Introduction to Negotiable Instruments Act

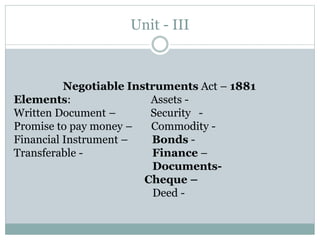

- 1. Unit - III Negotiable Instruments Act – 1881 Elements: Assets - Written Document – Security - Promise to pay money – Commodity - Financial Instrument – Bonds - Transferable - Finance – Documents- Cheque – Deed -

- 2. Negotiable Instruments Act – 1881 Cheque CD ( Certificate of Deposits) UPI NEFT RTGS DD

- 3. Characteristics of Negotiable Instruments Easily Transferable Written Documents duly signed presumptions No notice to transfer Right to Sue Credit of the party title free from defects

- 4. Negotiable Instruments Act – 1881 Cheque - Bill of Exchange - Promissory Note – Certificate of Deposit -

- 5. Types of Crossing Cheque Types of Cheque Crossing General Crossing Special Crossing Restrictive Crossing Non-Negotiable Crossing

- 7. General Cheque Crossing In general crossing, the cheque bears across its face which includes the addition of 2 parallel crossing lines with little spacing between them, within the case of general crossing on the cheque, the paying banker pays cash to any banker. For the aim of general crossing 2 crosswise parallel lines at the corner of the cheque are necessary.

- 10. Special Cheque Crossing In this case, the paying banker pays the quantity of cheque solely to the banker whose name seems within the crossing or to his assembling agent. The paying banker can honor the cheque only if it's ordered through the bank which is mentioned within the crossing. However, in special crossing 2 parallel crosswise lines don't seem to be essential however the name of the banker is most significant.

- 13. Restrictive Cheque Crossing The amount mentioned on the cheque is credited only to the payee whose name is mentioned on the cheque. This type of crossing restricts the negotiability of the cheque. It directs the assembling banker to credit the amount of money in a cheque to the account of the receiver. Where the assembling banker credits the return of a cheque bearing such crossing to the other account, he shall be guilty of negligence. Also, he won't be eligible for the protection to the assembling banker below section 131 of the Act. However, such crossings can don't have any impact on the paying banker. This is often therefore as a result of it's not his duty to see that the cheque is collected for the account of the receiver.

- 15. Not Negotiable Cheque Crossing A cheque holder which has crossed any single leaf of cheque either generally or in a special case. In either case, the words “non-negotiable”. The Non-Negotiable Crossing doesn't mean that the cheque is non-transferable. As per the Non- Negotiable Act, 1881 section 130

- 16. Not Negotiable Cheque Crossing

- 17. Types of Cheque Crossing General Crossing – cheque bears across its face an addition of 2 parallel crosswise lines. Special Crossing – It bears the crossing across its face in which the banker’s name is included Restrictive Crossing – It directs the assembling banker that he has to credit the number of cheques solely to the account of the receiver. Non-Negotiable Crossing – it's once the words ‘Not Negotiable’ are written between the 2 parallel crosswise lines.

- 18. Endorsement

- 19. Endorsement An endorsement is the process of signing the back of a paper, thereby imparting the rights that the signer had in the paper to another person. The number of times an instrument may be endorsed is unlimited. There is no requirement that the word "order" be embodied in the endorsement.

- 20. Endorsement The act of a person who is a holder of a negotiable instrument in signing his or her name on the back of that instrument, thereby transferring title or ownership is an endorsement. An endorsement may be in favour of another individual or legal entity. An endorsement provides a transfer of the property to that other individual or legal entity. The person to whom the instrument is endorsed is called the endorsee. The person making the endorsement is the endorser.

- 21. Types of Endorsement 1. Blank Endorsement 2. Special Endorsement 3. Restrictive Endorsement 4. Partial Endorsement 5. Conditional Endorsement

- 23. Blank Endorsement An endorsement is blank or general where the endorser signs his name only, and it becomes payable to bearer. Thus, where a bill is payable to “Ram or order”, and he writes on its back “Ram”, it is an endorsement in blank by Ram and the property in the bill can pass by a mere presentation.

- 25. Special or Full Endorsement

- 26. Special or Full Endorsement An endorsement “in full” or a special endorsement is one where the endorser puts his signature on the instrument as well as writes the name of a person to whom order the payment is to be made.

- 27. Special or Full Endorsement

- 29. Restrictive Endorsement An endorsement is restrictive which restricts the further negotiation of an instrument. Example of restrictive endorsement: “Pay to Mrs. Geeta only” or “Pay to Mrs Geeta for my use” or “Pay to Mrs Geeta on account of Reeta” or “Pay to Mrs. Geeta or order for collection”.

- 32. Partial Endorsement An endorsement partial is one which allows transferring to the endorsee a part only of the amount payable on the instrument. This does not operate as a negotiation of the instrument.

- 33. Partial Endorsement Example: Mr. Mohan holds a bill for Rs. 5,000 and endorses it as “Pay Sohan or order Rs. 2500”. The endorsement is partial and invalid.

- 35. Conditional or Qualified Endorsement Where the endorser puts his signature under such writing which makes the transfer of title subject to fulfilment of some conditions of the happening of some events, it is a conditional endorsement.

- 36. Conditional or Qualified Endorsement file:///E:/SNR%20College/Notes/2021- 2022/Banking%20&%20I.Law/Unit%20III/negoati ation-endorsement-7-638.webp

- 37. Types of Endorsement Blank Endorsement – Where the endorser signs his name only, and it becomes payable to bearer. Special Endorsement – Where the endorser puts his sign and writes the name of the person who will receive the payment. Restrictive Endorsement – Which restricts further negotiation. Partial Endorsement – Which allows transferring to the endorsee a part only of the amount payable on the instrument. Conditional Endorsement – Where the fulfilment of some conditions is required.

- 41. What is Material alteration? The term ‘material alteration‘ indicates alteration or change in the material parts of the instrument. It may be defined as any change, which alters the very nature of the instrument. Thus, it is the alteration, which changes and destroys the legal identity of the original instrument and causes it to speak a different language in legal effect from that which it originally spoke.

- 43. What constitutes a Material Alteration? Every alteration or change on a negotiable instrument cannot be established as material alteration and would not necessarily vitiate the instrument or affect the rights and obligations of the parties thereto. The Negotiable Instruments Act is silent on the subject as to what constitutes a material alteration. Courts of Law in India in this regard have followed the English Common Law, which held that anything, which has the effect of altering the legal relations between the parties, the character of the instrument, or the sum payable, amounts to a material alteration.

- 45. Material Alteration The following are considered as material alteration. 1. Alteration of the date of the instrument 2. Alteration of the amount payable 3. Alteration in time of payment 4. Alteration of the place of payment 5. Alteration of rate of interest or any change of party thereto, if any 6. Tearing of the material part of the instrument 7. Where a bill is accepted generally, the insertion of a place of payment 8. Addition of a new party to the instrument 9. Addition of words to a bill of exchange endorsed in blank so as to convert the same into special endorsement.

- 46. Meaning of Material alteration: – Material alteration means to make any change or alter some material parts of the instrument and try to make it a valid created with the purpose of the nature of that instrument. Any alteration in the original state of a cheque such as date, amount, payee’s name, changing the word ‘order’ to bearer appearing after payee’s name or in endorsement is called material alteration.

- 47. Payment of Cheques & Dishonor

- 48. Precautions and Statutory Protection of Paying and Collecting Banker