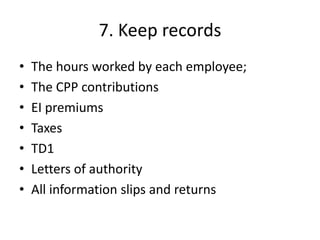

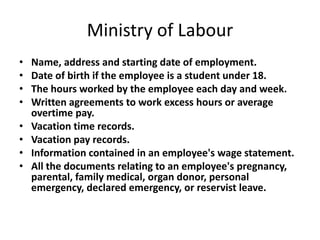

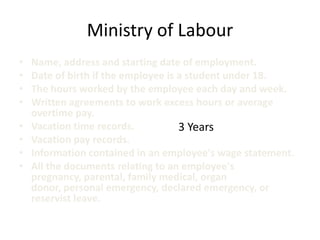

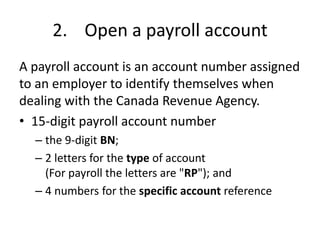

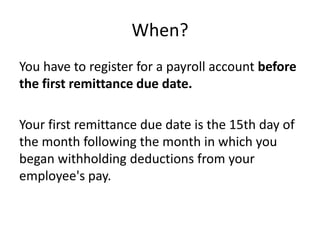

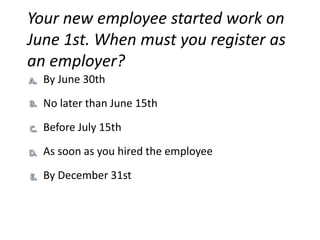

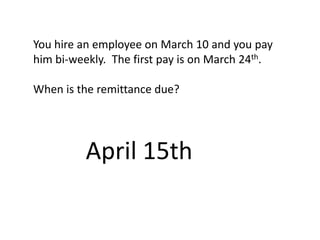

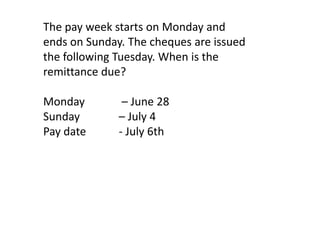

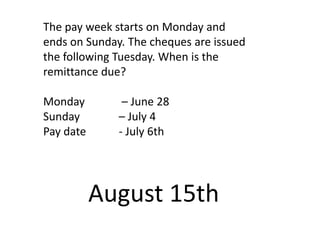

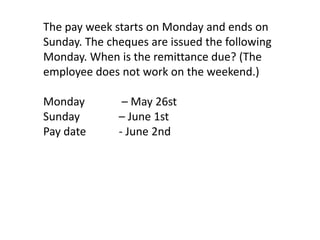

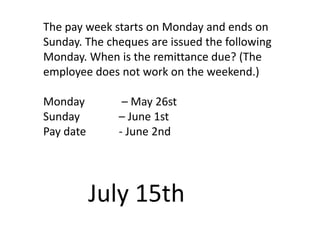

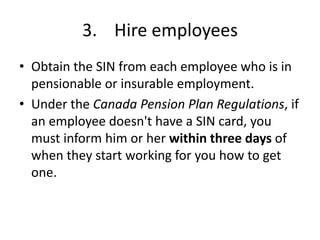

The document outlines the key steps and responsibilities for employers related to payroll. It discusses determining employer status, opening a payroll account, hiring employees, calculating deductions, remitting deductions, filing information returns, and record keeping requirements. Employers must keep payroll, tax, and employee records for 6 years for CRA and 3 years for Ministry of Labour requirements. The document provides guidance on payroll deadlines and due dates.

![6. File information returns

• Monthly remittances [PD7A]

• Annual filing

– T4s

– T4 summary](https://image.slidesharecdn.com/employerresponsibilities-120103145906-phpapp02/85/Employer-responsibilities-26-320.jpg)