Post market-report-2nd-dec

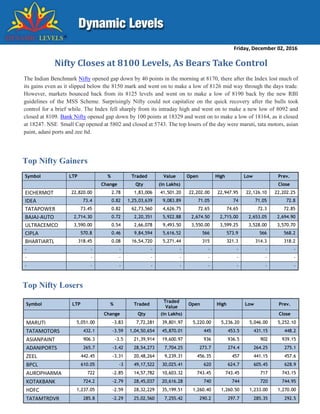

- 1. Friday, December 02, 2016 Top Nifty Gainers Symbol LTP % Traded Value Open High Low Prev. Change Qty (in Lakhs) Close EICHERMOT 22,820.00 2.78 1,83,006 41,501.20 22,202.00 22,947.95 22,126.10 22,202.25 IDEA 73.4 0.82 1,25,03,639 9,083.89 71.05 74 71.05 72.8 TATAPOWER 73.45 0.82 62,73,560 4,626.75 72.65 74.65 72.3 72.85 BAJAJ-AUTO 2,714.30 0.72 2,20,351 5,922.88 2,674.50 2,715.00 2,653.05 2,694.90 ULTRACEMCO 3,590.00 0.54 2,66,078 9,493.50 3,550.00 3,599.25 3,528.00 3,570.70 CIPLA 570.8 0.46 9,84,594 5,616.52 566 573.9 566 568.2 BHARTIARTL 318.45 0.08 16,54,720 5,271.44 315 321.3 314.3 318.2 - - - - - - - - - - - - - - - - - - - - - - - - - - - Top Nifty Losers Symbol LTP % Traded Traded Value Open High Low Prev. Change Qty (in Lakhs) Close MARUTI 5,051.00 -3.83 7,72,281 39,801.97 5,220.00 5,236.20 5,046.00 5,252.10 TATAMOTORS 432.1 -3.59 1,04,50,654 45,870.01 445 453.5 431.15 448.2 ASIANPAINT 906.3 -3.5 21,39,914 19,600.97 936 936.5 902 939.15 ADANIPORTS 265.7 -3.42 28,54,273 7,704.25 273.7 274.4 264.25 275.1 ZEEL 442.45 -3.31 20,48,264 9,239.31 456.35 457 441.15 457.6 BPCL 610.05 -3 49,17,522 30,025.41 620 624.7 605.45 628.9 AUROPHARMA 722 -2.85 14,57,782 10,603.32 743.45 743.45 717 743.15 KOTAKBANK 724.2 -2.79 28,45,037 20,616.28 740 744 720 744.95 HDFC 1,237.05 -2.59 28,32,229 35,199.51 1,260.40 1,260.50 1,233.00 1,270.00 TATAMTRDVR 285.8 -2.29 25,02,560 7,255.42 290.2 297.7 285.35 292.5 Nifty Closes at 8100 Levels, As Bears Take Control The Indian Benchmark Nifty opened gap down by 40 points in the morning at 8170, there after the Index lost much of its gains even as it slipped below the 8150 mark and went on to make a low of 8126 mid way through the days trade. However, markets bounced back from its 8125 levels and went on to make a low of 8190 back by the new RBI guidelines of the MSS Scheme. Surprisingly Nifty could not capitalize on the quick recovery after the bulls took control for a brief while. The Index fell sharply from its intraday high and went on to make a new low of 8092 and closed at 8109. Bank Nifty opened gap down by 100 points at 18329 and went on to make a low of 18164, as it closed at 18247. NSE Small Cap opened at 5802 and closed at 5743. The top losers of the day were maruti, tata motors, asian paint, adani ports and zee ltd.

- 2. A quick View of the Sectors SECTOR % CHANGE TODAY DEFENCE 1.75% AIRLINES -0.19% TEXTILES AND APPAREL -0.37% IT -0.46% INFRA- TELECOM -0.68% ENERGY-OIL & GAS -0.80% FMCG -0.86% AUTO- TYRES AND TUBES -0.88% INFRA- MACHINERY EQUIPMENT -0.91% BANKS-PRIVATE -0.92% INFRA- POWER -0.94% BANKS-PSU -1.20% FMCG- BREVERAGES -1.22% PHARMA -1.31% AUTO-AUTO ANCL AND COMPONENTS -1.39% JEWELLERY -1.39% REALTY -1.60% FMCG- FOOD -1.69% FOOTWEAR -1.73% METALS AND MINING -1.78% FERTILISERS -1.79% FINANCIAL SERVICES -1.81% TRANSPORTATION LOGISTICS -1.82% FMCG- PACKAGING -1.88% MEDIA- ENTERTAINMENT -1.90% AUTO- AUTOMOBILES AND AUTO PARTS -1.97% REALTY- HOUSEHOLD -1.99% CHEMICALS -2.06% CEMENT -2.07% DIVERSIFIED -2.22% FINANCIAL SERVICES- NBFC -2.31% FMCG- SUGAR -2.31% ENTERTAINMENT-HOTELS AND LEISURE -2.34% INFRA- CONSTRUCTION ENGINEERING AND MATERIALS -2.48% PAPER -2.73% MEDIA -2.75% Dynamic Sector Performance – 2nd December 2016 Some Indices turned positive while most of them stayed in the red zone. Defense gained the most, followed by Airlines, Textiles and Apparel and IT. While, Media, Paper, Infra- Construction Engineering and Material and FMCG - Sugar lost the most in the day’s trade.

- 3. NSE High Volumes Stock Performer List TOP GAINER TOP LOSER SYMBOL LTP %CHANGE SECTOR SYMBOL LTP %CHANGE SECTOR HINDOILEXP 69.85 4.18 ENERGY-OIL & GAS BINANIIND 72.20 -5.50 CEMENT KNRCON 773.00 2.83 INFRA- CONSTRUCTION ENGINEERING AND MATERIALS TRIGYN 95.90 -5.38 IT RAIN 51.50 2.38 CEMENT RAMCOIND 195.20 -5.24 REALTY- HOUSEHOLD SHARDACROP 431.00 1.50 CHEMICALS SATIN 416.50 -5.00 FINANCIAL SERVICES COSMOFILMS 334.45 1.09 FMCG- PACKAGING IGPL 233.20 -4.99 CHEMICALS AARTIIND 728.00 0.96 CHEMICALS SSWL 603.10 -4.87 AUTO-AUTO ANCL AND COMPONENTS BAJAJFINSV 2964.75 0.87 FINANCIAL SERVICES- NBFC BHAGERIA 365.80 -4.68 CHEMICALS VGUARD 170.30 0.83 REALTY- HOUSEHOLD SURYAROSNI 198.40 -4.66 REALTY- HOUSEHOLD IIFL 263.30 0.65 FINANCIAL SERVICES JBMA 220.05 -4.60 AUTO-AUTO ANCL AND COMPONENTS FINCABLES 416.05 0.64 INFRA- TELECOM SYNGENE 577.00 -4.58 PHARMA ANANTRAJ 40.90 0.61 REALTY AEGISCHEM 142.65 -4.55 TRANSPORTATION LOGISTICS JKCEMENT 733.05 0.48 CEMENT STCINDIA 116.60 -4.23 DIVERSIFIED KAJARIACER 527.75 0.44 REALTY- HOUSEHOLD NOCIL 67.15 -4.21 CHEMICALS CARERATING 1395.00 0.27 FINANCIAL SERVICES MOIL 365.50 -3.98 METALS AND MINING VTL 1104.35 0.26 TEXTILES AND APPAREL KESORAMIND 135.25 -3.77 DIVERSIFIED PEL 1634.00 0.19 PHARMA SMLISUZU 1090.95 -3.71 AUTO- AUTOMOBILES AND AUTO PARTS SHRIRAMCIT 1878.15 0.12 FINANCIAL SERVICES- NBFC WHIRLPOOL 918.20 -3.66 REALTY- HOUSEHOLD DCBBANK 108.95 0.09 BANKS-PRIVATE GSFC 87.95 -3.56 FERTILISERS HGS 512.80 0.00 IT ADFFOODS 151.65 -3.53 FMCG- FOOD KALPATPOWR 244.05 -0.29 INFRA- POWER HONDAPOWER 1470.00 -3.51 INFRA- MACHINERY EQUIPMENT PRICOL 89.90 -0.44 AUTO-AUTO ANCL AND COMPONENTS RBL 905.00 -3.50 AUTO- AUTOMOBILES AND AUTO PARTS FIEMIND 1123.00 -0.50 AUTO-AUTO ANCL AND COMPONENTS TFCILTD 50.95 -3.41 FINANCIAL SERVICES- NBFC MONSANTO 2256.60 -0.58 CHEMICALS CANFINHOME 1636.00 -3.41 FINANCIAL SERVICES- NBFC TUBEINVEST 578.45 -0.58 AUTO-AUTO ANCL AND COMPONENTS CENTURYPLY 172.25 -3.39 REALTY- HOUSEHOLD HIMATSEIDE 278.45 -0.62 TEXTILES AND APPAREL HERITGFOOD 856.30 -3.35 FMCG- FOOD IGARASHI 720.00 -0.64 AUTO-AUTO ANCL AND COMPONENTS OUDHSUG 106.50 -3.31 FMCG- SUGAR TIMETECHNO 91.85 -0.65 FMCG- PACKAGING DELTACORP 109.50 -3.27 ENTERTAINMENT-HOTELS AND LEISURE NEULANDLAB 1018.95 -0.70 PHARMA SARDAEN 231.50 -3.20 METALS AND MINING TIRUMALCHM 779.40 -0.72 CHEMICALS KIRIINDUS 268.95 -3.20 CHEMICALS

- 4. Balkrishna Industries is a tire manufacturing company placed in Mumbai, India. The firm manufactures off-highway tires used in specialist segments like mining, earthmoving, agriculture as well as gardening in five factories located in Aurangabad, Bhiwadi, Chopanki, Dombivali as well as Bhuj. In the year 2013, Balkrishna Industries was ranked 41st among the world’s tire makers. On 30th November 2016, the company had announced the results for the second quarter with its Q2FY17 numbers above the estimates of the market. The revenue came in 5.5 per cent higher and the net profit came in 84.2 per cent higher than the market estimates. Extending its post Q2 rally, Balkrishna Industries share price traded at the new lifetime high value of Rs. 1,285.75. Its previous lifetime high had been Rs. 1,204.80 at which it had traded on 5th October 2016. Balkrishna Industries is currently an OEM vendor for heavy equipment manufacturers like JCB (company), John Deere and CNH Industrial. The company at present enjoys 2 per cent market share of the global off-the- road tyre segment. The company has the consolidated PE ratio for the FY 15-16 is 19.98 while its standalone PE ratio for the FY 15-16 is 20.27. As on 2nd December 2016, the market cap of the company stands at 11505.27 crores. The stock’s one month return is 11.87 per cent with the book value of 288.27. Nelco share price recovered from its 52 week low and surged over 6 per cent in today’s morning trade. Nelco, Balaji Telefilms, Endurance Technologies, Hotel Leelaventure, Kamat Hotels (India), Mirza International, Puravankara Projects, Peninsula Land, MT Educare and others had hit their respective 52-week lows on the Bombay Stock Exchange (BSE) a few days ago. Fundamentals one should be aware of Before Investing in the Stock: Balkrishna Industries Trades Lifetime High re Price Surges 13% over Q2 Nelco Share Price Recovers from its 52 Week Low re Price Surges 13% over Q2A surprise victory of Donald Trump in the US Presidential elections, and the economic (housing and jobless claims) data from the United States that could push the US Federal Reserve (US Fed) to hike rates in the upcoming policy review this month had dented sentiment. Also, Foreign Institutional Investors or FIIs and foreign portfolio investors or FPIs had sold equity shares worth over 1 billion dollars in after the government had demonetized Rs.500 and Rs.1000 currency notes. At 11:57 am, Nelco share price was trading at Rs.87, up 5.2 per cent on the National Stock Exchange (NSE). The scrip opened at Rs.83 from a previous closing of Rs.82.70. The upper and lower Average Daily Movement [ADM] 4.72 Average Volume [20 days] 91764 1 Month Return (%) -7.8 Consolidated Trailing PE Ratio 78.17 Standalone Trailing PE Ratio 78.17 Book Value 4.24 Market Cap 188.71 (Cr)

- 5. On 2nd Dec, Dilip Buildcon share price tanked by more than 11 per cent. The stock opened with a fall of 30 points at Rs. 237.95 as compared to its previous closing at Rs.254.05. As of now, the stock is quoting at Rs. 224.05 and touched the days high and low at Rs. 239.50 and Rs. 221. Previously during this month, Dilip Buildcon has been given the Letter of Award (LoA) for two projects. The first project is for Rehabilitation & Up-gradation of NH-18 (New NH-40) from Km 108/850 to Kml60/200 of (Rayachoti - Kadapa section) to two lane with paved shoulder in the state of Andhra Pradesh under corridor approach through EPC basis of contract from Government of Andhra Pradesh (AP) PWD (R & B) Department. The second LoA if for Rehabilitation and up-gradation of NH-66 (erstwhile NH-17) from Km 406/030 to Km 450/170 (Kalmath to Zarap section) to four lane with paved shoulder in the state of Maharashtra under NHDP-IV on Hybrid Annuity Mode from Government of India, Ministry of Road Transport & Highways. Dilip Buildcon Limited is a private sector road-focused engineering procurement construction (EPC) contractor in India. It is a growing infrastructure development firm with around 78.44 per cent y-o-y growth for the past four years. It is developing infrastructure over the country in many different areas such as roads and bridges, water sanitation and sewage, irrigation, industrial, commercial and residential buildings. A2Z share price tanked over 7 per cent intraday on the National Stock Exchange (NSE). From a previous closing of Rs. 43.15, A2Z share price today opened at Rs. 41.75. The stock has an ADM or Average Daily Movement of 2.42. The one- month return percentage stands at - 3.68. The market cap of A2Z amounts to Rs. 559.32 (Cr) as on 2nd December 2016 while the book value stands at 37.39. As recognized by the Dynamic Levels, A2Z belongs to the top 500 stocks out of the 1700 shares listed on the NSE. It has strong fundamentals and impressive financials. For the quarter ended 30-Sep-2015, the company has reported a Consolidate sales of Rs. 362.55 Cr, up 108.26 per cent from last quarter Sales of Rs. 174.09 Cr and unchanged from last year same quarter Sales of Rs. N/A. Company has reported net profit after tax of Rs. -32.00 Cr in latest quarter. As of 9:27 am, A2Z share price was trading at Rs.40.30, down by 6.60 per cent. The day’s high of the stock at the time stands at Rs. 41.75 while the day’s low read at Rs. 38.95. So far, the traded volume stands at A2Z Share Price tanks over 7 Per Cent Intraday on NSE Dilip Buildcon Share Price skids during the Morning Trade 383577 shares with an aggregated traded value of Rs. 153.74 lac on the National Stock Exchange (NSE). However, the average volume of 20 days of the scrip reads at 1066550 shares.

- 6. Hot Picks of the Day SBI will Launch Mobile Wallet for Feature Phone Arundhati Bhattacharya, the chairperson of State Bank of India (SBI) informed that the bank will launch a mobile wallet for feature phone by the first half of this December. She further added that the bank has already launched a mobile wallet named 'State Bank Buddy' for smart phone users. Furthermore, the persons, who do not own smart phones, will be able to use this software tool for money transaction through their feature phones. Visit page Global Markets Influenced By Major Events This Month The market is likely to remain cautious ahead of key events this month. One among them is the GST council meet that begins today. The dream tax structure will take a step further towards its realization. The other most important event is the RBI Credit Policy that will be held on 7th of this month. This credit policy needs to be monitored even more minutely as Demonetization has already left its unforgettable mark on the face of Indian Economy. Expectations are that of a rate cut which would be cheered by the markets and companies like DHFL, Yes Bank and others in the Banking and Financial Services Sector would be direct beneficiaries. Read more… The Indian Chemical stocks hit by rising Crude Prices Recently, world’s largest oil producers gathered in Vienna to try to agree a production cut that could be bigger than expected, taking oil pricesto a jump of more than eight per cent and to a five-week high. Oil prices surged 4 percent on yesterday, with Brent crude at its highest in almost 16 months, extending gains after OPEC and Russia settled to restrict output to reduce the global supply glut more quickly. This, in turn, has pulled down the entire Chemical Sector on its feet as Crude oil is a major raw material used in making chemicals. Read more….

- 7. Disclaimer The investment advice or guidance provided by way of recommendations, reports or other ways are solely the personal views of the research team. Users are advised to use the data for the purpose of information and rely on their own judgment while making investment decision. Dynamic Equities Pvt. Ltd - SEBI Investment Advisory Reg. No.: INA300002022 Disclosure Dynamic Equities Pvt. Ltd. is a member of NSE, BSE, MCX SX and a DP with NSDL & CDSL. It is also engaged in Investment Advisory Services and Portfolio Management Services. Dynamic Commodities Pvt. Ltd., associate company, is a member of MCX & NCDEX. We declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered. SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise letters or levied minor penalty on for certain operational deviations. Answers to the Best of our knowledge and belief of Dynamic/ its Associates/ Research Analyst: DYNAMIC/its Associates/ Research Analyst/ his Relative: Do not have any financial interest / any actual/beneficial ownership in the subject company. Do not have any other material conflict of interest at the time of publication of the research report Have not received any compensation from the subject company in the past twelve months Have not managed or co-managed public offering of securities for the subject company. Have not received any compensation for brokerage services or any products / services or any compensation or other benefits from the subject company, nor engaged in market making activity for the subject company Have not served as an officer, director or employee of the subject company Report Prepared By: Mayank Jain - NISM-201500086427 Vikash Kandoi - NISM-201500086430