He complimented the engineering skills and unflagging efforts exhibited by L&T and encouraged the team to achieve the completion of the project to the satisfaction of the end user and maintaining a no lost time incident status. Y. S. Trivedi, chairman of the board of Larsen & Toubro Heavy Engineering highlighted the

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 achievement of the company mentioning the coming of age of the facility in the Sultanate and re- affirmed L&T's commitment towards the vision of His Majesty Sultan Qaboos for in country value and playing a vital role towards non-oil sector contributions to the economy Admiring the contribution of the Omanis in the manufacturing of the equipment he further added that the pride of being associated with such ground breaking projects will lead the way to provide impetus to the new generation to participate in the manufacturing sector L&T Heavy Engineering has been consistently been raising the bench mark not only in the Gulf Cooperation Council (GCC) but the world over as a leading manufacturer of super critical equipment for the process plant and refinery business The workshop in Oman boasts of being the only fabricator manufacturing critical reactors of Cr- Mo-V in the GCC and amongst the 10 companies qualified worldwide. In a short time the company has spread its customer base covering Germany, Spain, South Africa, Turkey, Bahrain, the US, Saudi Arabia, Kuwait, India to mention a few . About Larson & Toubro Larsen & Toubro Limited (L&T) is a technology, engineering, construction and manufacturing company. It is one of the largest and most respected companies in India's private sector. More than seven decades of a strong, customer-focused approach and the continuous quest for world-class quality have enabled it to attain and sustain leadership in all its major lines of business. L&T has an international presence, with a global spread of offices. A thrust on international business has seen overseas earnings grow significantly. It continues to grow its global footprint, with offices and manufacturing facilities in multiple countries. The company's businesses are supported by a wide marketing and distribution network, and have established a reputation for strong customer support. L&T believes that progress must be achieved in harmony with the environment. A commitment to community welfare and environmental protection are an integral part of the corporate vision.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 Statoil could pay high cost for response to exploration failure (Reuters)+NewBase After the failure of its risky exploration strategy this year, Norwegian oil firm Statoil is cutting costs as fast and deep as it can to preserve cash for dividends - and may be jeopardising future production in doing so, industry insiders say. Statoil took a big gamble by committing major resources to what it hoped would be new discoveries in Angola, the Norwegian Arctic and the U.S. Gulf of Mexico. They all failed, leaving two Tanzanian gas fields its only major finds in 2014. With no new prospects to drill, and a 35 percent drop in the price of oil since June, the company is now paying hundreds of millions of dollars to cancel or suspend a third of its exploration fleet in order to find the cash it needs to pay its dividend, which so far this year equalled nearly all of its 30.9 billion crown ($4.46 bln) net profit. "They have gambled and...bet on the wrong horses," says Hilde-Marit Rysst, the head of labour union SAFE, which has thousands of employees with Statoil and its contractors. "They have spent too much and made too many commitments." Statoil's problems are several but the root of them can be simply put: it spent too much money on long drilling contracts in exploration areas before ensuring there would be enough work. Additionally, it took out those contracts at the top of the market, paying record day rates to secure capacity. The company also introduced a quarterly dividend in 2014, bowing to pressure from investors, and put extra burden on cash flow already strained by years of heavy investments. The dividend increase came even as its production cost per barrel jumped by a quarter since 2009, while oil prices have fallen. Analysts estimate Statoil needs oil to rise back to $110 per barrel for it to finance investments and dividends from its cash flow. Oil prices recently slumped to fresh lows around $71 a barrel after OPEC decided not to cut production despite a huge oversupply in world markets. Analysts say Statoil's cash flow at this price is already negative before dividends. Compounding the company's difficulties, Statoil is without a permanent chief executive. Helge Lund left in October for rival BG Group - where his pay could be almost 10 times higher - and Statoil is currently under the helm of former marketing, processing and renewable energy chief Eldar Saetre. "DOUBLE ERROR" At the start of the decade Statoil revamped its exploration strategy, faced with reserves that were starting to dwindle. Instead of small, safe projects, the company went after what exploration chief Tim Dodson called "high impact prospects" around the globe, boosting spending and taking on more risk.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 The strategy advocated by Dodson - a 29-year veteran of Statoil - worked for several years and the company made big finds in Brazil, Canada, Norway and Tanzania. With its failure to make big finds this year, Statoil has taken six rigs out of use, mainly in Norway and also Angola, though it says some of these are short-term. Exiting Angola alone cost it $350 million. The price of many still-operational rigs is eye-watering. One in Tanzania costs more than $700,000 a day to run even as charter rates have fallen this year to below $400,000 per day. "They chartered these vessels at the peak of the cycle and they're cancelling contracts at trough of the cycle. It's a double error," said John Olaisen, an analyst at brokerage ABG. "They're panicking ... They should leverage up to avoid cutting too much." Less exploration will cut Statoil's reserves while reduced drilling on existing fields could cut into recovery rates and its output, analysts said. Spending cuts elsewhere, particularly maintenance work on mature fields, could also affect its output. NO DIVIDEND CUT Though under pressure, the company will stand by its dividend payments, say analysts who met Saetre on Thursday. "Mr Saetre said he would consider a great many options before he cuts the dividend," said Swedbank analysts Teodor Nielsen, who attended the meeting. "We got confirmation that the dividend is a top priority." Even with such generous dividends still in prospect, the Statoil stock is down 4 percent in the past year. Over the past three years, it is down by 7 percent, underperforming all majors, including BP, which was weighed down by the cost of its Macondo spill. For a graphic on oil stocks' performance this year, click here: link.reuters.com/duq53w For a graphic on oil stocks' over the past 3 years, click here: link.reuters.com/fuq53w BP, Shell, ExxonMobil and Total are all cutting costs, laying off staff and selling assets to cope with lower oil prices and pressure from investors for higher returns after their 10-year spending spree. But Statoil is cutting more than the others because its costs are so much higher. Statoil's Dodson declined to be interviewed and the firm said it would announce 2015 exploration plans in February. "They have spent and spent but should have thought more about the long term," said Leif Sande, the head of labour union Industri Energi. "In past cycles they always said they would do better next time, but when (the oil price) goes up again they forget about that." (Editing by Sophie Walker)

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 Russia:Gazprom, PetroVietnam to Jointly Develop Gas Resources Source: RIA Novosti + NewBase Gazprom and PetroVietnam on Tuesday signed a framework agreement on joint development of the Nagumanovskoye and Severo-Purovskoye fields in Russia. The agreement was signed by Alexey Miller, Chairman of the Gazprom Management Committee and Nguyen Xuan Son, Chairman of the PetroVietnam Oil and Gas Group (PVN) Board of Directors. The Gazpromviet joint company will be responsible for the implementation of the agreement. Gazpromviet was set up by Gazprom (51 per cent stake) and PetroVietnam (49 per cent), in 2009 to conduct geological exploration, production and transmission of natural gas, gas condensate and crude oil. The company holds a subsurface use license for the Nagumanovskoye and Severo-Purovskoye fields. “Gazprom stays focused on developing the long-term strategic relationship with Vietnam. We are successful in joint gas production from the Republic's shelf; we are also engaged in oil refining projects as well as develop the NGV sector in Vietnam. Today's agreement will reinforce our partnership in gas production on the Russian territory. It is for the first time when a company from Asia-Pacific acts as a business partner and co-investor of Gazprom's promising fields in Russia,” said Alexey Miller, Chairman of the Gazprom Management Committee, on Tuesday. The Nagumanovskoye oil, gas and condensate field is located within the Akbulak district of the Orenburg region. It holds 5.8 billion cubic meters of proven in-place gas reserves, 1,683 thousand tons of recoverable condensate reserves and 960 thousand tons of recoverable oil reserves. Severo-Purovskoye gas and condensate field is situated within the Purovsky district of the Yamal- Nenets Autonomous Area. Its proven in-place gas reserves account for 45.5 billion cubic meters, recoverable condensate reserves – 6,826 thousand tons. Nguyen Xuan Son and Alexey Miller .

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 Oil Price Drop Special Coverage Dubai finance chief confident on mega-projects even as oil price falls The National + NewBase Dubai’s finance chief believes the emirate can pay for the mega-projects planned over the next five years despite the falling oil price. Speaking exclusively to The National, Abdulrahman Al Saleh, director general of the Dubai Department of Finance, said: “The capital markets have shown full faith in Dubai’s business model and as you have seen, both equity and long term debt is easily accessible to Dubai entities. In addition we have seen the private sector is very keen to participate in the future growth plans of Dubai. “We are fairly confident that all these projects will be commercially viable and will be able to raise both equity and debt to manage healthy financial ratios,” he added. Dubai is a relatively small oil producer, but experts believe the “feelgood factor” of high oil prices in the region is important for the emirate’s overall financial health. The finance department does not believe the state of the oil market is directly relevant to Dubai’s long- term plans. “We are currently growing at a healthy and sustainable pace of 4.5 to 5 per cent in real terms and targeting a similar growth pattern going forward, which when compared to some of the developed nations is very good,” said Mr Al Saleh. “The next five years are very exciting for us. “All entities will be very focused on achieving their targets under the Expo 2020 master plan and will benefit the economy significantly.” Mr Al Saleh added that the emirate’s financial position had improved significantly since the Dubai World “standstill” of 2009. “All headline issues have been addressed, a lot of deleveraging has happened in the past five years and the cost of debt across Dubai has fallen. “Most of the entities which were impacted by the financial crisis have altered their business plans to reflect the new reality and the risks of asset liability mismatches have been materially dealt with,” he said. Dubai would finance its growth though a number of options. “As far as the government is concerned, we would continue to build infrastructure in line with the UAE and Dubai strategic plan 2021, which is based on an analysis of various demand supply dynamics in each sector of the economy.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 “The government in its forthcoming budgets has enough headroom to fund the projects through a healthy debt equity mix. In addition, DoF has been built a strong yield curve to raise both long- term and short-term funds at attractive rates,” he said. The media was partly to blame for the problems of 2009-10, when Dubai was restructuring debts against a background of volatile global markets. “With the benefit of hindsight, the media reaction to the news in 2009 was disproportionate to the actual problem and that led to investors being doubtful of the Dubai growth model,” said Mr Al Saleh. “The leadership in Dubai recognised the issues and came up with a swift action plan to correct the same. As you can see now the government has delivered on all these commitments during the past four to five years.” Mr Al Saleh, who is preparing the imminent Dubai government budget, said that key areas of government work had been on improving communications with investors, property regulation and enforcement and clarity around government and government guaranteed debt, among others.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 Iran, Iraq face difficult time as oil prices plunge . + NewBase Abu Dhabi: Countries which are battling insurgency and economic sanctions will be the first one to get affected as global oil prices continue to drop due to oversupply and lack of demand, energy experts said. The Organisation of the Petroleum Exporting Countries (Opec), which met last week in Vienna, refused to cut the production to arrest the slide of prices. It left the production target unchanged at 30 million barrels per day causing Brent crude to tumble further. Prices hovered around $70.15 per barrel on Sunday. Tommy Amstrup Laursen, director of Ramboll Oil & Gas Middle East, said Libya, Iraq and Iran would face immediate problems. “They’ve been into trouble. [A] drop in prices will affect their revenue and development projects would be put on hold,” Laursen said. Laursen said Gulf countries would not feel the pressure but in the longer run some of their development projects could stall. “They have cash reserves to sustain the price slide. Existing projects are already funded but future projects might get affected.” He believes prices might stabilise after a year to between $85 to $90. “It is a temporary phase,” he said. Arjuna Mahendran, a chief investment officer at Emirates NBD, said Gulf countries are insulated from the crisis at the moment. “They have accumulated good cash reserves over the years. It may not be a big problem for them but it is a tough time for Libya, Iraq and Iran. GDP growth will slow down and budgets will be difficult to fund. They have to cut down on subsidies and raise taxes,” Mahendran said. “Though fall in prices is bad for oil producing countries but it will help oil importing countries like India and China,” he added. “It will spur the global growth and revive the economy. We will see the effect in the next six to twelve months.” Other Opec countries like Venezuela, Algeria, Nigeria, Ecuador and Angola will also see their revenues plunging. Venezuelan President Nicolas Maduro said Caracas will keep trying for a cut in oil production until prices rebound to $100 per barrel. The country is heavily dependent on oil revenues to support its economy.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Dr Sara Vakhshouri, president of US-based SVB Energy International and an expert on Iran, said the country’s economy is going to hurt but they could overcome this by raising taxes. “I think they can manage it but it depends for how long. It will be hard for people due to taxes.” The country is under economic sanctions over its nuclear programme and is holding negotiations with a group of six western nations to end sanctions and increase its exports. Francisco Quintana, an analyst from Asiya Investments said Iran will be the one to suffer first. “The country needs a price of $130 to balance budget. The impact is probably being felt already quite acutely by the authorities there. The situation in terms of reserves is not particularly buoyant, with close to $70 billion.” Next would be Iraq, which needs a $100 barrel to square the budget, with similar reserves to Iran, he said. “Oman and Bahrain also have high breakeven prices and are already looking into measures to cut down spending. Their level of reserves is also low. “ If low prices continue, Oman and Bahrain will have to revise very seriously their budgets for 2016, he added. UAE is unlikely to face the heat. Investments in the oil sector will continue despite the drop in prices, the country said last week. It produces around 2.8 million barrels per day and intends to increase the production to 3.7 million barrels per day by 2017. Oil seen in new era as Opec won’t yield to US shale boom Bloomberg + NewBase Opec’s decision to cede no ground to rival producers underscored the price war in the crude market and the challenge to US shale drillers. The 12-nation Organisation of Petroleum Exporting Countries kept its output target unchanged even after the steepest slump in oil prices since the global recession, prompting speculation it has abandoned its role as a swing producer. Thursday’s decision in Vienna propelled futures to the lowest since 2010, a level that means some shale projects may lose money. “We are entering a new era for oil prices, where the market itself will manage supply, no longer Saudi Arabia and Opec,” said Mike Wittner, the head of oil research at Societe Generale SA in New York. “It’s huge. This is a signal that they’re throwing in the towel. The markets have

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 changed for many years to come.” The fracking boom has driven US output to the highest in three decades, contributing to a global surplus that Venezuela has estimated at 2mn bpd, more than the production of five Opec members. Demand for the group’s crude will fall every year until 2017 as US supply expands, eroding its share of the global market to the lowest in more than a quarter century, according to the group’s own estimates. Benchmark Brent crude fell the most in more than three years after Opec’s decision, sliding 6.7% to close at $72.58 a barrel. Futures for January settlement sank to $70.15 on Friday, the lowest close since May 2010. Prices peaked this year at $115.71 in June. “We will produce 30mn barrels a day for the next 6 months, and we will watch to see how the market behaves,” Opec secretary-general Abdalla El-Badri told reporters in Vienna after the meeting. “We are not sending any signals to anybody, we just try to have a fair price.” Opec pumped 30.56mn bpd in November and has exceeded its current output ceiling in all but four of the 34 months since it was implemented, according to data compiled by Bloomberg. Opec’s own analysts estimate production was 30.25mn in October, according to a report on November 12. Members will abide by the 30mn barrel-a-day target, El-Badri said on Friday. “Opec has chosen to abdicate its role as a swing producer, leaving it to the market to decide what the oil price should be,” Harry Tchilinguirian, head of commodity markets at BNP Paribas SA in London, said on Thursday by phone. “It wouldn’t be surprising if Brent starts testing $70.” Conventional oil producers in Opec can no longer dictate prices, UAE Energy Minister Suhail al- Mazrouei said in an interview in Vienna on November 26. Newcomers to the market who have the highest costs and created the glut should be the ones to determine the price, he said. “That is what Opec is hoping for,” Carsten Fritsch, a commodity analyst at Commerzbank AG in Frankfurt, said in an e- mail. “It’s the question of who will blink first.” Opec may now be prepared to let prices fall to force some drillers with higher production costs to stop pumping, said Julian Lee, an oil strategist who writes for Bloomberg First Word and has

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 worked in the industry for 25 years. That scenario would mark the start of a fourth oil-market era since the end of the 1970s, he said. Since the early 2000s, surging demand growth drove up prices allowing companies to apply new extraction techniques and develop deep-water and other costly oil. That ended an era that pervaded since the mid 1980s, which was characterised by low prices and Opec regaining the market share that it had previously sacrificed in an attempt to preserve high prices, Lee said. Opec will face pressure too, with prices now below the level needed by nine member states to balance their budgets, according to data compiled by Bloomberg. “They haven’t taken collective action,” Richard Mallinson, an oil analyst at London-based Energy Aspects Ltd, said by phone. “That doesn’t mean they won’t do it in the next few months if prices stay low.” Venezuela’s oil income has fallen by 35%, President Nicolas Maduro said on state television on November 19. Nigeria increased interest rates for the first time in three years on November 26 and devalued its currency. The government is planning to cut spending by 6% next year, Finance Minister Ngozi Okonjo-Iweala said on November 16. US oil production has risen to 9.077mn bpd, the highest level in weekly data from the Energy Information Administration going back to 1983. Output will climb to 9.4mn next year, the most since 1972, it forecasts. Middle Eastern exporters including Saudi Arabia, Iran and Iraq can break even on a cost basis at about $30 a barrel, Sanford C Bernstein & Co. They need more to balance their budgets. Some US producers need more than $80, the consulting firm said in a report last month. Opec’s policy will spur a crash in the US shale industry, Leonid Fedun, a vice president and board member at OAO Lukoil, Russia’s second-largest oil producer, said in an interview in London before the group’s decision. “In 2016, when Opec completes this objective of cleaning up the American marginal market, the oil price will start growing again,” said Fedun. “The shale boom is on a par with the dot-com boom. The strong players will remain, the weak ones will vanish.” Igor Sechin, the chief executive officer of Rosneft, Russia’s largest oil producer, said after a meeting with Venezuela, Saudi Arabia and Mexico that his nation wouldn’t need to cut output even if prices fell below $60. “The question is, what price level will be low enough to slow US production growth?” Torbjoern Kjus, an analyst at DNB ASA, Norway’s biggest bank, said by phone. “What price will get US growth to slow to 500,000 bpd from this year’s rate of 1.4mn barrels?” Only about 4% of US shale production needs $80 or more to be profitable, according to the Paris- based International Energy Agency. Most production in the Bakken formation, one of the main drivers of shale oil output, remains profitable at or below $42 a barrel, the IEA estimates. The agency expects US supply to rise by almost 1mn bpd next year, with increasing flows to international markets. “Opec’s decision means it is over to you America,” Miswin Mahesh, a London-based commodities analyst at Barclays, said in an e-mail. “This opens the window for the US to be the new swing producer.”

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your Guide to Energy events in your area

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 01 December 2014 K. Al Awadi

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18