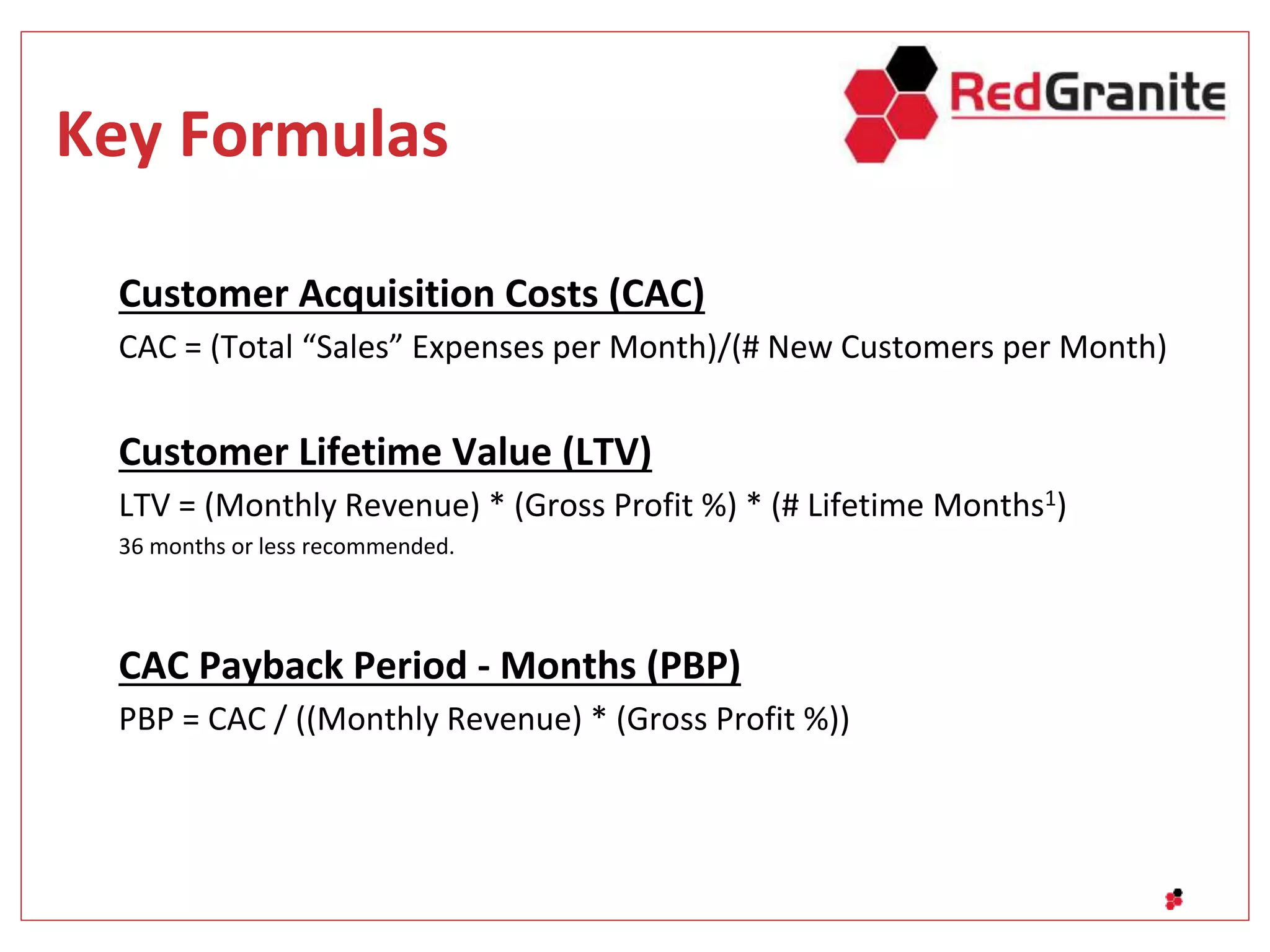

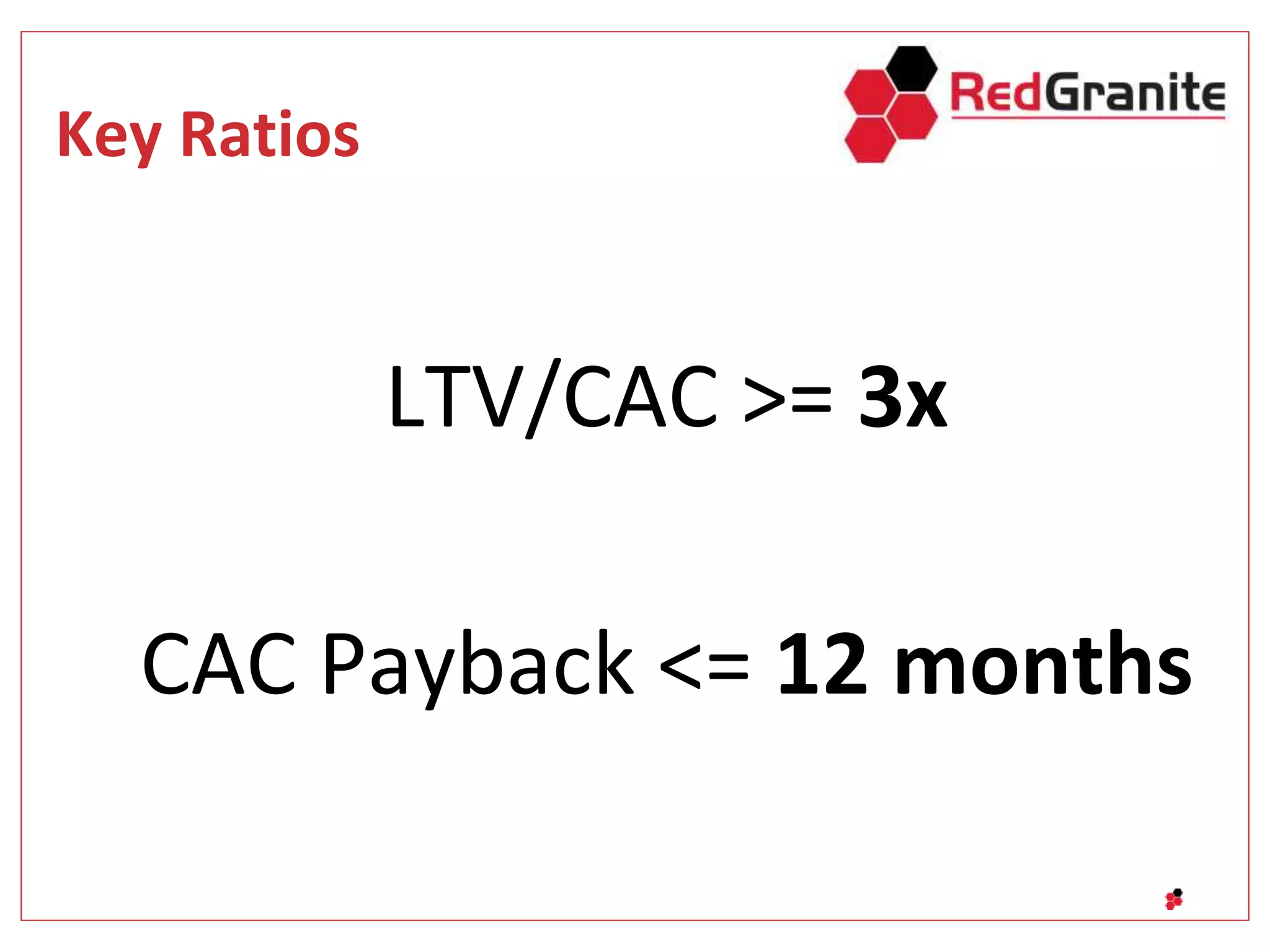

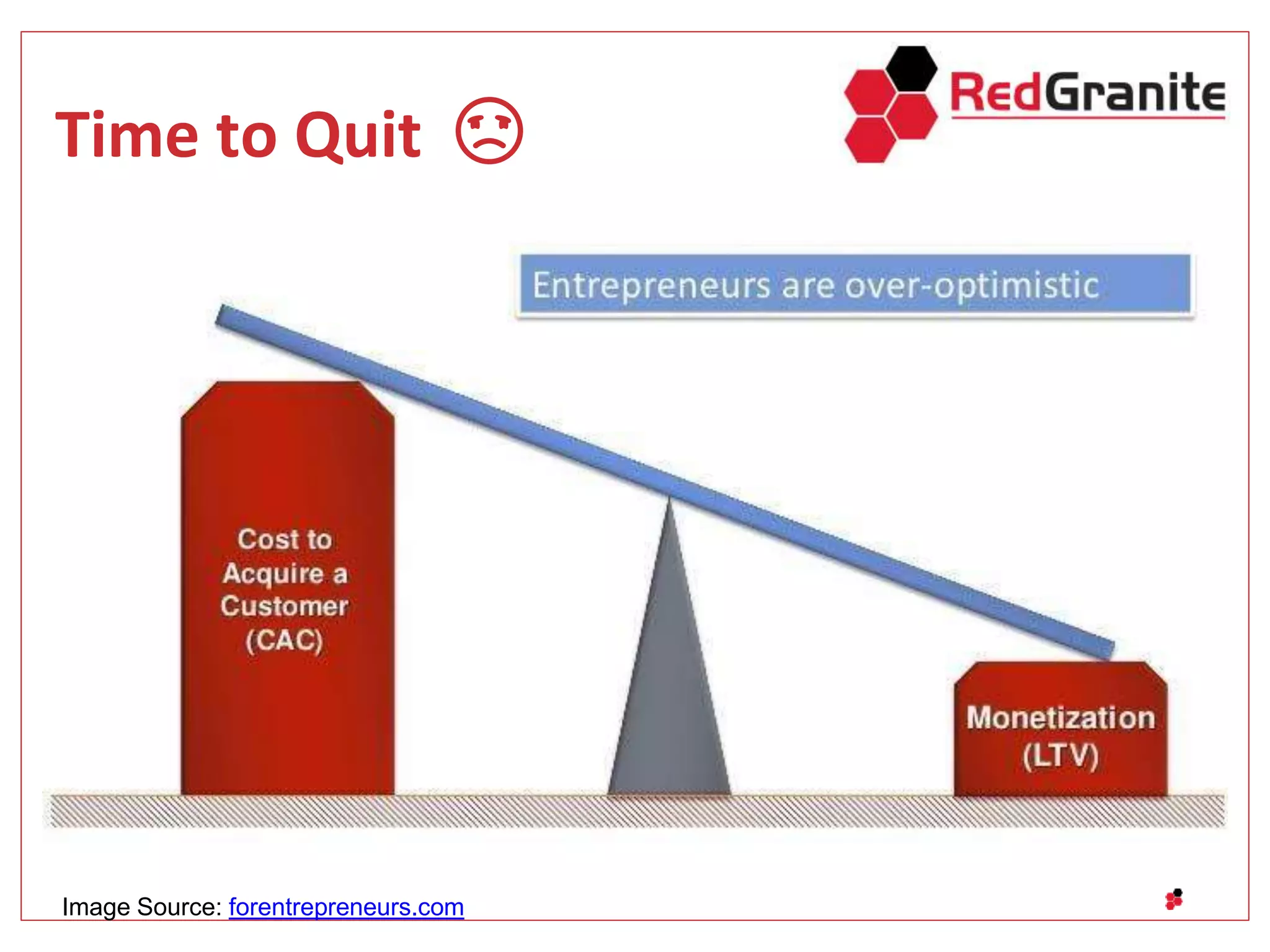

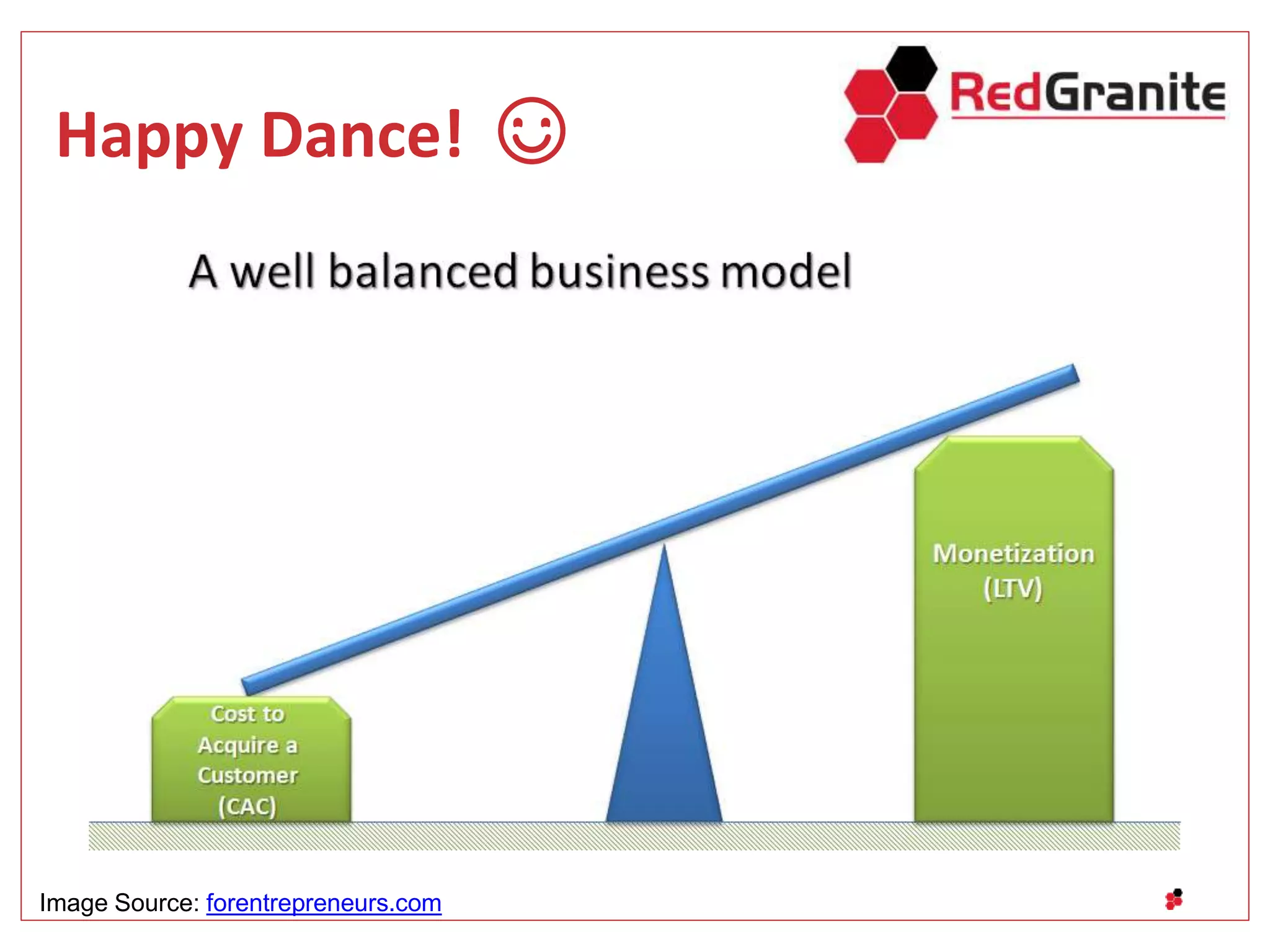

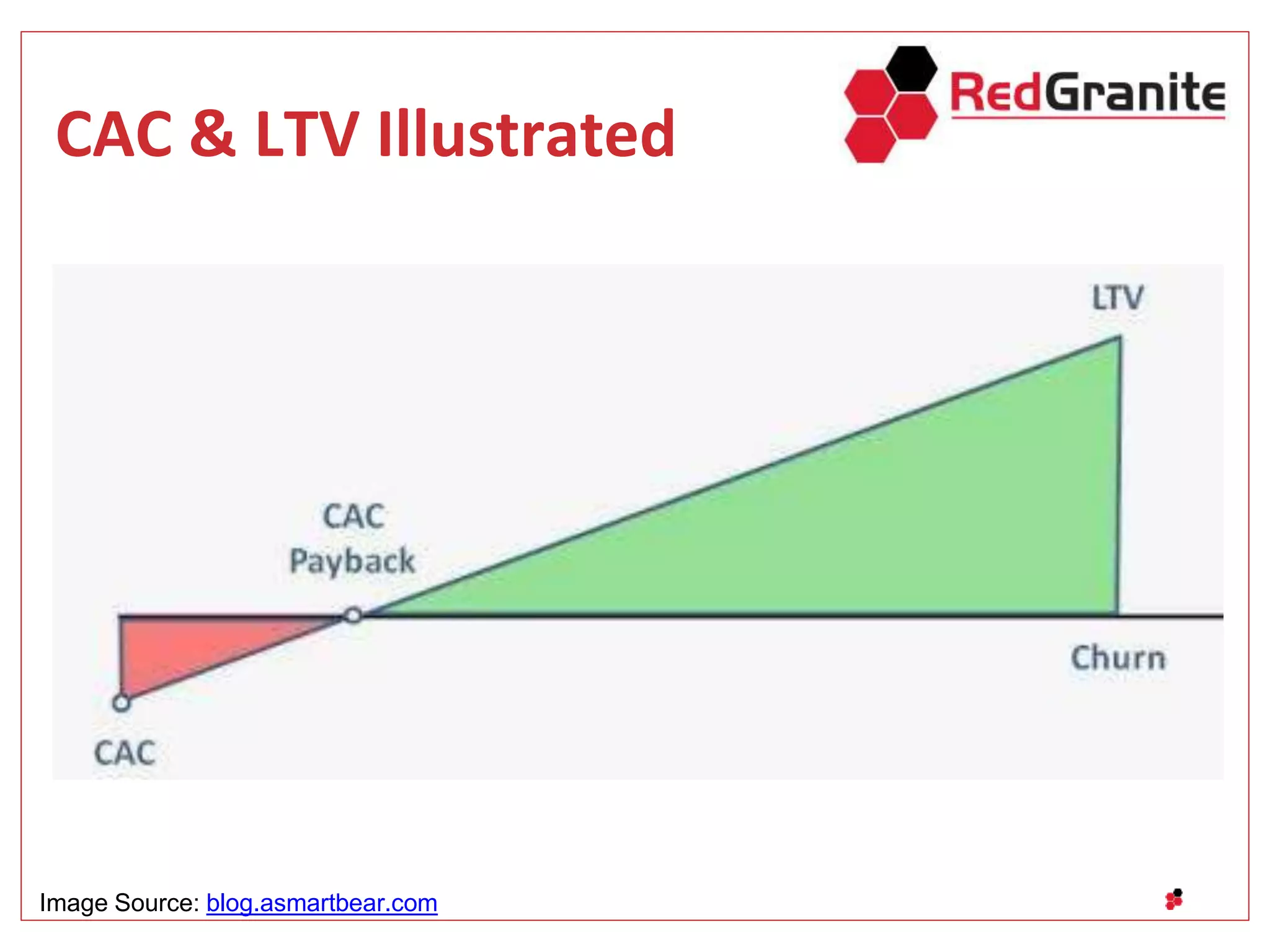

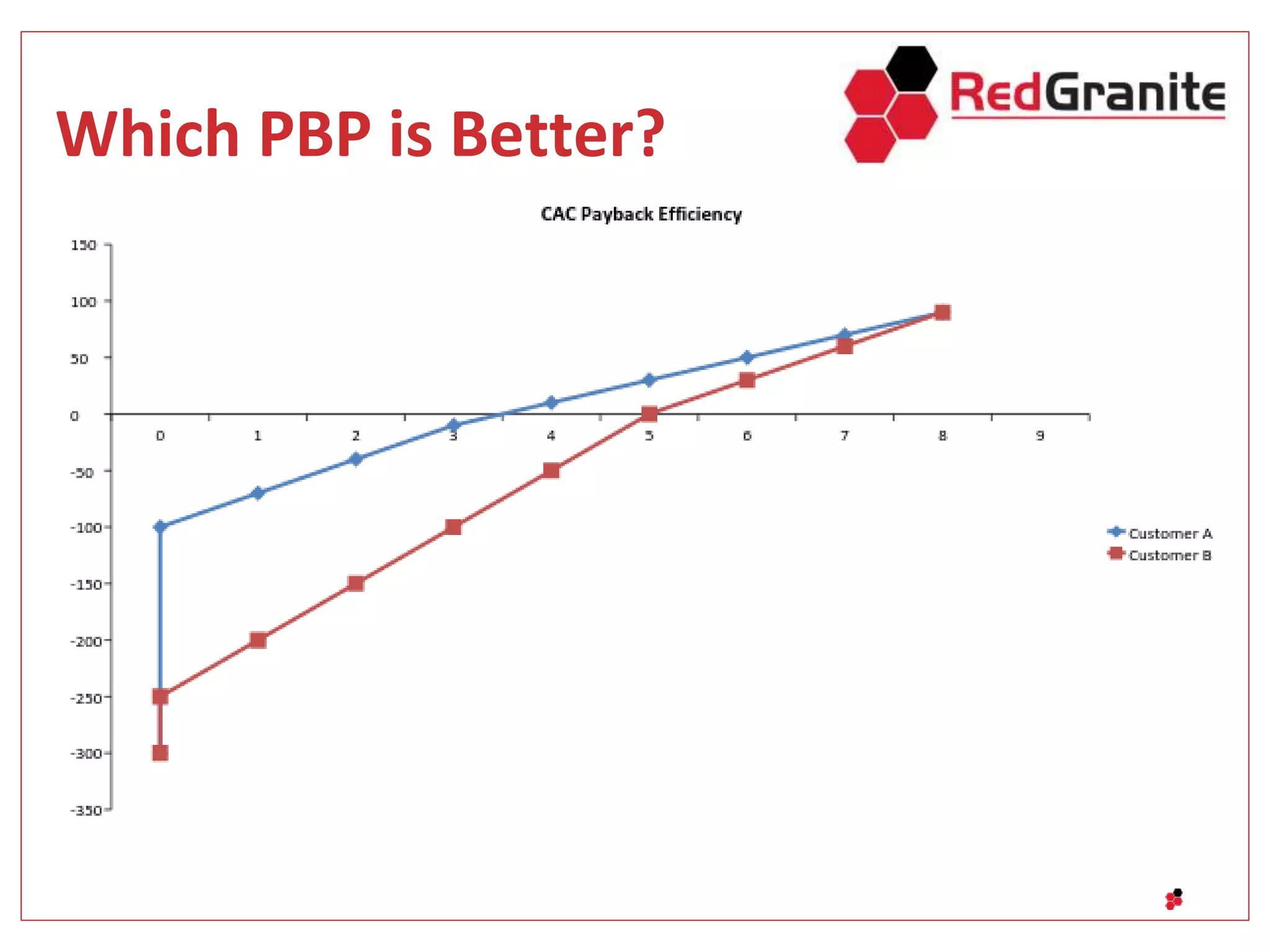

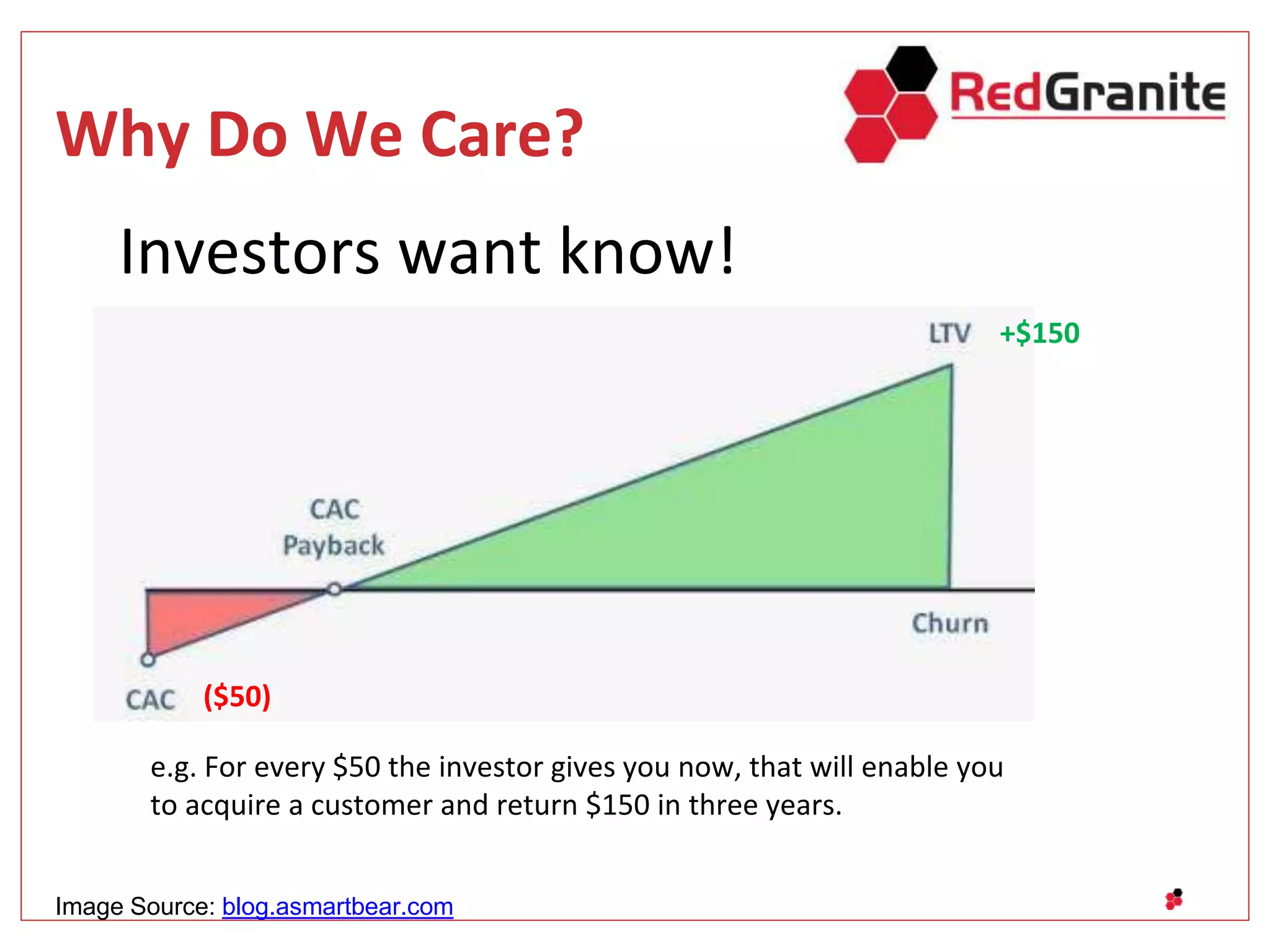

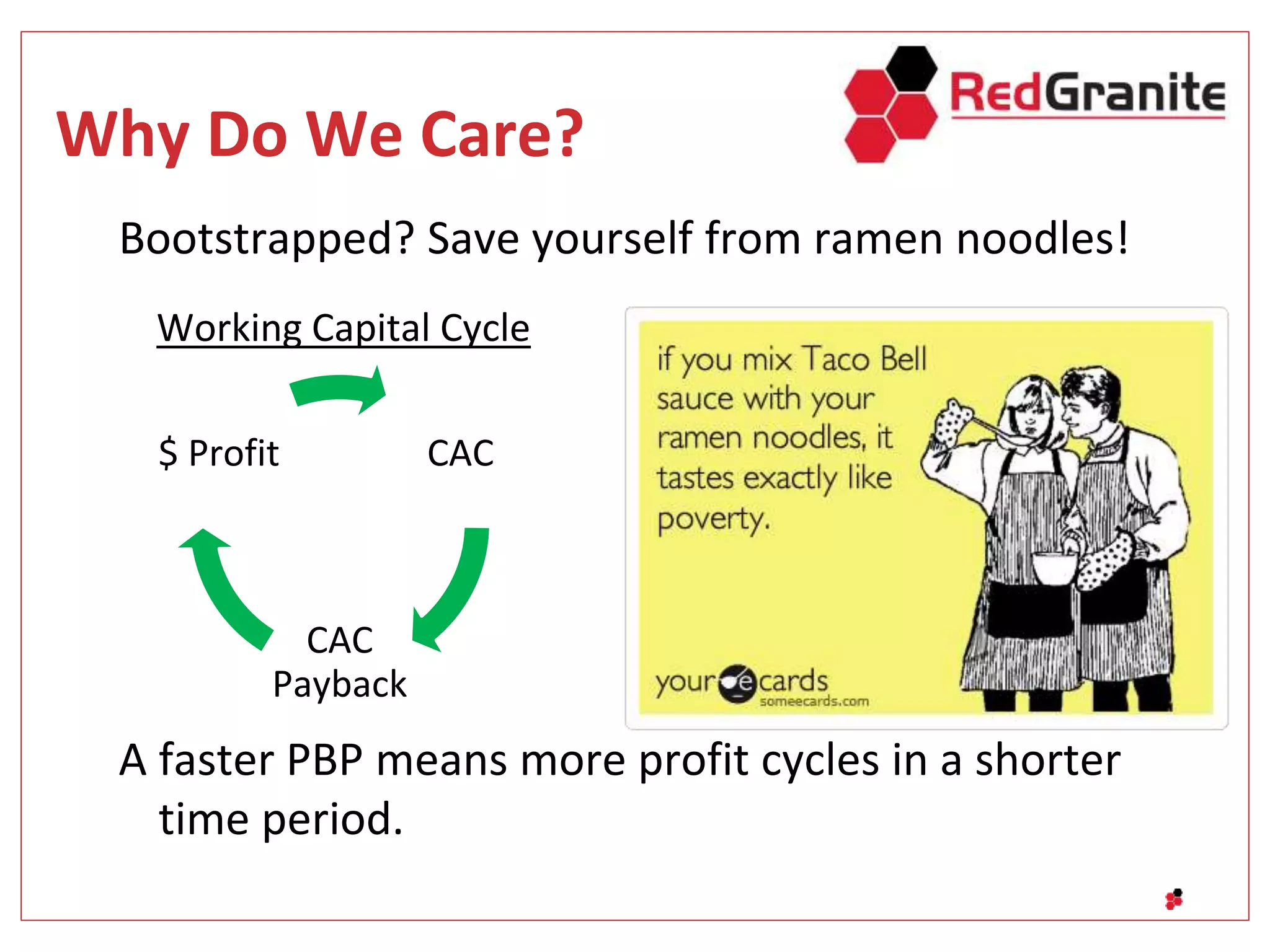

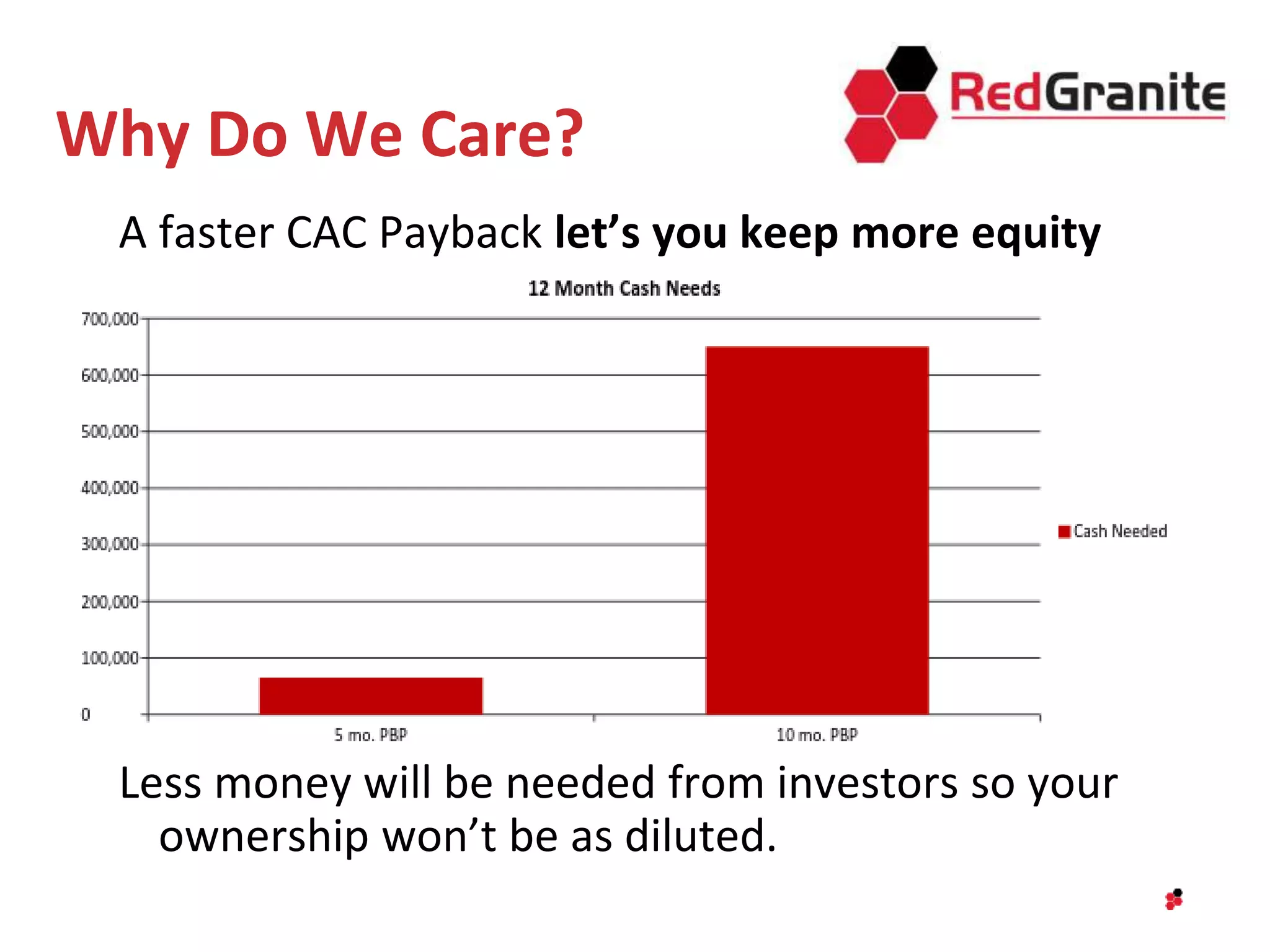

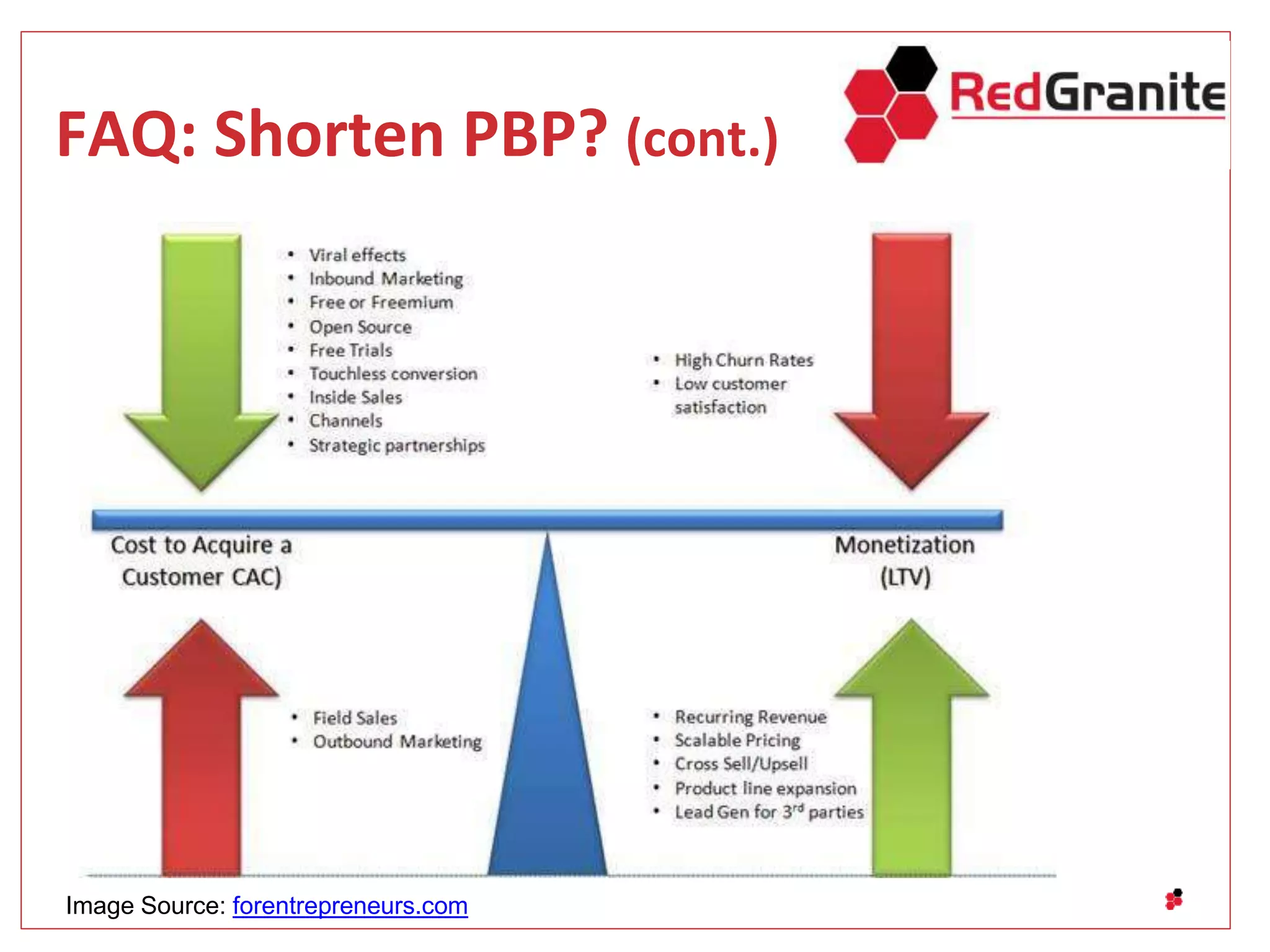

This document discusses customer acquisition cost (CAC) and lifetime value (LTV), two key metrics for evaluating the financial performance of acquiring customers. It defines CAC as the cost to acquire a new customer and LTV as the total revenue generated by a customer over their lifetime. It provides formulas for calculating CAC, LTV, and the CAC payback period. A CAC/LTV ratio of at least 3x and payback period of 12 months or less are recommended targets. The document explains why these metrics are important for investors, bootstrapped companies, and reducing equity dilution. It addresses common questions about including costs in CAC calculations and estimating customer lifetime.