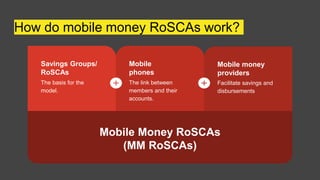

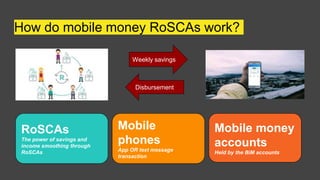

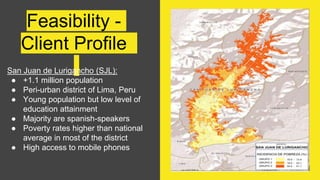

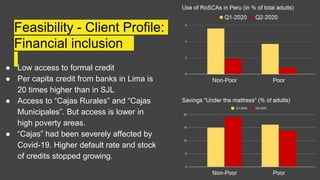

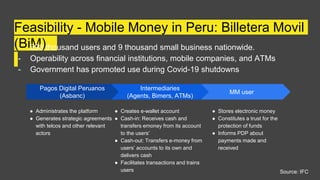

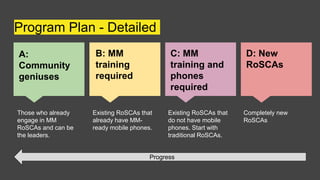

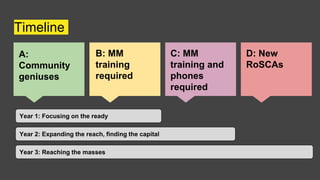

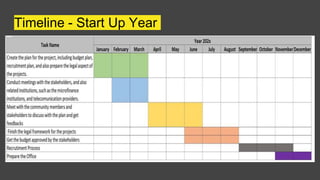

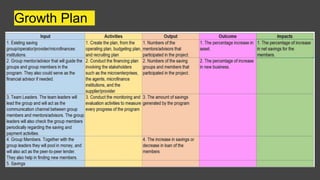

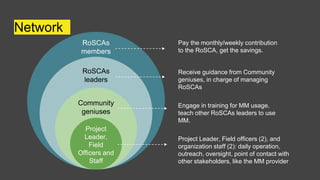

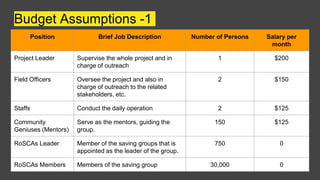

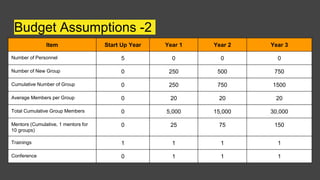

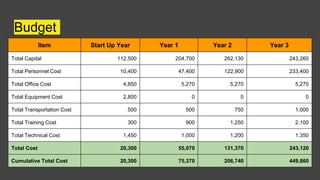

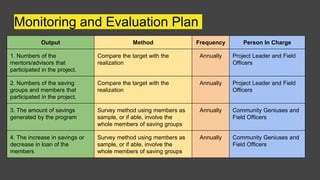

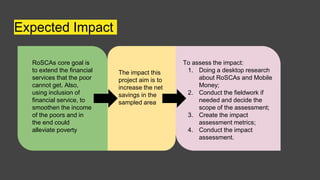

The document proposes establishing mobile money savings groups called Mobile Money RoSCAs in Lima, Peru over 3 years. It would reach 30,000 people through 1,500 savings groups. Such groups help with poverty alleviation through regular savings and loans. Mobile money allows the groups to operate remotely using phones and accounts. The plan is to start with existing "community geniuses" who use mobile money and expand to other existing and new groups with training and phones. Budgets, timelines, and monitoring are proposed to track targets for numbers of groups, members and savings amounts. The expected impact is increased savings through expanded access to financial services for the poor.