The document summarizes findings from a survey of 350 businesses on their use of managed IT services. Key findings include:

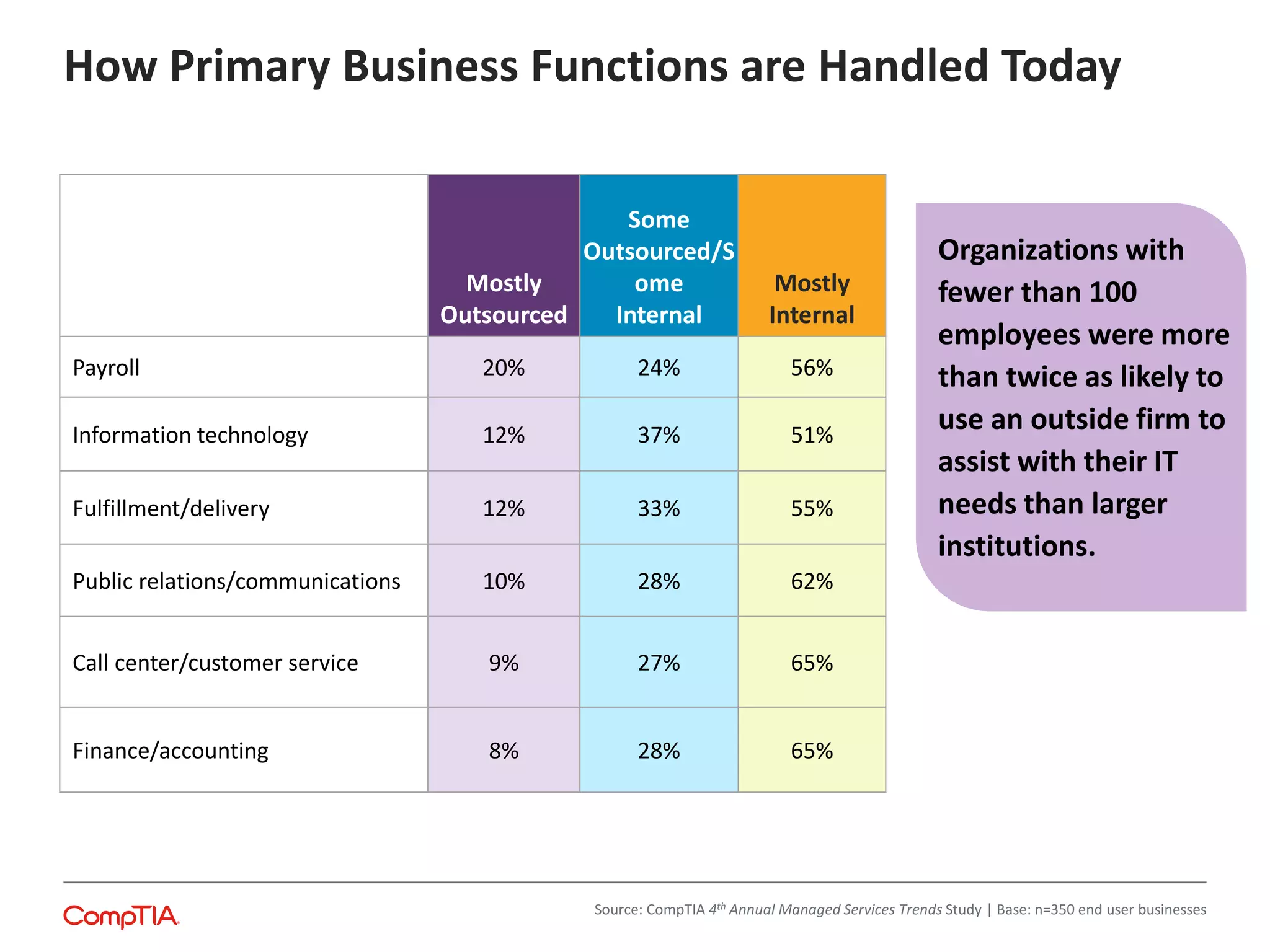

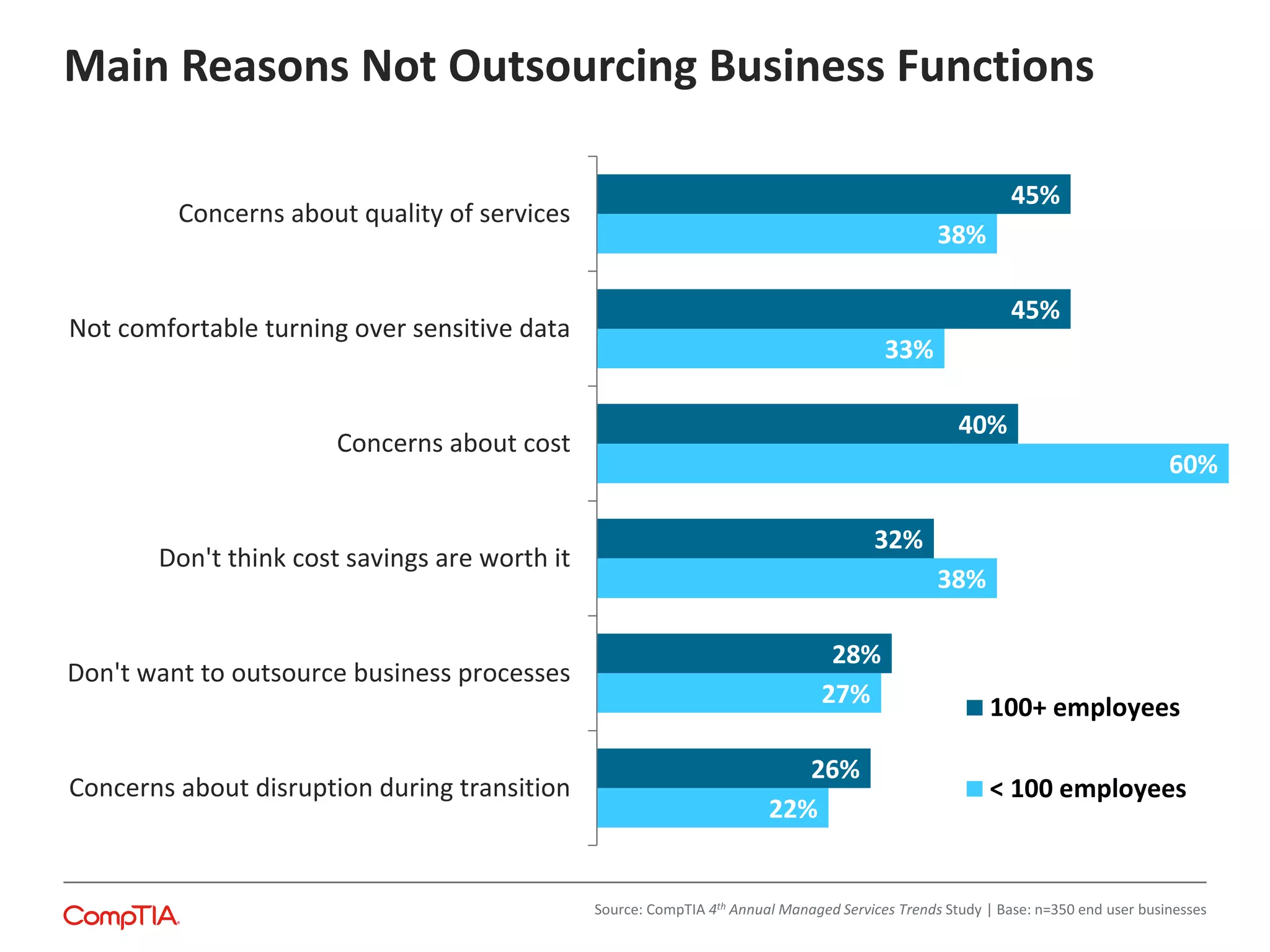

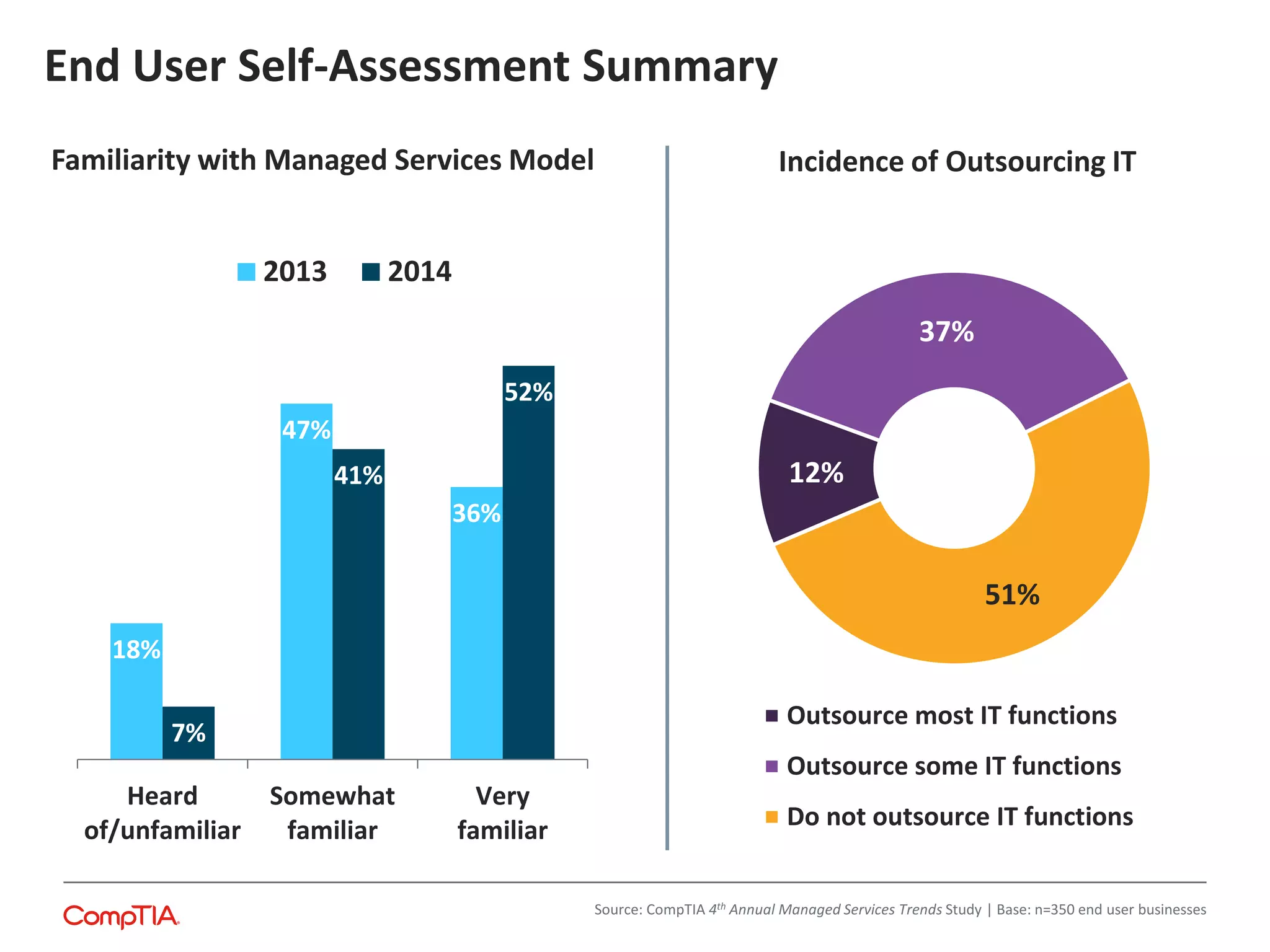

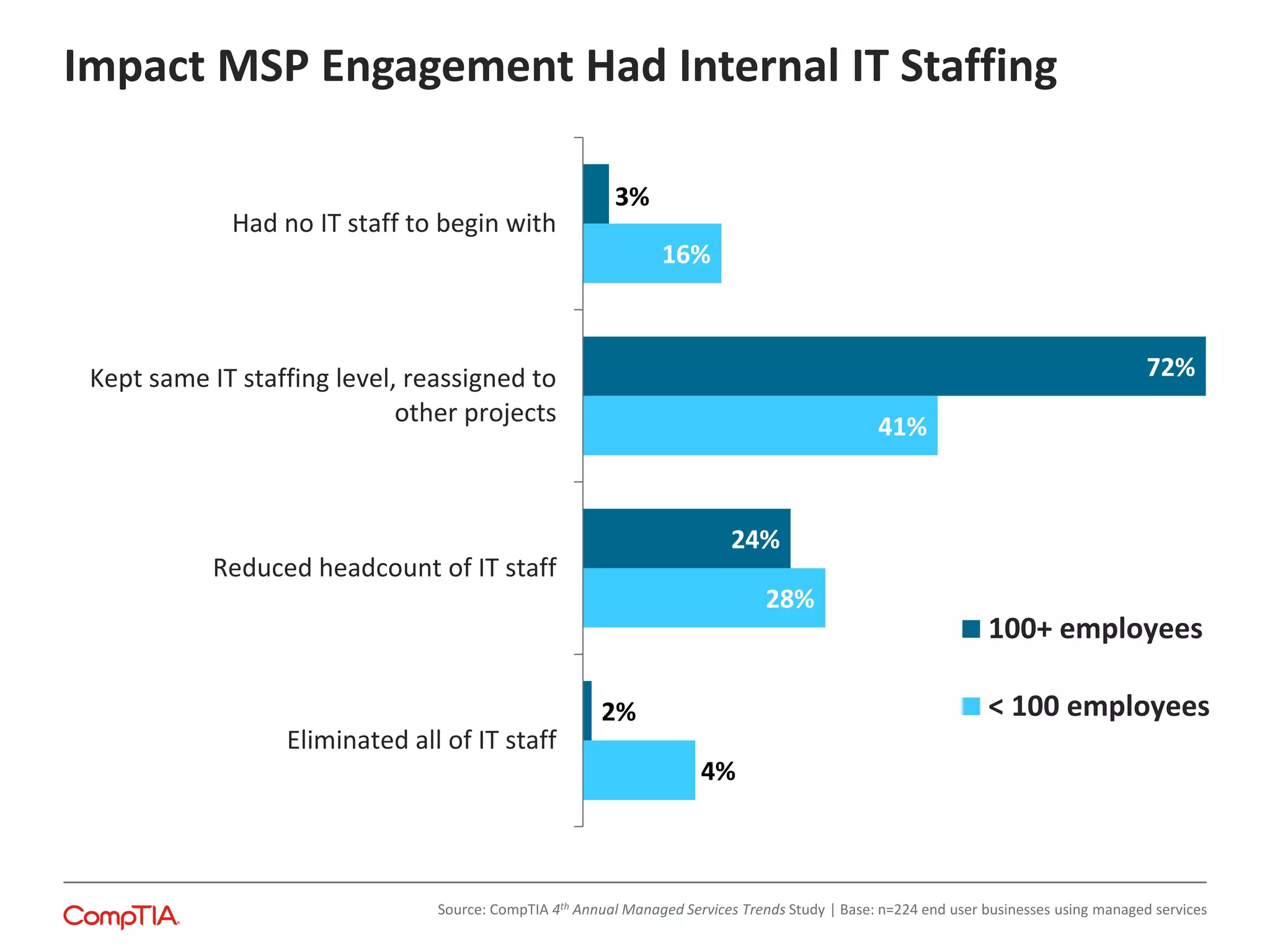

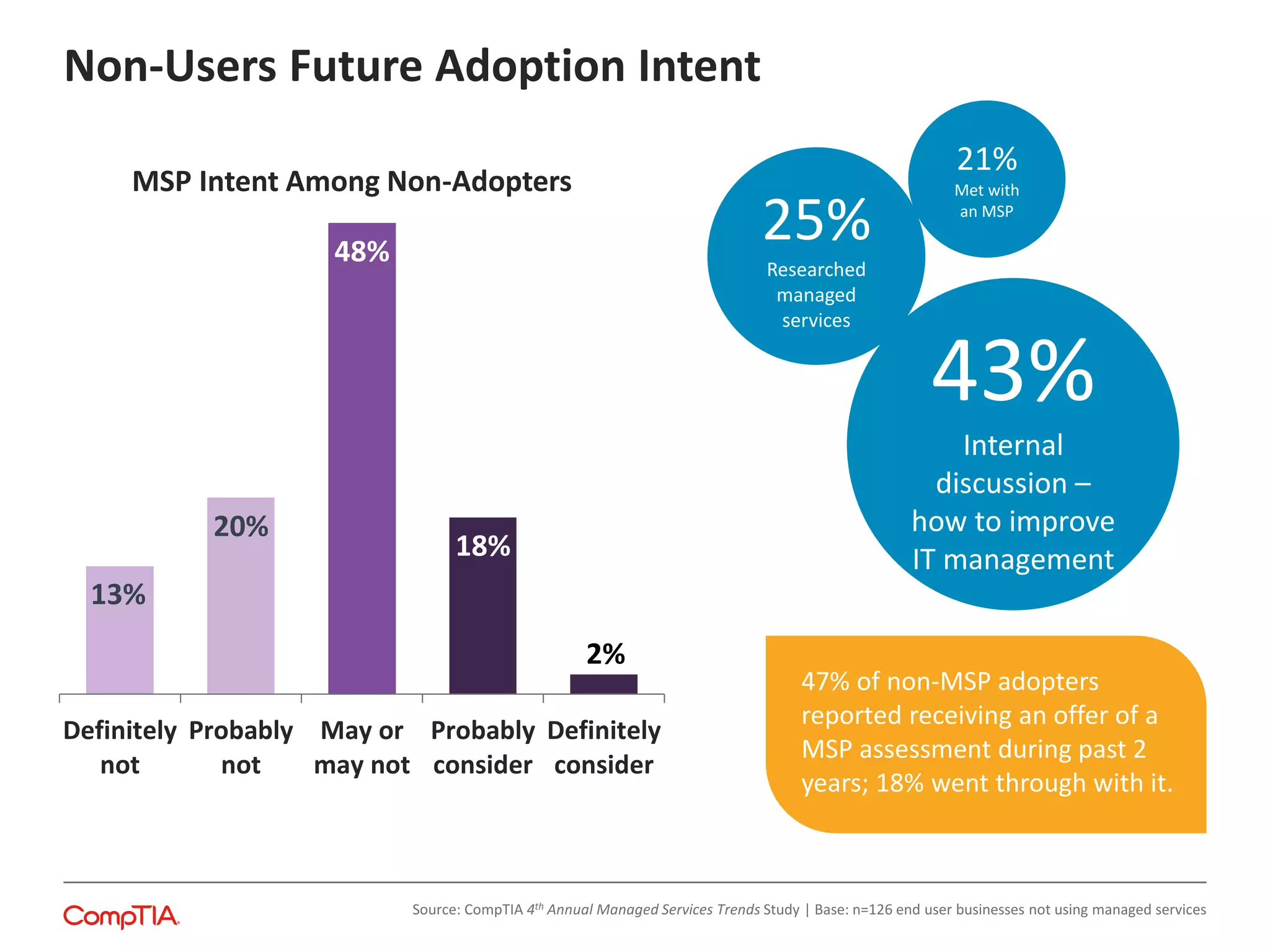

- Smaller businesses (<100 employees) were over twice as likely to outsource IT compared to larger businesses.

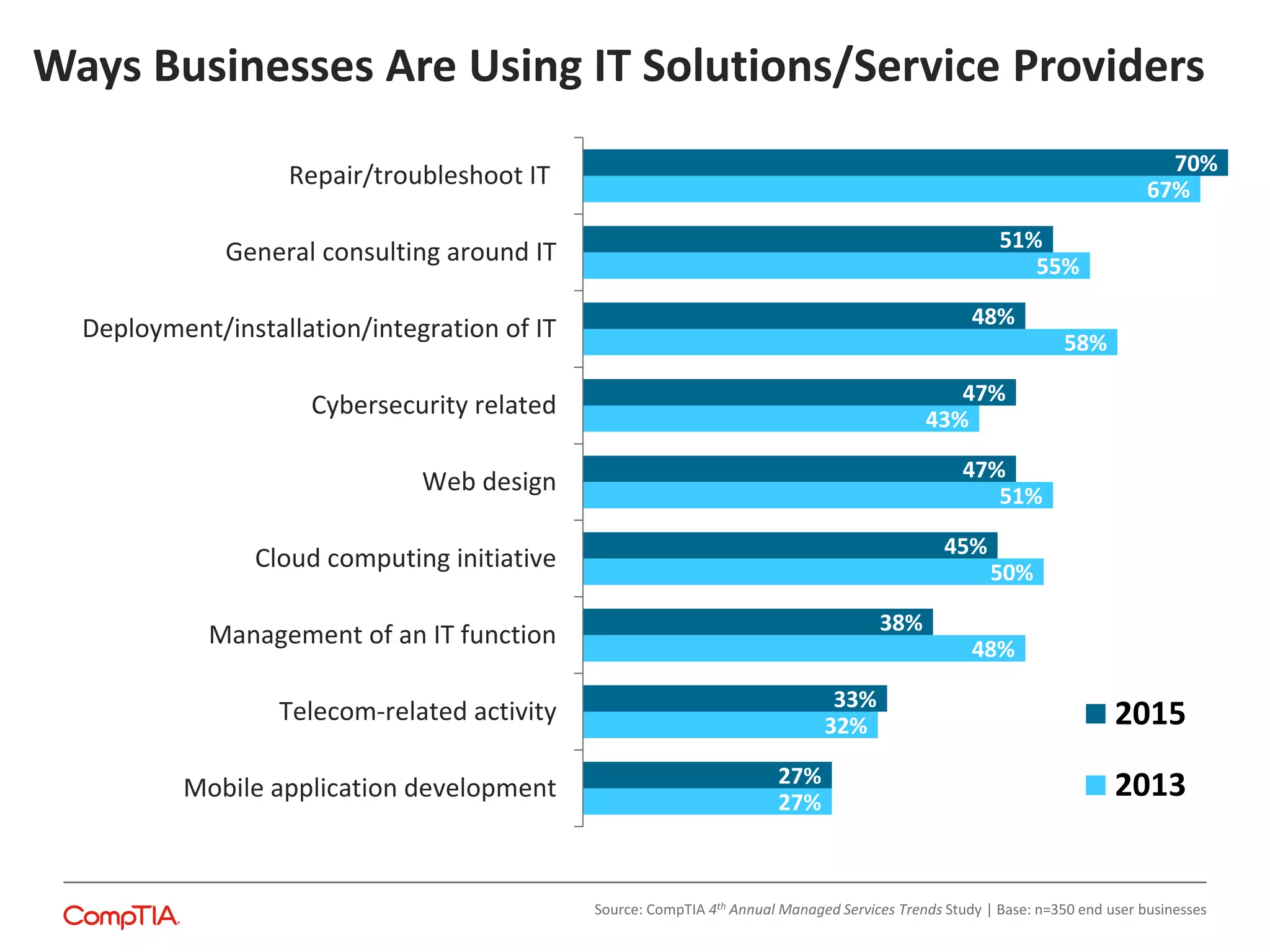

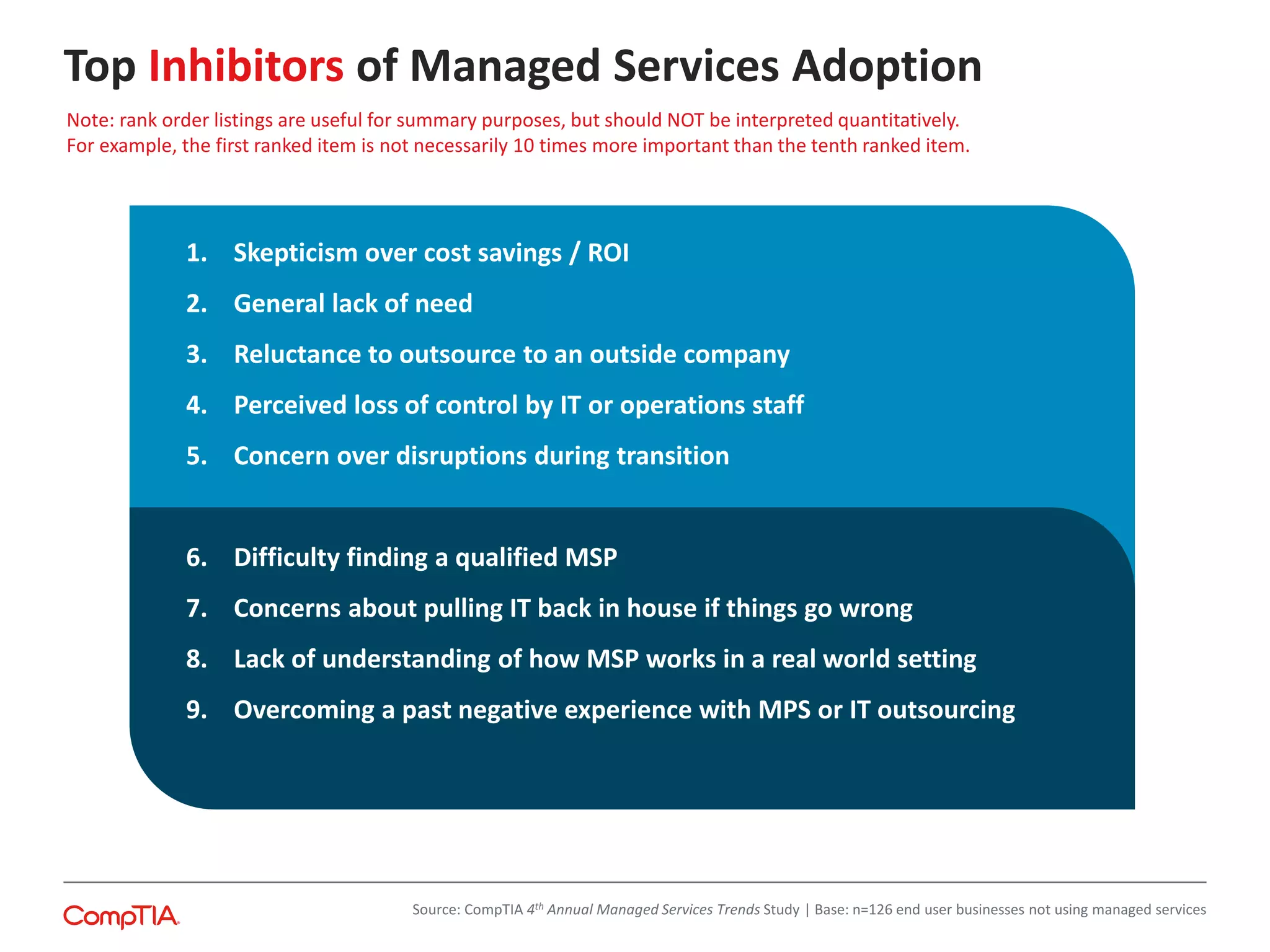

- While most businesses have a formal IT department, many also use outside firms for projects or troubleshooting.

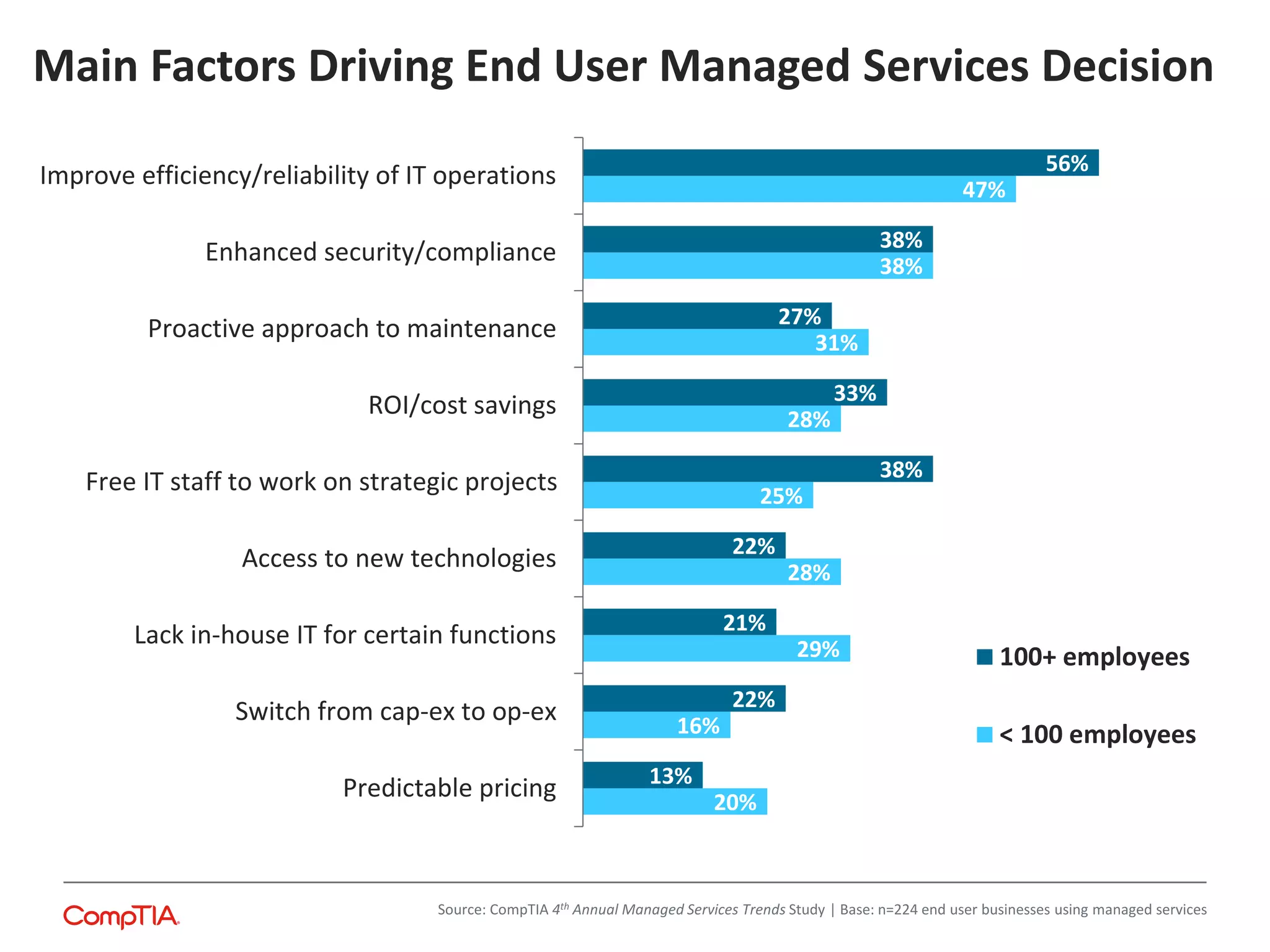

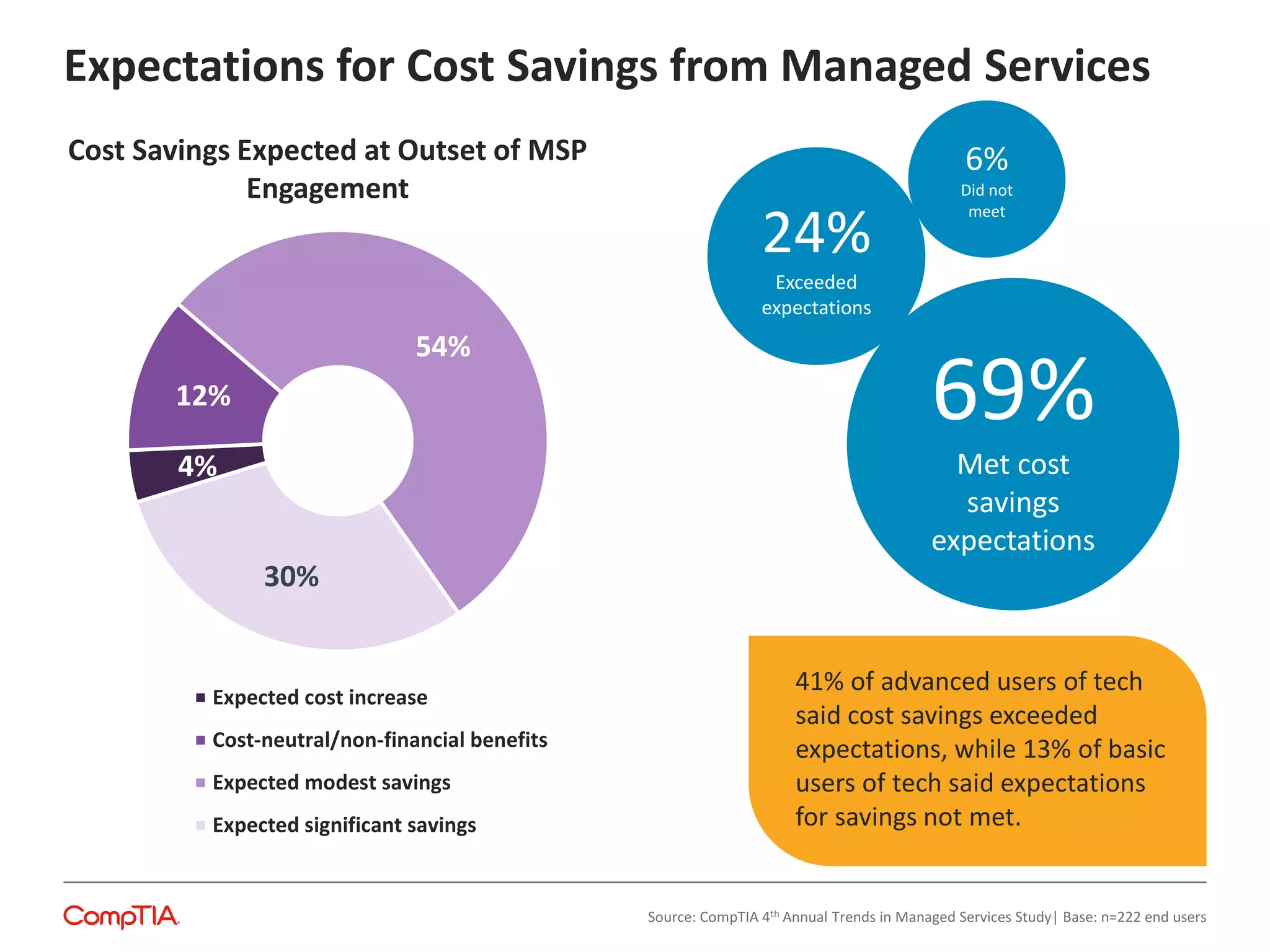

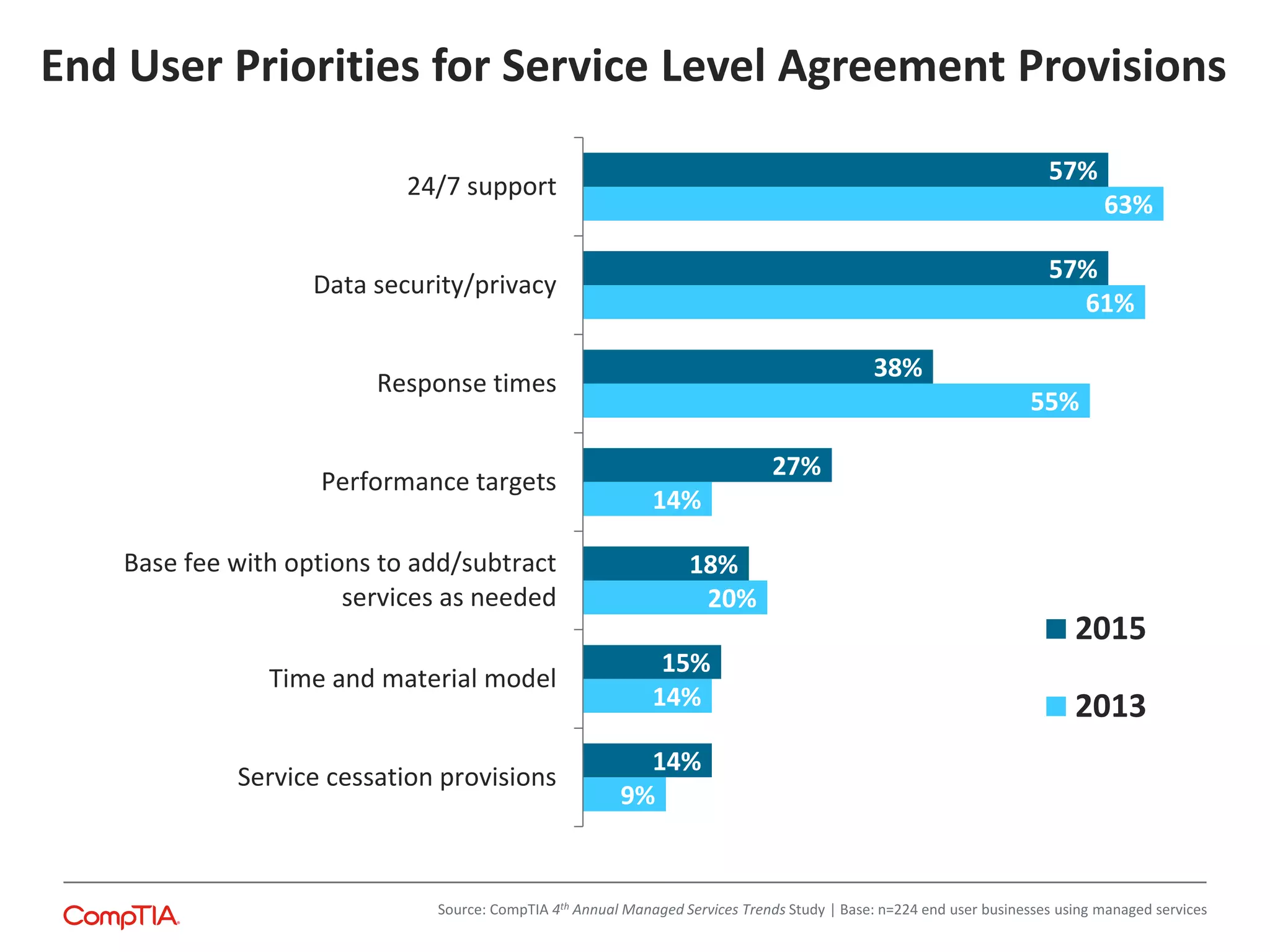

- Over half of businesses were satisfied with their current IT management, but 39% said it could be better.

- Functions like security, cloud computing and mobile apps saw larger increases in outsourcing from 2013-2015.