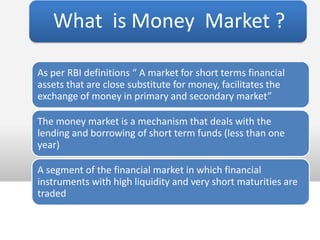

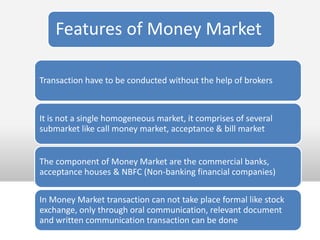

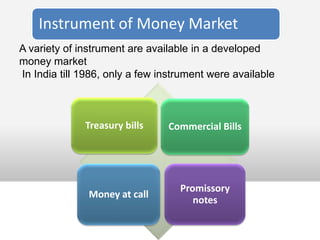

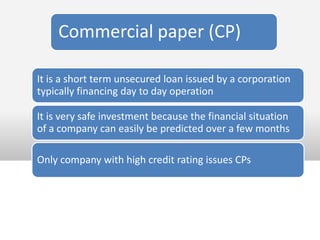

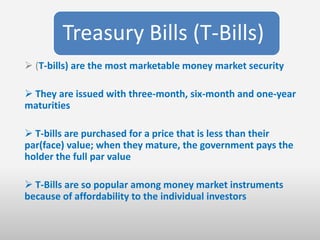

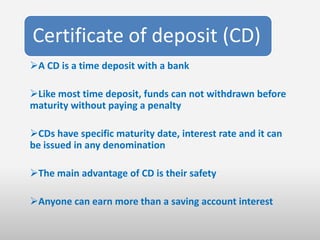

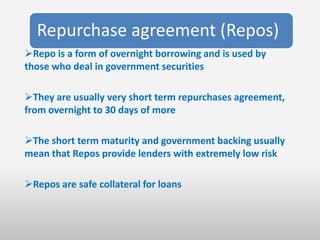

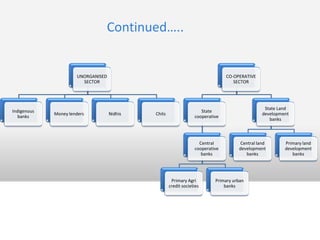

The document discusses features of the Indian money market, including its objectives to provide short-term funding at reasonable costs, key instruments like treasury bills, commercial papers, repos, and bankers acceptances, as well as its structure involving organized sectors such as commercial banks and unorganized sectors like money lenders. It also covers characteristics of a developed money market and disadvantages like volatility and seasonal shortages of funds.