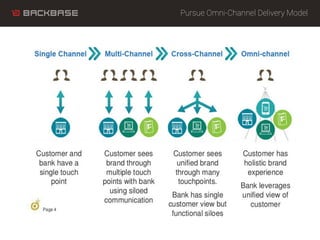

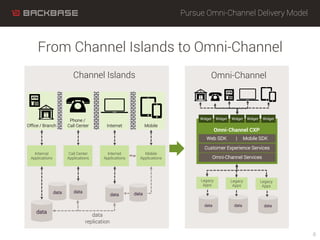

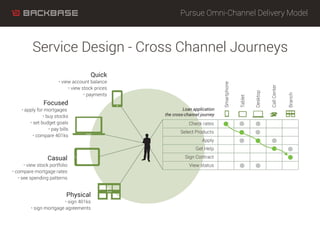

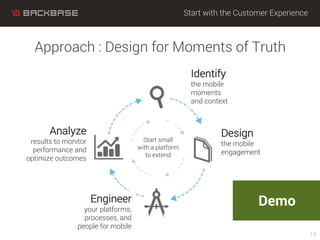

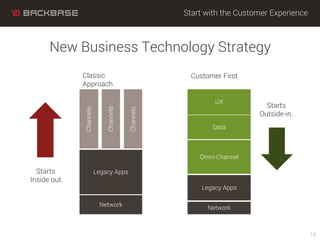

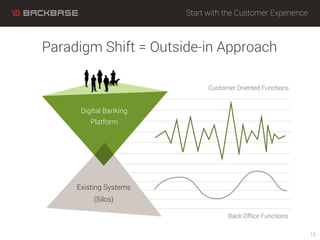

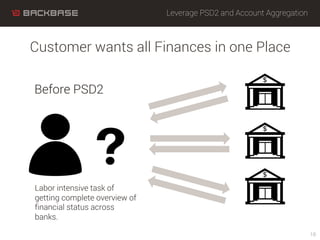

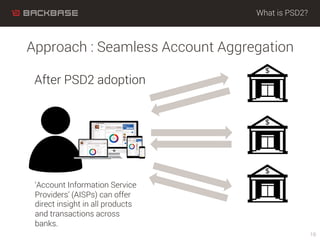

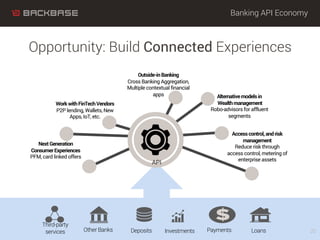

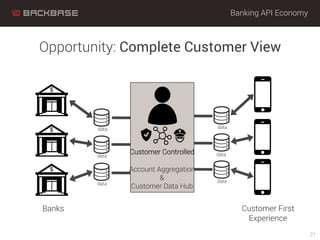

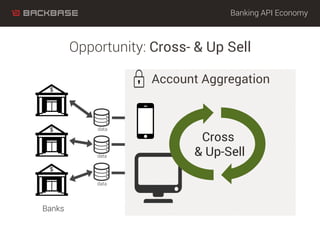

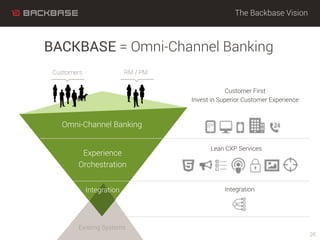

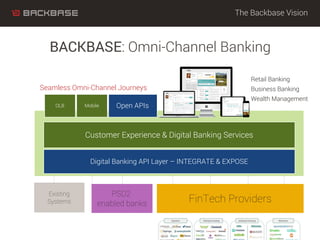

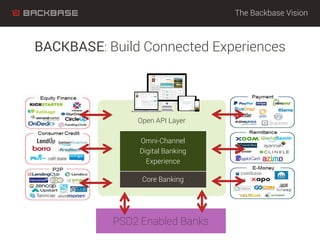

This document discusses strategies for banks to pursue an omni-channel delivery model and leverage new technologies like PSD2 and account aggregation to improve the customer experience. It recommends starting with the customer experience by designing services around their needs and behaviors. PSD2 regulations allow third parties to access customer data, enabling one-stop-shop banking across institutions through account aggregation. This opens opportunities to build connected experiences through open banking APIs and gain a complete view of customers.