Embed presentation

Downloaded 49 times

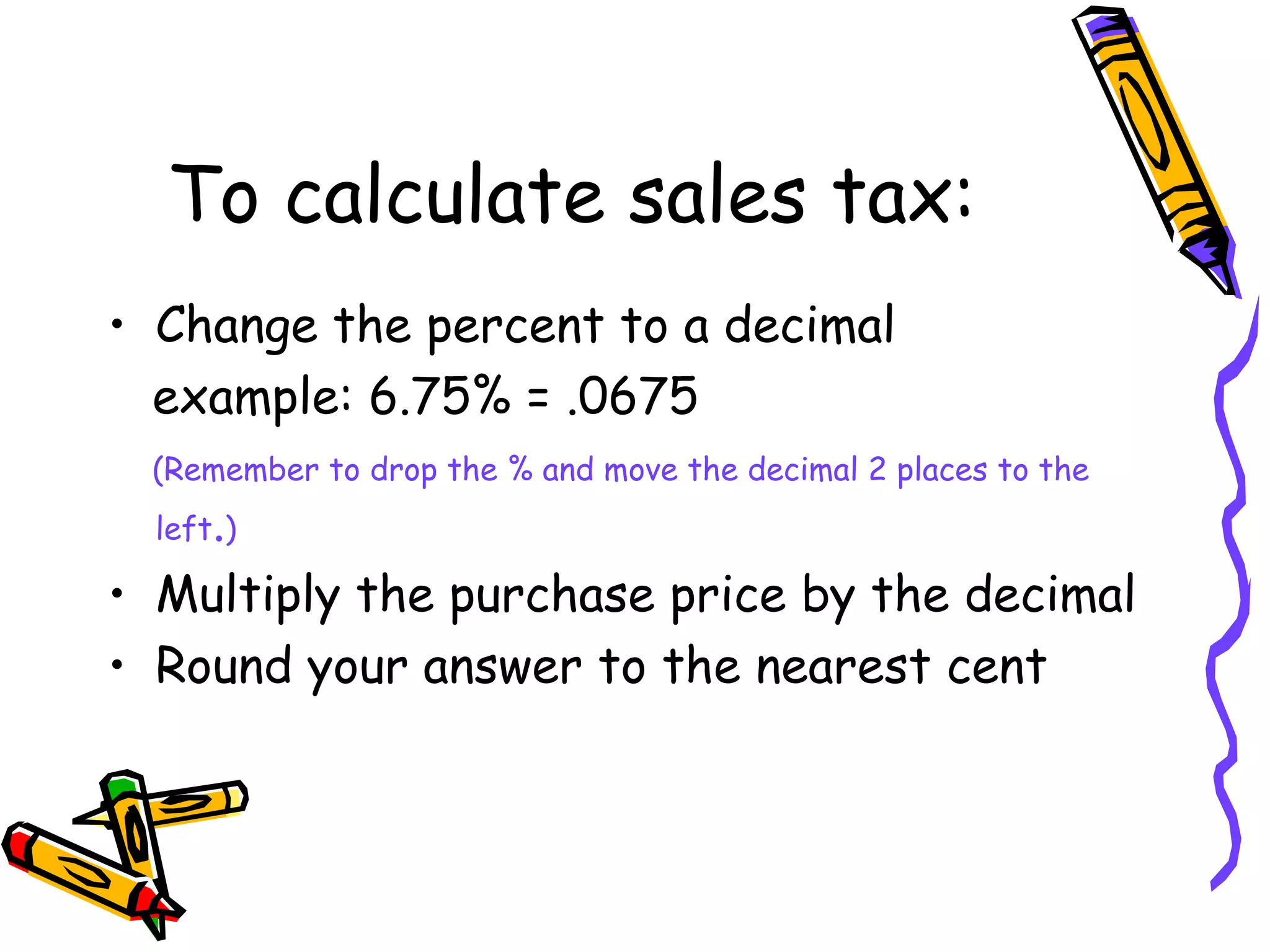

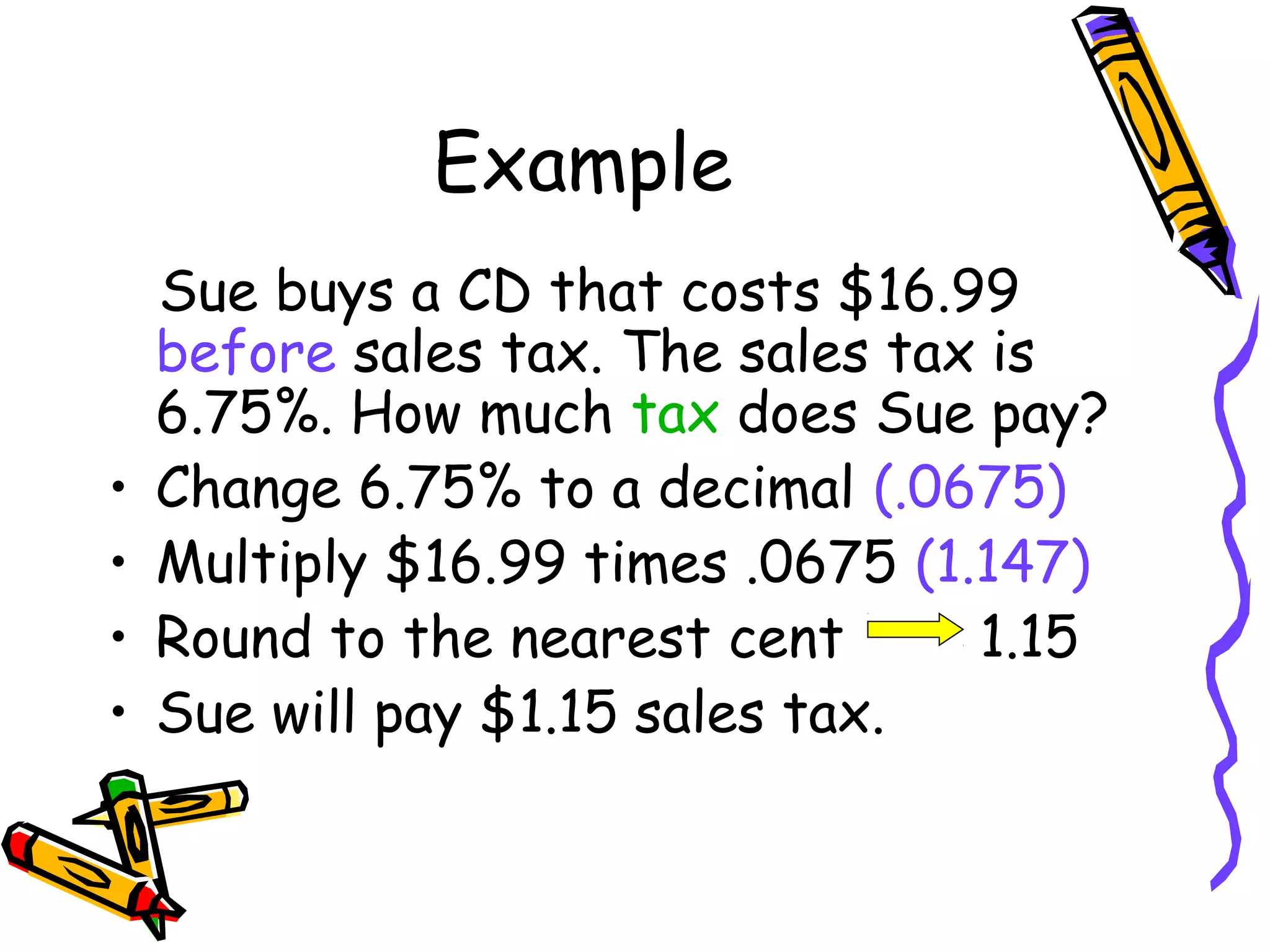

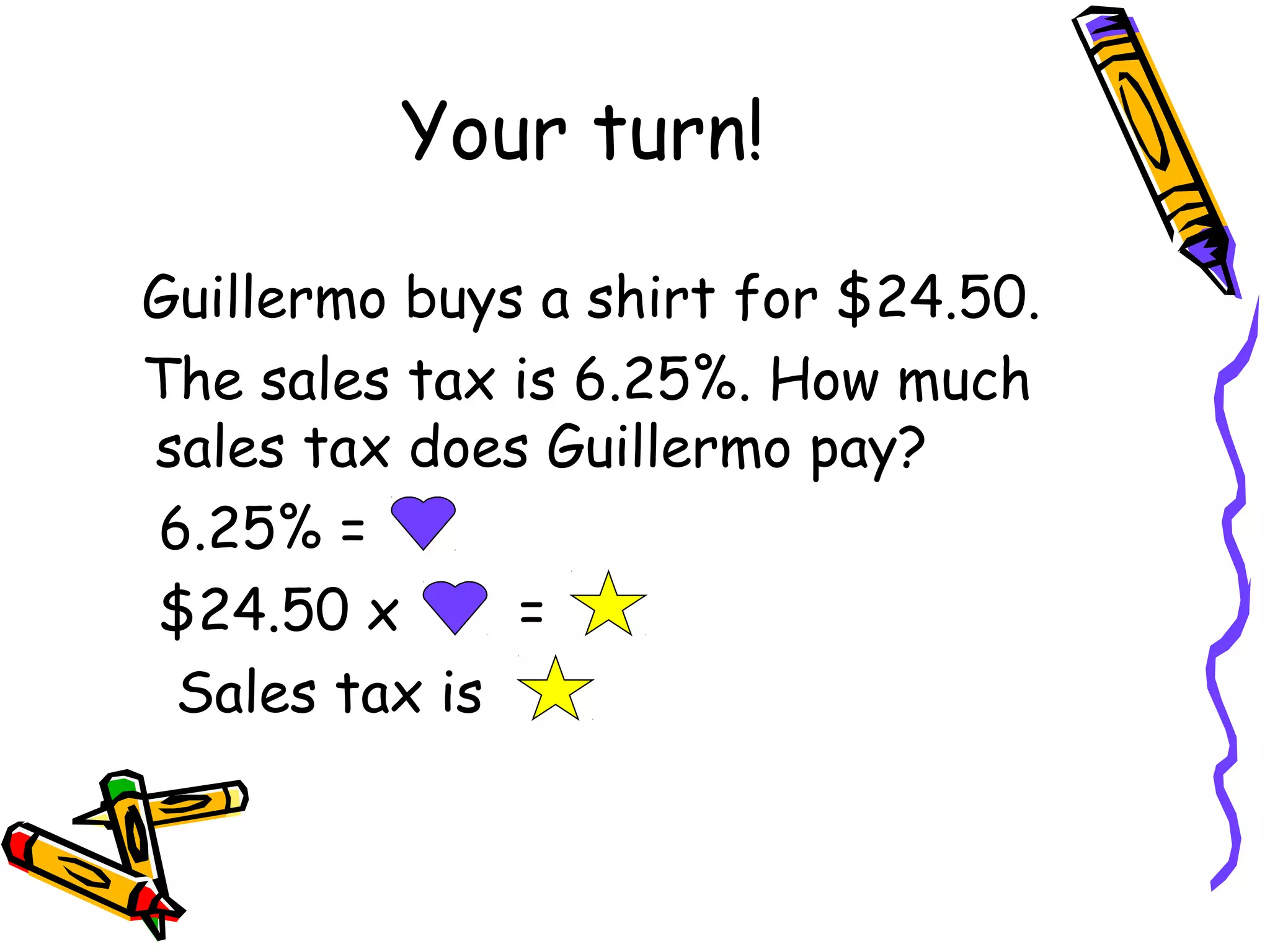

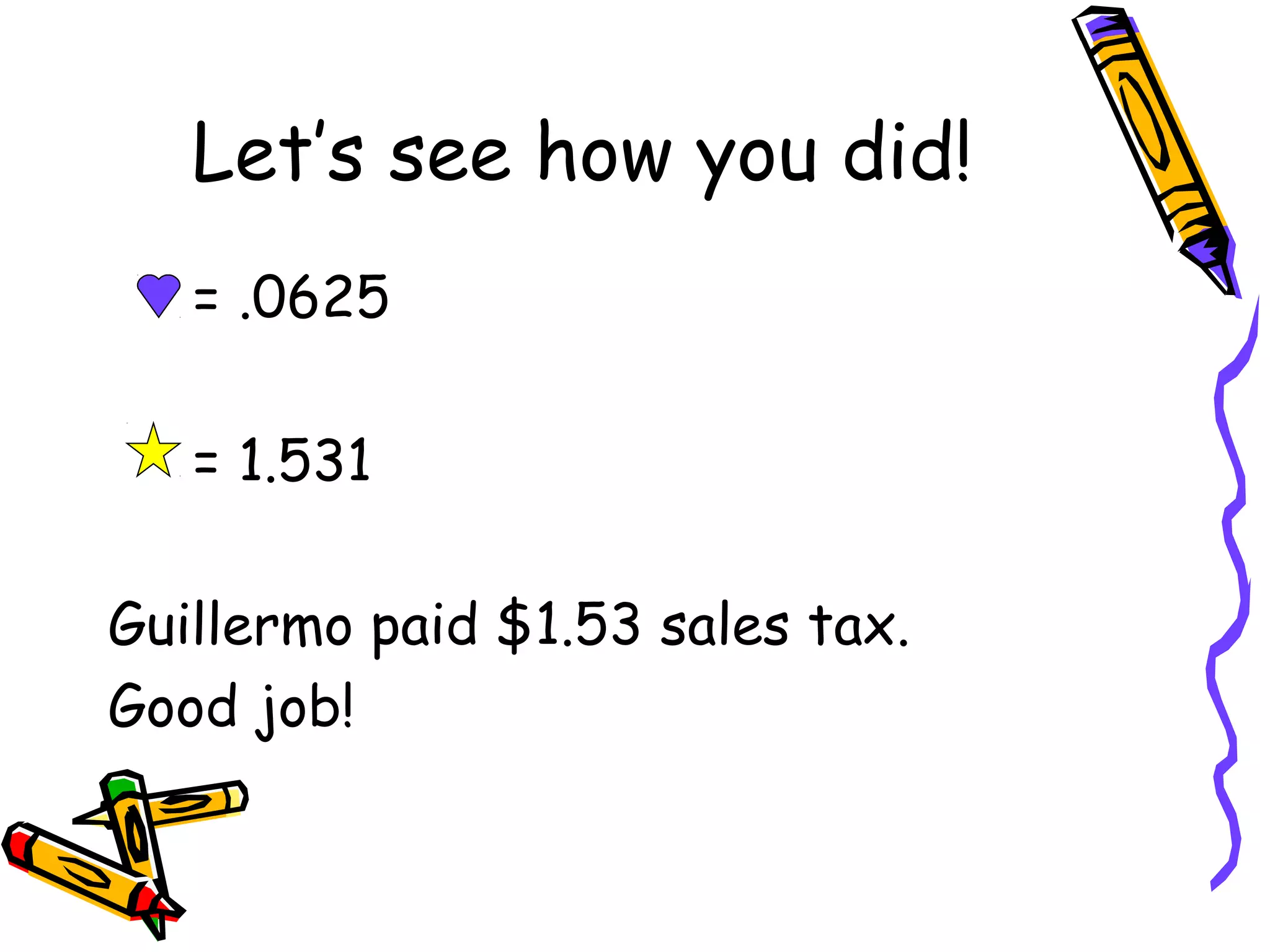

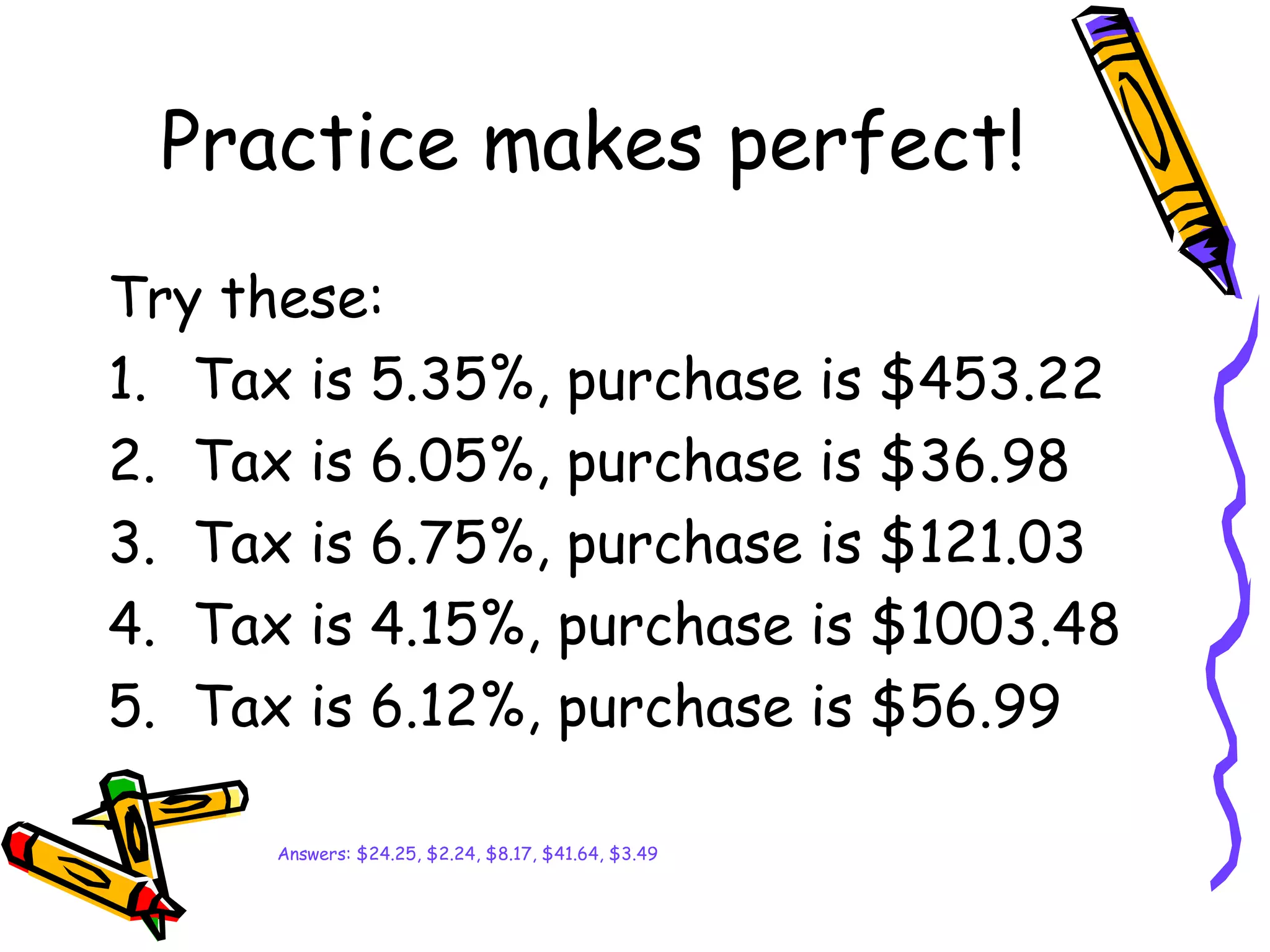

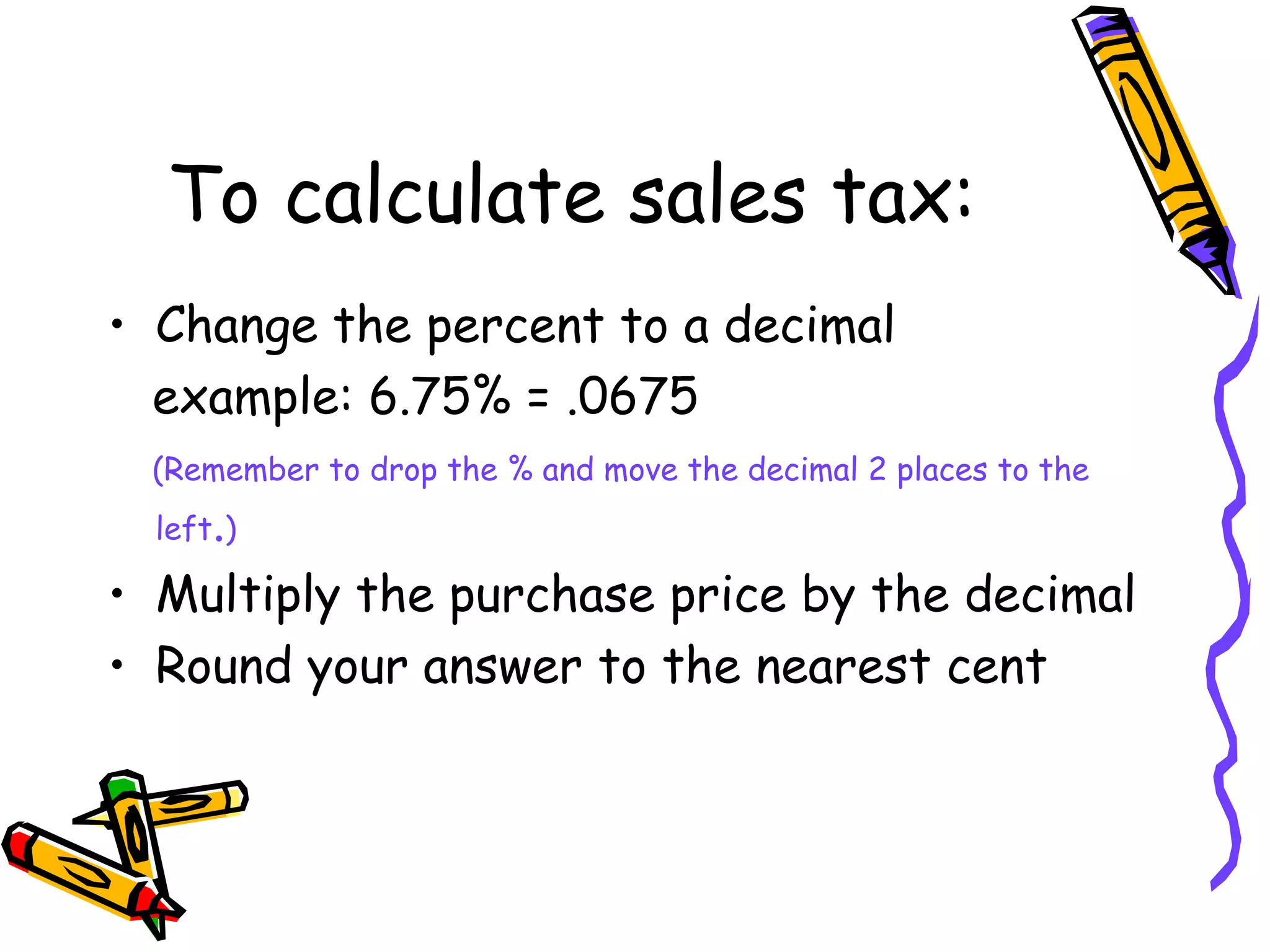

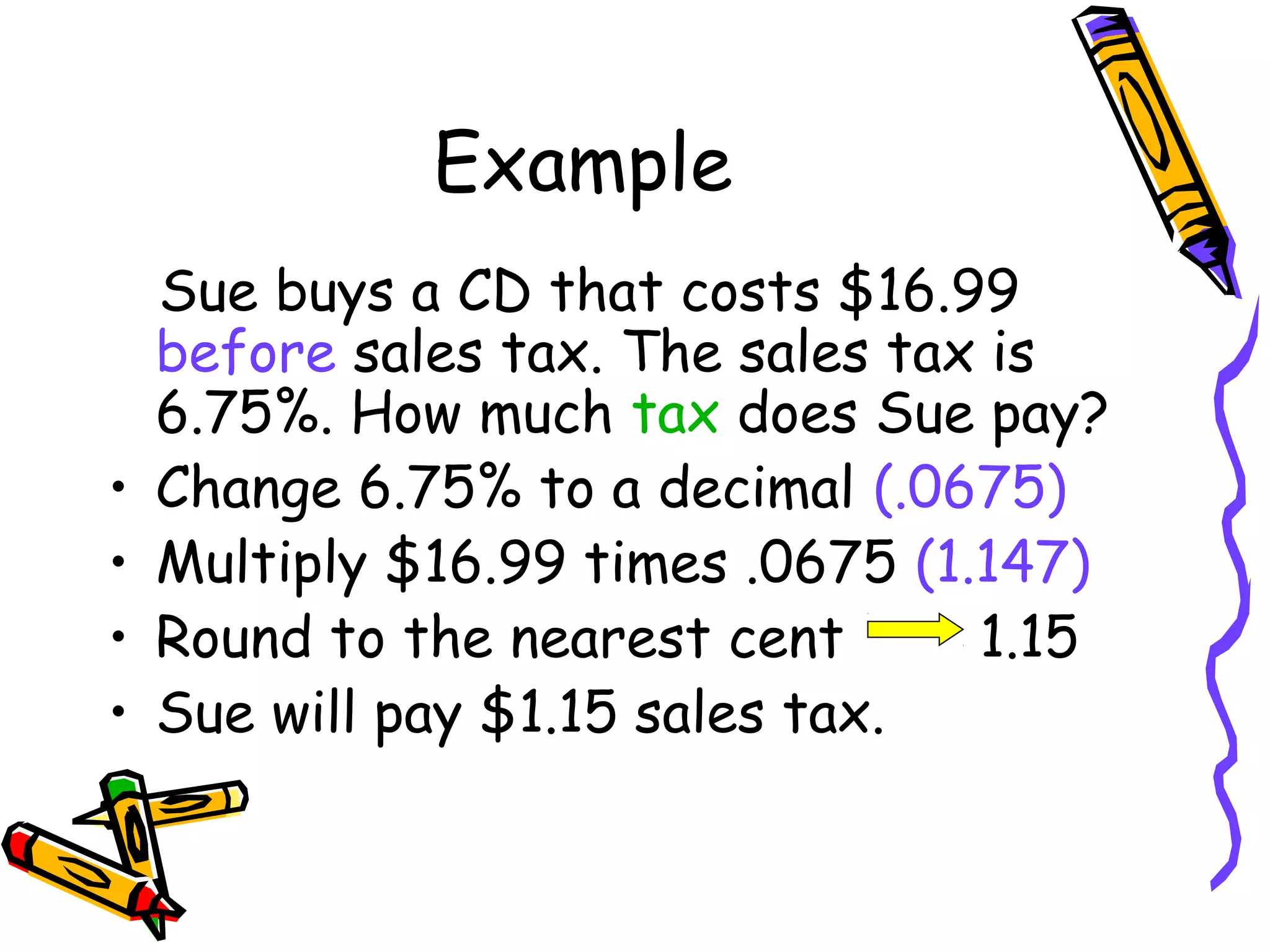

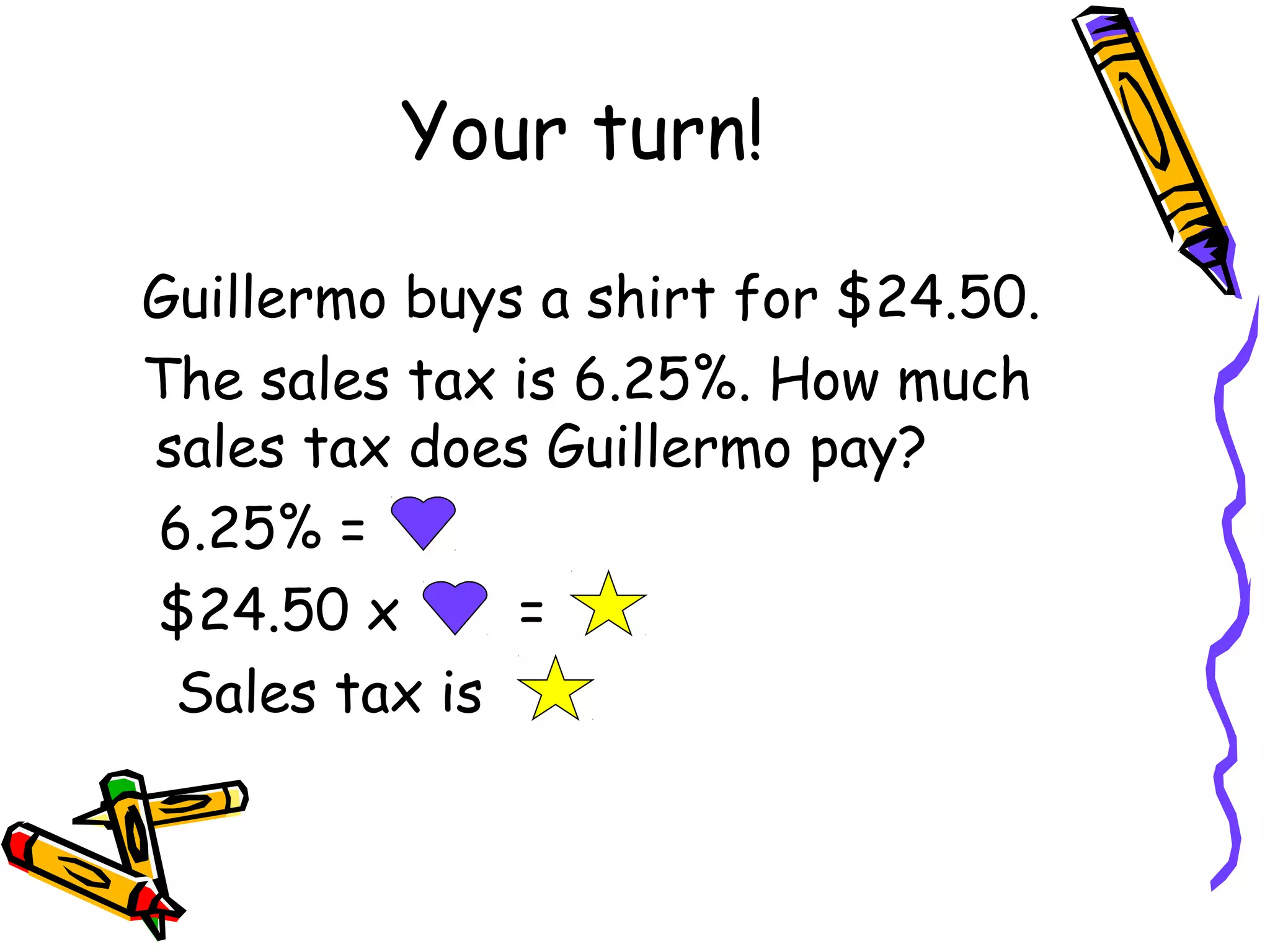

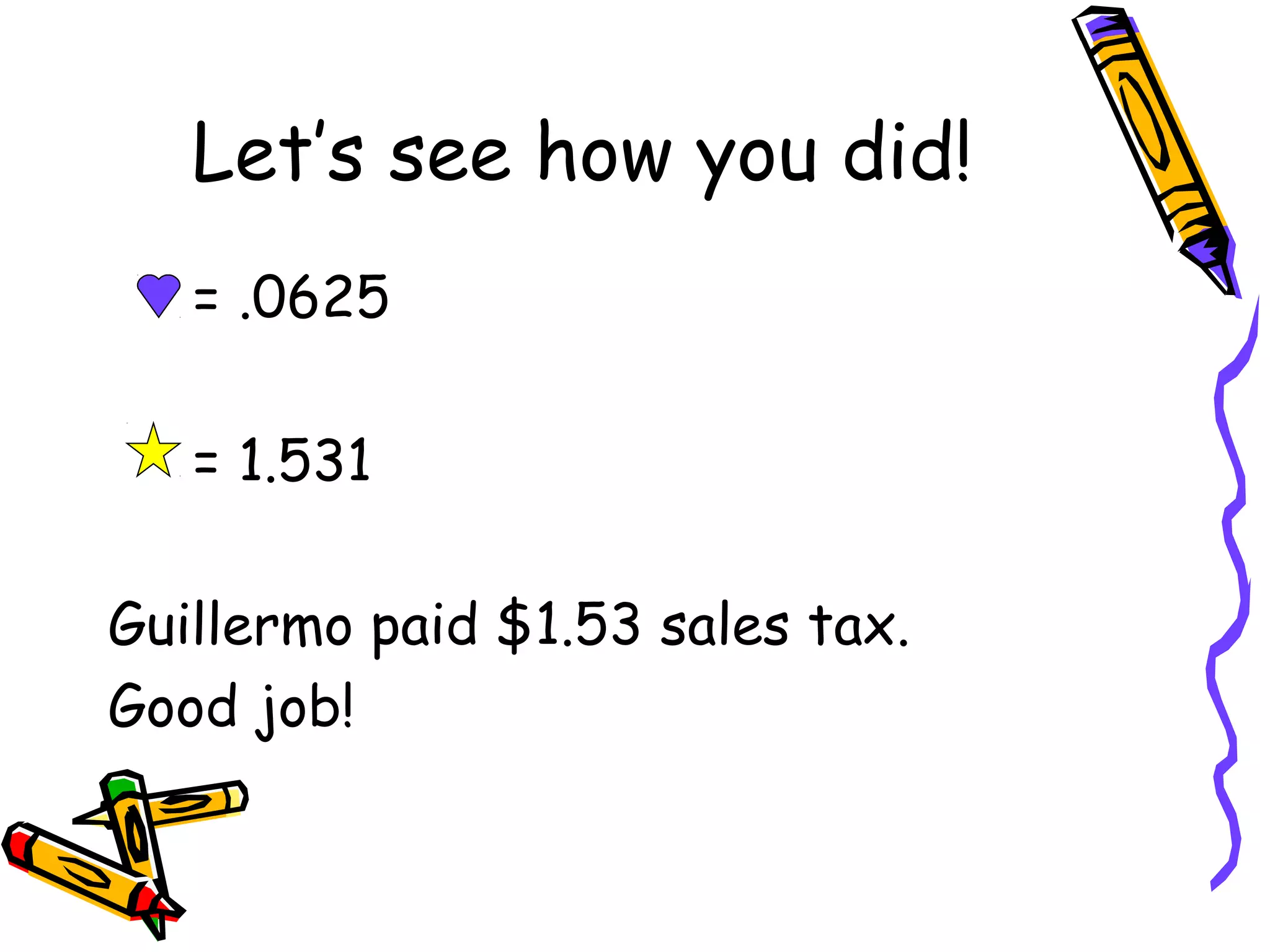

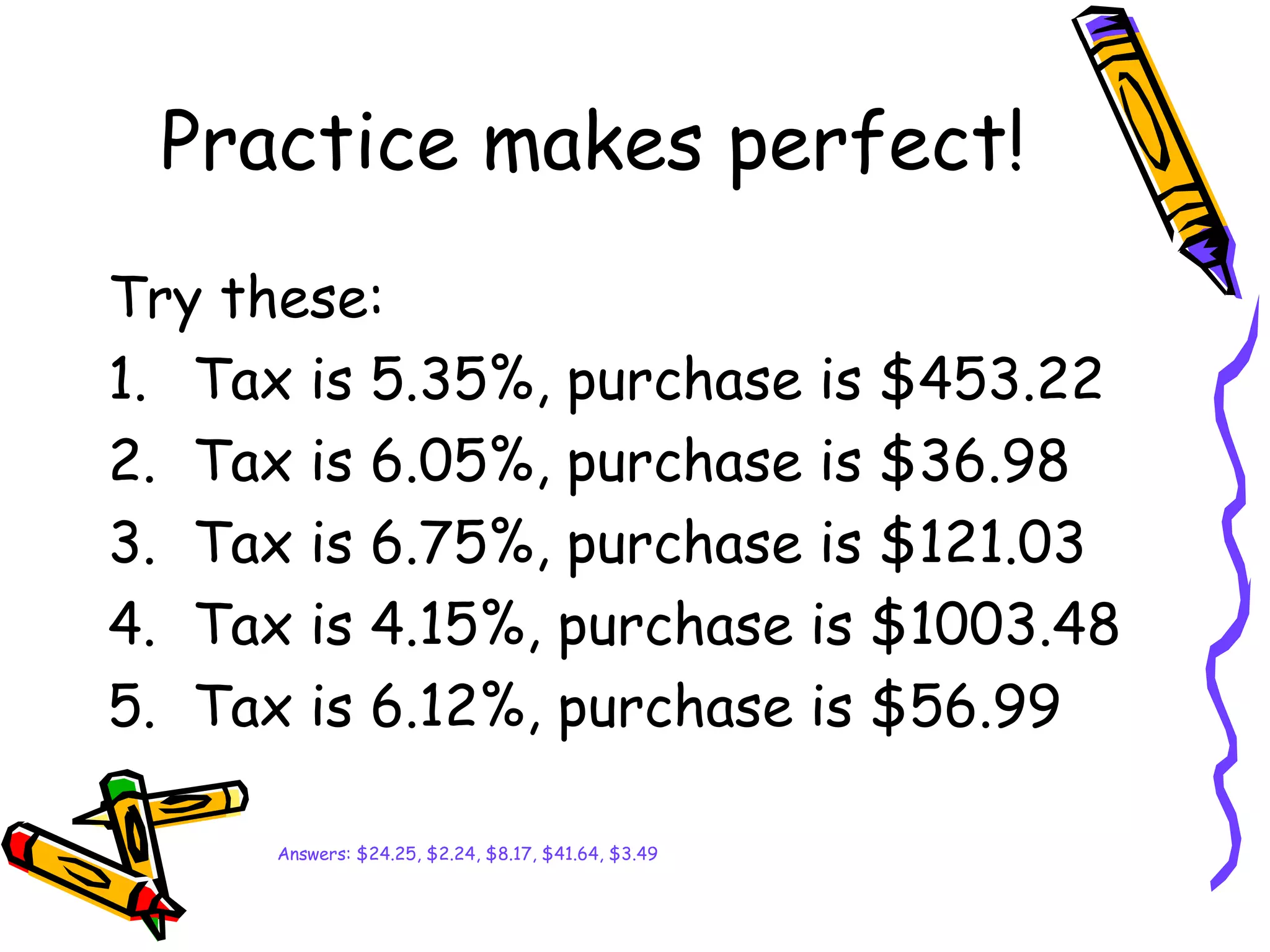

This document provides instructions for calculating sales tax by converting the tax percentage to a decimal, multiplying the purchase price by that decimal, and rounding the result to the nearest cent. An example is shown of calculating the 6.75% sales tax on a $16.99 CD purchase. Readers are then prompted to calculate the 6.25% sales tax on a $24.50 shirt. The correct answer of $1.53 is provided along with an encouragement to practice. Finally, five additional practice problems are presented with their answers.