Eff Set2 Assets

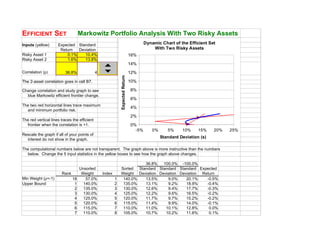

- 1. EFFICIENT SET Markowitz Portfolio Analysis With Two Risky Assets Inputs (yellow) Expected Standard Dynamic Chart of the Efficient Set Return Deviation With Two Risky Assets Risky Asset 1 0.1% 10.4% 16% Risky Asset 2 1.6% 13.8% 14% Correlation (ρ) 36.8% 4 12% Expected Return The 2-asset correlation goes in cell B7. 10% Change correlation and study graph to see 8% blue Markowitz efficient frontier change. 6% The two red horizontal lines trace maximum 4% and minimum portfolio risk. 2% The red vertical lines traces the efficient frontier when the correlation is +1. 0% -5% 0% 5% 10% 15% 20% 25% Rescale the graph if all of your points of Standard Deviation (s) interest do not show in the graph. The computational numbers below are not transparent. The graph above is more instructive than the numbers below. Change the 5 input statistics in the yellow boxes to see how the graph above changes. 36.8% 100.0% -100.0% Unsorted Sorted Standard Standard Standard Expected Rank Weight Index Weight Deviation Deviation Deviation Return Min Weight (ρ=-1) 18 57.0% 1 140.0% 13.5% 9.0% 20.1% -0.5% Upper Bound 1 140.0% 2 135.0% 13.1% 9.2% 18.9% -0.4% 2 135.0% 3 130.0% 12.6% 9.4% 17.7% -0.3% 3 130.0% 4 125.0% 12.2% 9.6% 16.5% -0.2% 4 125.0% 5 120.0% 11.7% 9.7% 15.2% -0.2% 5 120.0% 6 115.0% 11.4% 9.9% 14.0% -0.1% 6 115.0% 7 110.0% 11.0% 10.1% 12.8% 0.0% 7 110.0% 8 105.0% 10.7% 10.2% 11.6% 0.1%

- 2. 8 105.0% 9 100.0% 10.4% 10.4% 10.4% 0.1% 9 100.0% 10 95.0% 10.2% 10.6% 9.2% 0.2% 10 95.0% 11 90.0% 10.0% 10.7% 8.0% 0.3% 11 90.0% 12 85.0% 9.8% 10.9% 6.8% 0.4% 12 85.0% 13 80.0% 9.7% 11.1% 5.6% 0.4% 13 80.0% 14 75.0% 9.6% 11.3% 4.4% 0.5% 14 75.0% 15 70.0% 9.6% 11.4% 3.1% 0.6% 15 70.0% 16 65.0% 9.6% 11.6% 1.9% 0.7% 16 65.0% 17 60.0% 9.7% 11.8% 0.7% 0.7% 17 60.0% 18 57.0% 9.8% 11.9% 0.0% 0.8% 19 55.0% 19 55.0% 9.9% 11.9% 0.5% 0.8% 20 50.0% 20 50.0% 10.1% 12.1% 1.7% 0.9% 21 45.0% 21 45.0% 10.3% 12.3% 2.9% 1.0% 22 40.0% 22 40.0% 10.5% 12.4% 4.1% 1.0% 23 35.0% 23 35.0% 10.9% 12.6% 5.3% 1.1% 24 30.0% 24 30.0% 11.2% 12.8% 6.5% 1.2% 25 25.0% 25 25.0% 11.6% 13.0% 7.8% 1.3% 26 20.0% 26 20.0% 12.0% 13.1% 9.0% 1.3% 27 15.0% 27 15.0% 12.4% 13.3% 10.2% 1.4% 28 10.0% 28 10.0% 12.8% 13.5% 11.4% 1.5% 29 5.0% 29 5.0% 13.3% 13.6% 12.6% 1.6% 30 0.0% 30 0.0% 13.8% 13.8% 13.8% 1.6% 31 -5.0% 31 -5.0% 14.3% 14.0% 15.0% 1.7% 32 -10.0% 32 -10.0% 14.8% 14.1% 16.2% 1.8% 33 -15.0% 33 -15.0% 15.4% 14.3% 17.4% 1.9% 34 -20.0% 34 -20.0% 15.9% 14.5% 18.6% 1.9% 35 -25.0% 35 -25.0% 16.5% 14.7% 19.8% 2.0% 36 -30.0% 36 -30.0% 17.0% 14.8% 21.1% 2.1% 37 -35.0% 37 -35.0% 17.6% 15.0% 22.3% 2.2% 38 -40.0% 38 -40.0% 18.2% 15.2% 23.5% 2.2% 39 -45.0% 39 -45.0% 18.8% 15.3% 24.7% 2.3% 40 -50.0% 40 -50.0% 19.4% 15.5% 25.9% 2.4% 41 -55.0% 41 -55.0% 20.0% 15.7% 27.1% 2.5% Lower Bound 42 -60.0% 42 -60.0% 20.6% 15.8% 28.3% 2.5%