QNBFS Daily Market Report November 27, 2017

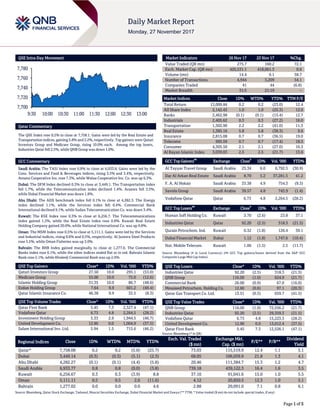

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.2% to close at 7,758.1. Gains were led by the Real Estate and Transportation indices, gaining 5.8% and 2.2%, respectively. Top gainers were Qatari Investors Group and Medicare Group, rising 10.0% each. Among the top losers, Industries Qatar fell 2.5%, while QNB Group was down 1.0%. GCC Commentary Saudi Arabia: The TASI Index rose 0.8% to close at 6,933.8. Gains were led by the Cons. Services and Food & Beverages indices, rising 3.5% and 3.4%, respectively. Amana Cooperative Ins. rose 7.3%, while Walaa Cooperative Ins. Co. was up 6.3%. Dubai: The DFM Index declined 0.3% to close at 3,449.1. The Transportation index fell 1.7%, while the Telecommunication index declined 1.4%. Aramex fell 3.3%, while Dubai Financial Market was down 1.8%. Abu Dhabi: The ADX benchmark index fell 0.1% to close at 4,282.3. The Energy index declined 1.1%, while the Services index fell 0.4%. Commercial Bank International declined 9.1%, while Sudan Telecommunication Co. was down 3.4%. Kuwait: The KSE Index rose 0.3% to close at 6,256.7. The Telecommunications index gained 1.3%, while the Real Estate index rose 0.9%. Kuwait Real Estate Holding Company gained 20.0%, while National International Co. was up 9.8%. Oman: The MSM Index rose 0.5% to close at 5,111.1. Gains were led by the Services and Industrial indices, rising 0.6% and 0.5%, respectively. Al Jazeera Steel Products rose 3.5%, while Oman Fisheries was up 3.0%. Bahrain: The BHB Index gained marginally to close at 1,277.0. The Commercial Banks index rose 0.1%, while the other indices ended flat or in red. Bahrain Islamic Bank rose 2.1%, while Khaleeji Commercial Bank was up 2.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 27.50 10.0 295.1 (53.0) Medicare Group 55.00 10.0 75.0 (12.6) Islamic Holding Group 31.35 10.0 86.7 (48.6) Ezdan Holding Group 7.64 9.9 601.2 (49.4) Qatar Islamic Insurance Co. 46.38 9.9 32.5 (8.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 5.45 7.3 2,327.4 (47.1) Vodafone Qatar 6.73 4.8 2,264.5 (28.2) Investment Holding Group 5.33 2.9 1,944.5 (46.7) United Development Co. 12.90 0.0 1,004.9 (37.5) Salam International Inv. Ltd. 5.94 1.5 715.6 (46.2) Market Indicators 26 Nov 17 23 Nov 17 %Chg. Value Traded (QR mn) 275.7 160.2 72.1 Exch. Market Cap. (QR mn) 420,531.1 418,061.3 0.6 Volume (mn) 14.4 9.1 58.7 Number of Transactions 4,944 3,209 54.1 Companies Traded 41 44 (6.8) Market Breadth 31:5 21:19 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 13,009.84 0.2 0.2 (23.0) 12.4 All Share Index 2,142.45 1.0 1.0 (25.3) 12.0 Banks 2,462.98 (0.1) (0.1) (15.4) 12.7 Industrials 2,405.62 0.3 0.3 (27.2) 16.0 Transportation 1,502.90 2.2 2.2 (41.0) 11.3 Real Estate 1,385.16 5.8 5.8 (38.3) 9.6 Insurance 2,815.08 0.7 0.7 (36.5) 19.0 Telecoms 995.59 0.7 0.7 (17.4) 18.5 Consumer 4,305.50 2.1 2.1 (27.0) 10.3 Al Rayan Islamic Index 3,039.03 2.5 2.5 (21.7) 13.6 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Al Tayyar Travel Group Saudi Arabia 25.34 6.0 6,792.5 (30.9) Dar Al Arkan Real Estate Saudi Arabia 8.70 5.2 37,281.5 41.2 F. A. Al Hokair Saudi Arabia 33.38 4.9 754.3 (9.3) Savola Group Saudi Arabia 39.57 4.8 745.9 (1.4) Vodafone Qatar Qatar 6.73 4.8 2,264.5 (28.2) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Human Soft Holding Co. Kuwait 3.70 (2.6) 23.8 37.1 Industries Qatar Qatar 92.20 (2.5) 318.3 (21.5) Qurain Petrochem. Ind. Kuwait 0.32 (1.8) 126.4 39.1 Dubai Financial Market Dubai 1.12 (1.8) 1,747.6 (10.4) Nat. Mobile Telecom. Kuwait 1.06 (1.5) 2.5 (11.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Industries Qatar 92.20 (2.5) 318.3 (21.5) QNB Group 116.00 (1.0) 624.9 (21.7) Commercial Bank 26.00 (0.9) 67.0 (16.0) Mesaieed Petrochem. Holding Co. 12.60 (0.6) 97.1 (20.3) Qatar Gas Transport Co. Ltd. 13.51 (0.5) 659.7 (41.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 116.00 (1.0) 72,556.2 (21.7) Industries Qatar 92.20 (2.5) 29,359.3 (21.5) Vodafone Qatar 6.73 4.8 15,223.3 (28.2) United Development Co. 12.90 0.0 13,012.4 (37.5) Qatar First Bank 5.45 7.3 12,526.1 (47.1) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 7,758.08 0.2 0.2 (5.0) (25.7) 73.03 115,519.9 12.4 1.1 5.1 Dubai 3,449.14 (0.3) (0.3) (5.1) (2.3) 68.05 106,039.9 21.8 1.3 4.1 Abu Dhabi 4,282.27 (0.1) (0.1) (4.4) (5.8) 20.46 111,384.7 15.3 1.2 4.7 Saudi Arabia 6,933.77 0.8 0.8 (0.0) (3.8) 739.18 439,122.3 16.4 1.6 3.5 Kuwait 6,256.67 0.3 0.3 (3.9) 8.8 37.10 91,041.6 15.0 1.0 5.5 Oman 5,111.11 0.5 0.5 2.0 (11.6) 4.12 20,850.5 12.3 1.0 5.1 Bahrain 1,277.02 0.0 0.0 0.0 4.6 2.88 20,091.0 7.1 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 7,700 7,720 7,740 7,760 7,780 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index rose 0.2% to close at 7,758.1. The Real Estate and Transportation indices led the gains. The index rose on the back of buying support from Qatari and non-Qatari shareholders despite selling pressure from GCC shareholders. Qatari Investors Group and Medicare Group were the top gainers, rising 10.0% each. Among the top losers, Industries Qatar fell 2.5%, while QNB Group was down 1.0%. Volume of shares traded on Sunday rose by 58.7% to 14.4mn from 9.1mn on Thursday. Further, as compared to the 30-day moving average of 6.9mn, volume for the day was 108.2% higher. Qatar First Bank and Vodafone Qatar were the most active stocks, contributing 16.1% and 15.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) News Qatar QSE expresses hope of MSCI keeping status quo on use of official Qatari Riyal exchange rate – The Qatar Stock Exchange (QSE) expressed the hope that the global index compiler MSCI will maintain status quo on the use of official foreign exchange rates for transactions rather than the offshore rates. “In view of the Qatar Central Bank’s (QCB) announcement and subsequent actions, the QSE believes that the concerns expressed by international investors have now been addressed and that this will result in a positive decision by MSCI on the use of the official rate and maintenance of the status quo,” according to a bourse spokesman. The statement comes in the wake of reports that MSCI is considering a proposal to apply offshore rates of Qatari Riyal instead of the official exchange rate in respect of transactions. The spokesman added, “There are no restrictions on all banking transactions including transfers, stressing the free movement of money transfers into and outside the country at the official exchange rates, which the QCB announces on daily basis.” (Gulf-Times.com) Qatari minister in talks with Turkey and Iran to enhance trade ties – HE the Minister of Economy and Commerce, Sheikh Ahmed Bin Jassim Bin Mohamed Al Thani, discussed with Iranian Minister of Trade Mohamed Shariatmadari ways to enhance economic, trade and bilateral relations between the two countries in Tehran. The meeting came during an official visit of Sheikh Ahmed Bin Jassim to Iran, in response to an invitation from Shariatmadari. Sheikh Ahmed and the delegation accompanying him met a group of Iranian businessmen and company executives to discuss topics of common interest and increasing trade with Iran, in addition to exploring the available trade opportunities in the two countries. Both parties agreed on the importance of developing and boosting trade relations and easing all hurdles that may hinder the progress of such cooperation, and to benefit from the available trade opportunities in both countries. Also, a tripartite meeting among Sheikh Ahmed Bin Jassim, Shariatmadari, and Turkey’s Economy Minister Nihat Zeybekci was held, where they discussed ways of cooperation among the three countries in economy and trade. (Gulf-Times.com) Blockade helped Qatar’s sustainability drive – Blockade imposed on Qatar by the siege countries helped the country to move further on the path of sustainability. Addressing a conference, Abdullah Bin Hamad Al Attiyah, Chairman of the Al Attiyah International Foundation for Energy and Sustainable Development, said that siege countries have failed to get global support on the issue of blockade. “The blockade has also helped us to wake up and to build our own sustainability,” said Abdullah Bin Hamad Al Attiyah speaking at the 2017 Energy Transitions Conference held at Hamad Bin Khalifa University (HBKU). (Peninsula Qatar) Qatari projects registered for GSAS certification exceeds QR500bn – The estimated value of the investments in the green projects registered in Qatar for the Global Sustainability Assessment System (GSAS) certification is more than half a trillion Qatari Riyals, said the Founding Chairman of Gulf Organization for Research and Development (GORD), Yousef Alhorr. During his speech at the opening of Sustainability Summit 2017, Alhorr said the candidates for the GSAS certification include all 2022 World Cup stadiums, all railway stations, all public works projects such as schools, health centers, mosques and administrative establishments, all the facilities of Hamad International Port and the city of Lusail and the economic zones and their facilities of all kinds. (Peninsula Qatar) QFE sells 5% stake in Bharti Airtel – Qatar Foundation Endowment (QFE) announced the successful sale, via a block trade, of the entire 5% stake it holds in Bharti Airtel. The sale was made through its Asia-Pacific regional holding company Three Pillars Pte Ltd (TPPL). The block trade was priced at INR481 per share, a discount of 6.4% to the previous closing price as of November 7, 2017. In May 2013, TPPL invested INR68bn in Bharti Airtel to strengthen the capital structure and allow further investment for growth. The investment saw TPPL acquire 199.87mn shares at a price of INR340 per share. Given the sale price of INR481 per share, the sale of this stake realized a significant gain for TPPL. The proceeds of the share sale will be reinvested as part of the QFE Group’s ongoing global portfolio growth and diversification, as it seeks to generate long-term financial returns by investing across a range of asset classes, industries, and geographies. (Peninsula Qatar) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 46.15% 33.83% 33,980,088.60 Qatari Institutions 21.55% 27.79% (17,211,593.85) Qatari 67.70% 61.62% 16,768,494.75 GCC Individuals 0.54% 0.50% 114,930.40 GCC Institutions 0.99% 13.86% (35,476,028.79) GCC 1.53% 14.36% (35,361,098.39) Non-Qatari Individuals 12.09% 10.26% 5,033,182.61 Non-Qatari Institutions 18.68% 13.76% 13,559,421.03 Non-Qatari 30.77% 24.02% 18,592,603.64

- 3. Page 3 of 5 Qatar’s first renewable energy strategy on the anvil – Plans are underway to adopt Qatar’s first renewable energy strategy, said a top official at the Sustainability Summit 2017 which opened at Ritz Carlton, Doha. General Electricity and Water Corporation’s (Kahramaa) President, Essa Bin Hilal Al Kuwari said that a discussion between the Ministry of Energy & Industry, Kahramaa and other partners, is underway to adopt Qatar’s first renewable energy strategy to diversify energy sources and reduce harmful emissions. Al Kuwari was speaking on behalf of HE the Minister of Energy and Industry Mohamed Bin Saleh Al Sada. In the energy and industry sector, per capita electricity consumption is reduced by 18% and water consumption by 20% in 2016 compared to the previous year, he pointed out. (Gulf-Times.com) Vodafone Qatar, GWCS develop digital solution for enhanced customer experience – Vodafone Qatar and Gulf Warehousing Company (GWCS) launched an innovative digital solution for enhanced customer experience. Vodafone Qatar’s Logistics department and GWCS’ Contract Logistics and Information Technology department, worked closely to develop an Android App and a web-based order management system (OMS), which allows for end-to-end management of the supply chain cycle. This includes real-time stock visibility and allocation, order placement, work flow approvals and notifications, distribution and delivery to Vodafone end customers. (Gulf-Times.com) Qatar to host ‘World Halal Day 2018’ – Qatar will host the ‘World Halal Day 2018’, according to private sector leader Qatar Chamber, which is organizing the event. This was announced during the ‘5th World Halal Summit’ held recently in Istanbul under the patronage of Turkish President Recep Tayyip Erdogan. Qatar Chamber’s Chairman, Sheikh Khalifa Bin Jassim Al Thani led a delegation during the summit, which included Director-General Saleh Bin Hamad Al Sharqi and Board Members Mohamed Gohar Al Mohamed, Ali Abdullatif Al Misnad, and Abdul Aziz Ridwani. On the sidelines of the summit, Al Mohamed, on behalf of the chamber, signed an agreement with the United World Halal Development for the hosting of the next ‘World Halal Day’ slated in Doha on November 1, 2018. He stressed that hosting the conference in Doha will encourage food, cosmetics, travel and tourism, and infrastructure firms to invest in Qatar. (Gulf-Times.com) Qatar General Organization for Standardization joins SMIIC – Qatar General Organization for Standardization joined the membership of the Standards and Metrology Institute for the Islamic Countries (SMIIC), during the 15th meeting of the Board of Directors and the 12th meeting of its General Assembly, currently in session in Istanbul, Turkey. (Peninsula Qatar) QSE announces trading suspension in the shares of KCBK on November 27 – Qatar Stock Exchange (QSE) announced the trading suspension of Al Khalij Commercial Bank (KCBK) shares on November 27, 2017 due to its AGM and EGM being held on the day. (QSE) International China’s industrial profits up 25.1% YoY in October – Profits earned by China’s industrial companies in October rose 25.1% from a year earlier, the statistics bureau stated, slowing from 27.7% gain in September. Profits rose to $112.94bn in October, the National Bureau of Statistics (NBS) stated. In September, profits increased the most in nearly six years as prices of finished goods including steel and copper rose. Prices increased due to fears of supply shortages in the winter amid an ongoing government crackdown on air pollution. In the first ten months, industrial profits rose 23.3% from a year earlier, versus the 22.8% increase in January-September, according to the statistics bureau. At the end of October, industrial firms’ liabilities were 6.7% higher than a year earlier, with the growth rate unchanged from the end of September. (Reuters) Regional Islamic finance can play key role in PPP delivery – The fast- growing Islamic finance industry can play a significant role in closing the infrastructure gap in the GCC region and beyond, through public-private partnerships (PPP). Given the potential of Islamic finance to support infrastructure development in emerging and developing countries, it is critical to address how to best deploy Islamic project finance in PPP delivery frameworks, noted latest World Bank report on ‘Mobilizing Islamic Finance for infrastructure PPPs’. According to the World Bank document, Shari’ah-compliant assets have grown exponentially in the past two decades, accumulating nearly $1.9tn in assets and spreading across 50 Muslim and non- Muslim countries around the world. (Peninsula Qatar) Middle Eastern economies set for transition in 2018 – Several economies in the Middle East, particularly in the GCC, are transitioning towards a new normal in 2018, allowing spending to start gradually recovering. Overall, GCC’s GDP is expected to grow from just 0.3% in 2017 to 2.8% next year, and acceleration from 1.4% in 2017 to 3.2% next year in the wider Middle East. However, several risks remain to growth in the region, including those from politics and security. (GulfBase.com) Bright future for renewable energy in MENA region – Declining renewable energy prices and increasing energy demand in the Middle East and North Africa (MENA) region present a unique opportunity for stakeholders to accelerate renewable energy production, invest in long-term competitiveness and energy security. The bright future for renewable energy in MENA region was explored in-depth at a recent Bloomberg New Energy Finance (BNEF) event in Dubai, attended by approximately 60 energy and financial services professionals. (GulfBase.com) GPCA: GCC’s chemical production capacity to post 5.3% growth in 2017 – Overall chemical production capacity in the GCC region is expected to post 5.3% growth in 2017 to about 167.3mn tons, largely on new plants that started up in Saudi Arabia, the Secretary General of the Gulf Petrochemicals and Chemicals Association (GPCA) said. This growth is lower than the 8.5% YoY capacity expansion in 2016, and also a deceleration from the 6.0% growth recorded in 2015. (GulfBase.com) Saudi Aramco and SABIC to sign MoU on $25bn oil to chemicals complex – Saudi Aramco and Saudi Basic Industries Corp. (SABIC) will sign a memorandum of understanding (MoU) to build a complex converting crude oil to chemicals in Saudi Arabia. The two companies had agreed in June 2016 to conduct a feasibility study for the project, which industry sources have estimated would cost around $25bn to build. (GulfBase.com)

- 4. Page 4 of 5 Saudi Aramco sees oil market balanced as UAE dismisses shale threat – Global crude inventories are declining and supply & demand are in balance, according to Saudi Aramco’s CEO, Amin Nasser; while UAE’s Energy Minister said US shale oil doesn’t threaten OPEC’s efforts to support the market. Demand for crude is continuing to rise and oil inventories are returning to the levels of the past five years, Nasser said. (GulfBase.com) Non-oil trade between the UAE and Australia reaches $2.8bn – The volume of non-oil trade between the UAE and Australia reached to $2.8bn last year. The UAE and Australia affirmed their commitment to the free trade agreement between Australia and the GCC, being an efficient mechanism conducive to broadening economic ties. (GulfBase.com) Emirates REIT considering sale of up to $425mn in Sukuk – The real estate investment trust, Emirates REIT stated that the trust is planning to sell Sukuk with five year tenor. Trust hired Dubai Islamic Bank, Emirates NBD, Noor Bank, Standard Chartered for a potential Dollar-Sukuk sale. (Bloomberg) KHCB prepares to list its shares on the DFM – Khaleeji Commercial Bank (KHCB) announced plans to list its shares in the Dubai Financial Market (DFM) after obtaining necessary regulatory approvals. The Bahrain-based bank said it is awaiting clearances from the regulatory authorities in Bahrain and the UAE, including the Central Bank of Bahrain (CBB), DFM, as well as the Securities and Commodities Authority. The listing process is expecting completion by the end of this year. (GulfBase.com) Jafza steel, building materials trade tops $3.6bn – Jafza, the Dubai flagship logistics hub of global trade enabler DP World, stated that trade in steel and building materials reached $3.6bn during 2016 with further increases expected as the free zone continues to develop services for companies in the sector. DP World’s Chairman and CEO, Sultan Ahmed Bin Sulayem said, “Ongoing construction projects in the UAE and GCC are strong boost for the metal, steel and construction sector in Jafza as companies benefit from the growth in development projects throughout the region.” (GulfBase.com) Abu Dhabi records 18% rise in hotel guests in October – Abu Dhabi hotels reported brisk demand in October with Chinese visitor arrivals to the Emirate expanding at high double-digit figures. The Department of Culture and Tourism stated that 418,883 guests checked into Abu Dhabi’s 163 hotels and hotel apartments in October, or about 18% higher compared with the same month of last year. (GulfBase.com) Kuwait and Iraq near agreement on price for gas exports – Kuwait and Iraq reached a preliminary agreement on a price for gas exports clearing the way to a deal for a pipeline and petrochemical project. Kuwait is waiting for Iraqi government’s final approval. Iraq would agree to export 50mn cubic feet of gas per day for ten years, increasing to 200mn cubic feet per day during that time. (GulfBase.com) CBO to float OMR150mn bond issue on December 6 – Central Bank of Oman (CBO) plans to raise OMR150mn by way of a government development bond issue, which will open on December 6. The bond will have a maturity period of seven years and will carry a coupon rate of 5.25% per annum. The issue will open for subscription between December 6 and December 14, 2017, while the auction will be held on December 17, 2017. The issue settlement date will be on December 19. Interest on the new bonds will be paid semiannually on June 19 and December 19 every year, until the maturity date on December 19, 2024. Investors may apply for these bonds through the competitive bidding process only. (GulfBase.com)

- 5. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 Oct-13 Oct-14 Oct-15 Oct-16 Oct-17 QSE Index S&P Pan Arab S&P GCC 0.8% 0.2% 0.3% 0.0% 0.5% (0.1%) (0.3%)(0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,288.80 (0.2) (0.4) 11.8 MSCI World Index 2,059.54 0.3 1.3 17.6 Silver/Ounce 17.08 (0.1) (1.3) 7.3 DJ Industrial 23,557.99 0.1 0.9 19.2 Crude Oil (Brent)/Barrel (FM Future) 63.86 0.5 1.8 12.4 S&P 500 2,602.42 0.2 0.9 16.2 Crude Oil (WTI)/Barrel (FM Future) 58.95 1.6 4.2 9.7 NASDAQ 100 6,889.16 0.3 1.6 28.0 Natural Gas (Henry Hub)/MMBtu 2.93 0.0 (4.1) (20.5) STOXX 600 386.63 0.5 1.8 21.0 LPG Propane (Arab Gulf)/Ton 100.75 0.0 (0.1) 39.7 DAX 13,059.84 1.1 1.6 28.6 LPG Butane (Arab Gulf)/Ton 102.00 0.0 (2.2) (12.7) FTSE 100 7,409.64 0.1 1.3 12.0 Euro 1.19 0.7 1.2 13.5 CAC 40 5,390.46 0.9 2.4 25.4 Yen 111.53 0.3 (0.5) (4.6) Nikkei 22,550.85 0.1 1.1 23.3 GBP 1.33 0.2 0.9 8.1 MSCI EM 1,154.26 0.2 1.6 33.9 CHF 1.02 0.2 0.9 4.0 SHANGHAI SE Composite 3,353.82 0.0 (0.4) 13.9 AUD 0.76 (0.1) 0.7 5.7 HANG SENG 29,866.32 0.6 2.3 34.8 USD Index 92.78 (0.5) (0.9) (9.2) BSE SENSEX 33,679.24 0.3 1.6 33.2 RUB 58.37 (0.2) (1.2) (4.7) Bovespa 74,157.38 (0.5) 2.1 24.1 BRL 0.31 (0.4) 0.7 0.6 RTS 1,166.09 0.6 3.0 1.2 88.5 88.2 80.6