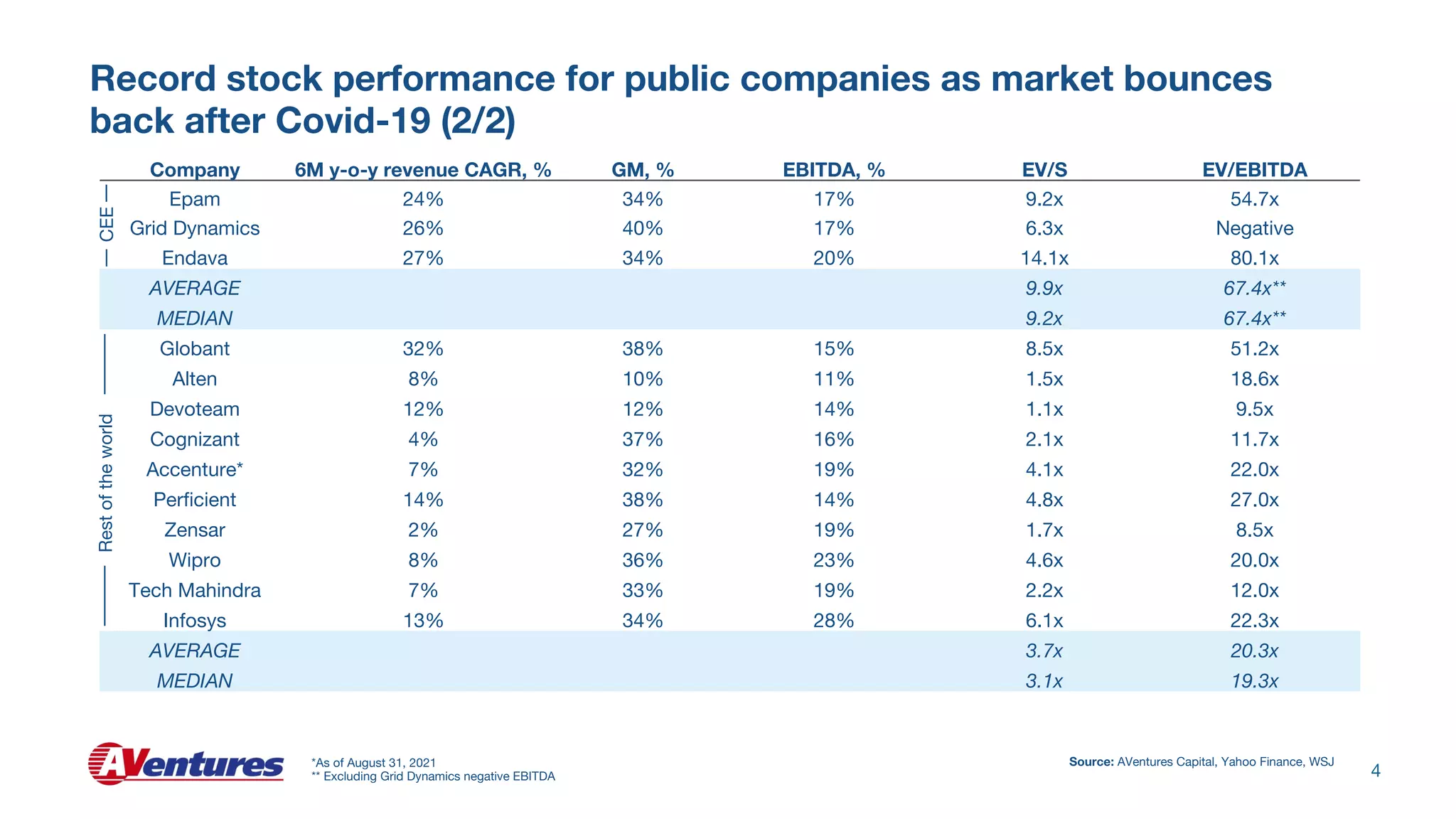

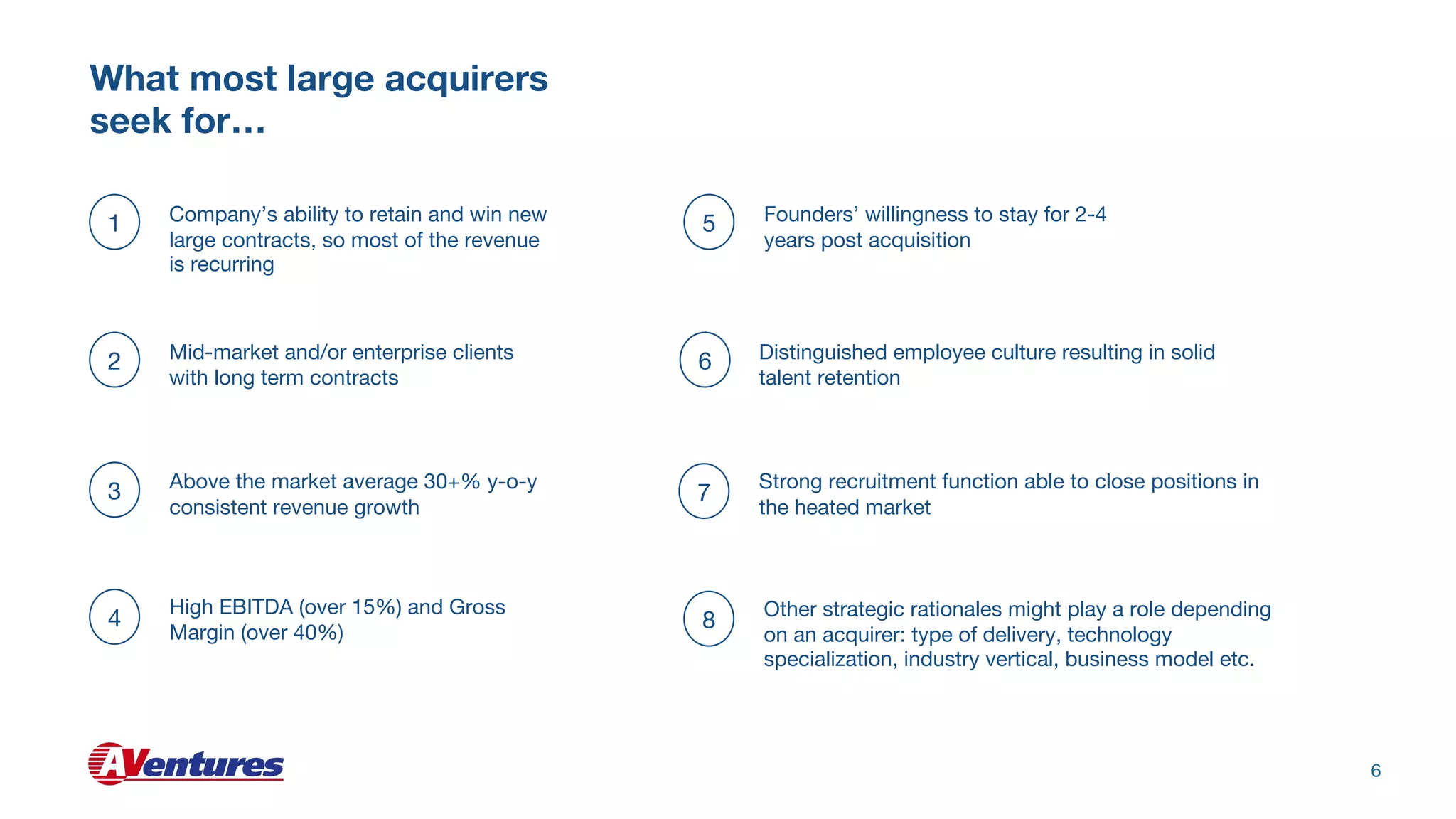

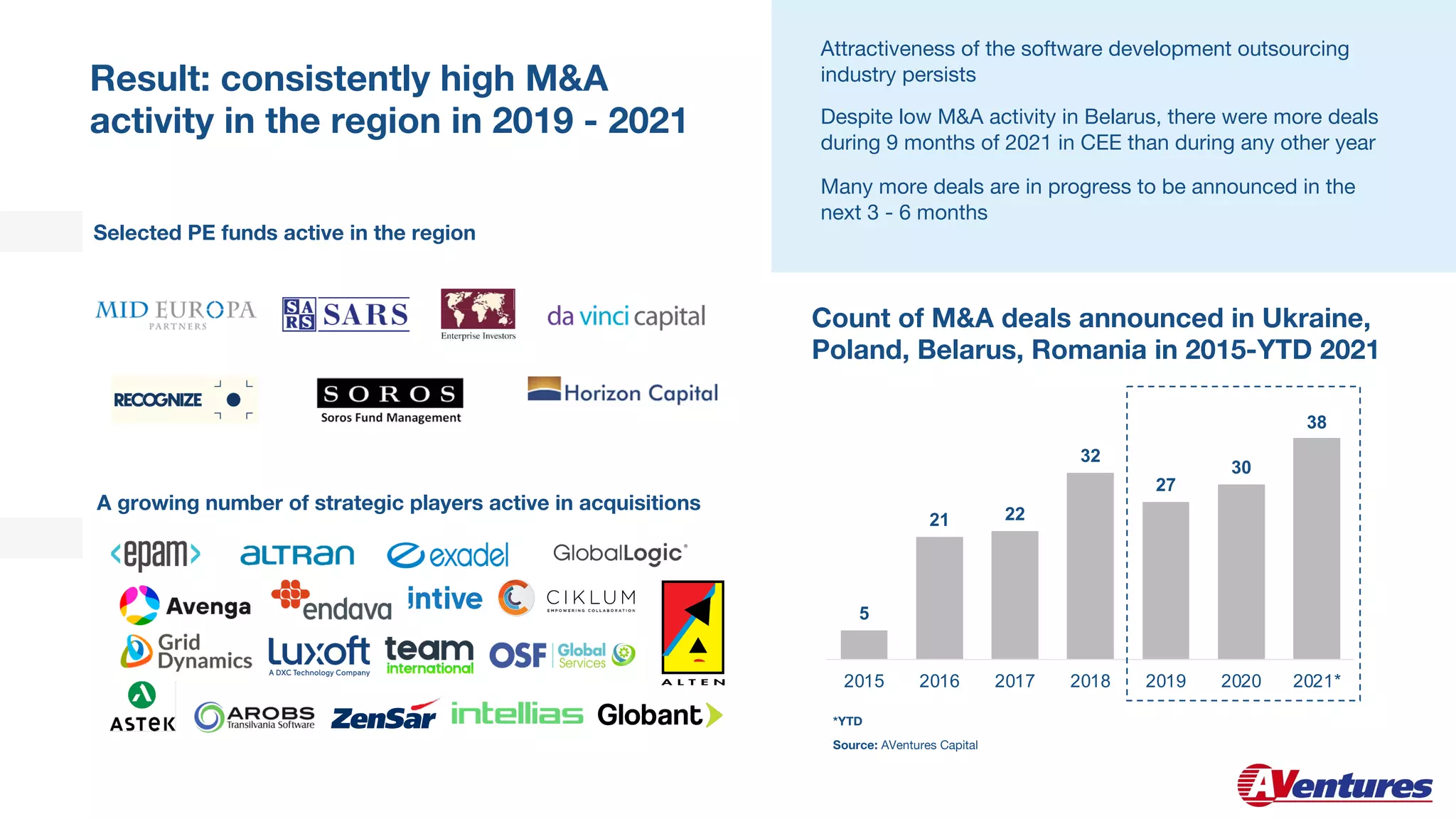

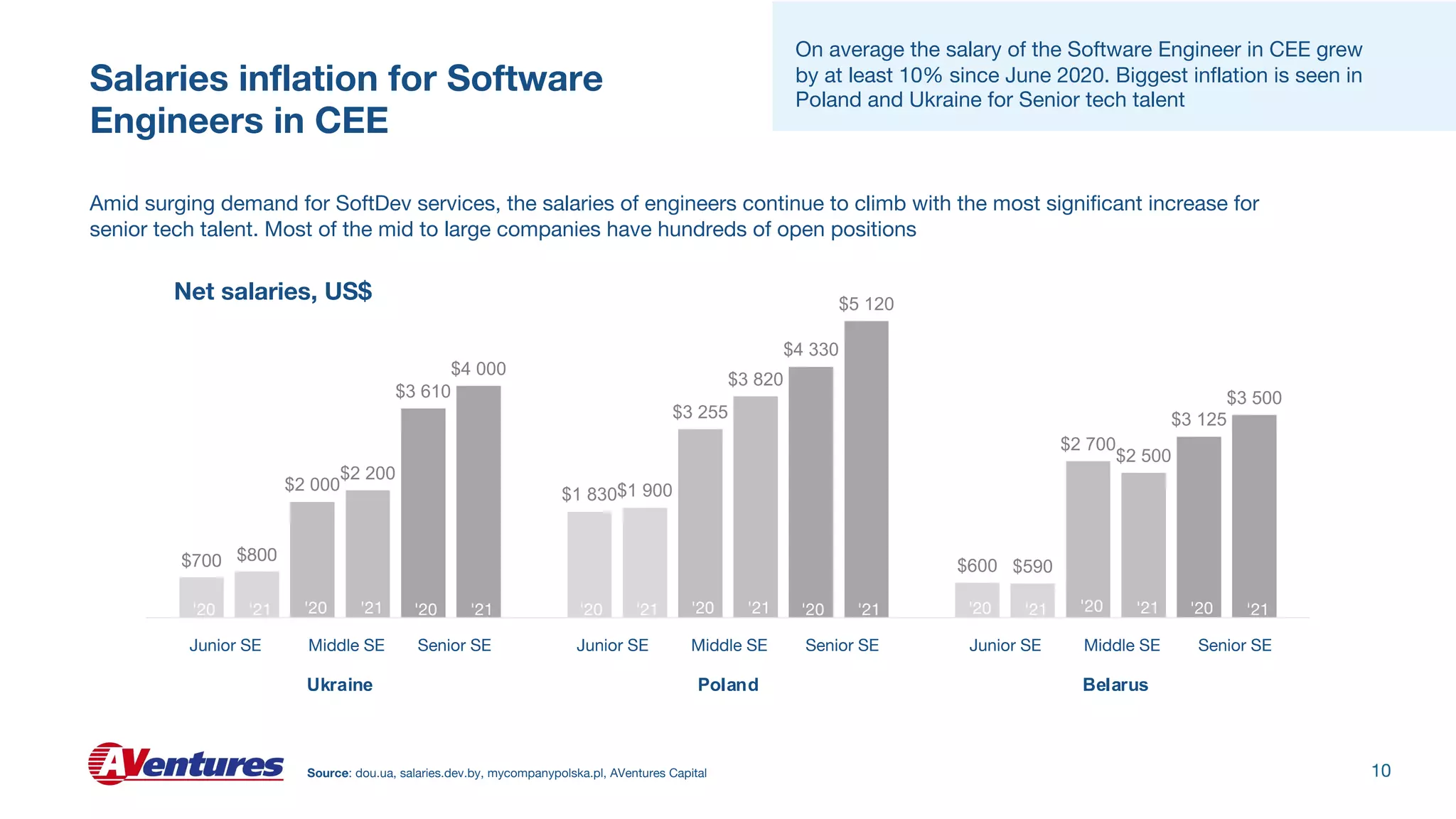

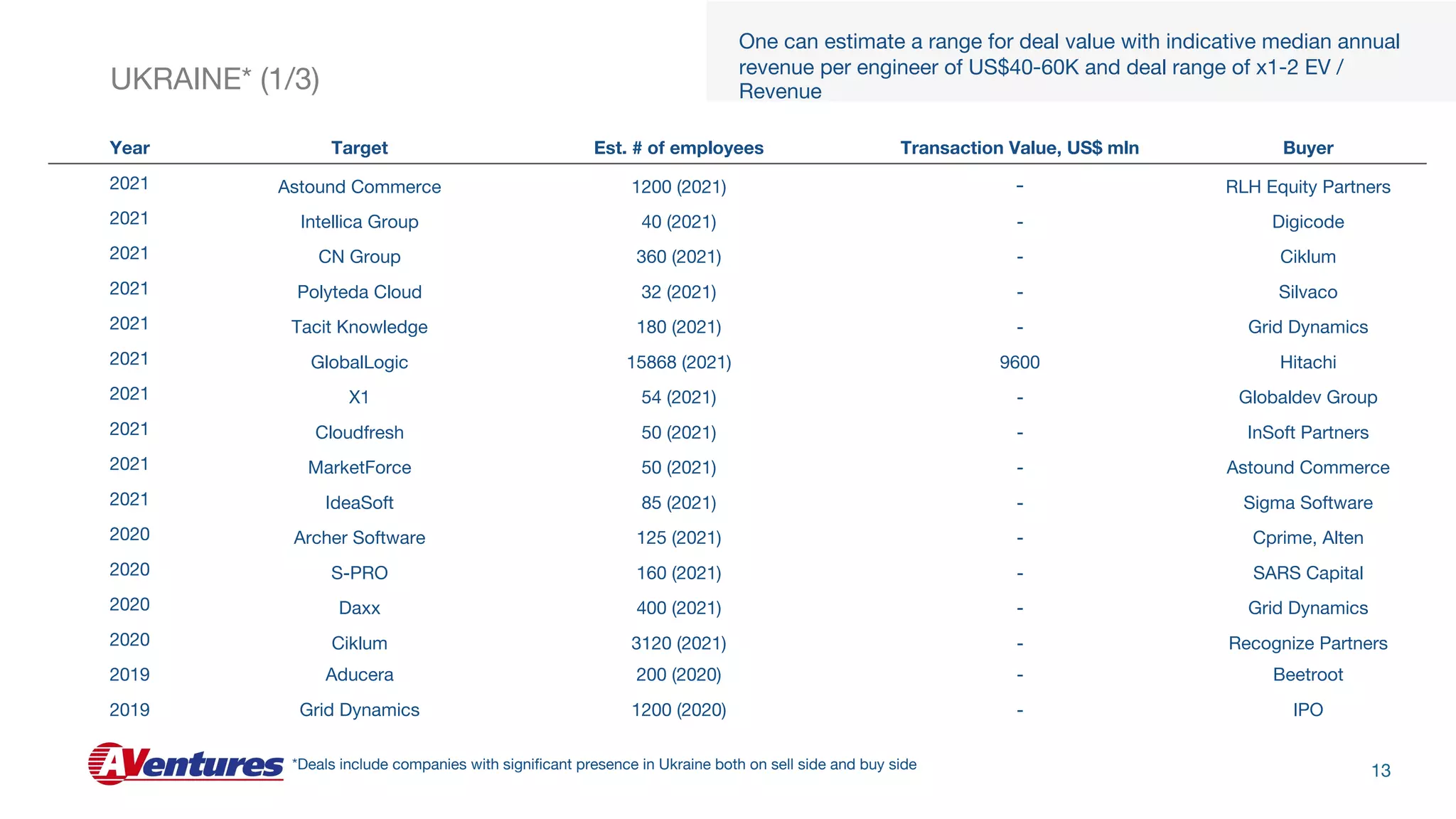

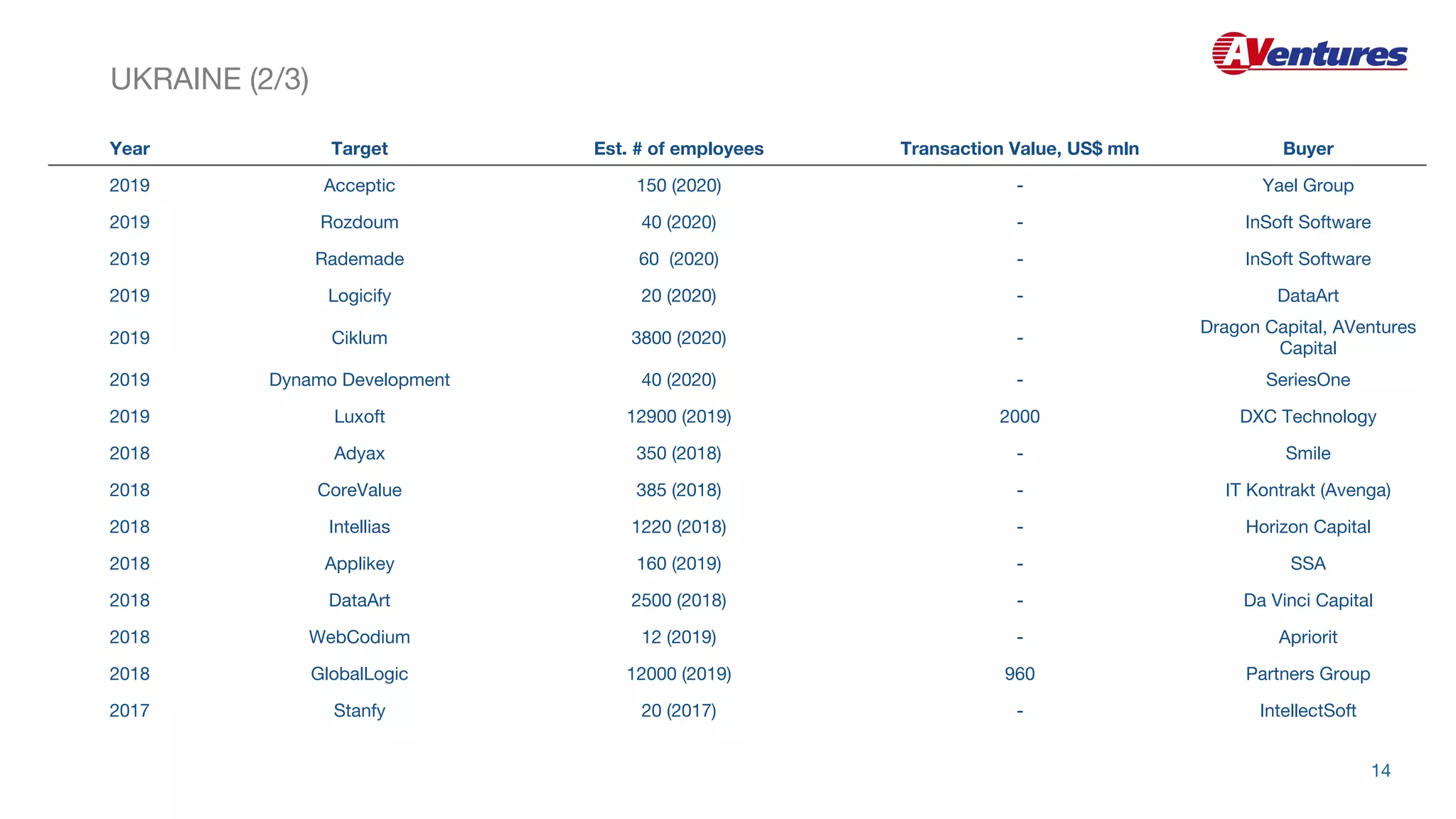

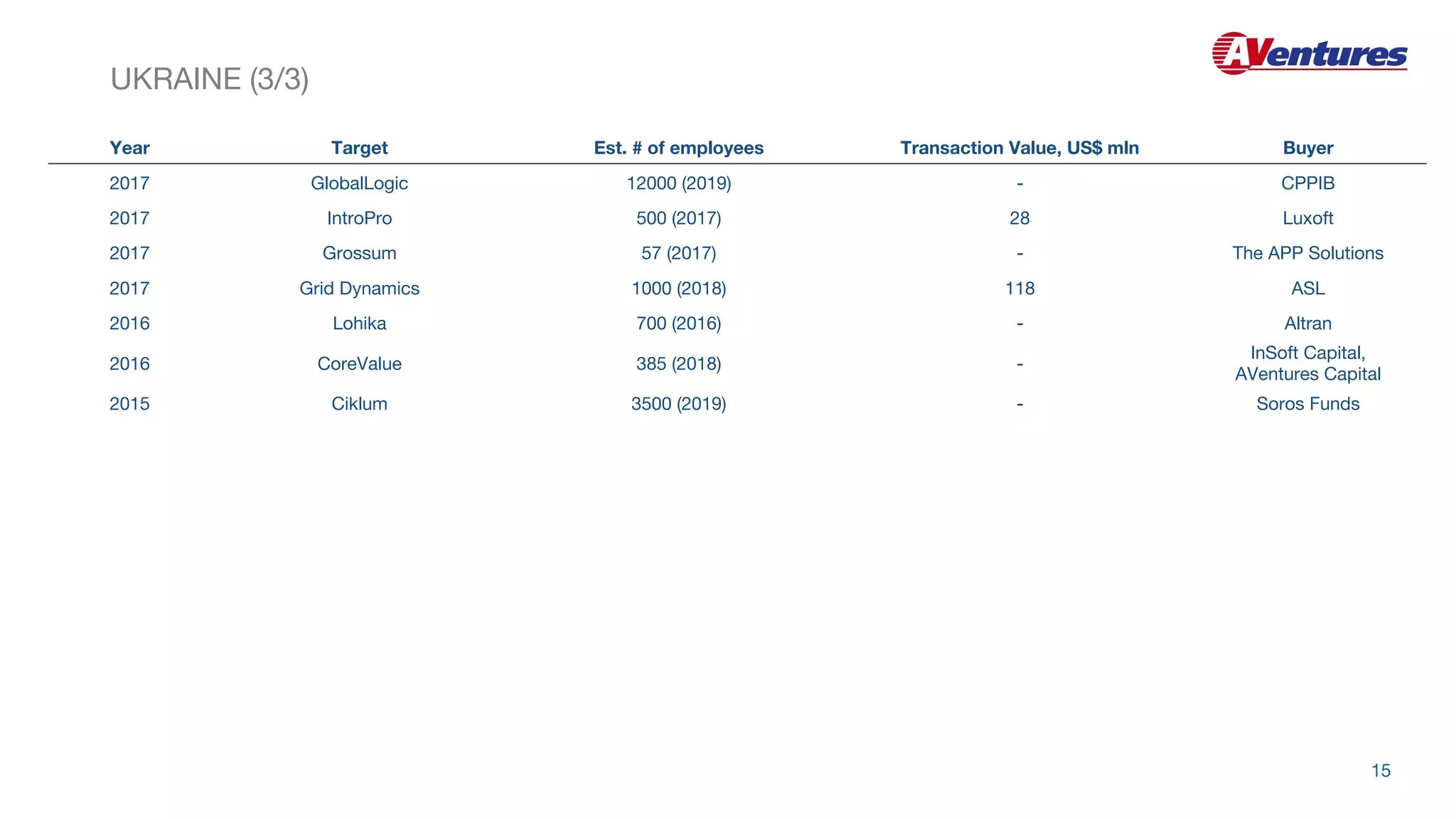

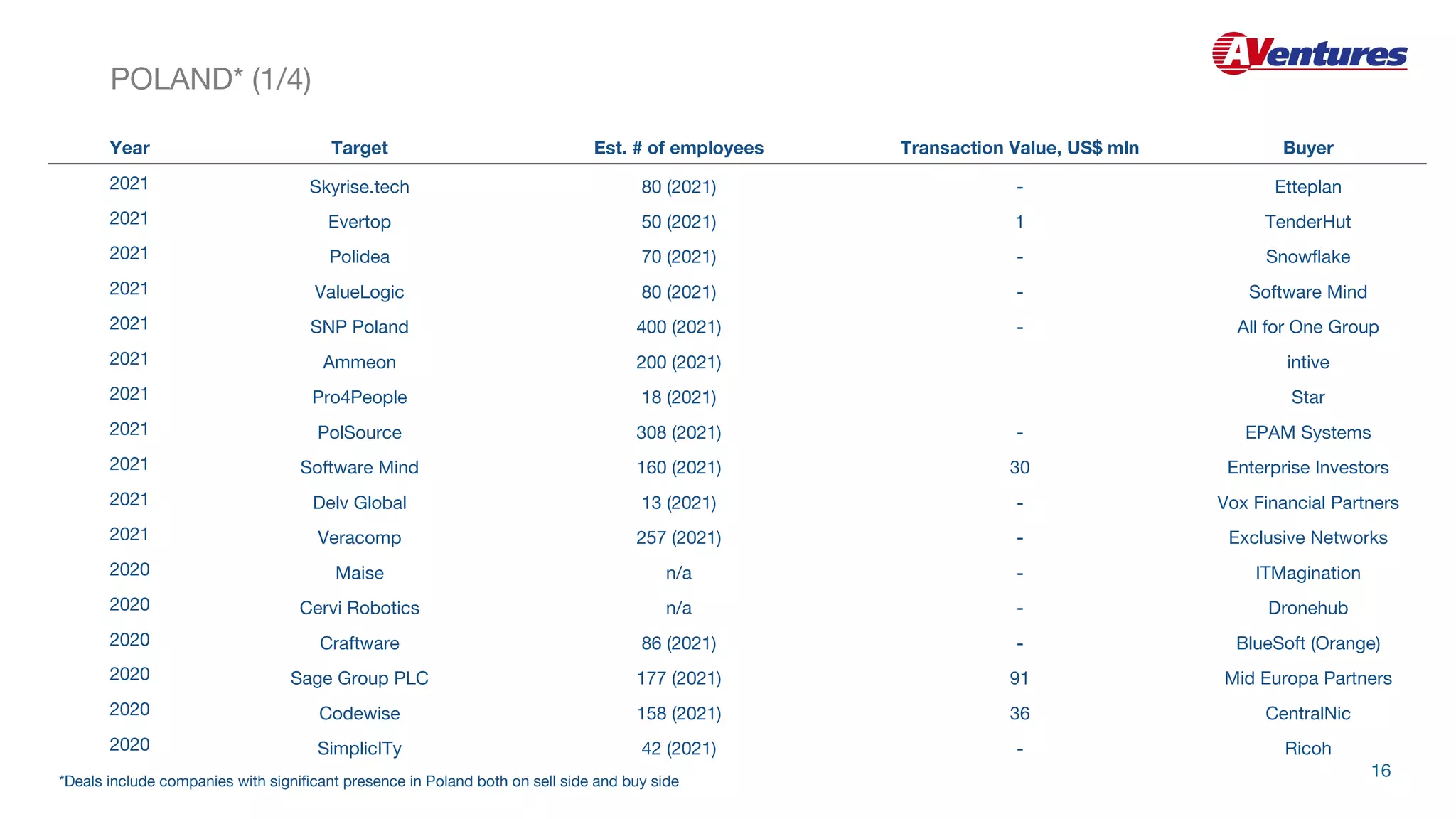

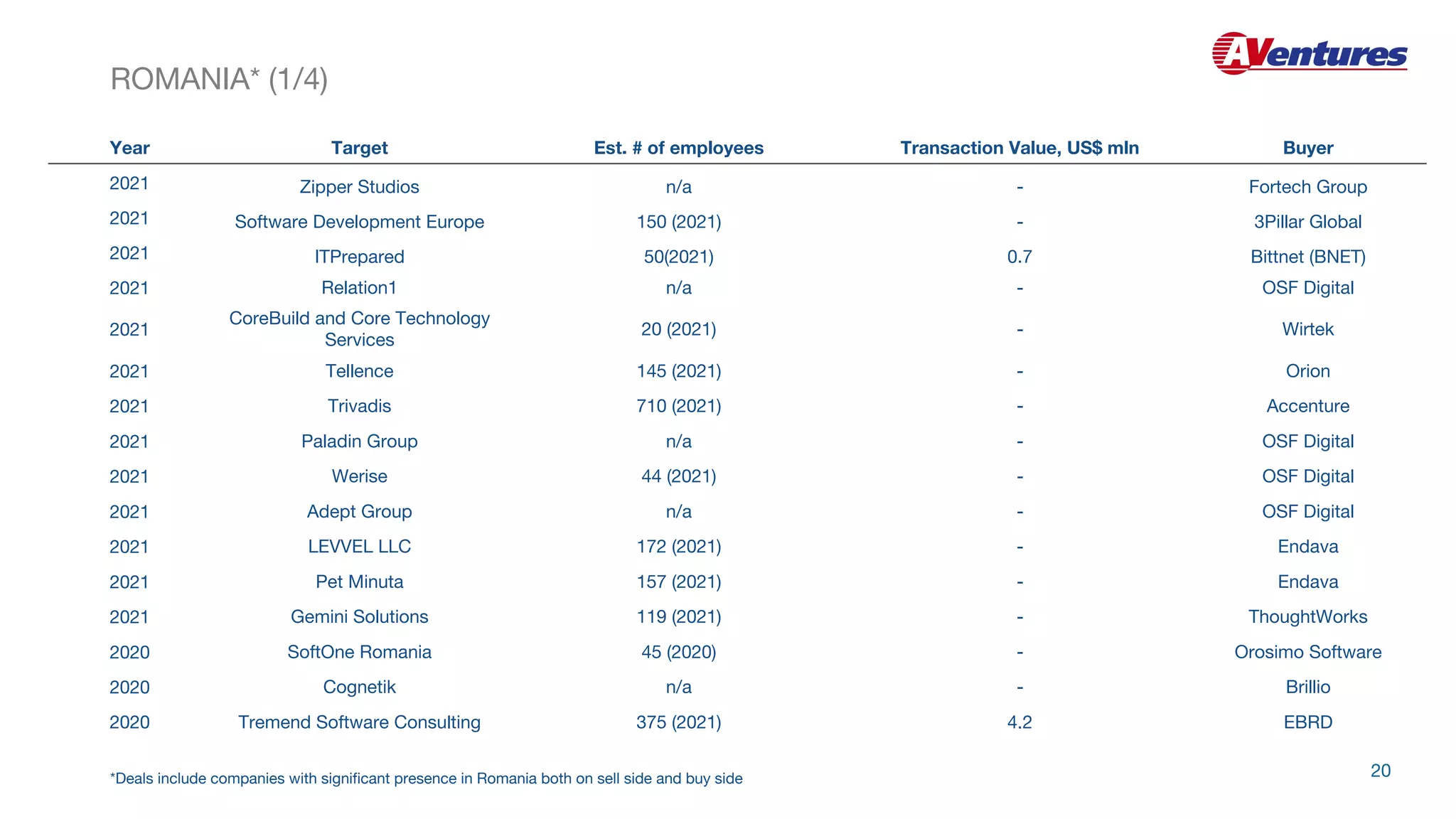

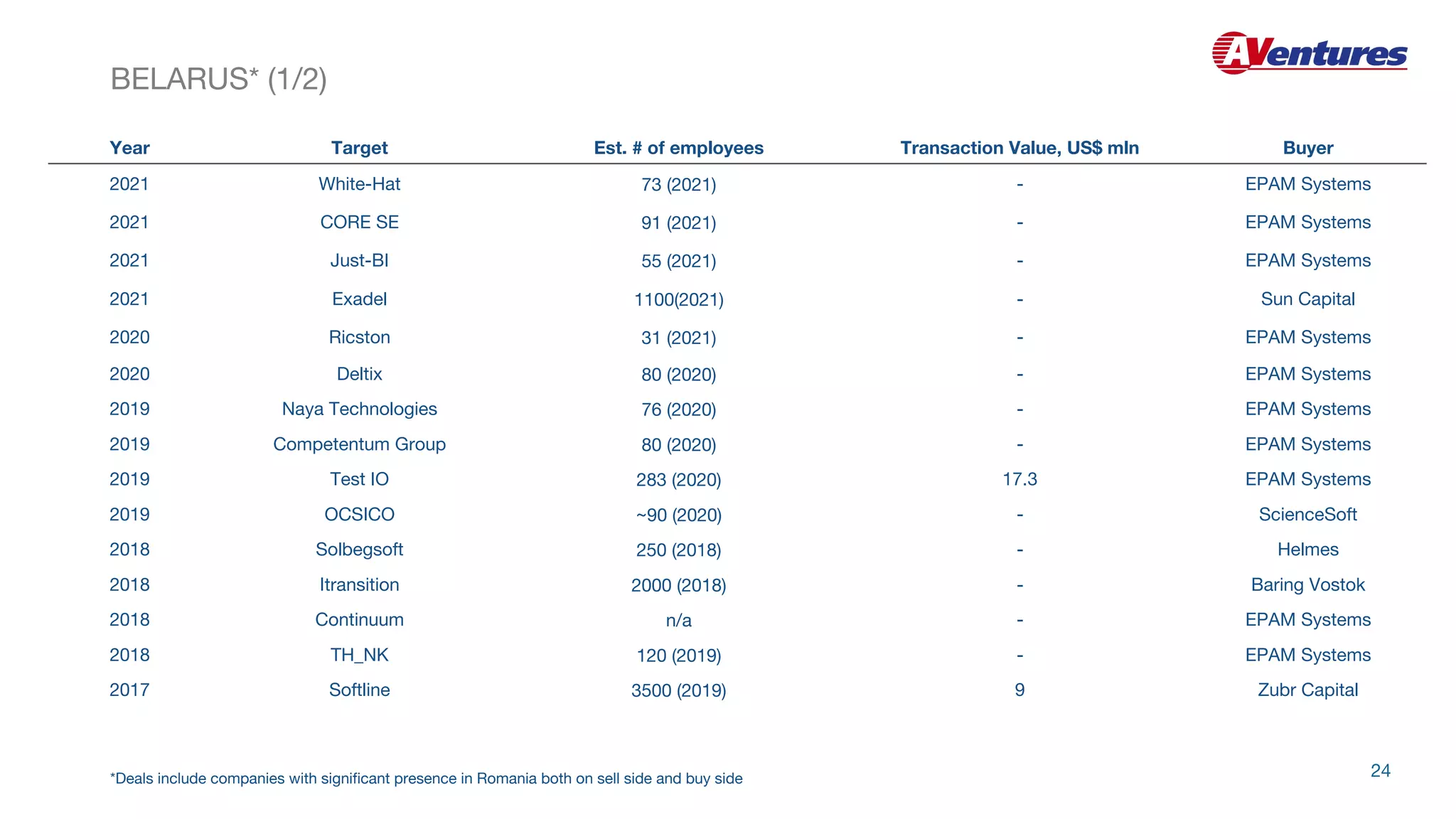

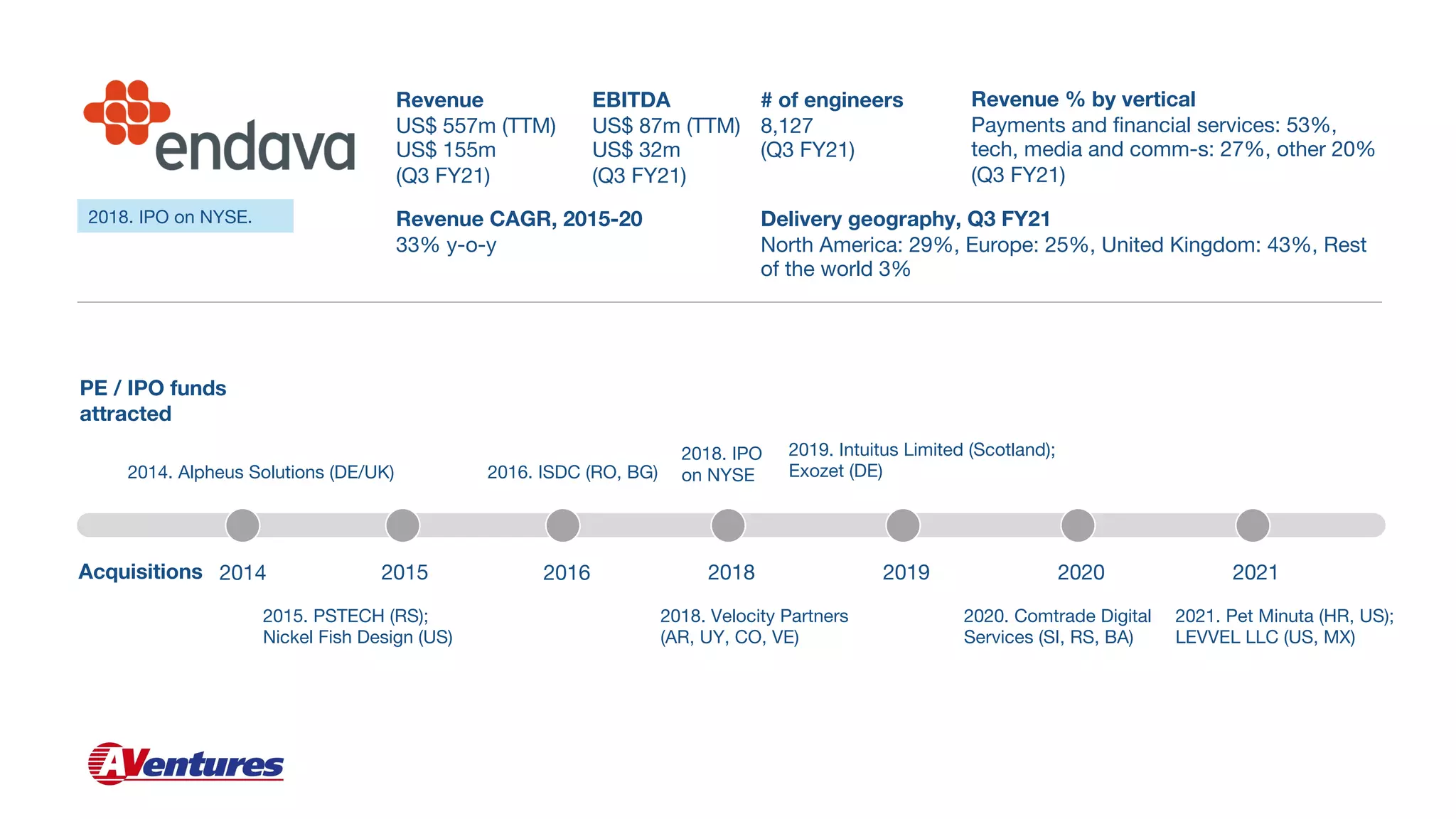

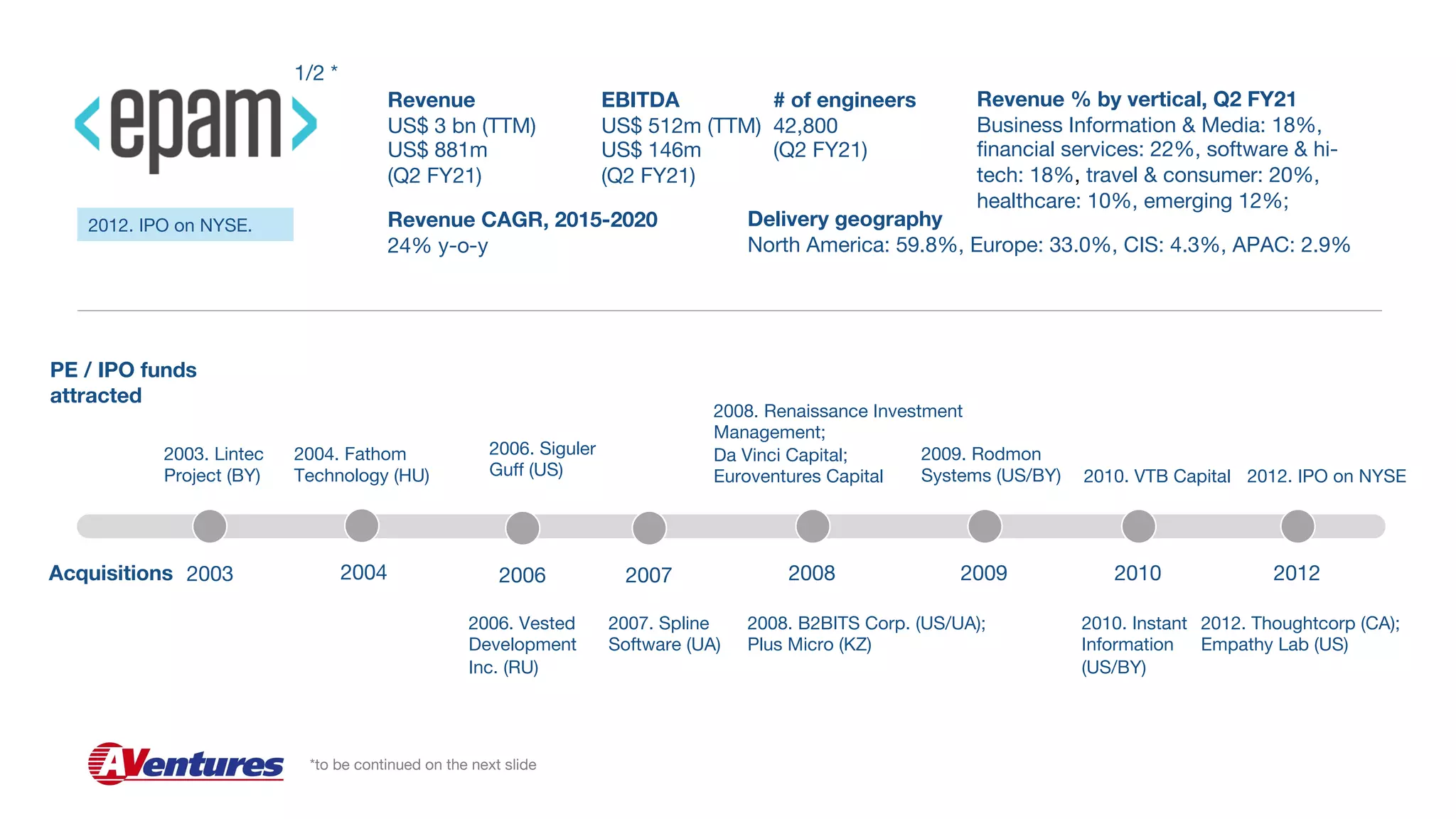

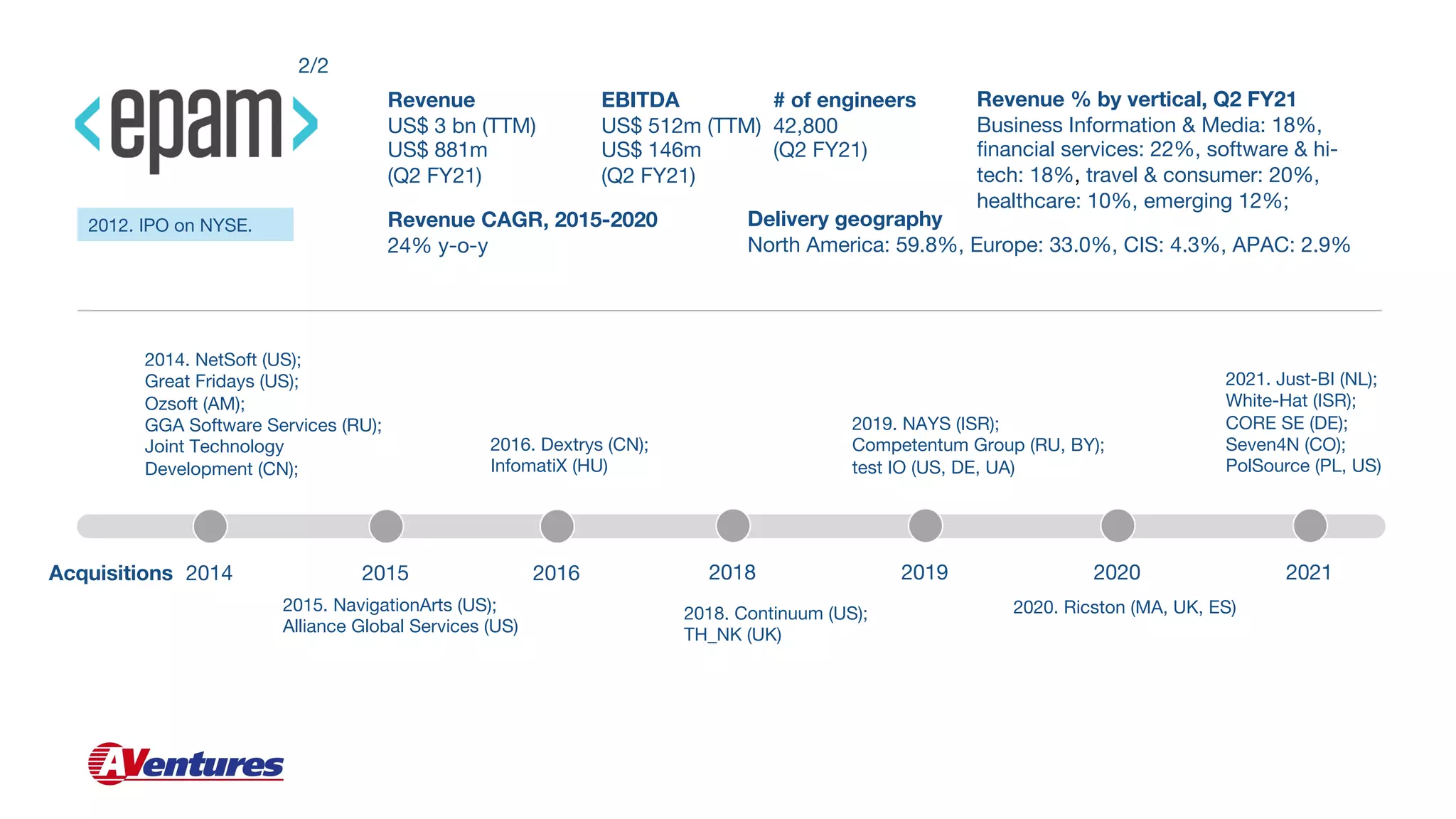

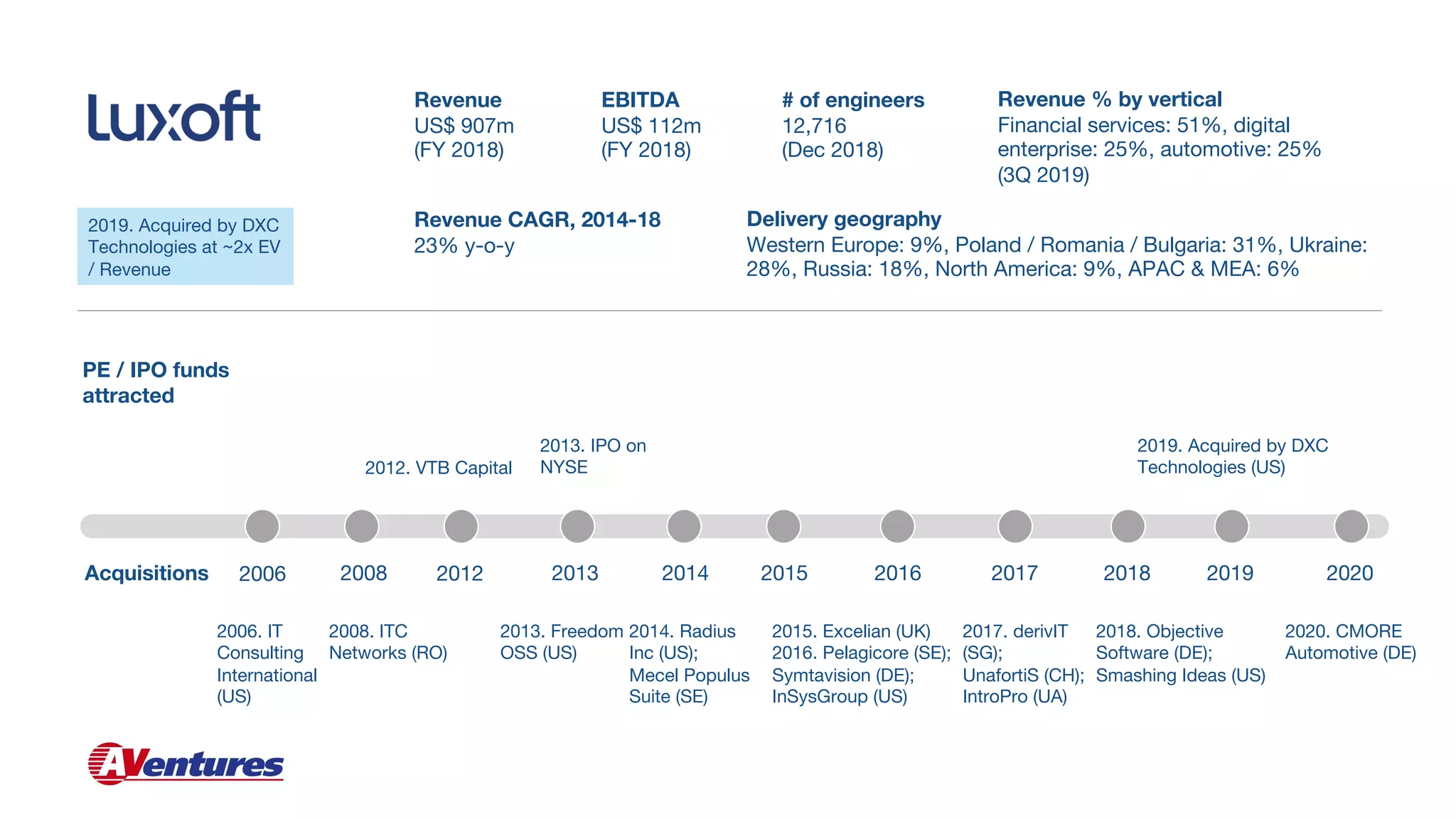

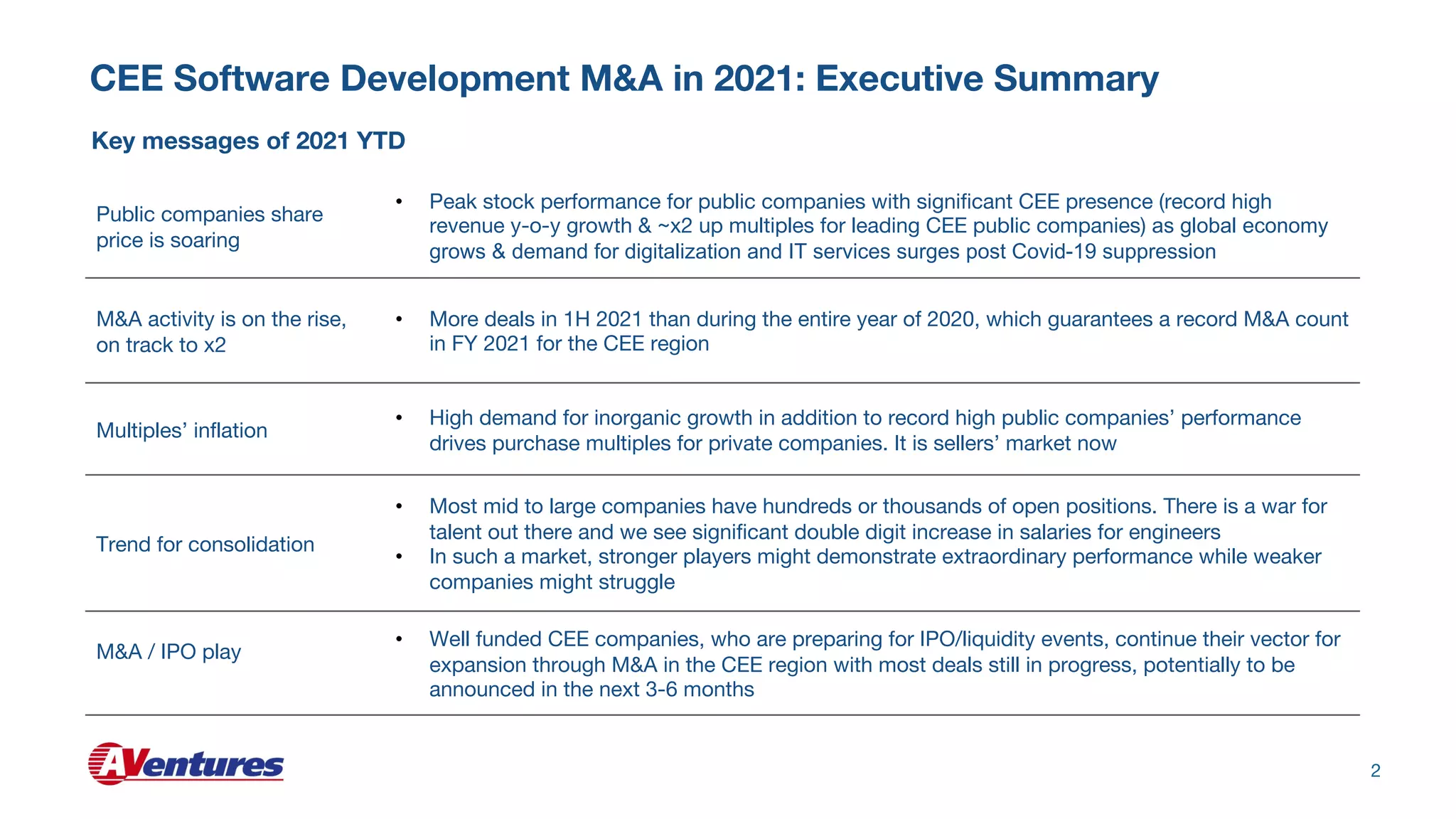

The CEE software development M&A report highlights a significant rise in M&A activity and stock performance for public companies in 2021, driven by increased demand for digitalization post-COVID-19. Key trends include a competitive talent market leading to salary inflation for engineers, and well-funded companies are pursuing acquisitions as a strategy for expansion ahead of potential IPOs. The document indicates a record number of deals is anticipated in the CEE region over the next few months, positioning it as a rapidly evolving market landscape.

![3

-100%

0%

100%

200%

300%

400%

500%

600%

Oct, 2018 Mar, 2019 Jul, 2019 Dec, 2019 Apr, 2020 Aug, 2020 Jan, 2021 May, 2021

505%

162%

450%

548%

68%

20%

67%

41%

H1 2021* YTD**

Since Oct,

2018**

Globant 4% 76% 548%

[Endava] 54% 146% 505%

[Epam] 47% 93% 450%

[Grid Dynamics] 22% 233% 162%

Alten 22% 95% 68%

S&P500 16% 28% 67%

Devoteam 14% 29% 41%

Cognizant -12% 15% 20%

*January 1 – June 30, 2021

**Data as of August 26, 2021

Record stock performance for public

companies as market bounces back after

Covid-19 (1/2)

During 2020-2021, companies with delivery in CEE

(Endava, Epam & Grid Dynamics) on average grew

faster than those in different geographies

Source: Yahoo Finance, AVentures Capital

[

]

–

companies

with

significant

delivery

in

CEE

Globant

Endava

Epam

Grid

Dynamics

Alten

S&P500

Devoteam

Cognizant](https://image.slidesharecdn.com/aventures-ceemareport2021oct-211006114537/75/CEE-Software-Development-M-A-Report-2021-3-2048.jpg)