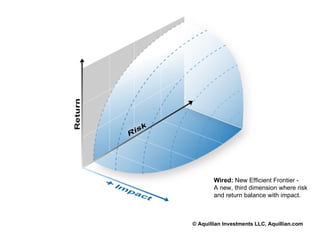

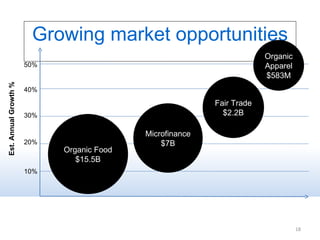

This document discusses Goodcap, an investment fund that aims to generate both social and financial returns. It summarizes Goodcap's approach of investing in companies at the intersection of money and meaning. Initially, Goodcap faced skepticism from traditional investors but was able to prove its model works by investing in companies like Better World Books and Adina for Life that achieved strong social impacts and financial growth. Goodcap also helped validate the emerging field of social capital markets by launching an annual conference that has grown significantly in attendance each year. Looking ahead, Goodcap plans to focus on further investing in the fast growing fair trade sector and may raise a second fund dedicated to this area.