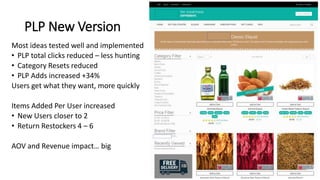

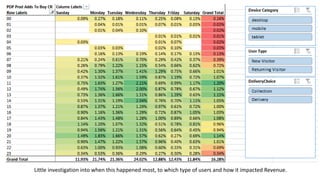

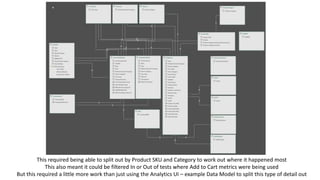

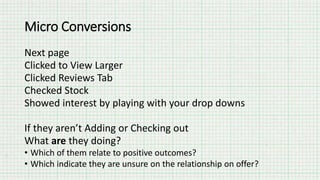

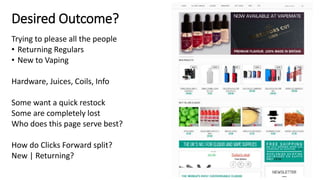

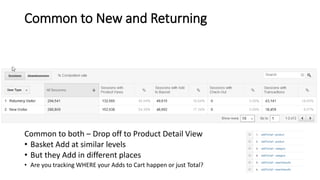

The presentation focuses on converting user intent into actionable outcomes, specifically targeting conversion specialists rather than general marketers. It emphasizes the importance of understanding user journeys, micro-conversions, and the relationship between user behavior and business growth, using data analytics tools to optimize performance. Additionally, it discusses various strategies for improving interactions on e-commerce platforms, highlighting the role of user experience in achieving higher conversion rates.

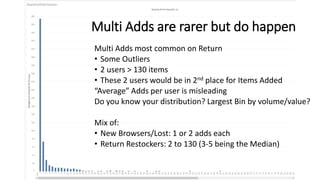

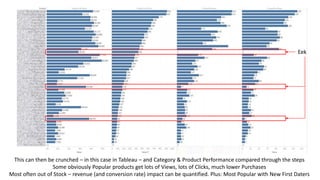

![Quantify Value of Changes

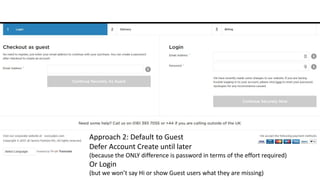

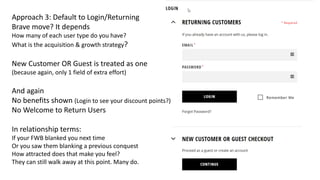

IF fixed THEN [this] is the range of Potential Value or Risk Avoided

Not a “Quick Fix” or uplift on a “Test Metric”

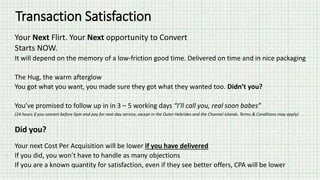

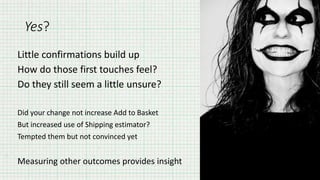

Identifying optimal relationship value is a longer term process

You get a first date, you get the next date

You update your Facebook status to Its complicated

Maybe you get lucky first time; it can and does happen

But to get lucky again you need to put in the work](https://image.slidesharecdn.com/2017-06-testwithintelligence-conversionelite-170714101529/85/2017-06-test-withintelligence-conversionelite-86-320.jpg)

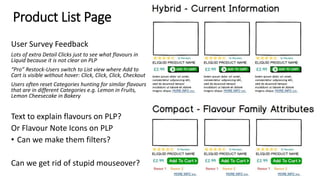

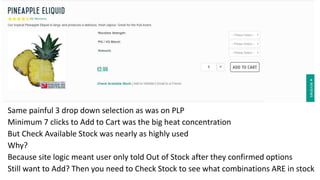

![How much effort for that first kiss?

That is some funky bad breath

And impossible on Mobile – our New & Lost Vapers

[animated version shows three mandatory drop downs before Add enables]

[CTA buttons only show on mouse over]](https://image.slidesharecdn.com/2017-06-testwithintelligence-conversionelite-170714101529/85/2017-06-test-withintelligence-conversionelite-137-320.jpg)