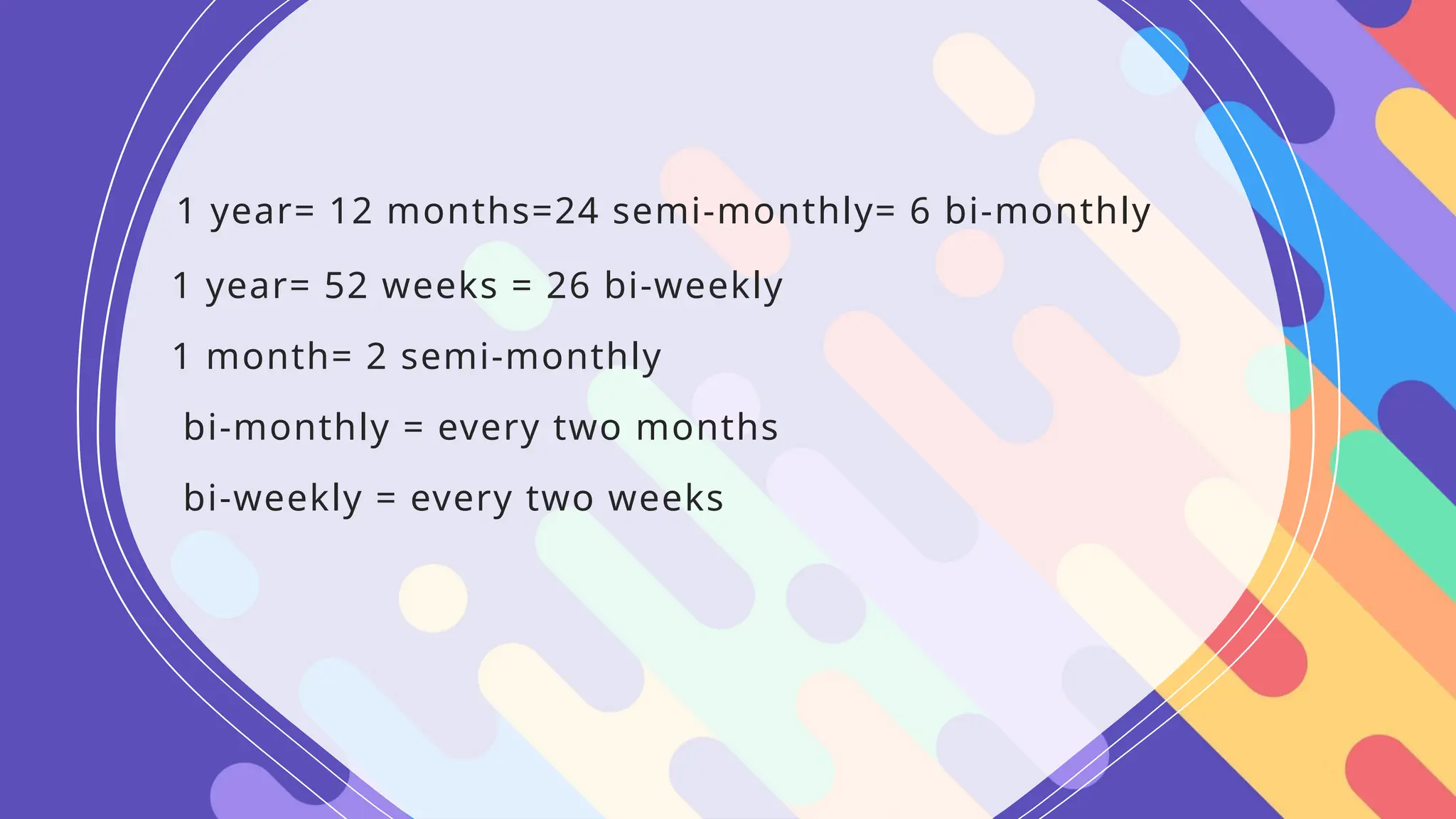

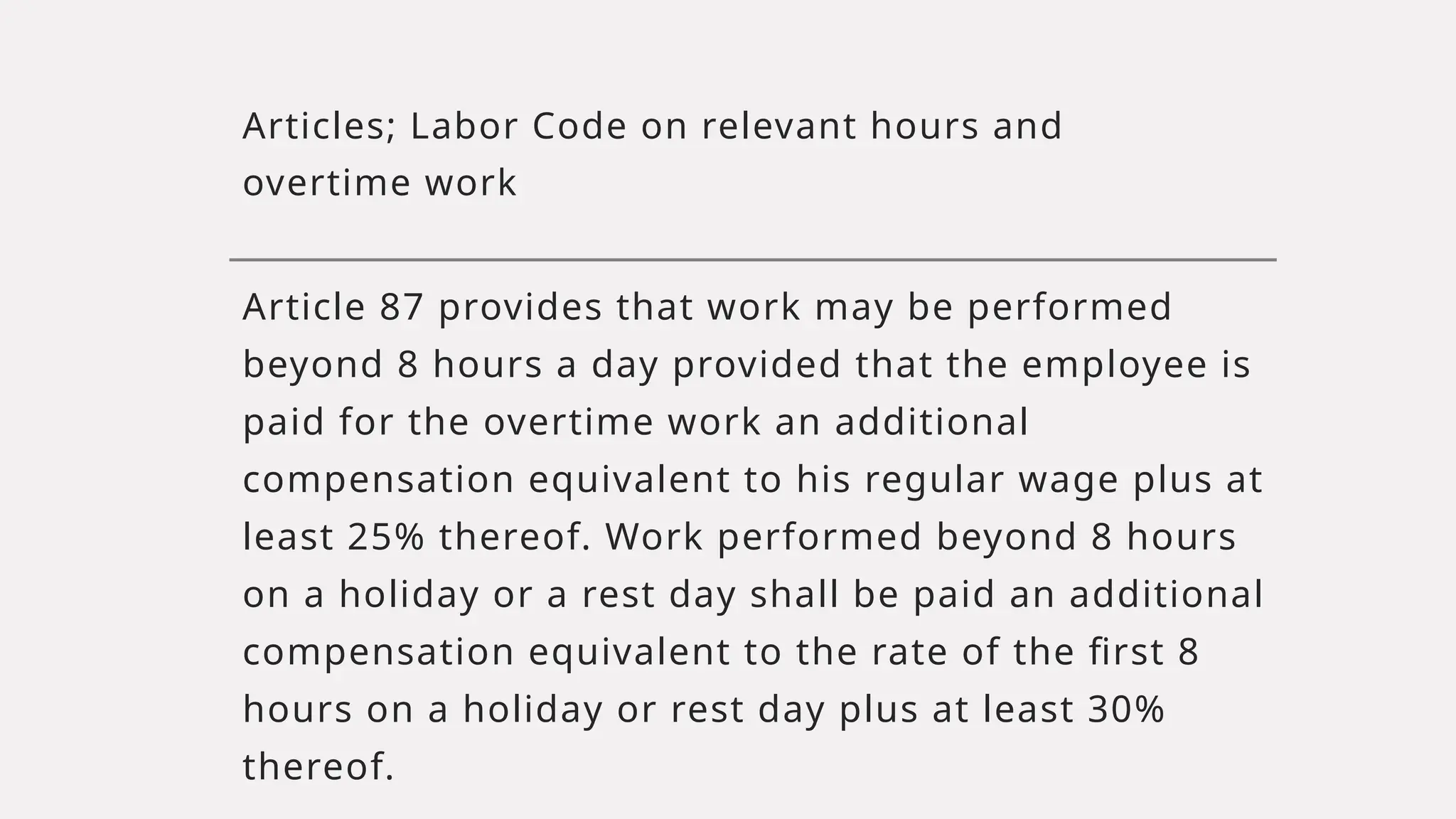

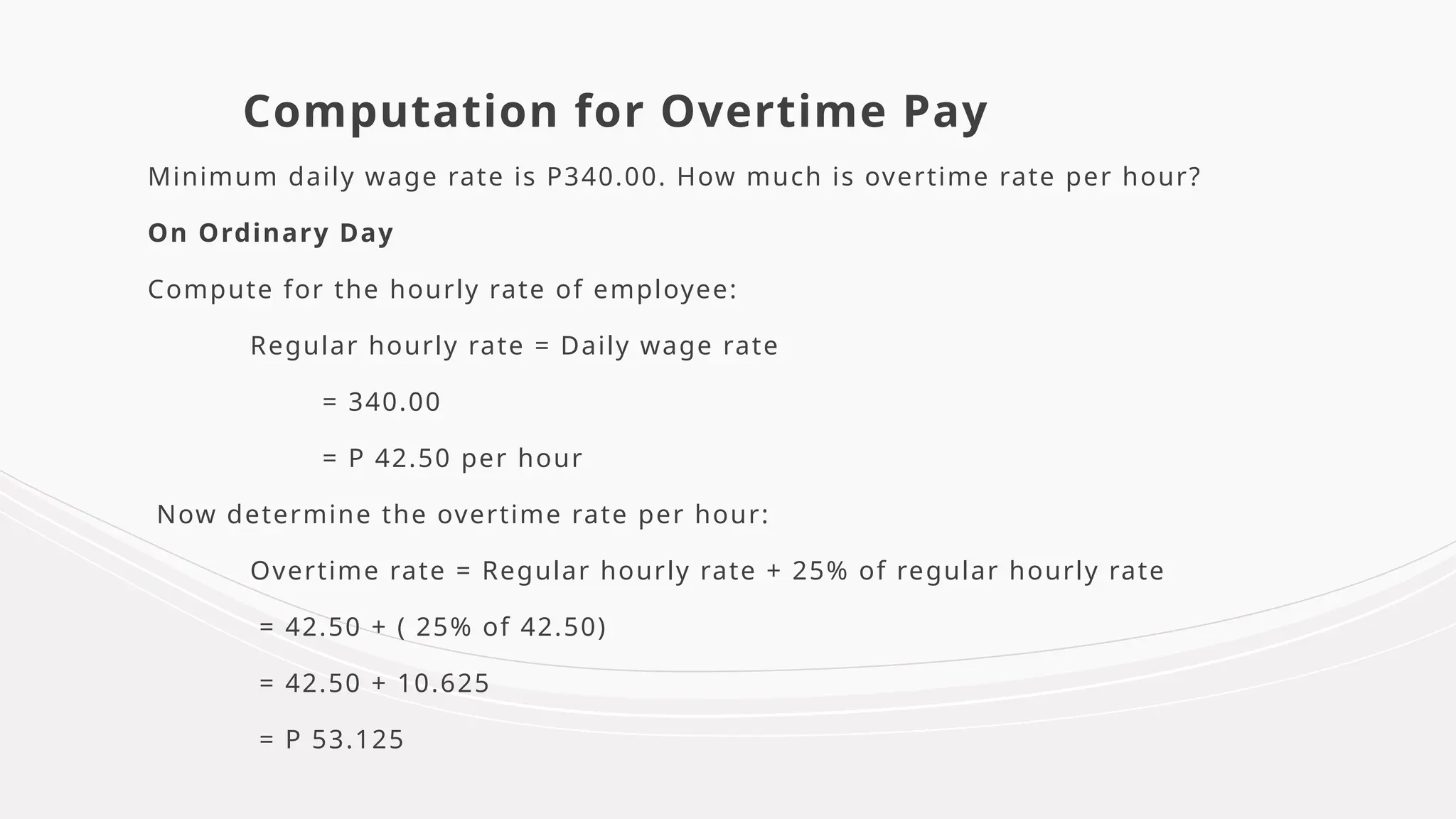

The document covers employee compensation, including definitions of salary, wages, and income, along with calculations for various payment structures such as hourly and piece rates. It details labor code regulations governing work hours, overtime compensation, and employee benefits including vacation, sick leave, and 13th month pay. Additionally, it explains payroll deductions related to social security, health insurance, and taxes to determine an employee's net pay.