Embed presentation

Downloaded 2,503 times

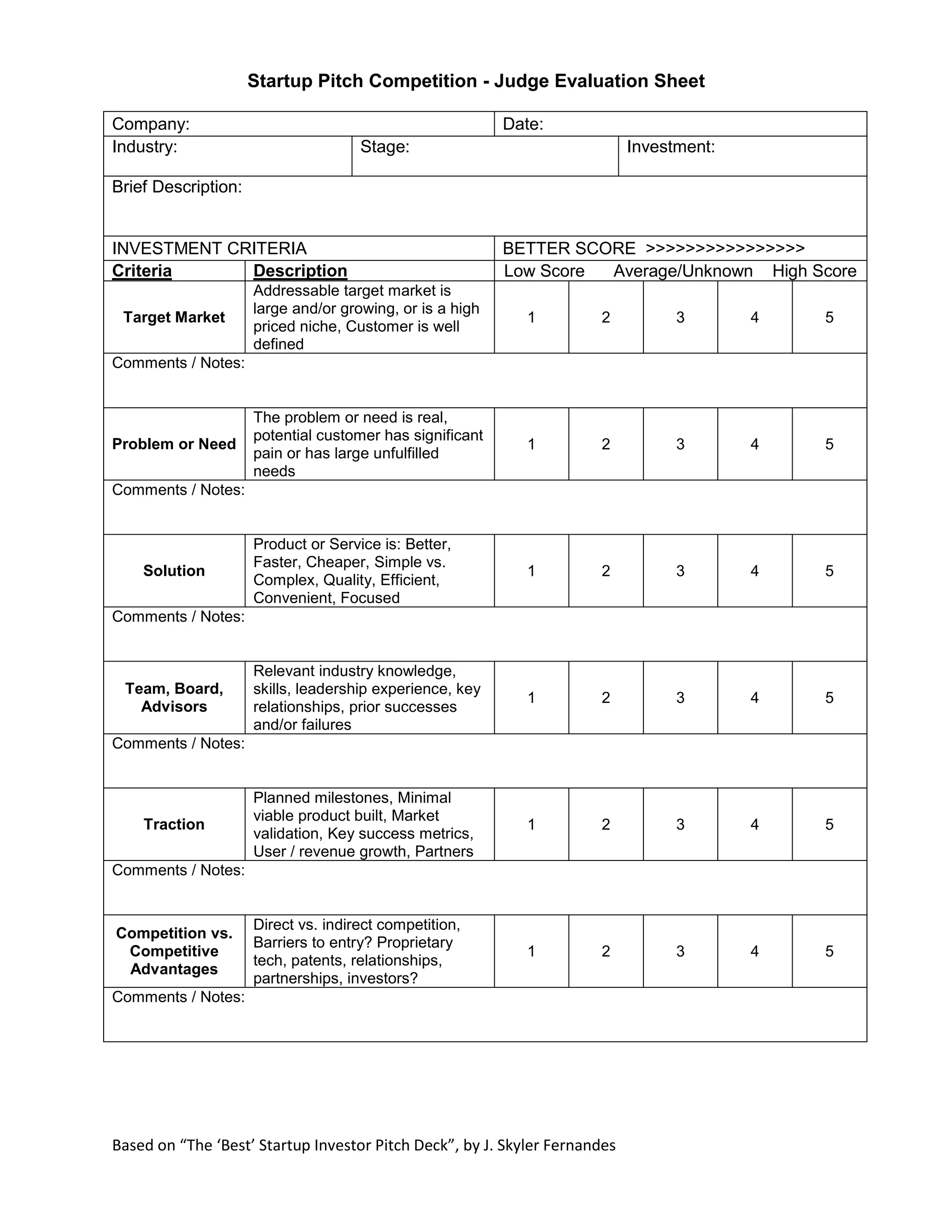

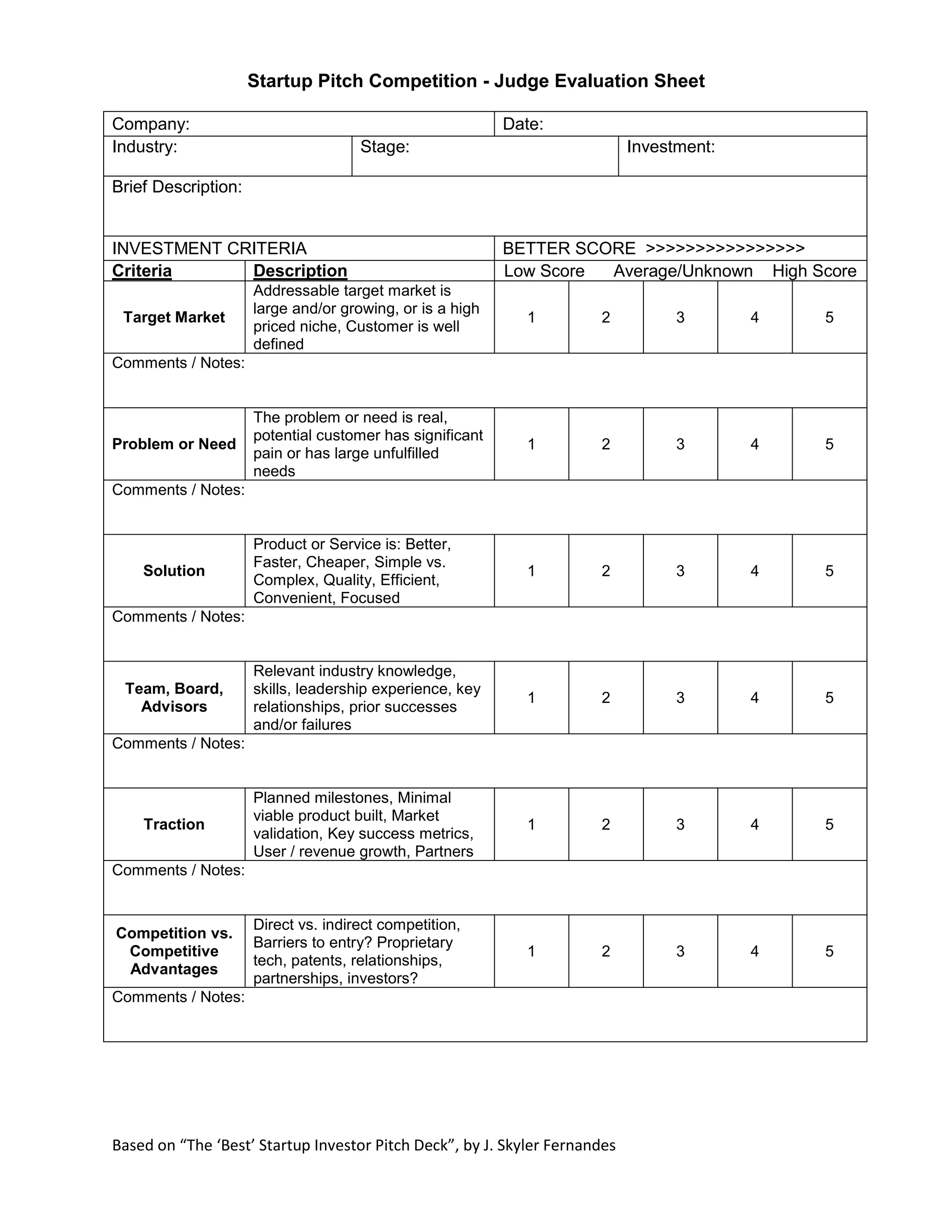

The document outlines an investment assessment framework focusing on various criteria to evaluate potential investments, including target market, problem identification, solution effectiveness, team capability, traction, competition, financials, exit opportunities, investment terms, and strategic value. Each criterion is rated on a scale from low to high score, allowing for a comprehensive analysis of the investment's potential. The scoring system emphasizes the importance of a clearly defined market and sustainable business model.