New base 16 february 2021 energy news issue 1406 by khaled al awadi

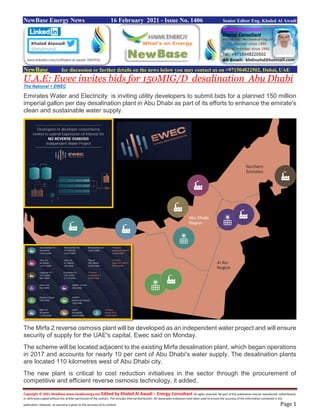

- 1. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 16 February 2021 - Issue No. 1406 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE U.A.E: Ewec invites bids for 150MIG/D desalination Abu Dhabi The National + EWEC Emirates Water and Electricity is inviting utility developers to submit bids for a planned 150 million imperial gallon per day desalination plant in Abu Dhabi as part of its efforts to enhance the emirate's clean and sustainable water supply. The Mirfa 2 reverse osmosis plant will be developed as an independent water project and will ensure security of supply for the UAE's capital, Ewec said on Monday. The scheme will be located adjacent to the existing Mirfa desalination plant, which began operations in 2017 and accounts for nearly 10 per cent of Abu Dhabi's water supply. The desalination plants are located 110 kilometres west of Abu Dhabi city. The new plant is critical to cost reduction initiatives in the sector through the procurement of competitive and efficient reverse osmosis technology, it added.

- 2. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Reverse osmosis is a membrane-based method of desalination, which uses less energy compared with the thermal process of producing fresh water. The method helps lower the energy intensity of an industry that takes up a significant share of regional power consumption. The latest project is part of a wider initiative to "decouple" its power and water generation capacities, Ewec said. "M2 is a project we have developed to support these key strategic aims and enhance clean and sustainable water supply in the emirate of Abu Dhabi," Othman Al Ali, chief executive of Ewec, said. "As we begin the tender process, we are seeking distinguished partners to develop this key project with us," he added. Ewec plans to reach financial close on the scheme by the end of the year, with commercial operations set to commence by the first quarter of 2024. The successful developer or consortium of bidders will own up to 40 per cent of the plant, with the majority stake to be held indirectly by the government of Abu Dhabi. The deadline for the closing of bids for the first stage of the project is March 4 and Ewec will issue a request for qualifications following its review of the expressions of interest. About Emirates Water and Electricity Company Emirates Water and Electricity Company (EWEC) drives the planning, forecasting, purchase and supply of water and electricity in Abu Dhabi and beyond. EWEC performs its role as the sole procurer of water and electricity from independent producers, ensuring the short- and long-term balancing of bulk supply and demand for distribution companies. EWEC is part of ADQ, one of the region’s largest holding companies with a broad portfolio of major enterprises spanning key sectors of Abu Dhabi’s diversified economy. For more information please visit www.ewec.ae.

- 3. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Egypt: United Oil and Gas provides ASH-3 intercepted oil Source: United Oil & Gas AIM-listed United Oil & Gas has provided an update on the drilling of the ASH-3 well in the Abu Sennan concession, onshore Egypt. United holds a 22% non-operating interest in Abu Sennan, which is operated by Kuwait Energy Egypt. Highlights Total of 27.5m net pay interpreted over a 59m gross section in the targeted Alem El Buieb (AEB) reservoir Initial testing will be completed in the coming days before the well is then brought onstream through the existing ASH Field facilities ASH-3 Well The ASH-3 development well, which spudded on the 4th January, reached TD of 4,087m MD (3,918m TVDSS) on 8th February, 5 days ahead of schedule and under budget. The well, which has been drilled as a step-out development well in the ASH Field, has been logged and interpreted to have a 59m gross hydrocarbon column in the primary AEB reservoir target, 27.5m of which is estimated to be net pay. The well will be tested and completed in the coming days and will then be brought immediately onstream through the existing ASH facilities, delivering a further uplift to production. The ED-50 rig will then move to the north of the Licence, close to the producing Al Jahraa field to commence the drilling of the ASD-1X exploration well. This well is targeting the Abu Roash reservoirs in the 4-way dip-closed Prospect D structure and, if successful, can quickly be brought into production. The Company will make a further announcement once testing is complete. United Chief Executive Officer, Brian Larkin commented: 'We are very encouraged with the initial results of the ASH 3 well and we are delighted that it has been delivered safely, ahead of schedule and under budget by our licence partners. We anticipate the well will deliver a further uplift to our low cost production base, an encouraging result ahead of the spudding of our forthcoming exploration well and the remainder of our 2021 work, all of which is fully funded from operating cash flow. 'To date the ASH Field has produced close to 2 million barrels of oil, with current production rates at over 5,000 boepd, and we believe significant further potential exists within the licence.'

- 4. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 U.S: Extreme Cold Rocket energy prices into records levels Energy Crisis, … Bloomberg - Lynn Doan Energy markets have never seen anything quite like this. In a matter of four days, an intensifying cold blast gripping the central U.S. froze natural gas pipelines, sent electricity prices skyrocketing to record levels and ultimately forced Texas’s grid operator to plunge more than 2 million homes into darkness in the first winter weather-related rolling blackouts since 2011. As electricity outages began spreading through a 14-state grid across the southwest, plenty of blame for the crisis was already being assigned. 1. What started this? On the most basic level, the weather. A polar vorte x -- a girdle of winds that keep cold bottled in the Arctic -- buckled and released record-breaking cold across much of the U.S. at the end of the first week of February. By Feb. 9, temperatures had plummeted from Denver to Chicago, and hundreds of places across the central U.S. set daily temperature records. Prices for different types of heating fuels began to surge higher, including oil and natural gas. Demand for propane climbed to a 17-year high. Gas and electricity use similarly rose. 2. What turned the cold into an energy crisis? As temperatures continued to fall, gas pipelines began to seize up, wind turbines started to freeze, and oil wells shut in -- just as homes and businesses raised demand for heating to record levels. The strength of gas demand across the central U.S., especially in Oklahoma, caught some traders

- 5. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 by surprise. Physical delivery of the fuel at one hub in Oklahoma traded at an astonishing $600 per million British thermal units. By Friday Feb. 12, traders were panicking and trying to line up additional supplies for the long holiday weekend. That evening, Texas’s chief energy regulators called an emergency meeting to prepare to ration gas supplies across the state. They adopted a measure that put residential customers, medical facilities, schools and churches at the front of the line for gas ahead of industrial users. 3. Why couldn’t the grid keep up with demand? Texas’s grid operator says widespread shortages of natural gas supplies to power plants and a decline in wind generation helped create the shortfall. Several other plants tripped offline amid the cold for reasons that aren’t yet known. In all, the agency estimated that more than 34 gigawatts of generating capacity was wiped out. That’s as much as 40% of the capacity that the region was expected to have online by summer 2020. Wholesale electricity prices in Texas skyrocketed to $9,000 a megawatt-hour, the maximum allowed in the market. 4. What put the lights out? Texas’s grid operator and the Southwest Power Pool have both implemented rolling electricity outages. These are controlled blackouts -- designed to last anywhere from 15 minutes to an hour (but in reality are proving much longer) -- that force electricity demand offline to protect the grids from total collapse. In the past three decades, Texas has only resorted to such a drastic measure four times. The grid operator is expecting the state’s outages to extend into Tuesday, Feb. 16, as temperatures remain low. The U.S. Energy Department issued an order that allows power plants to keep running despite possibly violating certain environmental limits. President Joe Biden approved Texas’s emergency declaration, making more resources available. 5. Is the shift toward renewable energy to blame? Wind turbine blades icing over has become a real problem, but the cold is wreaking havoc on the region’s entire energy complex, crippling fossil-fuel and renewable resources alike. Half of the wind

- 6. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 power capacity on Texas’s grid was knocked offline, and wind accounts for nearly a quarter of the state’s supplies. But the region’s grid operator made clear that power plants -- across all resources -- had tripped offline. And in fact, data from the grid operator shows generation from wind farms has actually been exceeding the agency’s forecasts in recent days. Some are pointing fingers at more systemic, long- standing issues with how Texas manages its power system. 6. What’s different about the Texas system? The state doesn’t run so-called capacity markets like other parts of the country. These markets act like insurance policies, whereby electricity generators are paid to guarantee that their supplies will be available when consumers need them on the most extreme hot and cold days. If they don’t show up, they face stiff penalties. The grid spanning much of the eastern U.S. runs a market like this, for example. Texas is also home to the most competitive electricity market in the country, where people switch power providers like credit cards. It’s a cutthroat business, and as a result, power providers offer incredibly low rates and incentives to new customers. This can set them up for failure during extreme events like this if they aren’t properly hedged a surge in wholesale energy prices. 7. How might this crisis change the energy landscape? The crisis reinforces the need for policy makers and regulators to think carefully about what a world wholly dependent on electricity for lighting, cooling, heating, cooking and transportation would look like under extreme circumstances. The same risks were on full display last year when California, the largest electric car market in America and one of the biggest in the world, went through rolling blackouts of its own caused by intense heat waves and wildfires. Proposed solutions include large-scale batteries back up power plants, along with broader, more regionalized power grids. Some policy makers in Washington have argued that this dependency means it’s critical to preserve coal and nuclear power plants as so-called baseload resources that are available to run around the clock. The issue is gaining urgency as climate change only stands to bring about more extreme weather. That doesn’t just mean extreme heat, but extreme cold too.

- 7. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Malaysia: PETRONAS Floating LNG DUA marks its commissioning with the production of first LNG ….. Source: PETRONAS PETRONAS marked yet another significant milestone for its second Floating Liquefied Natural Gas (FLNG) facility, PFLNG DUA, with the achievement of its First Drop of LNG production recently. This historic event signifies the ability of PFLNG DUA topside facility to produce on spec LNG product, which further validates the technology concept of floating LNG solutions for deepwater gas fields. The Company’s first deep water FLNG facility is currently located at the Rotan gas field, 140km off Kota Kinabalu, Sabah. In collaboration with its upstream Production Sharing Contract partner, PTT Exploration and Production, it has successfully completed the subsea commissioning phase and achieved its First Gas on 6 February 2021. PETRONAS Vice President of LNG Asset Zakaria Kasah said: 'This achievement showcases our focused execution and continuous effort in pushing boundaries to deliver innovative and customer-centric solutions to our customers. Despite operating in a challenging environment which is exacerbated by the COVID-19 pandemic, we managed to commission this megastructure and achieve first LNG production in 7 days upon the first gas in. This is a record achievement, and a great milestone for PETRONAS and the LNG industry.' PFLNG DUA is expected to deliver its first LNG cargo to customers by the middle of March 2021. Upon commercialisation, PETRONAS will become the first global energy company to own and operate two floating LNG facilities.

- 8. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Together with PFLNG SATU, which first produced LNG from the Kanowit gas field offshore Sarawak in 2016 and was successfully relocated to Kebabangan field offshore Sabah in 2019, this game- changing solution allows for the processing of LNG to be done offshore hundreds of kilometres away from land. Its versatility enables PETRONAS to unlock remote and stranded gas fields that were previously uneconomical to explore. PFLNG DUA is capable of reaching gas fields in water depths up to 1,500 metres and produces 1.5 million tonnes of LNG per year. It is part of PETRONAS’ portfolio of LNG facilities around the world, enabling the company to achieve its aspiration to power the world with cleaner energy, and at the same time, transform Sabah into a regional deep-water hub. As noted in the intro, the predicament of the Prelude FLNG project is a major disappointment not only for Shell, but for those in the industry who believed that floating LNG offered an important medium for monetizing stranded gas. In the 2007-10 period, the talking heads at conferences made extensive claims about the number of small, isolated offshore gas fields whose location precluded onshore LNG production, and there was no shortage of promoters touting their credentials as potential providers of FLNG technology. These included newcomers such as Flex LNG as well as established players such as Hoegh and SBM Offshore. For its part, Shell planned Prelude to be the first (hence the name) of more units to come under the mantra of “design one, build many” and in July 2009 signed a master agreement with Technip and Samsung Heavy Industries for multiple units over a 15-year period. Prelude’s costs to date are estimated at between $10-$13 billion. But, as we mentioned, the unit struggled to hit its stride, and has produced only eight cargoes of LNG so far, out of a nameplate capacity of 3.6 million metric tons per annum (MMtpa), or about 0.5 Bcf/d.

- 9. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Iraq: DNO increases stake in Kurdistan’s Baeshiqa license DNO + NewBase DNO ASA, the Norwegian oil and gas operator, has acquired ExxonMobil’s 32 percent interest in the Baeshiqa license in the Kurdistan region of Iraq, doubling DNO’s operated stake to 64 percent. The company plans to continue an exploration and appraisal program on the license while fast tracking early production from existing wells in 2021. DNO has already demonstrated proof of concept of producing through temporary test facilities, having delivered 15,000 barrels of 40o API oil and 22o API oil for export from the Baeshiqa-2 and Zartik-1 wells, respectively. In November 2019 DNO issued a notice of discovery on the Baeshiqa license after flowing hydrocarbons from several Jurassic and Triassic zones to surface in the 3,204 meters (2,549 meters TVDSS) Baeshiqa-2 exploration well. Following acid stimulation, the zone flowed variable rates of light oil and sour gas. Two zones flowed naturally at rates averaging over 3,000 barrels of oil per day (bopd) of light gravity oil each and another averaged over 1,000 bopd also of light gravity oil. Subsequent analyses on surface samples collected during testing confirm that the Triassic reservoirs contain saturated oil with a gas cap. An exploration well was completed in 2020 on a second structure (Zartik) some 15 kilometres southeast of the Baeshiqa-2 discovery well. The 3,021 meters (2,322 meters TVDSS) well tested hydrocarbons to surface from several Jurassic zones, with the uppermost zone flowing naturally at rates averaging over 2,000 bopd of medium gravity oil. The Company currently estimates gross license contingent recoverable resources from three of the tested zones in the two wells ranging from 12 million barrels of oil (mmbbls) (1C) to 156 mmbbls (3C), with a 2C volume of 43 mmbbls. "By increasing our stake in the Baeshiqa license now, we demonstrate our belief in its ultimate potential,” said Bijan Mossavar-Rahmani, DNO's Executive Chairman. “Following the stabilization of oil prices and export payments in Kurdistan, DNO is stepping up spending on new opportunities.”

- 10. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 DNO acquired its first 32 percent interest from ExxonMobil and assumed operatorship of the Baeshiqa license in 2018. The 324 sq km license is situated 60 kilometres west of Erbil and 20 kilometres east of Mosul. The license contains two large structures, Baeshiqa and Zartik, which have multiple independent stacked target reservoir systems, including in the Cretaceous, Jurassic and Triassic. The remaining partners in the license include TEC with a 20 percent paying (16 percent net) interest and the Kurdistan Regional Government with a 20 percent carried interest. In addition to the Baeshiqa license, DNO also operates the Tawke license containing the Tawke and Peshkabir fields in Kurdistan. Gross operated production from the Tawke license averaged 110,300 bopd in 2020.

- 11. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase February 16-2021 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil prices climb as deep freeze shuts U.S. oil wells, curbs refineries Reuters + NewBase Oil prices rose on Tuesday as a cold front shut wells and refineries in Texas, the biggest crude producing state in the United States, the world’s biggest oil producer. Prices also gained as Yemen’s Iran-aligned Houthi group said it struck airports in Saudi Arabia with drones, raising supply concerns in the world’s biggest oil exporter, and on optimism for a global economic recovery amid accelerated COVID-19 vaccine rollouts. Brent crude was up 32 cents, or 0.51%, at $63.62 a barrel at 0544 GMT, after rising to its highest since January 2020 in the previous session. U.S. West Texas Intermediate (WTI) crude futures gained 81 cents, or about 1.36%, to $60.28 a barrel. WTI did not settle on Monday because of a U.S. federal holiday. Prices will settle at the close of trading on Tuesday. Oil price special coverage

- 12. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 “The unexpected U.S. supply disruption provides another short term price recovery bridge that has likely taken oil prices to a level where markets were eventually heading but just a little bit quicker than expected,” Stephen Innes, chief global markets strategist at Axi said in a note on Tuesday. The cold weather in the U.S. halted Texas oil wells and refineries on Monday and forced restrictions on natural gas and crude pipeline operators. The rare deep freeze prompted the state’s electric power suppliers to impose rotating blackouts, leaving nearly 3 million homes and businesses without power.Texas produces roughly 4.6 million barrels of oil per day and is home to 31 refineries, the most of any U.S. state, according to Energy Information Administration data, including some of the country’s largest. The World Health Organization (WHO) on Monday listed AstraZeneca and Oxford University’s COVID-19 vaccine for emergency use, widening access to the relatively inexpensive shot in the developing world. The combination of frigid temperatures and refinery closures has spurred a scramble for fuels and is likely to lead to higher American prices for everything from gasoline to propane. The U.S. crisis is just the latest in a series of cold snaps in the northern hemisphere that have boosted oil consumption this year.

- 13. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 In Europe, the North Sea oil market, which helps price more than two-thirds of the world’s crude, also saw its biggest spate of bullish activity in years on Monday. There’s a chance, meanwhile, that Norwegian crude supply will be disrupted after talks to avert a refinery strike went past a deadline. Saudi Arabia’s unilateral output cuts have helped the global crude benchmark rally more than 20% this year as swollen global stockpiles are drawn down even as a stubbornly persistent coronavirus leads to more lockdowns. The global oil market is “balanced”, with prices reflecting the current state of play, Russia’s Deputy Prime Minister Alexander Novak said Sunday. “Global supply is getting tighter with the U.S. cold snap here to stay for now, and there are also expectations for demand to improve,” said Will Sungchil Yun, a senior commodities analyst at VI Investment Corp. in Seoul. West Texas Intermediate oil at $65 a barrel “doesn’t look impossible anymore,” he said. The rebalancing has reshaped oil’s futures curve. Brent’s prompt timespread is 61 cents a barrel in backwardation -- a bullish market structure where near-dated prices are more expensive than later- dated ones -- compared with a 7-cent contango at the beginning of the year. Still, concerns remain over the sustainability of crude’s rally. Both Brent and WTI’s 14-day Relative Strength Indexes remain well above 70 in a sign that prices could be due for a pullback. In China, the world’s biggest oil importer, travel over the Lunar New Year period is well below normal levels amid a resurgence of Covid-19 in parts of the country.

- 14. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase Special Coverage The Energy world – Feb-16- -2021 Shell accelerates drive for net-zero emissions with customer-first strategy Source: Shell Shell has se t out its strategy to accelerate its transformation into a provider of net-zero emissions energy products and services, powered by growth in its customer-facing businesses. A disciplined cash allocation framework and rigorous approach to driving down carbon emissions will deliver value for shareholders, customers and wider society. Shell also confirmed its expectation that total carbon emissions for the company peaked in 2018, and oil production peaked in 2019. 'Our accelerated strategy will drive down carbon emissions and will deliver value for our shareholders, our customers and wider society,' said Royal Dutch Shell Chief Executive Officer, Ben van Beurden. 'We must give our customers the products and services they want and need – products that have the lowest environmental impact. At the same time, we will use our established strengths to build on our competitive portfolio as we make the transition to be a net-zero emissions business in step with society. 'Whether our customers are motorists, households or businesses, we will use our global scale and trusted brand to grow in markets where demand for cleaner products and services is strongest, delivering more predictable cash flows and generating higher returns.' From today, Shell is integrating its strategy, portfolio, environmental and social ambitions under the goals of Powering Progress: generating shareholder value, achieving net-zero emissions, powering lives and respecting nature. Shell’s reshaped organisation will deliver on these goals through the three business pillars of Growth, Transition and Upstream. FINANCIAL RESILIENCE AND PROFITABLE GROWTH THROUGH DISCIPLINED CAPITAL ALLOCATION Shell reiterated its cash priorities to deliver value for shareholders today while growing value for tomorrow, including: Maintain the progressive dividend policy, increasing dividend per share by around 4% per year, subject to Board approval. Retain near-term annual Cash capital expenditure of $19-22 billion. Reduce net debt to $65 billion.

- 15. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 On reducing net debt to $65 billion, target total shareholder distributions of 20-30% of cash flow from operations; increased shareholder distributions achieved through a combination of Shell’s progressive dividends and share buybacks. Disciplined and measured capital expenditure growth balanced with additional shareholder distributions and further strengthening of our balance sheet. In the near term we expect to maintain underlying operating expenses of no higher than $35 billion, and pursue divestments averaging $4 billion a year. Over time the balance of capital spending will shift towards the businesses in the Growth pillar, attracting around half of the additional capital spend. Cash flow will follow the same trend and in the long term will become less exposed to oil and gas prices, with a stronger link to broader economic growth. THE ROAD TO NET-ZERO EMISSIONS: A COMPREHENSIVE CARBON MANAGEMENT APPROACH Shell set out details of how it will achieve its target to be a net-zero emissions energy business by 2050, in step with society’s progress towards achieving net zero. This target covers the emissions from our operations and the emissions from the use of all the energy products we sell. And crucially, it includes emissions from the oil and gas that others produce and Shell then sells as products to customers, making the target comprehensive. Powering Progress supports the most ambitious goal of the Paris Agreement on climate change to limit the global temperature rise to 1.5° Celsius. To achieve net zero, Shell: will continue with short-term targets that will drive down carbon emissions as we make progress towards our 2050 target, linked to the remuneration of more than 16,500 staff. This

- 16. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 includes a new set of targets to reduce our net carbon intensity: 6-8% by 2023, 20% by 2030, 45% by 2035 and 100% by 2050, using a baseline of 2016; expects that its total carbon emissions peaked in 2018 at 1.7 gigatonnes per annum; confirms that its total oil production peaked in 2019; will seek to have access to an additional 25 million tonnes a year of carbon, capture and storage (CCS) capacity by 2035. Currently, three key CCS projects of which Shell is a part, Quest in Canada (in operation), Northern Lights in Norway (sanctioned) and Porthos in The Netherlands (planned), will total around 4.5 million tonnes of capacity; aims to use nature-based solutions (NBS), in line with the philosophy of avoid, reduce and only then mitigate, to offset emissions of around 120 million tonnes a year by 2030, with those we use being of the highest independently verified quality; will work with the Science Based Targets Initiative, Transition Pathway Initiative and others to develop standards for the industry and align with those standards; starting at the 2021 AGM, submit an Energy Transition Plan for an advisory vote to shareholders, the first in the sector to do so. We will update that plan every three years and seek an advisory vote on the progress made each year. DELIVERING WITH A PORTFOLIO FOR THE ENERGY TRANSITION Shell is a customer-focused organisation, serving more than 1 million commercial and industrial customers, and 30 million customers at 46,000 retail service stations daily. Shell uses its world- leading brand, global reach and expertise to be a one-stop shop for both consumer and business customers. A presence across the entire energy system means we can optimise, scale up, and trade products in a way that develops markets, drives down costs, and will help accelerate the energy transition. Shell’s aim is to build material low-carbon businesses of significant scale by the early 2030s. Upstream will continue to deliver vital energy supplies, which will help to generate the cash and

- 17. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 returns needed to fund shareholder distributions while accelerating investment in the growth businesses to capture new market opportunities. In the near term, Shell’s strategy will rebalance its portfolio, investing annually $5-6 billion in its Growth pillar (around $3 billion in Marketing; $2-3 billion in Renewables and Energy Solutions), $8- 9 billion in its Transition pillar (around $4 billion Integrated Gas; $4-5 billion Chemicals and Products) and around $8 billion in Upstream. Plans include: Growth: Marketing Target to increase Adjusted Earnings to around $6 billion by 2025 (from $4.5 billion in 2020), achieved by improving the already market-leading position of the lubricants business, an increase to 40 million customers at 55,000 retail sites (from 30 million at 46,000 sites today) and growth of global electric vehicle (EV) network from more than 60,000 charge points today to around 500,000 by 2025. Low-carbon fuels – extend our leading biofuels production and distribution business, which in 2019 sold more than 10 billion litres of biofuels. Our joint venture Raízen, which produces low-carbon fuels from sugar cane in Brazil, recently announced the acquisition of Biosev. This is set to increase Raízen’s bioethanol production capacity by 50%, to 3.75 billion litres a year, around 3% of global production. Renewables and Energy Solutions Integrated Power – aim to sell some 560 terawatt hours a year by 2030 which is twice as much electricity as we sell today. We expect to serve more than 15 million retail and business customers worldwide. We aim to be a leading provider of clean Power-as-a-Service. We will make our investments go further by partnering with others with the emphasis for Shell being on managing clean electrons.

- 18. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Nature-based solutions – expect to invest around $100 million a year in high-quality, independently verified projects on the ground to build a significant and profitable business to help customers meet their net-zero emissions targets. Hydrogen – build on Shell’s leading position in hydrogen by developing integrated hydrogen hubs to serve industry and heavy-duty transport, aim to achieve double-digit share of global clean hydrogen sales. Transition: Integrated Gas Extend leadership in liquefied natural gas (LNG) volumes and markets, with selective investment in competitive LNG assets to deliver more than 7 million tonnes per annum of new capacity on-stream by middle of the decade. Continue to support customers with their own net-zero ambitions, with leading offers such as carbon-neutral LNG. Chemicals and Products Transform our refinery footprint from 13 sites today to six high-value Chemicals and Energy Parks and reduce production of traditional fuels by 55% by 2030. Intention to grow volumes of the chemicals portfolio and increase cash generation from Chemicals by $1-2 billion a year by 2030 compared with the medium term. Will produce chemicals from recycled waste, known as circular chemicals, and by 2025 aim to annually process 1 million tonnes a year of plastic waste. Upstream: Focus on value over volume, being simpler and more resilient, continuing to provide material cash flow into the 2030s. An expected gradual reduction in oil production of around 1-2% each year, including divestments and natural decline. Shell’s measured approach to the energy transition stands apart from its peers BP Plc and Total SE, which have announced large deals to rapidly boost its clean-energy capacity. BP has promised to slash its oil production by 40% and ramp up low-carbon spending to $5 billion annually by the end of the decade, prompting some to say the firm is overpaying for renewables. Meanwhile, Shell’s investments in the space will remain at $2 billion to $3 billion a year. “Shell has set off on a different path” than other European majors, Adam Matthews, director of ethics and engagement for the Church of England Pensions Board said in a statement. “Different companies have different strategies and we now need to test the veracity of these.”

- 19. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Shell said its net carbon intensity will fall by 6% to 8% in 2023, compared with 2016. That reduction will widen to 20% in 2030, 45% in 2035 and 100% by 2050. Shell’s B shares were down 2.3% to 1,276 pence at 12:14 pm in London. Rivals Total and BP were also trading lower.

- 20. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase Energy News 16 February 2021 - Issue No. 1406 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat “with external voluntary Energy consultation for the GCC area via Hawk Energy Service, as the UAE operations base. Khaled is the Founder of NewBase Energy news articles issues, an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor- in-Chief of NewBase Energy News and is a professional environmental writer with more than 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above. NewBase: For discussion or further details on the news above you may contact us on +971504822502, Dubai, UAE NewBase 2021 K. Al Awadi

- 21. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21

- 22. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22

- 23. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 For Your Recruitments needs and Top Talents, please seek our approved agents below