51020804 indian-income-tax-deductions

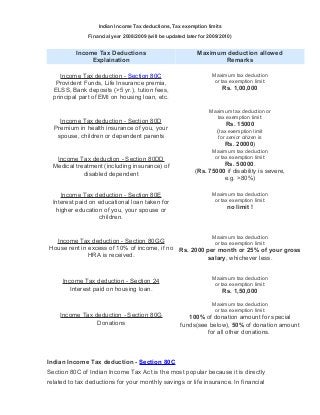

- 1. Indian Income Tax deductions, Tax exemption limits Financial year 2008/2009 (will be updated later for 2009/2010) Income Tax Deductions Explaination Maximum deduction allowed Remarks Income Tax deduction - Section 80C Provident Funds, Life Insurance premia, ELSS, Bank deposits (>5 yr.), tution fees, principal part of EMI on housing loan, etc. Maximum tax deduction or tax exemption limit: Rs. 1,00,000 Income Tax deduction - Section 80D Premium in health insurance of you, your spouse, children or dependent parents Maximum tax deduction or tax exemption limit: Rs. 15000 (tax exemption limit for senior citizen is Rs. 20000) Income Tax deduction - Section 80DD Medical treatment (including insurance) of disabled dependent Maximum tax deduction or tax exemption limit: Rs. 50000. (Rs. 75000 if disability is severe, e.g. >80%) Income Tax deduction - Section 80E Interest paid on educational loan taken for higher education of you, your spouse or children. Maximum tax deduction or tax exemption limit: no limit ! Income Tax deduction - Section 80GG House rent in excess of 10% of income, if no HRA is received. Maximum tax deduction or tax exemption limit: Rs. 2000 per month or 25% of your gross salary, whichever less. Income Tax deduction - Section 24 Interest paid on housing loan. Maximum tax deduction or tax exemption limit: Rs. 1,50,000 Income Tax deduction - Section 80G Donations Maximum tax deduction or tax exemption limit: 100% of donation amount for special funds(see below), 50% of donation amount for all other donations. Indian Income Tax deduction - Section 80C Section 80C of Indian Income Tax Act is the most popular because it is directly related to tax deductions for your monthly savings or life insurance. In financial

- 2. years 2008/2009 and also in 2009/2010 the maximum income tax deduction allowed under section 80C is 1,00,000. The following is a list of important ways in which a taxpayer can get benefit of section 80C of Indian Income Tax Act. 1. Provident Fund (PF): Any contributions to Provident Fund, Voluntary provident Fund (VPF) or savings made in Public Provident Fund (PPF Account) are eligible for income tax deduction under section 80C of Indian Income Tax Act. 2. Life Insurance Premiums: Any Life Insurance premiums (for one or more insurance policies) paid by you for yourself, your spouse or your children is eligible under income tax deduction under section 80C of Indian Income Tax Act. 3. ELSS Equity Linked Saving Schemes: Any investment made in certain Mutual Funds called equity linked saving schemes qualifies for section 80C deduction. Please note that not all mutual fund investments are eligible for this deduction. Some examples of ELSS funds are : SBI Magnum Tax Gain, HDFC Tax Saver, HDFC Long term advantage, etc. 4. ULIP (Unit Linked Insurance Plan): Investments made in certain ULIPs of Unit Trust of India and LIC of India are eligible for 80C deduction. 5. Bank Fixed deposits or Term deposits of >5 years: According to a relatively new provision amount saved in fixed deposits of term at least five years is eligible for income tax deduction under section 80C of Indian Income Tax Act. 6. Principal part of EMI on Housing Loan: If you are paying EMI on a housing loan, note that the EMI (equated monthly installments) consists of two parts - principal part and interest part. The principal part of the EMI on your housing loan is eligible for income tax deduction under section 80C. Note that the interest part is also eligible for tax deduction, however not under section 80C but section 24. (read below). If you do not own a house but pay rent for it, see section 80GG of Indian Income Tax Act below. 7. Tuition Fees: Amount paid as tuition fee for the education of two children of the assessee is eligible for deduction under section 80C of Indian Income Tax Act. 8. Other 80C deductions: Amount saved in National Saving Certificate (NSC), Infrastructure Bonds or Infra Bonds, amount paid as stamp duty and registration charges while buying a new home are eligible for income tax deductions under section 80C of Indian Income Tax Act. Indian Income Tax deduction - Section 80D:

- 3. Section 80D of Indian Income Tax Act is especially useful if your employer does not cover your health or medical expenses. It is a good idea to get medical insurance or health insurance for you, your spouse, dependent children or dependent parents, as you can claim a deduction of upto Rs. 15000/- per anum for the premia paid on this insurance. For senior citizen this limit is Rs. 20000. With effect from 1-4-2009, you can claim the total of the following items for deduction under section 80D. 1. Total amount of premium paid for health insurance of family (meaning spouse + children), or Rs. 15,000 , whichever less. 2. Total amount of premium paid for health insurance of your parents or Rs. 15,000, whichever less. Thus if you are paying premiums of mediclaim policies for your spouse children and parents you can get a total tax deduction of upto Rs. 30,000. Indian Income Tax deduction - Section 80DD Section 80DD of Indian Income Tax Act provides provision for tax deduction if you incurred medical expenditure for a dependents who are disabled. Here dependent means spouse, children, brothers, sisters or any one of them. The maximum tax deduction provided by section 80DD is Rs. 50000 in case of ordinary disability and Rs. 75000 if the disability is severe. The definition of severe disability is as defined in the official page of Indian Income tax Act. Indian Income Tax deduction - Section 24: Whenever you take a housing loan build or buy a new home, the interest payable on this home loan is eligible for income tax deduction under section 24. Maximum deductible amount, i.e. maximum interest you can claim for income tax deduction under section 24 is Rs. 1,50,000. In case you are paying interest on money borrowed for renovation of your home, even this may qualify for tax deduction under section 24 of Indian Income Tax Act. Indian Income Tax deduction - Section 80GG: If you pay rent for the house that you are staying in and do not get HRA, any rent you pay in excess of 10 percent of your salary is eligible for income tax deduction under section 80GG of Indian Income Tax Act. The income tax deduction you can claim is the minimum of the following amounts. 1. Rent you pay minus 10% of your salary.

- 4. 2. 25% of your gross total income. 3. Rs. 2000/- per month. Indian Income Tax deduction - Section 80E Under section 80E of Indian Income Tax Act, any amount of interest paid on educational loan taken for your higher education or higher education of your husband / wife or children is deductible from your taxable income. Here higher education means - studies for any graduate or post-graduate course in engineering, medicine, management or for post-graduate course in applied sciences or pure sciences including mathematics and statistics. Indian Income Tax deduction - Section 80G: Donations made to funds like Prime Minister's Relief Fund, National Children Foundation, any University or educational institution of 'national eminence', etc. (see official page for complete list) are deductible from your taxable income according to section 80G of Indian Income Tax Act. For any other donations you are eligible to take income tax deduction for 50% of the donation amount. Math homework help https://www.homeworkping.com/ Math homework help https://www.homeworkping.com/