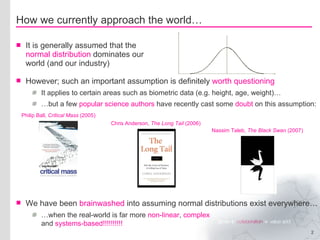

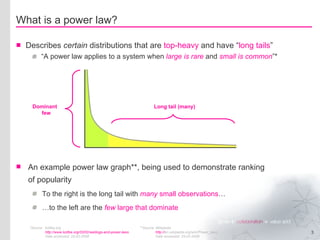

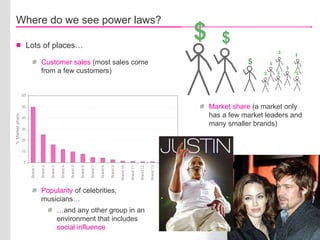

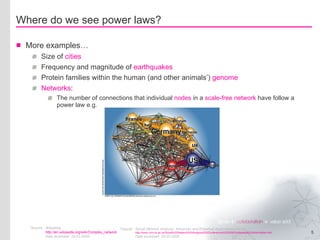

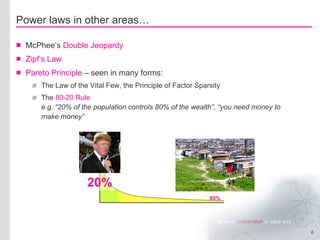

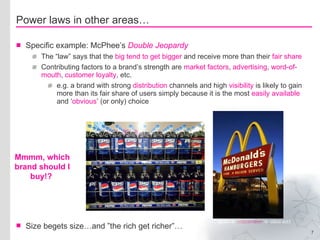

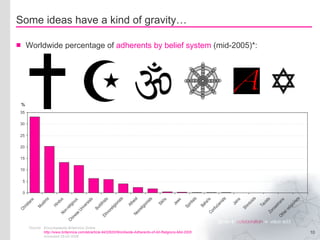

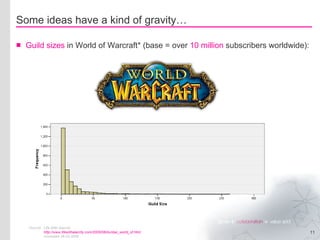

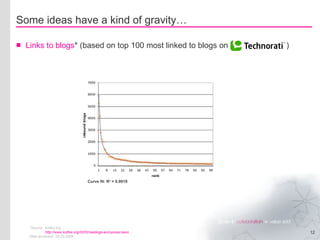

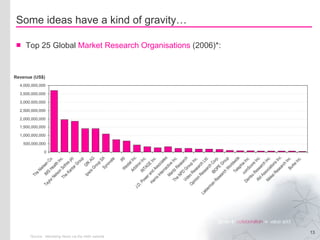

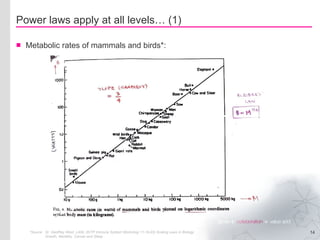

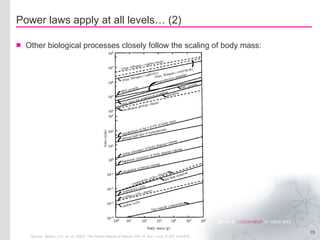

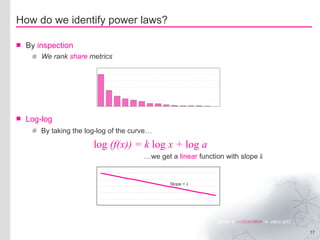

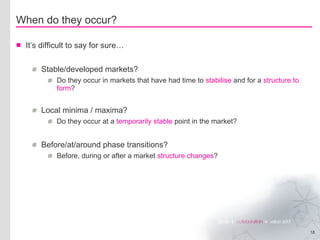

The document discusses the concept of power laws, challenging the assumption that normal distributions dominate various fields, including market dynamics. It highlights examples of power law applications across different domains such as customer sales, market share, and biological processes. The content emphasizes the rarity of large occurrences compared to the commonality of smaller ones, suggesting that these distributions could provide insight into brand momentum and market strategies.

![Kyle Findlay [email_address] The TNS Customer Equity Company Research & Development March 2008 An Introduction to Power Laws Image: Map of the human genome](https://image.slidesharecdn.com/kylefindlayintrotopowerlawsmarch2008slideshare-091221084651-phpapp01/75/Intro-To-Power-Laws-March-2008-1-2048.jpg)