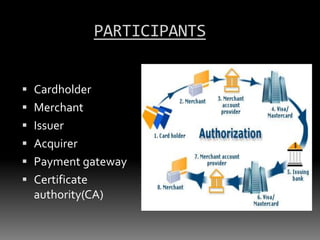

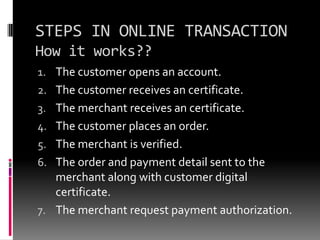

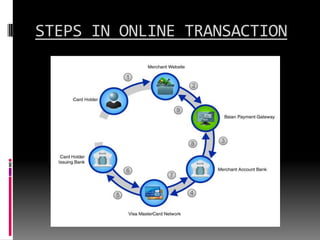

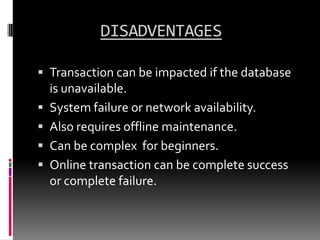

This document discusses online transactions. It begins by defining online transactions as covering both computer and mobile transactions that allow users to view accounts, transfer funds, and make payments with 24/7 access. The main features highlighted are users having control, the ability to access accounts from anywhere, making electronic payments, transaction speed, time savings, and flexibility. The participants in online transactions are identified as the cardholder, merchant, issuer, acquirer, and payment gateway. The document then outlines the 10 step process for how an online transaction works, from opening an account to receiving goods or services. It also discusses e-money as an electronic form of money used for online payments, and provides security tips for online transactions. Potential disadvantages discussed include system