Equity Update - May 2019

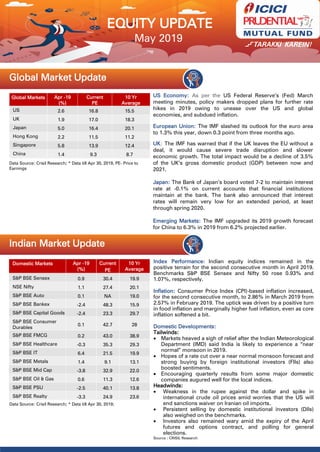

- 1. May 2019 Global Market Update Indian Market Update Global Markets Apr -19 (%) Current PE 10 Yr Average US 2.6 16.8 15.5 UK 1.9 17.0 18.3 Japan 5.0 16.4 20.1 Hong Kong 2.2 11.5 11.2 Singapore 5.8 13.9 12.4 China 1.4 9.3 8.7 Domestic Markets Apr -19 (%) Current PE 10 Yr Average S&P BSE Sensex 0.9 30.4 19.9 NSE Nifty 1.1 27.4 20.1 S&P BSE Auto 0.1 NA 19.0 S&P BSE Bankex -2.4 48.3 15.9 S&P BSE Capital Goods -2.4 23.3 29.7 S&P BSE Consumer Durables 0.1 42.7 28 S&P BSE FMCG 0.2 43.0 38.9 S&P BSE Healthcare -0.3 35.3 29.3 S&P BSE IT 6.4 21.5 19.9 S&P BSE Metals 1.4 9.1 13.1 S&P BSE Mid Cap -3.8 32.9 22.0 S&P BSE Oil & Gas 0.6 11.3 12.6 S&P BSE PSU -2.5 40.1 13.8 S&P BSE Realty -3.3 24.9 23.6 US Economy: As per the US Federal Reserve‟s (Fed) March meeting minutes, policy makers dropped plans for further rate hikes in 2019 owing to unease over the US and global economies, and subdued inflation. European Union: The IMF slashed its outlook for the euro area to 1.3% this year, down 0.3 point from three months ago. UK: The IMF has warned that if the UK leaves the EU without a deal, it would cause severe trade disruption and slower economic growth. The total impact would be a decline of 3.5% of the UK‟s gross domestic product (GDP) between now and 2021. Japan: The Bank of Japan‟s board voted 7-2 to maintain interest rate at -0.1% on current accounts that financial institutions maintain at the bank. The bank also announced that interest rates will remain very low for an extended period, at least through spring 2020. Emerging Markets: The IMF upgraded its 2019 growth forecast for China to 6.3% in 2019 from 6.2% projected earlier. Index Performance: Indian equity indices remained in the positive terrain for the second consecutive month in April 2019. Benchmarks S&P BSE Sensex and Nifty 50 rose 0.93% and 1.07%, respectively. Inflation: Consumer Price Index (CPI)-based inflation increased, for the second consecutive month, to 2.86% in March 2019 from 2.57% in February 2019. The uptick was driven by a positive turn in food inflation and marginally higher fuel inflation, even as core inflation softened a bit. Domestic Developments: Tailwinds: Markets heaved a sigh of relief after the Indian Meteorological Department (IMD) said India is likely to experience a “near normal” monsoon in 2019. Hopes of a rate cut over a near normal monsoon forecast and strong buying by foreign institutional investors (FIIs) also boosted sentiments. Encouraging quarterly results from some major domestic companies augured well for the local indices. Headwinds: Weakness in the rupee against the dollar and spike in international crude oil prices amid worries that the US will end sanctions waiver on Iranian oil imports. Persistent selling by domestic institutional investors (DIIs) also weighed on the benchmarks. Investors also remained wary amid the expiry of the April futures and options contract, and polling for general elections. Source : CRISIL Research EQUITY UPDATE Data Source: Crisil Research; * Data till Apr 30, 2019; Data Source: Crisil Research; * Data till Apr 30, 2019, PE- Price to Earnings

- 2. Indian Market Update Earnings Growth (%) FY19 FY20E FY21E Sensex 11 26 18 Macro Indicators Latest Update Previous Update GDP (YoY%) 6.6% (3QFY19) 7.1% (2QFY19) IIP (YoY%) 0.1% (Feb) 1.4% (Jan) Crude ($ bbl) 72.80 (Apr 30) 68.4 (Mar 29) Core Sector Growth (YoY%) 4.7 (Mar 2019) 2.2 (Feb 2019) Trade Deficit ($ mn) -10,890 (Mar 2019) -9,595 (Feb 2019) Current Account Deficit ($ bn) -16.9 (3QFY19) -19.1 (2QFY19) FII Holding in Indian Equities (%)# 21.7 (4QFY19) 21.7 (3QFY19) Flows Apr -19 Mar- 19 Feb-19 FIIs (Net Purchases / Sales) (Rs cr) 2,119.3 3,398.1 -4,262 MFs (Net Purchases / Sales) (Rs cr) -492 -762.7 6,995 Note: # FII hldg includes ADR/GDR (BSE500 Index); Data Source: Crisil Research; * Data till April 30, 2019; CAD: Current Account Deficit; GDP: Gross Domestic Product, IIP: India Industrial Production FII: Foreign Institutional Investors; MF-Mutual Fund; PMI – Purchasing Manager‟s Index Global Developments: Tailwinds: Gains in global equities following steady growth rate from China, positive economic cues from the US and hopes of progress in the US-China trade talks. Intermittent easing of the crude oil prices after International Energy Agency (IEA) stated that the oil market is "adequately supplied" and "global spare production capacity remained at comfortable levels” also aided the indices. Headwinds: Decline in global equities after the IMF lowered its outlook on global economic growth to the lowest since 2009 and slower- than-expected growth of China‟s factory activity also dampened sentiments. Sectoral Impact: Performance of the S&P BSE sectoral indices was mixed in April 2019. A weak rupee pushed IT stocks higher. S&P BSE IT index was the top sectoral gainer – up 6.43%. Metal stocks ended higher due to optimism about US-China trade talks; S&P BSE Metal index rose 1.39%. S&P BSE Realty index and S&P BSE Power index was the top laggards down 3.30% and 3.19%, respectively due to profit booking. Outlook & Triggers The Nifty 50 Index was up by 1.1%. The positive returns of the index hides the heightened volatility witnessed in the month of April. This was reflected in India NSE volatility index which spiked by ~27%. The outcome of the ongoing general elections, concerns around oil prices and global geo-political developments mainly weighed on the investor sentiments. On the global front, US announced an end to waivers on Iranian oil imports and EU extended the deadline for UK‟s departure. The Global sentiments got a boost as the US –China trade talks made significant progress in the latest round of negotiations. Global growth concerns alleviated post mixed macro prints from China. However, further gains for the global market were capped, as investors remained cautious ahead of the Federal Open Market Committee (FOMC) policy meet. On the Domestic front, Lok Sabha elections took center stage as 4 of 7 polling phases were completed (source- Election Commission of India) with mixed trends in voter turnouts. Rupee saw some pressure in the month, hitting above 70/$, due to Global macro developments. The market also seemed concerned about the deterioration in India‟s macroeconomic conditions, especially with global crude prices reaching higher levels from India‟s CAD/BoP perspective. Additionally, other Macro-economic indicators were also not supportive. PMIs declined sequentially, IIP numbers came sharply below expectations, and CPI picked-up pace. Going forward, the uncertainty in markets is likely to prevail due to: a) Increased proximity to the outcome of the General Elections, b) Impact on MSCI India index due to MSCI China A share expected weight increase in the semiannual index review on May 15th, c) Inflation risk due to potential El Nino effect on the monsoon d) Volatility in Oil prices and e) Muted seasonality of FPI flows in the Q1 of the new financial year. We remain neutral on equities and recommend investors to give prime importance to asset allocation with adequate exposure to Debt. The Indian market‟s valuations look quite full versus historical levels and compared to bond yields. In particular, valuations of most „megacap‟ stocks continue to remain stretched. Hence, as highlighted above heightened volatility paves way for Dynamic Asset Allocation schemes which can manage equity levels based on the market valuations. Also, the valuations disconnect between growth and value stocks can be played through Value and special situations theme. Equity accumulation, in mid- and small-caps, should be done in a staggered manner via SIP/STP.

- 3. Market Outlook & Triggers Equity valuation index is calculated by assigning equal weights to Price to Earnings (PE), Price to book (PB), G-Sec*PE and Market Cap to Gross Domestic Product (GDP) Our Recommendation Our recommendations for various investor types are as follows:- Long Term Horizon – SIPs/STPs in Mid and Small Cap schemes Underweight On Equity – Large and Multi Cap schemes Moderately invested in equities – Asset Allocation schemes For existing investors, continue with their SIPs in pure equity schemes. Our Recommendations – Equity Schemes Pure Equity Schemes ICICI Prudential Bluechip Fund (An open ended equity scheme predominantly investing in large cap stocks) ICICI Prudential Multicap Fund (An open ended equity scheme investing across large cap, mid cap and small cap stocks) These Schemes aim to generate capital appreciation through participation in equities. Long-Term SIP Schemes ICICI Prudential Value Discovery Fund (An open ended equity scheme following a value investment strategy ICICI Prudential Smallcap Fund (An open ended equity scheme predominantly investing in small cap stocks) ICICI Prudential Midcap Fund (An open ended equity scheme predominantly investing in mid cap stocks) ICICI Prudential Large & Mid Cap Fund (An open ended equity scheme investing in both large cap and mid cap stocks) These schemes aim to generate long term wealth creation over a full market cycle. Asset Allocation Schemes ICICI Prudential Balanced Advantage Fund (An open ended dynamic asset allocation fund) ICICI Prudential Equity & Debt Fund (An open ended hybrid scheme investing predominantly in equity and equity related instruments) ICICI Prudential Multi-Asset Fund (An open ended scheme investing in Equity, Debt, Gold/Gold ETF/units of REITs & InvITs and other asset classes as may be permitted from time to time) ICICI Prudential Equity Savings Fund (An open ended scheme investing in equity, arbitrage and debt) ICICI Prudential Regular Savings Fund (An open ended hybrid scheme investing predominantly in debt instruments) These schemes aim to benefit from volatility and can be suitable for investors aiming to participate in equities with low volatility. 123.38 50 70 90 110 130 150 170 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11 Apr-12 Apr-13 Apr-14 Apr-15 Apr-16 Apr-17 Apr-18 Apr-19 Invest in Equities Aggressively invest in Equities Neutral Incremental Money to Debt Book Partial Profits Equity Valuation Index

- 4. ICICI Prudential Asset Allocator Fund (An open ended fund of funds scheme investing in equity oriented schemes, debt oriented schemes and gold ETFs/schemes)*Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes in which this Scheme makes investment. Thematic /Sectoral themes ICICI Prudential India Opportunities Fund (An open ended equity scheme following special situation theme) risk investmen Investors could invest in this thematic scheme for tactical allocation. None of the aforesaid recommendations are based on any assumptions. These are purely for reference and the investors are requested to consult their financial advisors. ICICI Prudential Bluechip Fund is suitable for investors who are seeking*: Long term wealth creation An open ended equity scheme predominantly investing in large cap stocks. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Large & Mid Cap Fund is suitable for investors who are seeking*: Long term wealth creation An open ended equity scheme investing in both largecap and mid cap stocks *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Value Discovery Fund is suitable for investors who are seeking*: Long term wealth creation An open ended equity scheme following a value investment strategy. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Equity & Debt Fund is suitable for investors who are seeking*: Long term wealth creation solution A balanced fund aiming for long term capital appreciation and current income by investing in equity as well as fixed income securities. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Balanced Advantage Fund is suitable for investors who are seeking*: Long term wealth creation solution An equity fund that aims for growth by investing in equity and derivatives. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Multicap Fund is suitable for investors who are seeking*: Long term wealth creation An open ended equity scheme investing across largecap, mid cap and small cap stocks. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Equity Savings Fund is suitable for investors who are seeking*: Long term wealth creation An Open ended scheme that seeks to generate regular income through investments in fixed income securities, arbitrage and other derivative strategies and aim for long term capital appreciation by investing in equity and equity related instruments. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Riskometers

- 5. ICICI Prudential Multi-Asset Fund is suitable for investors who are seeking*: • Long term wealth creation • An open ended scheme investing across asset classes. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Regular Savings Fund is suitable for investors who are seeking*: Medium to Long term regular income solution A hybrid fund that aims to generate regular income through investments primarily in debt and money market instruments and long term capital appreciation by investing a portion in equity. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Midcap Fund is suitable for investors who are seeking*: Long term wealth creation An open-ended equity scheme that aims for capital appreciation by investing in diversified mid cap companies. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Smallcap Fund is suitable for investors who are seeking*: Long term wealth creation An open ended equity scheme that seeks to generate capital appreciation by predominantly investing in equity and equity related securities of small cap companies. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Asset Allocator Fund is suitable for investors who are seeking*: Long Term Wealth Creation An open ended fund of funds scheme investing in equity oriented schemes, debt oriented schemes and gold ETFs/ schemes. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential India Opportunities Fund is suitable for investors who are seeking*: Long Term Wealth Creation An equity scheme that invests in stocks based on special situations theme. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. In the preparation of the material contained in this document, the AMC has used information that is publicly available, including information developed in-house. Information gathered and material used in this document is believed to be from reliable sources. The Fund however does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material no such party will assume any liability for the same. All recipients of this material should before dealing and or transacting in any of the products referred to in this material make their own investigation, seek appropriate professional advice and carefully read the scheme information document. We have included statements in this document, which contain words, or phrases such as "will", "expect", "should", "believe" and similar expressions or variations of such expressions that are "forward looking statements". Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monitory and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, the performance of the financial markets in India and globally, changes in domestic and foreign laws, regulations and taxes and changes in competition in the industry. All data/information used in the preparation of this material is dated and may or may not be relevant any time after the issuance of this material. The AMC takes no responsibility of updating any data/information in this material from time to time. he AMC (including its affiliates), the Fund and any of its officers directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible/are liable for any decision taken on the basis of this material. Disclaimer