posting

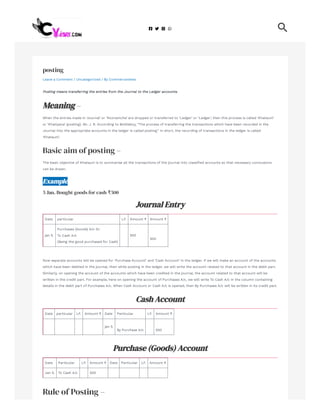

- 1. posting Leave a Comment / Uncategorized / By Commerceviews Posting means transferring the entries from the Journal to the Ledger accounts. Meaning – When the entries made in ‘Journal’ or ‘Roznamche’ are dropped or transferred to ‘Ledger’ or ‘Ledger’, then this process is called ‘Khatauni’ or ‘Khatiyana’ (posting). Mr. J. R. According to Bottleboy, “The process of transferring the transactions which have been recorded in the Journal into the appropriate accounts in the ledger is called posting.” In short, the recording of transactions in the ledger is called ‘Khatauni’. Basic aim of posting – The basic objective of Khatauni is to summarise all the transactions of the journal into classified accounts so that necessary conclusions can be drawn. Example 5 Jan. Bought goods for cash ₹500 Journal Entry Date particular LF. Amount ₹ Amount ₹ jan 5. Purchases (Goods) A/c Dr. To Cash A/c (Being the good purchased for Cash) 500 500 Now separate accounts will be opened for ‘Purchase Account’ and ‘Cash Account’ in the ledger. If we will make an account of the accounts which have been debited in the journal, then while posting in the ledger, we will write the account related to that account in the debit part. Similarly, on opening the account of the accounts which have been credited in the journal, the account related to that account will be written in the credit part. For example, here on opening the account of Purchases A/c, we will write To Cash A/c in the column containing details in the debit part of Purchases A/c. When Cash Account or Cash A/c is opened, then By Purchases A/c will be written in its credit part. Cash Account Date particular LF. Amount ₹ Date Particular LF. Amount ₹ jan 5. By Purchase A/c 500 Purchase (Goods) Account Date Particular LF. Amount ₹ Date Particular LF. Amount ₹ Jan 5. To Cash A/c 500 Rule of Posting –

- 2. (1) Open accounts for all the accounts named in the journal. (2) Write the names of the accounts in capital letters in the middle of the pages of the ledger. (3) If there are no boxes in the ledger, then draw the lines corresponding to the format or sample of the ledger given (ie four for the debit side and four for the credit side). (4) Now write all the accounts related to one name at one place. Remember, two accounts cannot be opened in the same name. If there are two customers with the same name, then write their subtle address in front of the account, so that the difference between the two can be known. For example, the account of Sanjiv (kumar), Sanjiv (Saharsa). (5) To write the accounts made in the journal in a sequential manner i.e. date wise. (6) The name in which the account is opened, the name of that account’s Dr. or Cr. It is never written on the side. ‘Same side opposite name. (7) The word ‘To’ is written before the debit side’s account and ‘By’ before the credit side’s account. (8) In the journal, if we are creating an account for which account has been debited, then write the date of transaction in the first field in the debit part of that account, then write the credit account related to that account in the column containing details . In the third column write the page number of the journal from where they were brought and the amount in the fourth column. Thus, the account being credited or credited in the journal is written on the debit side of the account related to it in the ledger. (9) Opening the account of the party to be credited in the journal as in rule eight, on the credit side, write the date of the transaction in the first box, the name of the account in the first line written in the journal in the second column (ie, the details box)- That is, write what has been debited. In the third box, write the page number of the journal from where they were brought and the amount in the fourth box. Thus, the account which is debited in the journal is written on the credit side of the ledger and the account which is credited in the journal is debited in the same account as in Khatauni. – Machinery purchased in cash ₹2,000 Machinery A/c Dr. ₹ 2,000 To Cash A/c ₹ 2,000 Machinery A/c has been debited in the above journal. Therefore, its Khatauni will be done by writing By Machinery A/c in the Credit Side of Cash A/c and Cash A/c has been credited, hence its Khatauni will be done by writing To Cash Ac in the Debit Side of Machinery A/c. (10) It is not necessary to write the word Account or A/c in front of the name of individual accounts while doing Khatauni. (11) If the complete details of an account cannot be found on one page of the ledger, then the total of that account should be moved to the next page and write [Balance Carried forward (c/f)] and on the next page Write [Balance Brought forward (b/f)) brought. (12) The number should be written on each page of the ledger. (13) The page number of the journal (Journal Folio or J.F.) must be written in the ledger. This facilitates in citing each other and extracting related accounts or journals. (14) If any mistake is made while doing the khatauni; For example, if there is a mistake in writing the amount or if there is a mistake in writing in the details column, then do not cross the account or write it again. Due to tampering or overwriting, the ledger will not be able to remain clean and will lose credibility. For this, it would be appropriate to open an account for rectification and get it done. (15) Mark those articles of the journal circumcision has been completed, so that it can be known which have been cut and which are yet to be circumcised. Basic Rules of Posting Rule 1: The item in which we make khataunis in the account, can never be khatauni in the same name in that account. Rule 2: Every debit has its own and equal credit. Balance and Closing Of Account To know the status of various accounts, the balance of all the accounts is usually drawn at the end of the year or on a certain date. In other

- 3. words, to get information about how much cash balance is in the business, how much money is in the bank, what is the position of debtors and creditors, how much assets are there, etc., it is necessary to calculate the balance of accounts. By the balance of accounts we mean the difference between the sum of the amounts on the debit side and credit side of the particular account. In this way, by adding the amounts of Jay Devit and Credit side, it is found that which side is bigger and than how much amount, then this process is called closing the account and withdrawing the balance. By Machinery (i) Debit Balance – If the sum of the debit part is more than the sum of the credit part, then the difference amount will be written in the credit part of the account as By Balance old and such balance will be called debit balance. (ii) Credit Balance – If the sum of the credit part is more than the sum of the debit part, then the difference amount will be written in the debit part of the account as To Balance c/d and such balance will be called credit balance. In short, the balance amount (Balance c/d) is written on the side on which the addition is less. 1. After writing the balance of the account (Balance c/d), the sum of the debit and credit sides of each account should be written in a straight line and two straight lines should be drawn below the amount. Now the sum of debit or credit side will appear to be same. 2. Sometimes the amounts on both the sides of the account (ie debit and credit sides) become equal. In such a situation, we will leave only by doing total. The action of extracting the balance will not be done. Equalization of the sum of both the sides is the proof that the account has been automatically closed. 3. Balance brought down (Balance brought down or b / d ) – If the name of an account is Debit balance (ie By Balance c / d is written in its deposit side) then the first month of the next month or new year On the debit side, the amount with Balance c/d will be written by writing To Balance b/d or To Balance b/f. Similarly, if the account has a credit balance (ie To Balance c/d is written in its debit side), then on the first day of the next month or new year, by writing By Balance b/d on the credit side, Balance c/d The amount will be written down. In short, (i) Balance c/d is drawn at the end of the month or year. (ii) Balance b/d is written on the first day of the next month or new year. (iii) The amount of Balance c/d becomes Balance b/d on the opposite side of the account. Opening and Closing Debit Balances Some Common terms used while Balancing an Account (1.) Balance Carried Down (c/d): It means the amount which is to be carried over to the next period as opening balance. In other words, it is to carry forward the ‘Balance’ on the same page to the next date or after a certain period has passed (eg- 31st March, 31st December). (2.)Balance Carried Forward (c/f) : It displays the total of a column of figures which will be the first item of the corresponding column on the second page. In other words, it is used to transfer the sum of the digits of one column to another column or page. Especially when the ‘posting’ of entries fills the ‘column’ or ‘page’. (3.) Balance Brought Down (b/d) : It shows the opening balance which is transferred from the previous period.has been brought forward. In other words, it is used to move the ‘remaining’ on the same page to the next date or after a certain period has elapsed (eg 31st March,

- 4. ot e o ds, t s used to o e t e e a g o t e sa e page to t e e t date o a te a ce ta pe od as elapsed (eg 3 st a c , 31st December). It is the opposite of Carried down (or c/d). ( 4.) Balance Brought Forward (b/f): Balance b/f is used when the total amount mentioned on the previous page of an account is brought to the next page. In other words, it is used to write the balance of an account on a page at the beginning of the account. Posting of the opening Entry In order to bring the balances of the previous year’s ledger to the new ledger, entry is passed in the particular journal. In fact, in the initial entry, ‘To Balance b/d’ is written in the Debit side of the accounts which have Debit balance in the account book and in the Credit side of those accounts which have Credit balance. ‘By Balance b/d’ is written. Generally, all assets have debit balances and all liabilities have credit balances. The closing entry of the previous period or the previous accounting year is marked as the opening entry in the new period or new year and posted in the respective accounts. That’s how we open those accounts in the new year. Example – Closing Balance of 31.12.2016: Debit Balance: Cash (Cash) ₹ 15,000; Bank ₹20,000; Debtors ₹15,000; Stock ₹10,000; Furniture ₹ 18,000; Credit Balance : Creditors ₹25,000; Bills Payable ₹10,000. In such a situation, at the beginning of the year To Balance b/d ₹ 15,000 will be written in the Debit side of Cash A/c, To Balance b/d ₹ 20,000 in Bank A/c but By Balance b/d ₹ ₹ in the creditor’s account. 25,000 will be written as creditor’s credit balance. b/d for b/b and c/d for c/b can also be used. Cash Account 1.1.2017 To Balance b/d ₹ 15,00 ₹ Bank Account 1.1.2017 To Balance b/d ₹ 20,000 ₹ Creditors’ Account ₹ 1.1.2017 By Balance b/d ₹ 25,000 Bill Payable Account ₹ 1.1.2017 By Balance b/d ₹ 10,000 Journalise the following transaction of M/s Mallika Fashion house nd post the entries to the Ledger: 2017 june 5. Business started with Cash ₹ 2,00,000 ” 8. Opened a Bank account with syndicate Bank. 80,000 ” 12. Goods purchased on credit from M/s Gulmohar Fashion house. 30,000 ” 12. Purchase office machines, paid by cheque. 20,000 ” 18. Rent paid By Cheque. 5,000 ” 20. Sale of Goods on credit to M/s Mohit Bros. 10,000 ” 22. Cash Sales. 15,000 Solution Recording the Transactions : In the Book of M/s Mallika Fashion House Journal Entries

- 5. Date Particular L.F. Amount ₹ Amount ₹ 2017 june 5. Cash A/c To Capital A/c Being (Business started with Cash) 2,00,000 2,00,000 ” 8 Bank A/c To Cash A/c (Being open a Bank Account) 80,000 80,000 ” 12 Purchases A/c To To M/S Gulmohar House A/c (Being goods Purchases on Credit) 30,000 30,000 ” 12 Office Machines A/c To Bank A/c. (Being office machine purchased) 20,000 20,000 ” 18 Rent A/c To Bank A/c (Being rent paid) 5,000 5,000 ” 20 M/s Mohit Bros. A/c To Sales A/c (Being goods sold on credit) 10,000 10,000 ” 22 Cash A/c To sales A/c (Being goods for for Cash) 15,000 15,000 Total 3,60,000 3,60,000 Posting in the Ledger Book Cash Account Date Particular LF. Amount ₹ Date Particular LF. Amount ₹ 2017 Jun 5. To Capital A/c 2,00,000 2017 June 8. By Bank A/c 80,000 ” 22 To Sales A/c 15,000 ” 25 By M/s Gulmohar A/c 30,000 ” 30 By Salary A/c 6,000 Capital Account Date Particular LF. Amount ₹ Date Particular LF. Amount ₹ 2017 June 5. By Cash A/c 2,00,000 Bank Account Date particular LF. Amount ₹ Date particular LF. Amount ₹ 2017 June 8. To Cash A/c 80,000 2017 June 12. By Office Machines A/c 20,000 ” 28 To M/s Mohit Bros. A/c 10,000 ” 18 By Rent A/c 5,000

- 6. Purchse Account Date Particular LF. Amount ₹ Date Particular LF. Amount ₹ 2017 June 12. To M/s Gulmohar House. A/c 30,000 ETC. Types of Account that are Balanced 1. Normally the balance of Personal and Real Accounts is drawn. 2. Normally the balance of Nominal Accounts is not drawn, but at the end of the accounting year they are closed by transferring them to Business Account and Profit and Loss Account. Yes, there is no loss in drawing balances of these accounts weekly, monthly, quarterly, half- yearly or at any time before the end of the accounting year. FAQ Qs. 1. The Credit Balance in nominal account shows : 1 Expenses 2. Gains. Ans…2 Qs. 2. The Credit balance in personal account shows : 1. Amount Payable 2. Gains. Ans….1 ← Previous Post Leave a Comment Your email address will not be published. Required fields are marked * Save my name, email, and website in this browser for the next time I comment. Post Comment » Type here.. Name* Email* Website

- 7. Privacy Policy Terms and Conditions Copyright[copyright 2022 | Powered by Commerceviews