QNBFS Daily Market Report March 27, 2019

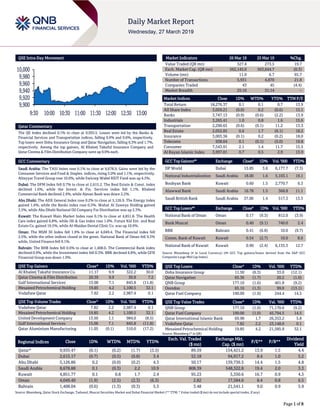

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index declined 0.1% to close at 9,935.5. Losses were led by the Banks & Financial Services and Transportation indices, falling 0.9% and 0.6%, respectively. Top losers were Doha Insurance Group and Qatar Navigation, falling 6.3% and 1.7%, respectively. Among the top gainers, Al Khaleej Takaful Insurance Company and Qatar Cinema & Film Distribution Company were up 9.9% each. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 8,678.9. Gains were led by the Consumer Services and Food & Staples. indices, rising 5.0% and 1.1%, respectively. Altayyar Travel Group rose 10.0%, while Swicorp Wabel REIT Fund was up 4.5%. Dubai: The DFM Index fell 0.7% to close at 2,615.2. The Real Estate & Const. index declined 1.6%, while the Invest. & Fin. Services index fell 1.1%. Khaleeji Commercial Bank declined 2.4%, while Ajman Bank was down 2.2%. Abu Dhabi: The ADX General Index rose 0.2% to close at 5,126.9. The Energy index gained 1.4%, while the Banks index rose 0.3%. Wahat Al Zaweya Holding gained 3.5%, while Abu Dhabi National Oil Company For Distribution was up 2.3%. Kuwait: The Kuwait Main Market Index rose 0.1% to close at 4,851.8. The Health Care index gained 6.8%, while Oil & Gas index rose 1.0%. Future Kid Ent. and Real Estate Co. gained 19.5%, while Al-Maidan Dental Clinic Co. was up 10.9%. Oman: The MSM 30 Index fell 1.9% to close at 4,049.4. The Financial index fell 2.5%, while the other indices closed in the green. National Bank of Oman fell 9.3% while, United Finance fell 9.1%. Bahrain: The BHB Index fell 0.6% to close at 1,408.0. The Commercial Bank index declined 0.9%, while the Investment index fell 0.3%. BBK declined 6.8%, while GFH Financial Group was down 1.9%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Insurance Co. 11.17 9.9 322.2 30.0 Qatar Cinema & Film Distribution 20.39 9.9 30.8 7.2 Gulf International Services 15.00 7.1 845.8 (11.8) Mesaieed Petrochemical Holding 19.85 4.2 1,100.5 32.1 Vodafone Qatar 7.82 2.2 2,987.4 0.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 7.82 2.2 2,987.4 0.1 Mesaieed Petrochemical Holding 19.85 4.2 1,100.5 32.1 United Development Company 13.50 1.1 984.0 (8.5) Gulf International Services 15.00 7.1 845.8 (11.8) Qatar Aluminium Manufacturing 11.05 (0.1) 510.0 (17.2) Market Indicators 26 Mar 19 25 Mar 19 %Chg. Value Traded (QR mn) 327.4 273.5 19.7 Exch. Market Cap. (QR mn) 562,145.0 563,644.7 (0.3) Volume (mn) 11.0 6.7 65.7 Number of Transactions 5,931 4,870 21.8 Companies Traded 43 45 (4.4) Market Breadth 25:16 31:14 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,276.37 0.1 0.1 0.7 13.9 All Share Index 3,059.21 (0.0) 0.2 (0.6) 15.1 Banks 3,747.13 (0.9) (0.6) (2.2) 13.9 Industrials 3,265.41 1.0 0.8 1.6 15.6 Transportation 2,290.65 (0.6) (0.1) 11.2 13.3 Real Estate 2,052.85 0.6 1.7 (6.1) 18.2 Insurance 3,003.36 (0.1) 0.2 (0.2) 18.0 Telecoms 938.64 0.1 (0.1) (5.0) 19.8 Consumer 7,543.91 2.1 1.4 11.7 15.5 Al Rayan Islamic Index 3,997.01 0.7 0.5 2.9 13.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% DP World Dubai 15.85 3.6 6,177.7 (7.3) National Industrialization Saudi Arabia 18.00 1.6 5,103.1 19.1 Boubyan Bank Kuwait 0.60 1.5 2,770.7 6.3 Alawwal Bank Saudi Arabia 16.78 1.5 368.8 11.1 Saudi British Bank Saudi Arabia 37.00 1.4 517.3 13.3 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% National Bank of Oman Oman 0.17 (9.3) 812.0 (3.9) Bank Muscat Oman 0.40 (9.1) 740.0 2.4 BBK Bahrain 0.41 (6.8) 10.0 (9.7) Comm. Bank of Kuwait Kuwait 0.54 (2.7) 10.0 8.0 National Bank of Kuwait Kuwait 0.90 (2.4) 6,135.3 12.7 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Doha Insurance Group 11.50 (6.3) 33.0 (12.1) Qatar Navigation 65.36 (1.7) 20.2 (1.0) QNB Group 177.10 (1.6) 401.8 (9.2) Ooredoo 65.16 (1.3) 99.0 (13.1) Qatar Fuel Company 190.00 (1.0) 244.4 14.5 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 177.10 (1.6) 71,170.6 (9.2) Qatar Fuel Company 190.00 (1.0) 45,794.5 14.5 Qatar International Islamic Bank 69.98 1.7 26,353.2 5.8 Vodafone Qatar 7.82 2.2 23,148.0 0.1 Mesaieed Petrochemical Holding 19.85 4.2 21,585.9 32.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,935.47 (0.1) (0.2) (1.7) (3.5) 89.59 154,421.2 13.9 1.5 4.4 Dubai 2,615.17 (0.7) (0.5) (0.8) 3.4 52.18 94,917.2 8.4 1.0 5.2 Abu Dhabi 5,126.86 0.2 (0.0) (0.2) 4.3 50.17 139,736.5 14.4 1.5 4.8 Saudi Arabia 8,678.88 0.1 (0.3) 2.2 10.9 808.39 548,322.8 19.4 2.0 3.3 Kuwait 4,851.77 0.1 0.8 1.7 2.4 95.23 3,350.6 16.7 0.9 4.3 Oman 4,049.40 (1.9) (2.5) (2.3) (6.3) 2.82 17,584.6 8.4 0.8 6.5 Bahrain 1,408.04 (0.6) (1.3) (0.3) 5.3 3.48 21,541.1 9.0 0.9 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,900 9,920 9,940 9,960 9,980 10,000 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index declined 0.1% to close at 9,935.5. The Banks & Financial Services and Transportation indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from GCC and non-Qatari shareholders. Doha Insurance Group and Qatar Navigation were the top losers, falling 6.3% and 1.7%, respectively. Among the top gainers, Al Khaleej Takaful Insurance Company and Qatar Cinema & Film Distribution Company were up 9.9% each. Volume of shares traded on Tuesday rose by 65.7% to 11.0mn from 6.7mn on Monday. Further, as compared to the 30-day moving average of 10.2mn, volume for the day was 8.4% higher. Vodafone Qatar and Mesaieed Petrochemical Holding Company were the most active stocks, contributing 27.1% and 10.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Arabian Aramco Total Services Company* Saudi Arabia SR 44,573.3 31.4% 2,134.7 -17.0% 446.9 3.6% Saudi Ground Services Co. * Saudi Arabia SR 2,554.0 -1.2% 371.2 -25.0% 368.4 -26.5% Wataniya Insurance Co.* Saudi Arabia SR 712.3 23.1% – – 1.8 -41.5% Saudi Enaya Cooperative Insurance Co. * Saudi Arabia SR 138.2 -49.7% – – 3.9 23.3% Saudi Printing and Packaging Co. * Saudi Arabia SR 1,018.5 2.7% -2.9 – -54.4 – Al-Etihad Cooperative Insurance Co. * Saudi Arabia SR 929.8 11.9% 0.0 – 6.4 237.4% Basic Chemical Industries Co. * Saudi Arabia SR 605.2 1.6% 82.2 -5.1% 49.7 13.5% Ash-Sharqiyah Development Co. * Saudi Arabia SR 0.3 -77.7% -7.2 – -6.7 – ALSalam Group Holding Company* Kuwait KD 6.5 30.1% 1.4 47.7% 0.3 – Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/26 Germany GfK AG GfK Consumer Confidence April 10.4 10.8 10.7 03/26 France INSEE National Statistics Office Business Confidence March 104 103 103 03/26 France INSEE National Statistics Office Manufacturing Confidence March 102 103 103 03/26 France INSEE National Statistics Office GDP QoQ 4Q2018 0.3% 0.3% 0.3% 03/26 France INSEE National Statistics Office GDP YoY 4Q2018 1.0% 0.9% 0.9% 03/26 Japan Bank of Japan PPI Services YoY February 1.1% 1.1% 1.0% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status MRDS Mazaya Qatar Real Estate Development 27-Mar-19 0 Due QGMD Qatari German Company for Medical Devices 27-Mar-19 0 Due ZHCD Zad Holding Company 30-Mar-19 3 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 33.86% 42.35% (27,772,648.61) Qatari Institutions 23.44% 18.06% 17,611,922.22 Qatari 57.30% 60.41% (10,160,726.39) GCC Individuals 0.63% 0.81% (594,578.52) GCC Institutions 1.05% 0.69% 1,202,825.10 GCC 1.68% 1.50% 608,246.58 Non-Qatari Individuals 8.45% 10.59% (7,011,342.24) Non-Qatari Institutions 32.57% 27.51% 16,563,822.05 Non-Qatari 41.02% 38.10% 9,552,479.81

- 3. Page 3 of 8 Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status QNBK QNB Group 9-Apr-19 13 Due ERES Ezdan Holding Group 11-Apr-19 15 Due CBQK The Commercial Bank 17-Apr-19 21 Due DHBK Doha Bank 30-Apr-19 34 Due Source: QSE News Qatar Nebras Power to mulls more than $1bn stake sale in Indonesian-based power producers – Nebras Power is considering selling its stake in PT Paiton Energy, one of Indonesia’s largest independently owned power producers, according to sources. Nebras Power’s 35.5% holding in Paiton could be valued at more than $1bn, sources said. Nebras Power has held initial talks with potential financial advisers, but has not started a formal sale process. No final decisions have been made, and Nebras Power may also decide to retain its stake in Paiton, sources added. (Bloomberg) QFBQ reports net loss of QR56.4mn in 4Q2018 – Qatar First Bank (QFBQ) reported net loss of QR56.4mn in 4Q2018 as compared to net loss of QR129.7mn in 4Q2017 and QR71.7mn in 3Q2018. Loss per share amounted to QR2.41 in FY2018 as compared to QR1.35 in FY2017. In FY2018, QFBQ posted net loss of QR481.9mn. The Shari’ah-compliant bank’s total income (excluding disposal loss and loss on fair value re-measurement of equity investments) showed a ‘growth momentum’ last year with an increase of 24.1% at QR222mn, compared to QR178mn in 2017. This was mainly driven by the fee income from the structured products and a reduction of 26% in returns to unrestricted investment account holders (the cost of funding) due to the better management of its loan to deposit ratio. QFBQ is regulated by QFCRA and listed on the Qatar Stock Exchange (QSE). QFBQ’s management continued to raise its efficiency through the implementation of its cost rationalization plan that resulted in reduction of total expenses of the bank by 10%, as compared to the previous year. This was mainly driven by reduction in staff cost by 18% and other operating expenses by 16%. The Treasury and investment arm has initiated an ambitious plan to continue increasing the assets under management through multiple deal-by-deal transactions and direct sourcing, structuring and placement of these deals. The asset and liability management desk continues its offering of innovative products and solutions to the Qatari Corporate client base while adhering to prudent liquidity management measures that enables the bank to maintain its cost of funding and generate positive net profit margins. The bank also reported a disposal loss and loss on fair value re-measurement of equity investments of QR331mn during the year, compared to QR119mn in the previous year. This was mainly driven by global and regional headwinds resulting in prevailing market uncertainties that affected the performance of the bank’s alternative investments portfolio. Despite the challenges faced by QFBQ previously, the bank said it “looks forward to the future today with positive considered forecasts.” In 2018, the bank underwent a ‘comprehensive exercise’ to identify weaknesses and strengths. The exercise revealed internal strategic capabilities in private banking and real estate investment that could offer a competitive edge that would enhance future returns in search of lucrative business opportunities that would have a positive impact on the bank’s future growth. The board of directors recommended not distributing any profit as dividend for FY2018. (QSE, Gulf- Times.com) ERES to disclose 1Q2019 financial statements on April 11 – Ezdan Holding Group (ERES) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 11, 2019. (QSE) DHBK to disclose 1Q2019 financial statements on April 30 – Doha Bank (DHBK) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 30, 2019. (QSE) CBQK to disclose 1Q2019 financial statements on April 17 – The Commercial Bank (CBQK) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 17, 2019. (QSE) IHGS’ EGM endorses all items on its agenda – Islamic Holding Group (IHGS) announced the resolutions of its Extraordinary General Assembly Meeting (EGM) on March 25, 2019 and discussed the items listed on its agenda and issued the following resolutions: (i) The amendment of Article (5) of the Basic Stock Split Regulations has been approved to amend the nominal value of the share to be only QR1 instead of QR10 in implementation of the decision of the Qatar Financial Market Authority on October 16, 2018, and (ii) The Chairman of the board of directors has been authorized to make any amendments to the basic law in accordance with the Extraordinary General Assembly Resolutions and to sign the amended basic law before the official bodies. (QSE) AKHI’S board of directors announces the approval of the settlement offer of some internal and external investment files with one of the related parties – Al Khaleej Takaful Insurance Company (AKHI) in its board of directors meeting held on March 25, 2019 announced the approval of offering the settlement for the local and overseas investment files with a related party, the financial effects of which were reflected in the financial statements for 2018, in return for an amount of QR146mn in four installments, payable from March 31, 2019 and ending on December 31, 2020. (QSE)

- 4. Page 4 of 8 New Panama Canal transits help Nakilat to expand its reach – The four gigantic LPG carriers (VLGCs) of Qatar Gas Transport Company Limited (Nakilat) have delivered around 1.344 metric tons of gas to various markets around the world last year, with most of them utilizing the newly expanded Panama Canal to reduce voyage durations. “As one of the world’s leading transporter of clean energy, Nakilat’s fleet of 70 vessels deliver to more than 26 countries across the world,” the company stated. The Panama Canal is one of the most commonly traversed waterways connecting the Pacific and Atlantic Oceans. Its expansion in 2016 allowed for bigger vessels (Neopanamax) such as LNG carriers to now transit through the Canal locks as they make their journey from East to West and vice versa. Passage through the canal allows vessels to shorten their voyage by about 13,000 kilometers or 7,000 nautical miles, leading to shorter delivery times as well as operational cost savings. Since the New Panama Canal has been in operation, Nakilat’s LPG vessels have transited through the Canal 16 times, while its joint-venture conventional LNG vessels have completed 38 transits. The flexibility of going through the New Panama Canal not only enables Nakilat to widen its international outreach and cement its position as a global leader of energy transportation, but also allows it to exceed customer satisfaction. Moving forward, Nakilat has conducted compatibility studies and thorough assessments of Q-Flex class LNG carriers on safely transiting through the new locks in the near future. (Qatar Tribune) WOQOD aims huge increase in fuel dispensers to boost sales – Qatar Fuel Company (WOQOD), the main distributor of retail petroleum products in Qatar, has unveiled its aggressive plans to increase the number of fuel dispensers, both for light and heavy vehicles, aiming to further ease congestion at fuel stations and boost sales. The company, as part of its longer- term business strategy, is working to increase the number of fuel dispensers to 1,032 by 2022 from 477 in 2018, which will be more than double (116% jump), compared to 2018 numbers. The number of Light Vehicle Dispensers (which are low speed) will increase from 419 in 2018 to 891 by 2022, which will be more than 112% from the existing capacity. Further the number of Heavy Vehicle Dispensers (high speed) will be increased to 141 by 2022, registering an increase of 143% compared to 58% in 2018. WOQOD has aggressive plans to increase its retail fuel market share to 85% by 2022. As the end of 2018, WOQOD’s retail fuel market share increased by 12% (70% in 2018 against 58% in 2017) driven by the opening of the new (petrol) stations. (Peninsula Qatar) Qatar well on its way to be a global player in logistics – As the size and value of logistics industry grow faster, Qatar is well- positioned to emerge as a key global player in the industry. The country’s geographical location, encouraging investment laws, stable exchange rate, abundant energy supply and its continuous development of the logistics sector help Qatar to take a leading position in this industry, Minister of Transport and Communications HE Jassim bin Saif Al Sulaiti said. The Minister said Qatar’s newly developed integrated and efficient transportation system will serve all sectors and connect Qatar to the regional and global economy. “We have the resources and a wise leadership committed to realizing our dreams on the ground the support provided by the State to the private sector to be a strategic partner will further leverage Qatar’s capabilities in logistics industry,” the Minister added. Currently, Qatar has one of the largest commercial ports in the world and the largest airport in the Middle East. The country is developing Doha Port as Qatar’s gateway to marine tourism. Qatar is also expanding the port of Ruwais to serve as Qatar’s northern maritime gateway. The ongoing highway program is linking all of Qatar’s facilities to each other. (Peninsula Qatar) Ashghal plans Al Wakra, Al Wukair STP project on PPP – Public Works Authority (Ashghal) organized a roadshow to introduce Al Wakrah and Al Wukair Sewage Treatment Plant (STP) project, the first project of the authority to be implemented in Public-Private Partnership (PPP) contract. The roadshow aimed at briefing the interested local and international companies, which have an experience in the field of infrastructure and drainage projects, about the details of the project and its components. The project is part of Ashghal’s efforts to develop and implement sustainable drainage infrastructure throughout the country. (Peninsula Qatar) DOHI’s President: Cyber insurance relevance increasing – The relevance of cyber insurance is increasing as major companies around the world face huge Internet-based risks, according to Doha Insurance Group’s (DOHI) President, Bassam Hussein. “Recently, a major European company’s IT system was attacked by cyber criminals. No matter how big or efficient your systems are, you can still be targeted by cyber criminals. Cyber insurance is fairly new. It has been around for only a few years now. But it is gradually gaining ground in view of increasing Internet-based risks,” Hussein pointed out. Cyber insurance is used to protect businesses and individual users from Internet- based risks, and more generally from risks relating to information technology infrastructure and activities. (Gulf- Times.com) Qatar Airways opens new office in Muscat – Qatar Airways celebrated the opening of its new office in Muscat, Oman. Qatar Airways’ CEO, HE Akbar Al-Baker said, “We are here to celebrate the longstanding and important relationship Qatar Airways shares with the Sultanate of Oman. Oman has always been a key market for us, with 70 direct flights to three destinations in Oman, and will continue to be so in the future.” (Gulf-Times.com) International US housing, consumer confidence data point to slowing economy – The US homebuilding fell more than expected in February as construction of single-family homes dropped to near a two-year low, offering more evidence of a sharp slowdown in economic activity early in the year. Concerns over the economy were also underscored by other data showing consumer confidence ebbing in March, with households a bit pessimistic about the labor market. The economy is facing rising headwinds, including slowing global growth, fading fiscal stimulus, trade tensions and uncertainty over Britain’s departure from the European Union. Those concerns contributed to the Federal Reserve’s decision last week to bring its three-year campaign to tighten monetary policy to an abrupt end, as it abandoned projections for any interest rate hikes this year. Housing starts decreased 8.7% to a seasonally adjusted annual rate of 1.162mn units last month, the Commerce

- 5. Page 5 of 8 Department stated. The percent decline was the largest in eight months, and bad weather could have contributed to the sharp drop in homebuilding last month. The report from the Conference Board showed its consumer confidence index fell 7.3 points to a reading of 124.1 in March. While noting that consumer confidence has been volatile in recent months, the Conference Board stated, “The overall trend in confidence has been softening since last summer, pointing to a moderation in economic growth.” Consumers’ assessment of both current business and labor market conditions weakened in March. The survey’s so-called labor market differential, derived from data about respondents who think jobs are hard to get and those who think jobs are plentiful, fell to an eight-month low. (Reuters) British banks approve fewer mortgages in February as Brexit nears – British banks approved fewer mortgages in February than during January, industry data showed. Seasonally- adjusted data from the UK Finance industry body showed banks approved 39,083 mortgages last month, down from 39,910 in January. The value of net mortgage lending has increased by 711mn Pounds, the smallest rise since April 2016 and around half the size of increases in much of last year. The figures added to signs of a weakening in Britain’s housing market ahead of Brexit. Overall consumer credit growth also slowed, rising by 3.8% compared with February last year, the smallest increase since October. (Reuters) UK public's inflation expectations cool in March – The British public’s expectations for consumer price inflation in the year ahead cooled to 2.7% this month from 2.9% in February, a survey showed. Longer-term inflation expectations also cooled to 3.0% from 3.2%, its lowest since May 2017, the survey from US investment bank Citi and polling firm YouGov showed. “Amid some volatility, long-term inflation expectations keep printing new lows. This establishes a downtrend, potentially due to weaker economic prospects,” Citi economists said about the numbers. Official data last month showed annual consumer price inflation ticked up in February to 1.9%, although it remained close to January’s two-year low. (Reuters) German consumer morale darkens unexpectedly – German consumer morale deteriorated unexpectedly heading into April, a survey showed, suggesting that household spending could weaken in the second quarter of this year. Domestic demand is expected to be the sole driver of growth this year in Europe’s largest economy as exporters struggle with a global slowdown, trade disputes and Brexit uncertainty. Record-high employment, hefty pay hikes, moderate inflation and low borrowing costs have helped household spending to replace exports as the most important pillar of economic growth. The GfK market research group stated its consumer sentiment indicator fell to 10.4 points heading into April from a revised 10.7 the previous month. That undershot the forecast of 10.8. (Reuters) IMF: Trade tensions could cut Asia's economic growth by 0.9 percentage points – Trade tensions between the US and China have caused huge amounts of economic uncertainty and could cut Asia’s economic growth by 0.9 percentage point, according to International Monetary Fund’s (IMF) Deputy Managing Director, Zhang Tao. (Reuters) China's industrial profits shrink most since late 2011 – Profits at China’s industrial firms suffered their worst contraction since late 2011 in the first two months of this year data showed, as increasing strains on the economy in the face of slowing demand at home and abroad took a toll on businesses. The sharp decline in profits suggests further trouble for the world’s second largest economy, which expanded at its slowest pace in almost three decades last year. The government has already lowered the economic growth target this year to 6.0%-6.5%, from 6.6% in 2018. Profits notched up by China’s industrial firms in January-February slumped 14.0% YoY to 708.01bn Yuan, the National Bureau of Statistics (NBS) stated. It marked the biggest contraction since Reuters began keeping records in October 2011. (Reuters) Regional Islamic finance is becoming a multi-faceted industry – Islamic finance is becoming a multi-faceted industry, the release of a new report called “Global Islamic Finance Market Growth, Trends, and Forecast (2018-2024)” by India-based market research firm Mordor Intelligence, which comes to the conclusion that the global Islamic finance market will keep growing over the mentioned period owing to strong investments in the halal sectors, infrastructure and energy, as well as Sukuk bonds. Islamic banking remains the largest segment in the Islamic finance industry, the report notes. Islamic banks contribute 71%, or $1.72tn to overall assets. The sector as of end 2017 comprised of 505 Islamic commercial, wholesale and other types of banks, including 207 Islamic banking windows, whereby commercial banking remained the main contributor to the sector’s growth. In the Middle East and North African (MENA) region, Islamic banking assets represented 14% of total banking assets in the research period. In the Gulf Co-operation Council (GCC), the market share of Islamic banking crossed the 25%-threshold, which suggests that Islamic banks have become systemically important in these countries. (Gulf-Times.com) PwC: Middle East shoppers most influenced by social media – The buying behaviors of Middle East shoppers are heavily influenced by social media than elsewhere in the world, a new study has found. According to the latest PwC Middle East findings on Global Consumer Insights Survey, about 60% of Middle East respondents said social media influenced their fashion purchasing decisions and 53% for tech purchases. It is no secret that social media is more widely used in the region, than globally. So, it came as no surprise that social media impacts the buying behaviors of consumers in the region. (Peninsula Qatar) Saudi Aramco building global gas business to cut carbon footprint – Saudi Aramco, the world’s biggest oil producer, is building an international gas business and converting more crude oil into chemicals in a bid to lessen its carbon footprint, CEO, Amin Nasser said. Saudi Aramco is building ‘an energy bridge’ between Saudi Arabia and China to meet the Asian energy consumer’s increasing need for oil and gas as well as for chemicals and Liquefied Natural Gas (LNG). “We need to help our stakeholders - including here in China and the wider Asia region - realize that oil and gas will remain vital to world energy for decades to come,” he said. “We need to reassure them with

- 6. Page 6 of 8 our own long-term investments that the safety belt we have always provided is one they can continue to rely on.” Saudi Aramco’s gas expansion strategy needs $150bn of investment over the next decade as the company plans to increase output and later become a gas exporter, Nasser had said in November. (Reuters) Saudi Aramco and Mcdermott sign deal for new oil services facility – Saudi Aramco signed a land lease agreement with McDermott Arabia Company to establish an engineering, procurement, construction, and installation facility in the King Salman International Complex for Maritime Industries in Ras Al-Khair, Saudi Arabia. A joint press release stated that Saudi Aramco signed the lease with McDermott Arabia, a subsidiary of McDermott International Inc, to establish a fabrication facility that will be used for large scale fabrication of offshore platforms and onshore/offshore modules. Saudi Aramco’s Senior Vice President of Technical Services, Ahmad Al Sa’adi said that the facility will serve as a major engineering, procurement, construction, and installation hub not only the Kingdom, but for the GCC region. (Reuters) Stalled Saudi Aramco IPO sets back deal-making at US subsidiary Motiva – Saudi Aramco’s delayed Initial Public Offering (IPO) is sidelining grand North American expansion plans at its US refining subsidiary Motiva Enterprises LLC, sources said, at a time when its rivals grew their market share. After dissolving a partnership with Royal Dutch Shell PLC two years ago, Motiva set out to rebuild and boost market share in the Americas. It evaluated deals for LyondellBasell Industries NV’s Houston refinery, with the Caribbean government of Curacao, and considered expanding its sole US oil refinery. However, none of those came to pass as the company feared it might pay too much for acquisitions or become too exposed to disruptions by expanding its sole US refinery, according to sources. As a result, Motiva has slipped to 11th place from ninth among the top US refiners by capacity since striking out on its own, according to US government data, as other refiners inked deals to take advantage of the shale boom. (Reuters) Saudi Arabia's Al Tayyar aims to double online booking sales by end-2020 – Saudi Arabia’s largest travel company, Al Tayyar Travel Group, aims to double its online booking sales to $1.1bn by 2020, capitalizing on a rapidly growing tourism market, its CEO, Abdullah Aldawood said. It also plans to invest heavily in technology to reap the benefits of Saudi Arabian government’s plans to develop domestic tourism and to attract non-Muslim tourists to the Kingdom. Al Tayyar was among the first investors in Careem. “We grew our online travel agency business from almost zero in 2015 to over SR2bn of gross booking volume in 2018 and we aim to double that number by the end of 2020,” he said. (Reuters) Careem Backer Al Tayyar sees $475mn Uber deal gain in 2020 – Al Tayyar Travel Group Holding Company, the largest corporate holder in Careem Networks FZ, is set to gain at least $475mn from its stake after Uber Technologies Inc. agreed to buy the ride-hailing competitor, the company’s CEO, Abdullah Aldawood said. (Bloomberg) Mastercard to invest $300mn in Network International's IPO – Mastercard Inc. will make a $300mn cornerstone investment in Middle Eastern payment processor Network International’s Initial Public Offering (IPO) in London. The companies also agreed to enter into a partnership to support and accelerate the development of electronic payments in Africa and the Middle East, according to a statement. Network International plans to list its shares in London next month in the first big IPO in the UK this year. The company intends to have a free float of at least 25% of its issued share capital. An offering could value the company at about $3bn, sources said in November and the company expects to be eligible for inclusion in FTSE UK indexes. Warburg Pincus and General Atlantic jointly own a 49% stake in Network International, while Dubai’s biggest bank, Emirates NBD, holds the remaining 51%. (Bloomberg) Uber buys rival Careem in $3.1bn deal to dominate ride-hailing in the Middle East – Global ride-hailing firm Uber Technologies Inc will spend $3.1bn to acquire Middle East rival Careem, buying dominance in a competitive region ahead of a hotly anticipated IPO. Uber had earlier stated that it would pay $1.4bn in cash and $1.7bn in convertible notes in a deal that gives it full ownership of Careem. The long-expected agreement ends more than nine months of start-and-stop negotiations between the two companies and hands Uber a much-needed victory after a series of overseas divestments. The notes will be convertible into Uber shares at a price equal to $55 apiece, Uber said, marking a nearly 13% increase over Uber’s share price in its last financing round, led by SoftBank Group Corp more than a year ago. (Reuters) Fujairah Oil Terminal and GTI seek merger at UAE port – Fujairah Oil Terminal (FOT) and Global Terminal Investments (GTI) both operate oil storage at Middle East’s ship-fueling hub, FOT’s commercial Director, Malek Azizeh said. The Companies hope to complete merger by year-end, Azizeh added, giving no details on possible value of a deal. Prostar Capital, with offices in Australia, US, Hong Kong, is shareholder in both the companies. (Bloomberg) Dubai's main bourse announces changes to post-trade services – The Dubai Financial Market (DFM) stated that it will implement a new organizational structure for post-trade services as part of reforms aimed at aligning the stock exchange with international peers. DFM, as the biggest stock exchange in Dubai is known, has completed the formation of a holding company that entails a securities depository and a clearing company, according to a statement. Regulatory approvals are still pending, with activities expected to begin this year. The new structure separates post-trade services from the exchange services of listing and trading of securities, and will allow the bourse to “achieve stronger and sustainable growth,” it stated. (Bloomberg) Emirate of Sharjah to raise $1bn with seven-year Sukuk – The Emirate of Sharjah, the third-largest constituent of the UAE, is set to raise $1bn in seven-year Sukuk, or Islamic bonds, sources said. It started marketing the paper earlier on Tuesday with a spread of around 180 basis points (bps) over mid-swap, which was later tightened to 155 bps, documents issued by one of the banks leading the deal showed. Bank ABC, Dubai Islamic Bank (DIB), HSBC, KFH Capital, Sharjah Islamic Bank and Standard Chartered Bank have been hired as deal bookrunners. (Reuters) Oman’s oil exports rise to 0.841mn bpd in February – Oman’s Oil exports rose 11.8% from 0.752mn b/d in January to 0.841mn

- 7. Page 7 of 8 bpd in February, according to data published on National Center for Statistics & Information. Oman exported 46.865mn barrels of oil in January-February, representing a fall of 2.1% YoY. (Bloomberg) Oman sells OMR26.58mn 91-day bills; bid-cover at 1.15x – Oman sold OMR26.58mn of bills due on June 26, 2019 on March 25, 2019. Investors offered to buy 1.15 times the amount of securities sold. The bills were sold at a price of 99.379, having a yield of 2.506% and will settle on March 27, 2019. (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 QSE Index S&P Pan Arab S&P GCC 0.1% (0.1%) 0.1% (0.6%) (1.9%) 0.2% (0.7%) (2.0%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,315.69 (0.5) 0.2 2.6 MSCI World Index 2,102.62 0.7 0.4 11.6 Silver/Ounce 15.43 (0.7) (0.0) (0.4) DJ Industrial 25,657.73 0.6 0.6 10.0 Crude Oil (Brent)/Barrel (FM Future) 67.97 1.1 1.4 26.3 S&P 500 2,818.46 0.7 0.6 12.4 Crude Oil (WTI)/Barrel (FM Future) 59.94 1.9 1.5 32.0 NASDAQ 100 7,691.52 0.7 0.6 15.9 Natural Gas (Henry Hub)/MMBtu 2.75 1.1 (0.7) (13.7) STOXX 600 377.20 0.5 0.2 10.1 LPG Propane (Arab Gulf)/Ton 64.25 1.4 0.6 0.4 DAX 11,419.48 0.3 0.4 6.7 LPG Butane (Arab Gulf)/Ton 62.38 (2.2) (3.3) (10.3) FTSE 100 7,196.29 0.6 0.0 11.0 Euro 1.13 (0.4) (0.3) (1.8) CAC 40 5,307.38 0.6 0.6 10.5 Yen 110.64 0.6 0.7 0.9 Nikkei 21,428.39 1.6 (1.3) 7.0 GBP 1.32 0.1 0.0 3.6 MSCI EM 1,050.45 0.3 (0.9) 8.8 CHF 1.01 (0.2) (0.1) (1.3) SHANGHAI SE Composite 2,997.10 (1.6) (3.4) 23.1 AUD 0.71 0.3 0.7 1.2 HANG SENG 28,566.91 0.1 (1.9) 10.3 USD Index 96.74 0.2 0.1 0.6 BSE SENSEX 38,233.41 1.0 0.5 7.1 RUB 64.41 0.7 (0.4) (7.1) Bovespa 95,306.82 1.8 2.2 8.6 BRL RTS 1,229.96 0.1 1.4 15.1 99.5 93.3 82.4