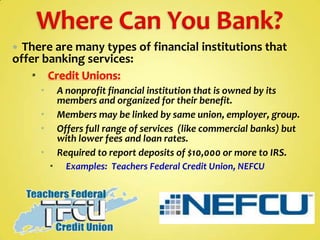

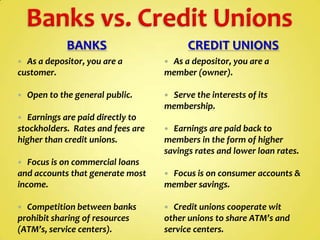

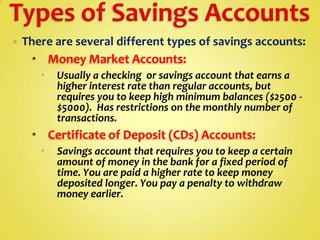

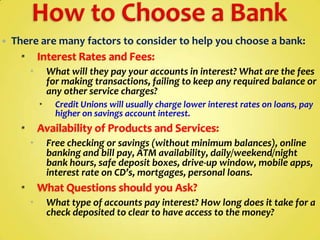

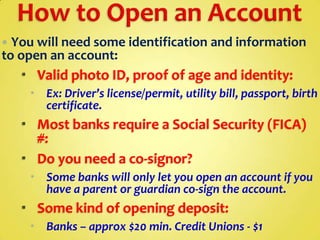

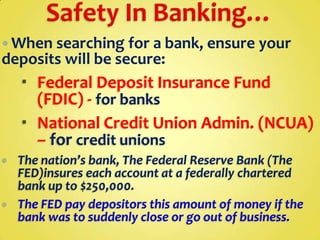

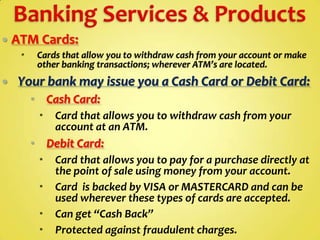

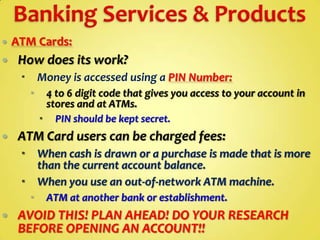

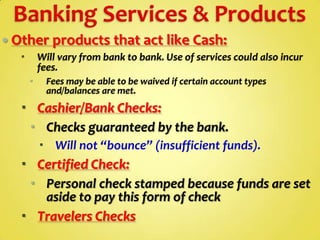

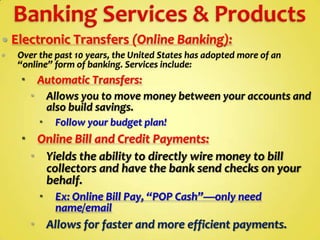

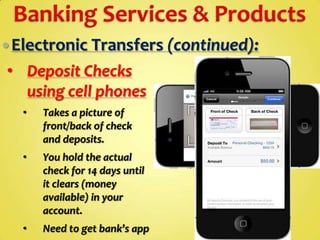

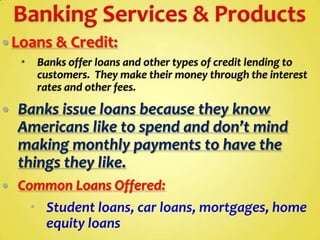

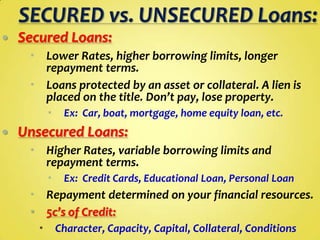

This document provides information on various types of financial institutions and banking services. It discusses commercial banks, credit unions, savings accounts, checking accounts, loans, online banking, and other services offered by banks. The key points covered include the differences between banks and credit unions, factors to consider when choosing a bank, requirements for opening an account, and fees associated with various products and services.