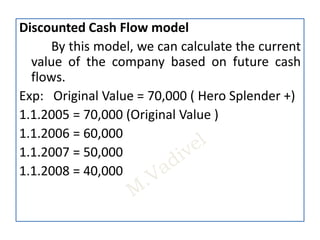

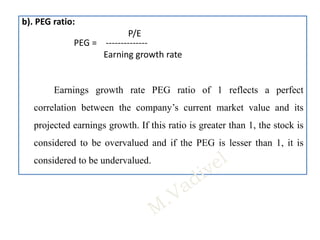

This document discusses methods for valuing stocks, including absolute and relative valuation. Absolute valuation focuses on intrinsic value using the dividend discount or discounted cash flow models. Relative valuation compares metrics like price-to-earnings, price-to-earnings growth, price-to-sales, and price-to-book value ratios to similar companies to determine if a stock is under or overvalued. Specific relative valuation metrics are defined, such as the PEG ratio comparing price-to-earnings ratio to earnings growth rate, with a ratio of 1 indicating fair value. The document emphasizes the importance of understanding valuation methods for investors to make well-informed decisions.