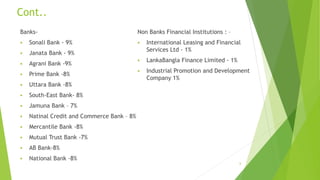

Treasury bills are short-term debt instruments issued by the Bangladesh government with maturities of up to one year. They are sold at a discount to their face value at maturity, with the difference representing the interest earned. Treasury bills carry essentially no default risk since they are guaranteed by the government. Major banks and non-bank financial institutions in Bangladesh participate as primary dealers in the treasury bill auction process managed by the central bank.