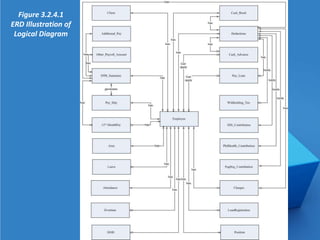

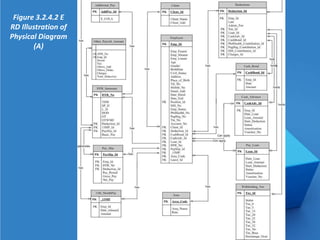

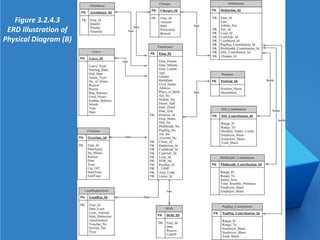

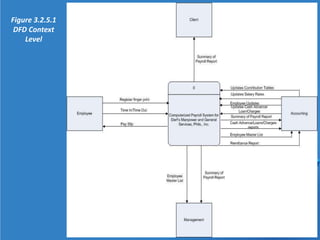

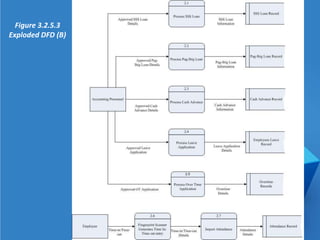

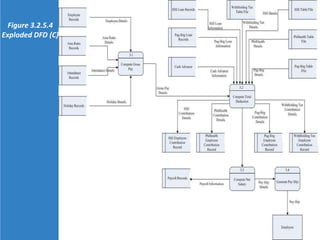

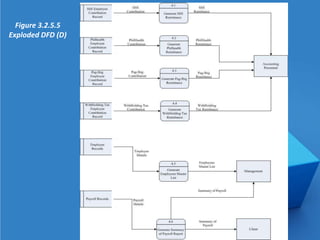

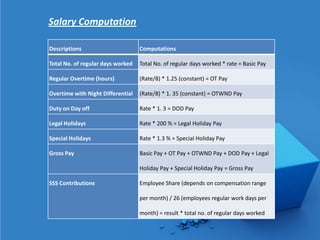

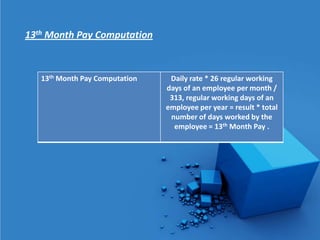

The document describes a computerized payroll system developed for Derf's Manpower and General Services Phils, Inc. The system aims to minimize manual tasks, monitor employee loans/deductions, and generate reports. It covers employee time tracking via fingerprint scanning and automates salary computation/payroll processing. The system helps prepare pay slips and track contributions, cash bonds, loans, and net pay calculations. Entity relationship diagrams and data flow diagrams illustrate the system's design and information flow.