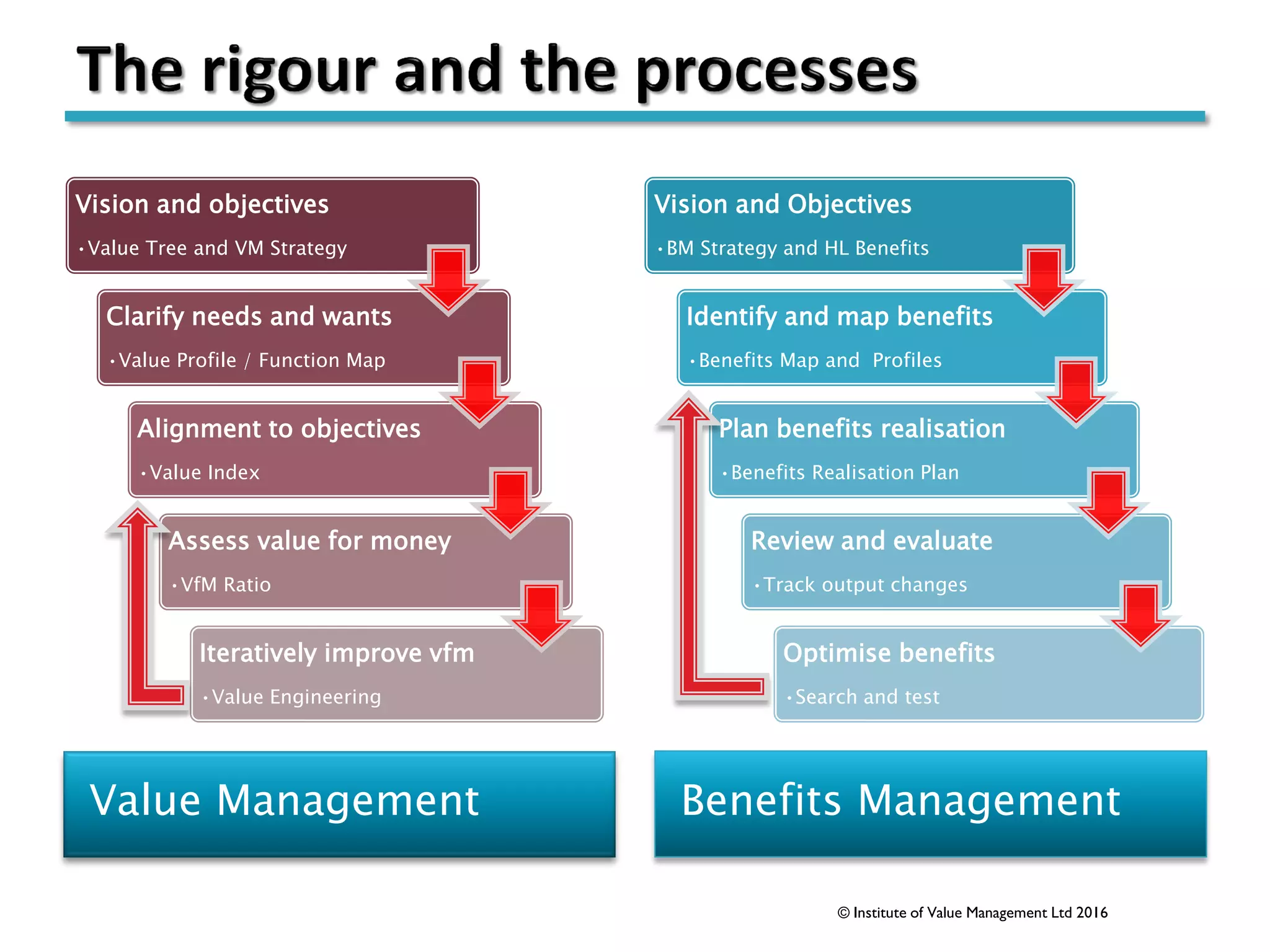

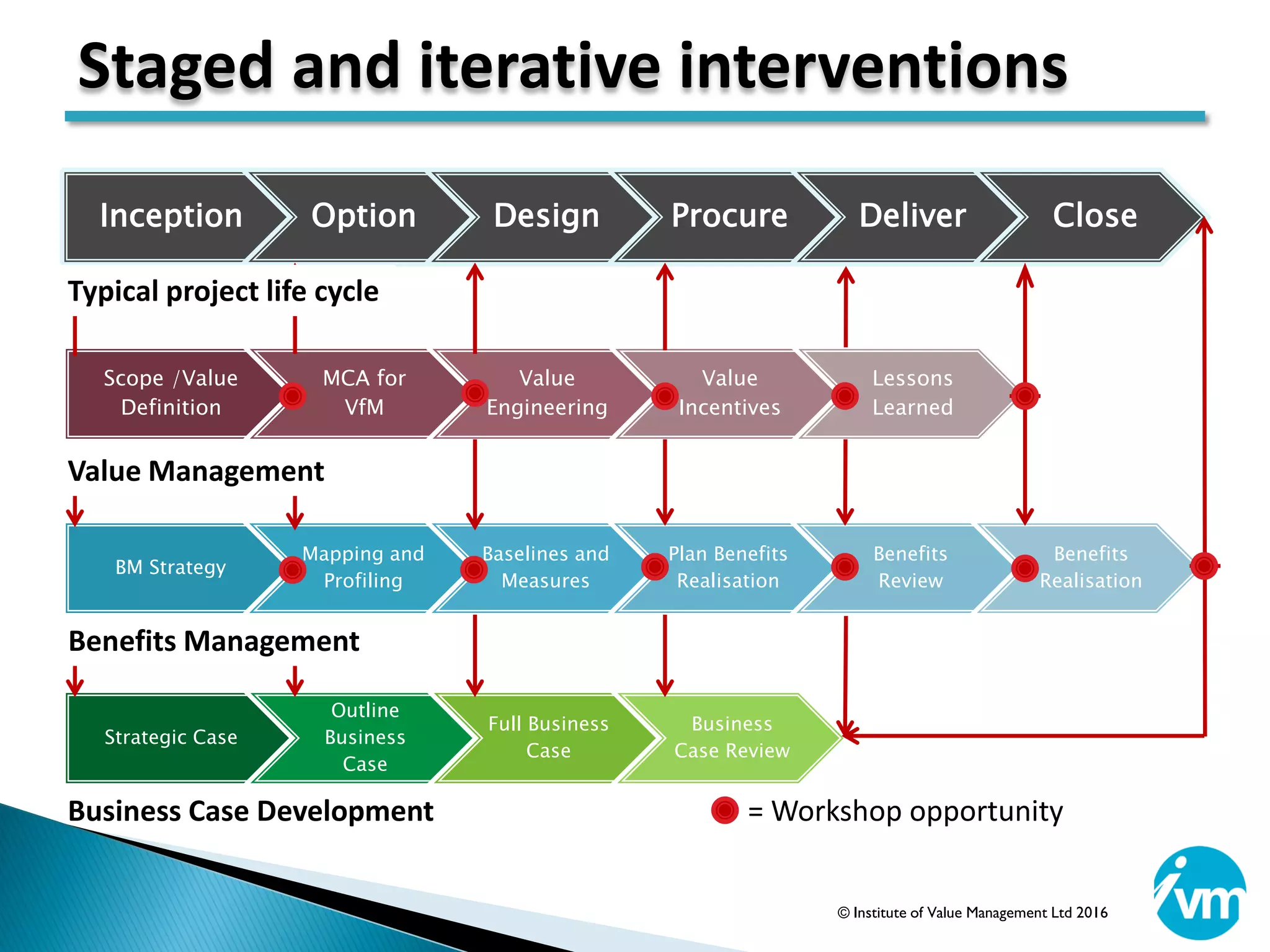

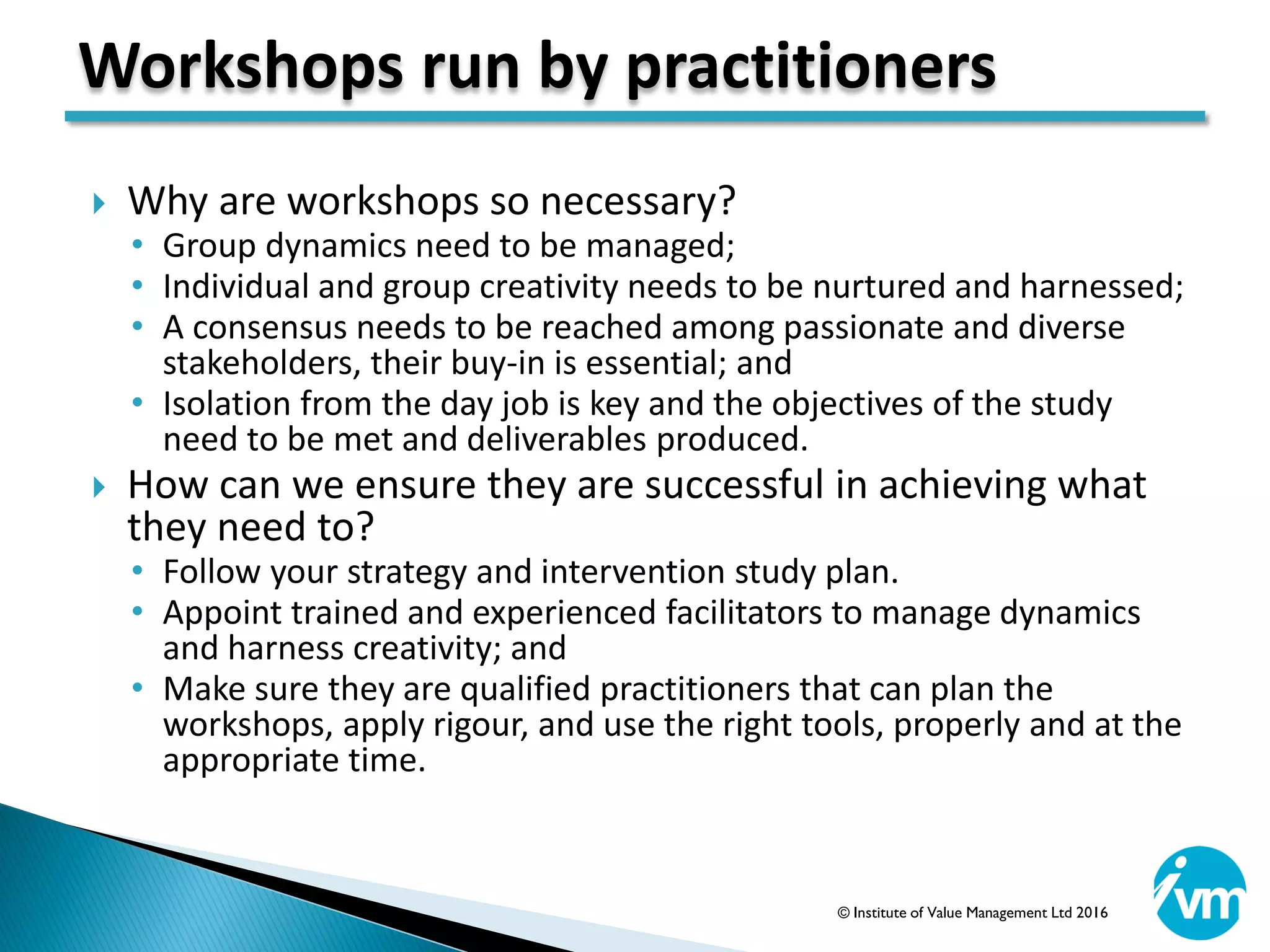

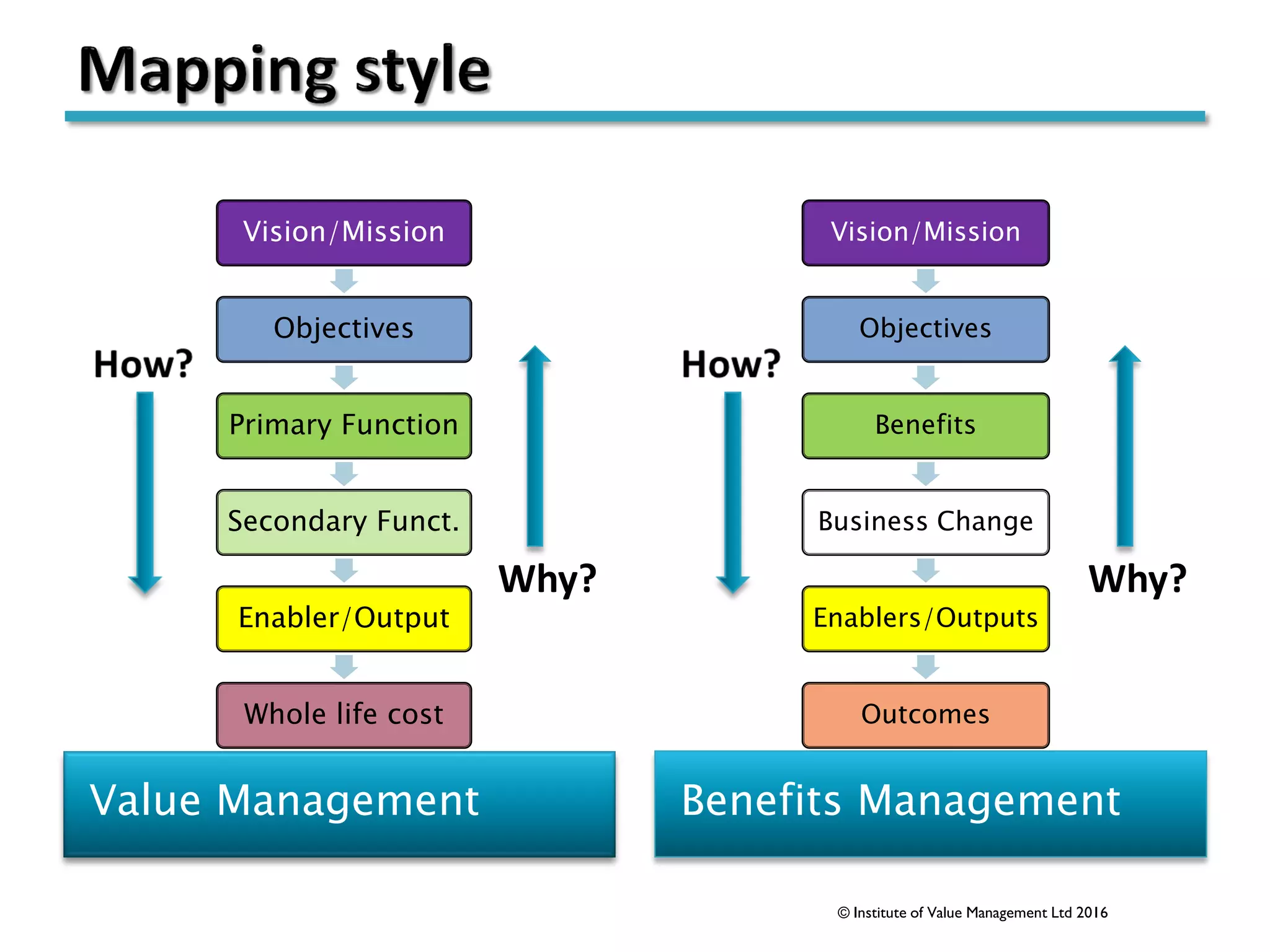

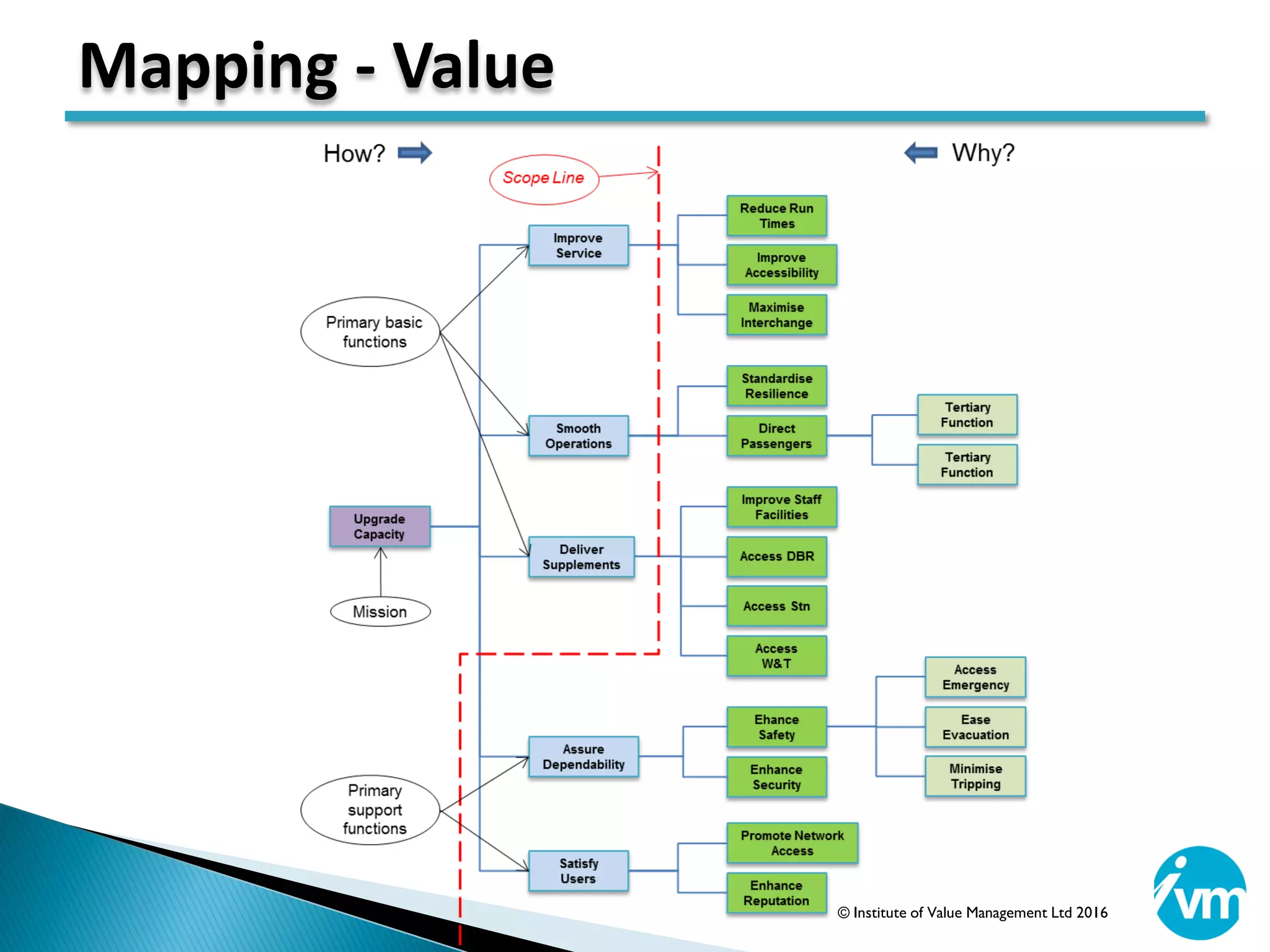

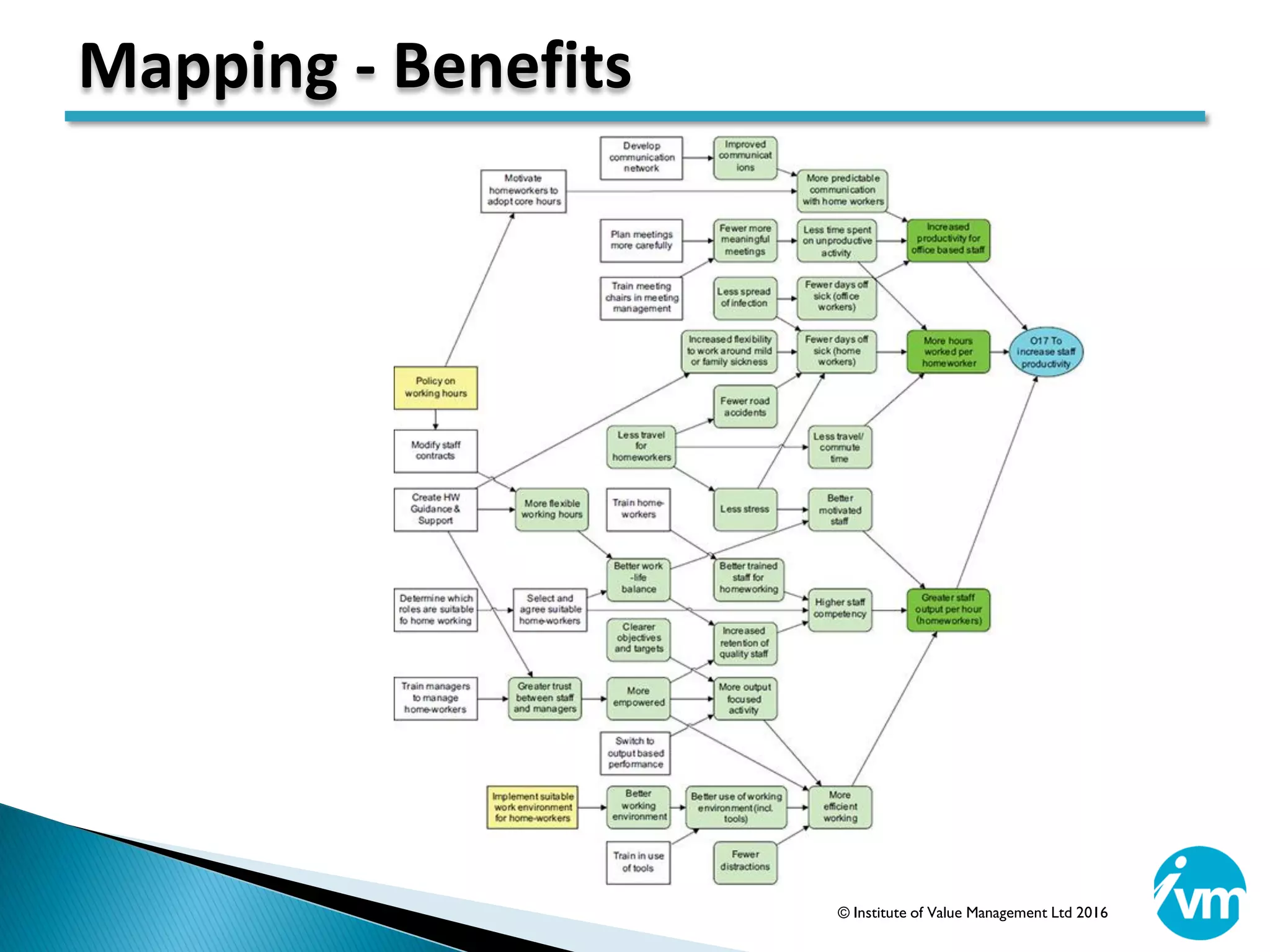

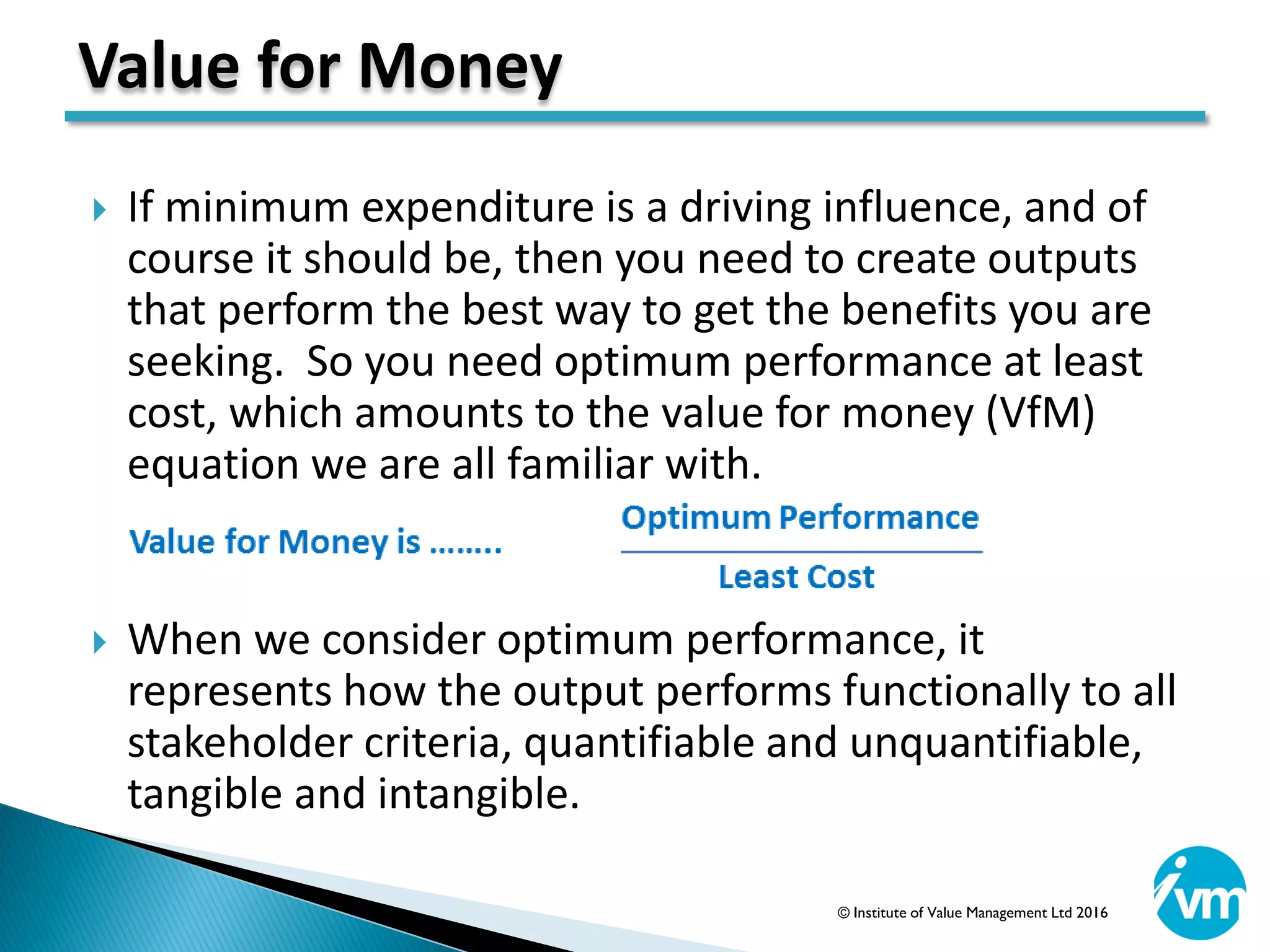

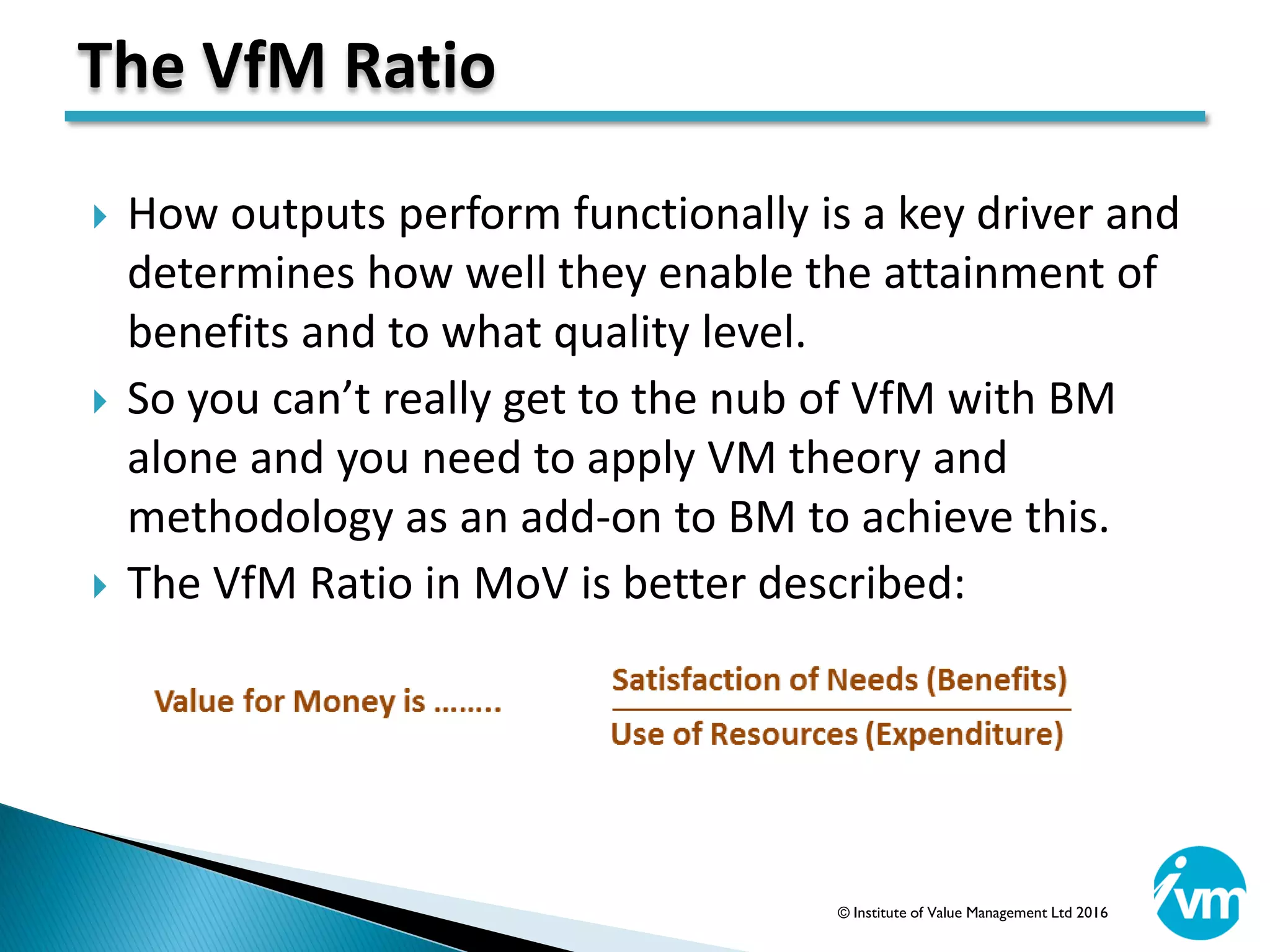

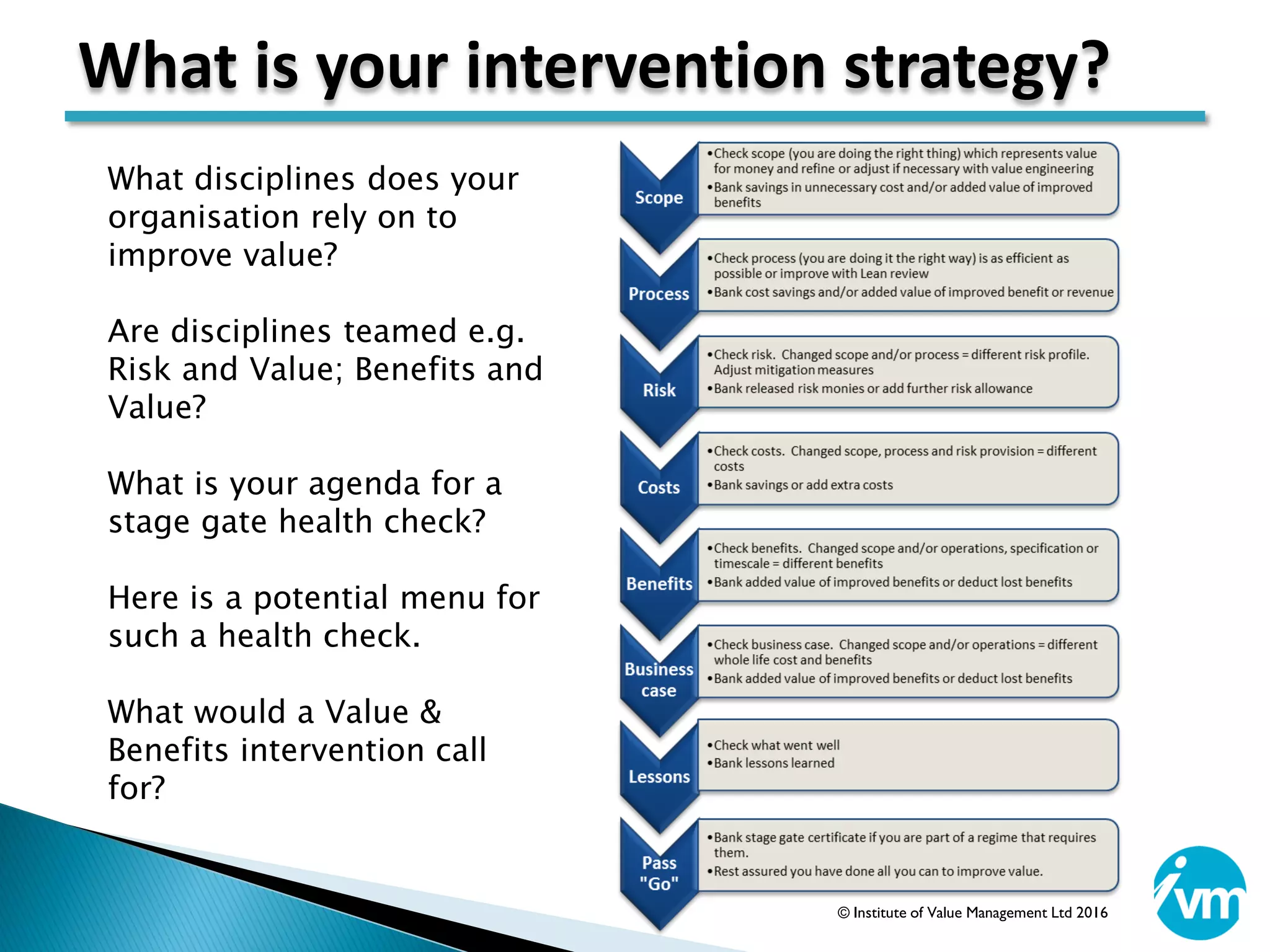

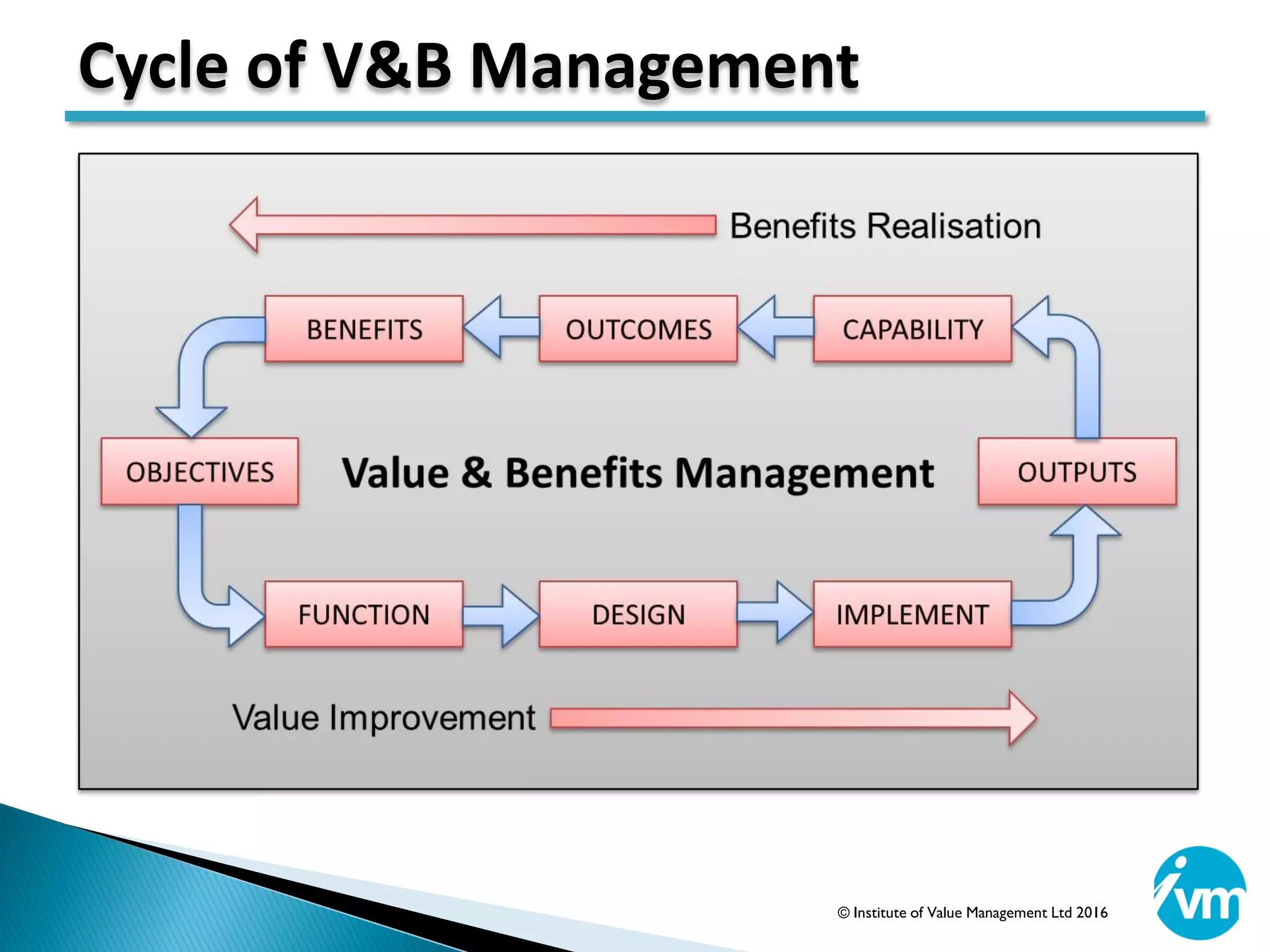

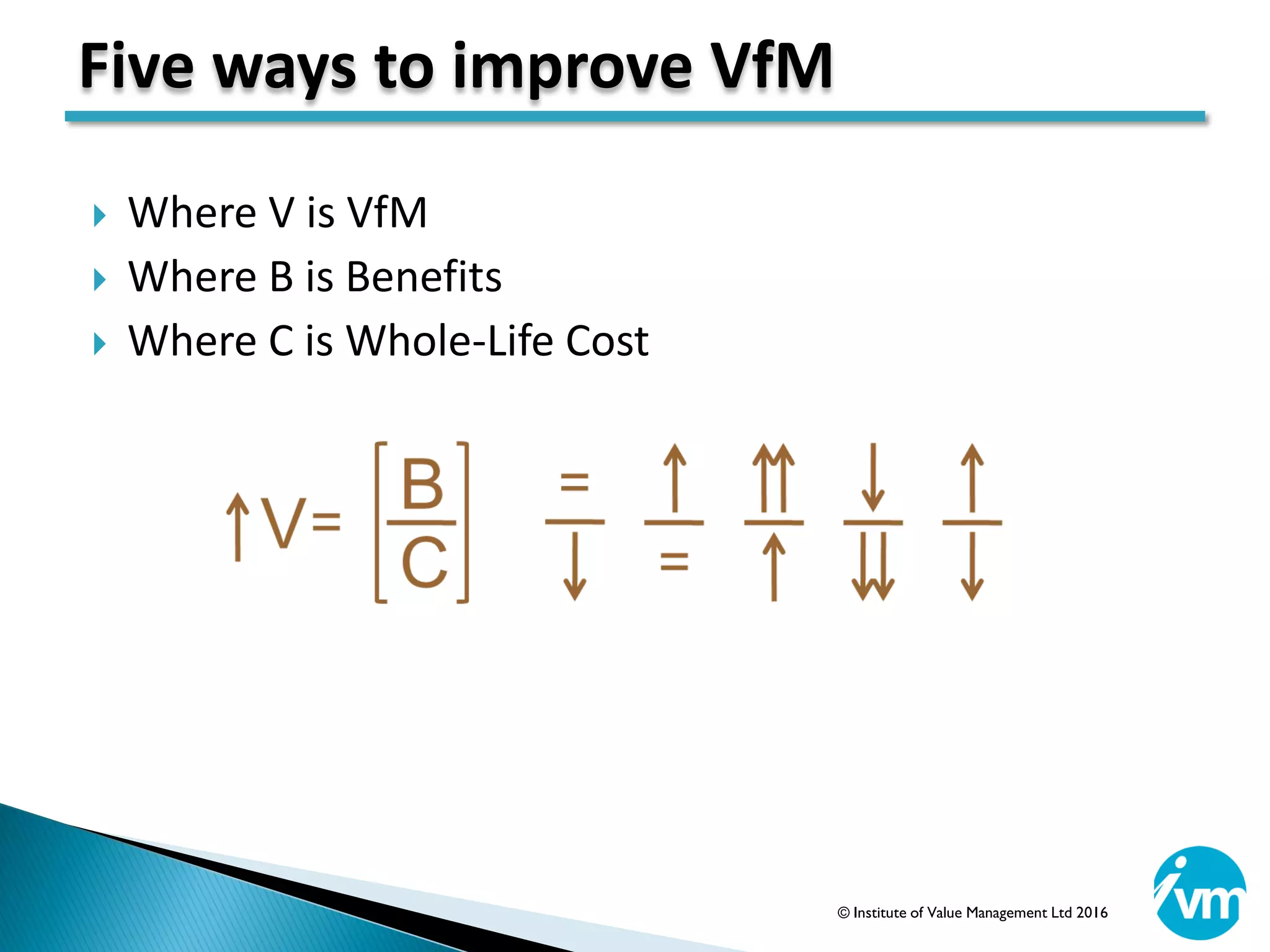

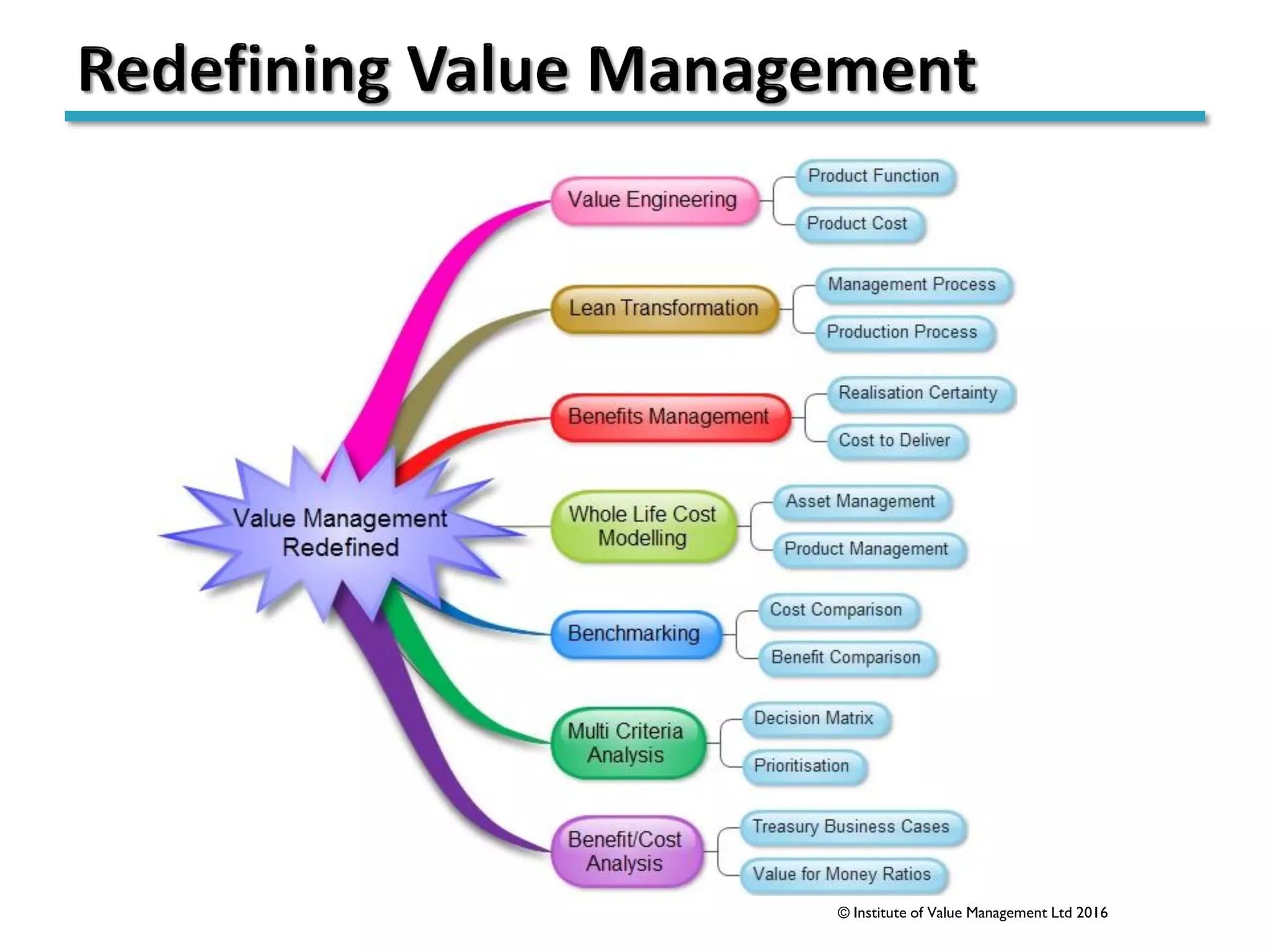

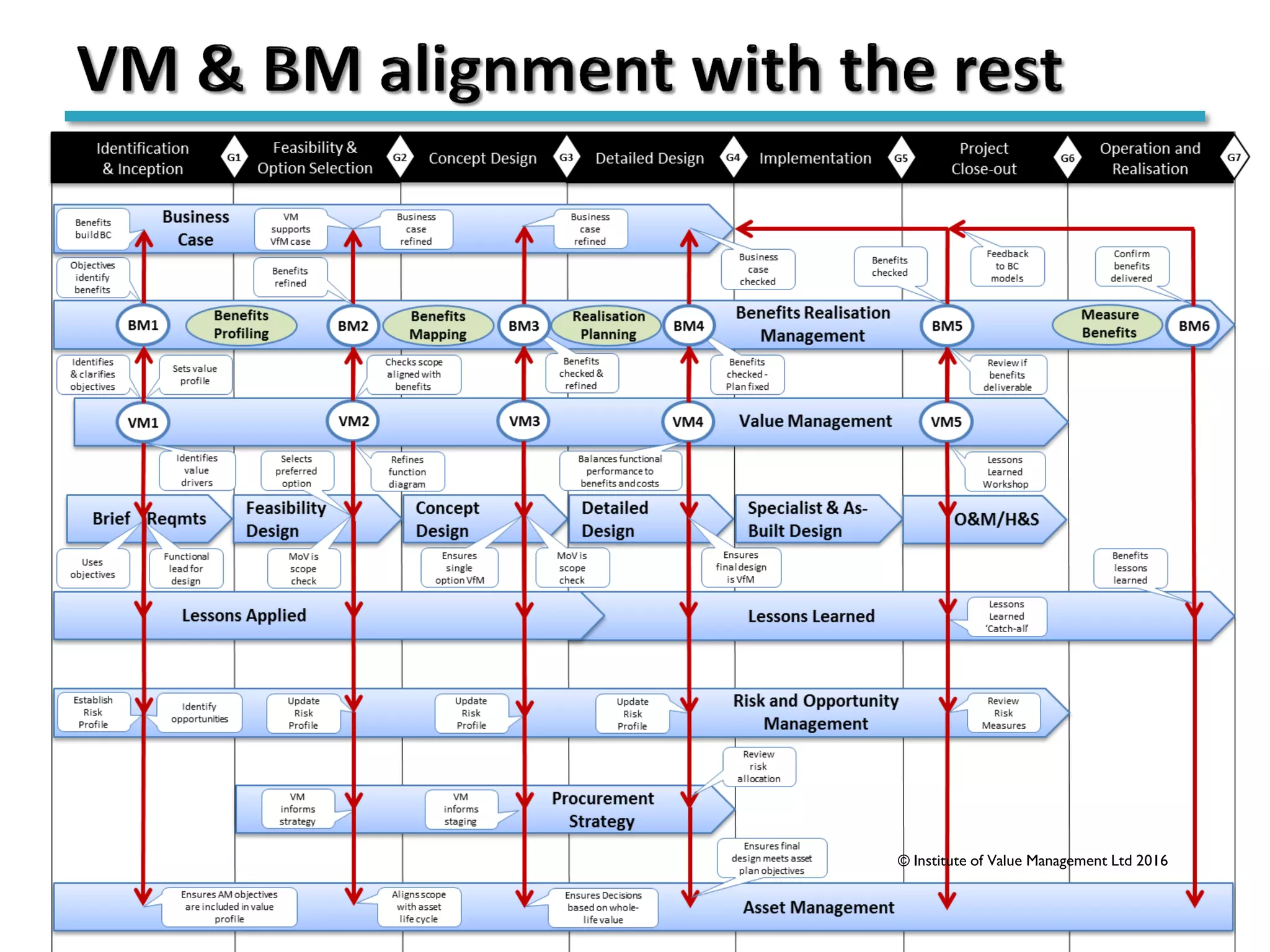

The document discusses the relationship between value management (VM) and benefits management (BM), emphasizing their roles in enhancing organizational effectiveness through defined processes and systematic methods. It highlights the importance of workshops and trained practitioners in aligning both disciplines for optimal value and benefits realization while distinguishing between improving value and achieving value for money. Additionally, it argues for integrating VM and BM across project and organizational life cycles to ensure that benefits reflect true value for money.