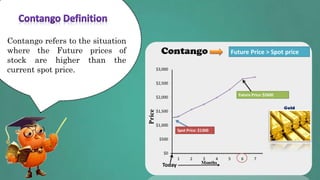

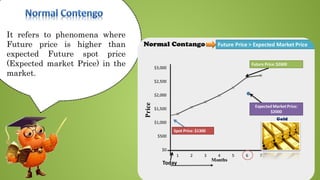

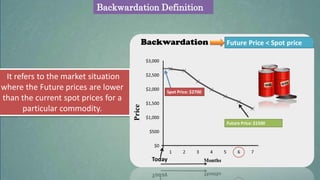

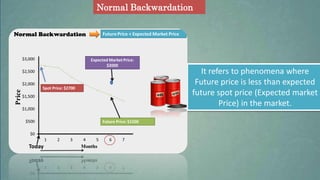

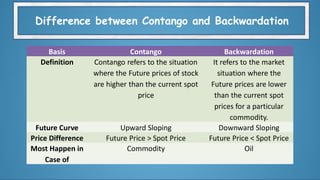

The document explains the concepts of contango and backwardation in commodity markets, particularly in crude oil. Contango occurs when future prices are higher than current spot prices, while backwardation is the situation where future prices are lower than current spot prices. The article aims to simplify these concepts for better understanding and practical application.