QNBFS Daily Market Report July 12, 2016

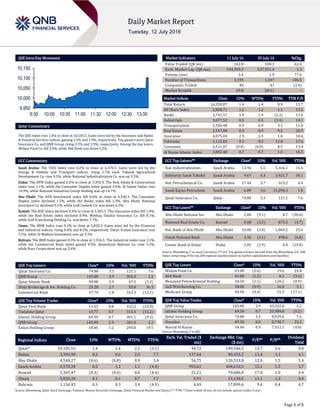

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.4% to close at 10,105.5. Gains were led by the Insurance and Banks & Financial Services indices, gaining 2.5% and 1.9%, respectively. Top gainers were Qatar Insurance Co. and QNB Group, rising 3.3% and 2.9%, respectively. Among the top losers, Widam Food Co. fell 2.6%, while Ahli Bank was down 1.2%. GCC Commentary Saudi Arabia: The TASI Index rose 0.2% to close at 6,570.3. Gains were led by the Energy & Utilities and Transport indices, rising 1.7% each. Tabouk Agricultural Development Co. rose 9.5%, while National Industrialization Co. was up 5.5%. Dubai: The DFM Index gained 0.2% to close at 3,392.9. The Real Estate & Construction index rose 1.1%, while the Consumer Staples index gained 0.6%. Al Salam Sudan rose 14.9%, while National Industries Group Holding was up 14.7%. Abu Dhabi: The ADX benchmark index fell 0.6% to close at 4,540.3. The Consumer Staples index declined 1.5%, while the Banks index fell 1.3%. Abu Dhabi National Insurance Co. declined 9.1%, while Gulf Cement Co. was down 6.3%. Kuwait: The KSE Index declined 0.3% to close at 5,365.5. The Insurance index fell 1.0%, while the Real Estate index declined 0.9%. Wethaq Takaful Insurance Co. fell 8.1%, while Gulf Franchising Holding Co. was down 7.7%. Oman: The MSM Index rose 0.1% to close at 5,820.3. Gains were led by the Financial and Industrial indices, rising 0.4% and 0.2%, respectively. Oman United Insurance rose 5.5%, while Al Madina Investment was up 3.3%. Bahrain: The BHB Index gained 0.3% to close at 1,156.5. The Industrial index rose 3.1%, while the Commercial Bank index gained 0.5%. Aluminium Bahrain Co. rose 3.2%, while Nass Corporation was up 2.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Insurance Co. 74.80 3.3 121.1 7.6 QNB Group 145.80 2.9 301.0 2.2 Qatar Islamic Bank 99.80 2.9 47.5 (2.3) Dlala Brokerage & Inv. Holding Co. 25.20 2.7 95.8 36.3 Commercial Bank 37.70 1.8 163.3 (12.1) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 11.55 0.8 332.2 (23.0) Vodafone Qatar 10.77 0.7 315.4 (15.2) Islamic Holding Group 69.50 0.7 301.1 (9.2) QNB Group 145.80 2.9 301.0 2.2 Ezdan Holding Group 18.46 1.2 290.8 19.5 Market Indicators 11 July 16 05 July 16 %Chg. Value Traded (QR mn) 162.8 100.3 62.4 Exch. Market Cap. (QR mn) 544,399.3 537,551.4 1.3 Volume (mn) 3.4 1.9 77.6 Number of Transactions 3,195 1,547 106.5 Companies Traded 40 41 (2.4) Market Breadth 29:8 28:11 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,350.07 1.4 1.4 0.9 13.7 All Share Index 2,808.71 1.2 1.2 1.1 13.2 Banks 2,742.57 1.9 1.9 (2.3) 11.6 Industrials 3,077.52 0.5 0.5 (3.4) 14.1 Transportation 2,506.48 0.9 0.9 3.1 11.6 Real Estate 2,547.88 0.9 0.9 9.2 20.9 Insurance 4,075.04 2.5 2.5 1.0 10.6 Telecoms 1,112.82 0.2 0.2 12.8 17.6 Consumer 6,511.07 (0.0) (0.0) 8.5 13.4 Al Rayan Islamic Index 3,892.48 0.7 0.7 1.0 16.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Industrialization Saudi Arabia 13.96 5.5 5,166.1 31.6 Solidarity Saudi Takaful Saudi Arabia 9.67 4.3 3,921.7 30.1 Nat. Petrochemical Co. Saudi Arabia 17.44 3.7 323.2 4.4 Saudi Kayan Petrochem. Saudi Arabia 6.89 3.6 31,096.3 1.8 Qatar Insurance Co. Qatar 74.80 3.3 121.1 7.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi National Ins. Abu Dhabi 2.00 (9.1) 8.7 (30.6) National Real Estate Co. Kuwait 0.08 (3.5) 875.2 (4.7) Nat. Bank of Abu Dhabi Abu Dhabi 10.00 (3.4) 1,869.2 25.6 Union National Bank Abu Dhabi 4.36 (3.1) 498.6 (6.8) Comm. Bank of Dubai Dubai 5.05 (2.9) 0.0 (19.8) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Widam Food Co. 63.00 (2.6) 19.6 24.8 Ahli Bank 41.00 (1.2) 0.1 (3.6) Mesaieed Petrochemical Holding 18.50 (1.1) 120.2 (0.9) Gulf Warehousing Co. 58.00 (0.9) 16.0 5.1 Medicare Group 94.50 (0.4) 15.5 (17.1) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 145.80 2.9 43,322.8 2.2 Islamic Holding Group 69.50 0.7 20,989.8 (9.2) Qatar Insurance Co. 74.80 3.3 8,929.6 7.6 Ooredoo 89.30 0.0 8,790.7 23.3 Masraf Al Rayan 34.40 0.9 7,912.1 (4.0) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,105.52 1.4 1.4 2.2 (3.1) 44.72 149,546.5 13.7 1.6 4.0 Dubai 3,392.90 0.2 0.6 2.5 7.7 137.64 90,455.2 11.4 1.3 4.1 Abu Dhabi 4,540.27 (0.6) (0.8) 0.9 5.4 56.75 120,533.8 12.0 1.5 5.4 Saudi Arabia 6,570.34 0.2 1.1 1.1 (4.9) 993.61 404,610.3 15.1 1.5 3.7 Kuwait 5,365.47 (0.3) (0.4) 0.0 (4.4) 21.21 79,686.9 17.8 1.0 4.4 Oman 5,820.34 0.1 0.1 0.7 7.7 5.91 23,130.5 11.1 1.3 4.4 Bahrain 1,156.45 0.3 0.3 3.4 (4.9) 4.49 17,899.6 9.6 0.4 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,950 10,000 10,050 10,100 10,150 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index rose 1.4% to close at 10,105.5. The Insurance and Banks & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Qatar Insurance Co. and QNB Group were the top gainers, rising 3.3% and 2.9%, respectively. Among the top losers, Widam Food Co. fell 2.6%, while Ahli Bank was down 1.2%. Volume of shares traded on Monday rose by 77.6% to 3.4mn from 1.9mn on Tuesday. However, as compared to the 30-day moving average of 4.0mn, volume for the day was 15.1% lower. Qatar First Bank and Vodafone Qatar were the most active stocks, contributing 9.8% and 9.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Commercial Bank of Dubai Capital Intelligence Dubai FSR/LT-FCR/ST- FCR/SR BBB+/ A-/ A2/2 BBB+/ A-/ A2/2 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, SR – Support Rating, LC – Local Currency) Earnings Releases Company Market Currency Revenue (mn) 2Q2016 % Change YoY Operating Profit (mn) 2Q2016 % Change YoY Net Profit (mn) 2Q2016 % Change YoY Advanced Petrochemical Company Saudi Arabia SR – – 192.0 -24.3% 186.0 -23.5% National Biscuit Industries Oman OMR 5.6 -0.6% – – 0.4 16.0% SMN Power Holding Oman OMR 47.4 -10.3% 9.8 -2.5% 4.4 0.2% Source: Company data, DFM, ADX, MSM Earnings Calendar Tickers Company Name Date of reporting 2Q2016 results No. of days remaining Status QNBK QNB Group 12-Jul-16 0 Due QEWS Qatar Electricity & Water Company 13-Jul-16 1 Due QGTS Qatar Gas Transport Company (Nakilat) 13-Jul-16 1 Due UDCD United Development Company 18-Jul-16 6 Due QIBK Qatar Islamic Bank 18-Jul-16 6 Due QATI Qatar Insurance Company 19-Jul-16 7 Due QIIK Qatar International Islamic Bank 19-Jul-16 7 Due MARK Masraf Al Rayan 19-Jul-16 7 Due IHGS Islamic Holding Group 19-Jul-16 7 Due CBQK Commercial Bank of Qatar 19-Jul-16 7 Due DHBK Doha Bank 20-Jul-16 8 Due KCBK Al Khalij Commercial Bank 20-Jul-16 8 Due ABQK Al Ahli Bank 20-Jul-16 8 Due NLCS National Leasing (Alijarah) 21-Jul-16 9 Due GWCS Gulf Warehousing Company 21-Jul-16 9 Due QIGD Qatari Investors Group 25-Jul-16 13 Due ORDS Ooredoo 26-Jul-16 14 Due VFQS Vodafone Qatar 26-Jul-16 14 Due QIMD Qatar Industrial Manufacturing Company 26-Jul-16 14 Due ERES Ezdan Real Estate Company 27-Jul-16 15 Due AKHI Al Khaleej Takaful Insurance 2-Aug-16 21 Due QISI Qatar Islamic Insurance 10-Aug-16 29 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 23.87% 34.97% (18,064,847.93) Qatari Institutions 9.24% 15.59% (10,335,735.13) Qatari 33.11% 50.56% (28,400,583.06) GCC Individuals 0.32% 1.50% (1,919,562.73) GCC Institutions 3.63% 4.43% (1,315,605.60) GCC 3.95% 5.93% (3,235,168.33) Non-Qatari Individuals 10.33% 13.04% (4,413,489.56) Non-Qatari Institutions 52.60% 30.46% 36,049,240.95 Non-Qatari 62.93% 43.50% 31,635,751.39

- 3. Page 3 of 5 News Qatar GWCS to disclose financial statements on July 21 – Gulf Warehousing (GWCS) will disclose the financial statements for the period ending June 30, 2016 on July 21, 2016. (QSE) QIGD to disclose financial statements on July 25 – Qatari Investors Group (QIGD) will disclose the financial statements for the period ending June 30, 2016 on July 25, 2016. (QSE) QNB Group: Qatar’s economy ‘weathers’ low oil prices on strong macroeconomic fundamentals – QNB Group (QNBK) has said in its ‘Qatar Economic Insight’ that Qatar’s economy has “weathered low oil prices” due to strong macroeconomic fundamentals including a low fiscal breakeven price, accumulation of significant savings from the past and low levels of public debt. QNB Group expects the real GDP growth to accelerate from 3.3% in 2016 to 3.9% in 2017 and 4.2% in 2018 with the ramp up in investment spending and initial gas production from the Barzan Gas Project. Qatar’s inflation is expected to rise to 3.2% in 2016 and 3.4% in 2017 in line with the pick-up in global inflation, before moderating slightly to 3% in 2018. International inflation is expected to rise on stronger food and oil prices, while population growth should support domestic inflation. Lower hydrocarbon revenue and continued capital spending by the government are expected to result in modest deficits in 2016 and 2017, but the rebound in oil prices should gradually bring the government back to near balance by 2018. Revenue is expected to decline in 2016 due to the weakness in oil prices and slower non-hydrocarbon growth, but should pick up over the medium-term due to the introduction of a 5% value- added tax in 2018. The government is expected to continue its investment spending program, while rationalizing current spending, leading to a modest decline in expenditure as share of GDP from 2016 to 2018. The country’s credit growth is projected to reach 11.0% in 2016 and 9% in each of 2017 and 2018, supported by project lending and higher consumption from the rising population. The loan-to-deposit ratio is expected to stabilize at around 120%; NPLs are forecast to remain low over the medium-term as asset quality is expected to be backed by the strong macroeconomic environment. (Gulf-Times.com) Qatar Airways 'fiscal 2016' net profit jumps 328% to QR1.6bn – Qatar Airways Group, the parent company of the Doha-based national airline, posted a net profit of QR1.6bn in FY2016 (April 2015 to March 2016), up 328% YoY. The group announced an operating profit of QR3bn – nearly three times greater than the FY2015 profit of QR1.1bn, resulting in an 8.6% operating profit margin. This shows an improvement of nearly six percentage points from the prior year – from QR35.6bn in revenues. Qatar Airways’ compound annual growth rate (CAGR) in available seat kilometers (ASK) terms since its relaunch in 1997 to March 31 is 28%. Meanwhile, the national airline said in its ‘Annual Report 2016’ that it plans to launch service to around 17 new destinations in FY2017. Qatar Airways and Gulfstream Aerospace Corporation have announced a new order for three new G650ERs on the opening day of the 2016 Farnborough International Airshow in the UK. The order adds to the three G650ER aircraft already in service and available for charter with Qatar Executive and is part of a 30- aircraft sales agreement announced in May 2015 between the two companies. This order makes Qatar Executive the largest dedicated G650 operator in the world. Qatar Airways Chief Executive Akbar al-Baker said the airline is engaged in advanced talks with Boeing to buy up to 30 narrow body planes and will not rule out additional cancellations of delayed deliveries from rival Airbus. (Gulf-Times.com) INSHA Company wins Barwa project – Barwa Real Estate (BRES) has awarded the construction of phase one of the Madinat Al Mawater project to INSHA Company. The contract is valued at QR99,850,000, with a construction duration of 12 months. The project, located on Rawdat Rashed Road and near the intersection along Salwa Road, is planned to be the primary destination for various services related to the sale, purchase and maintenance of used vehicles in Qatar. The phase one of the project will be constructed on a 215,677 square meters (sqm) plot, and will include 60 car showrooms with a total area of 18,506sqm, 176 residential apartments with a total area of 14,191sqm, and 10 commercial shops and workshops with a total area of 806sqm. The project infrastructure will also comprise three electrical substations, internal roads, potable water, firefighting, irrigation, sewage, storm water and CCTV networks, and all related services such as pump rooms and tanks in a 34,066sqm build up area. Furthermore, Woqod will construct a petrol station as part of the project. (Gulf-Times.com) International EU vote hits UK households and business morale, London hurt most – According to sources, British consumer spending fell last month, the business outlook darkened by the most in four years and economic activity in London slowed sharply. Figures for June from card company Visa, Lloyds Bank and Markit pointed to nervousness among businesses and households in the run-up to the June 23, 2016 Brexit referendum and in the days immediately after. Visa said consumer spending dropped for the second month in a row in June, down by 0.5% to leave overall purchases up just 1.4% YoY in the three months to June, the weakest inflation- adjusted growth since early 2014. Markit said businesses had the least positive economic outlook in four years, based on responses collected between June 13 and June 29, with many firms blaming the referendum. (Reuters) EU Commission cuts Eurozone, UK growth forecasts after Brexit vote – According to the early estimates unveiled by the European Economic Affairs Commissioner Pierre Moscovici, the European Commission has revised down its forecasts for growth in the Eurozone and in Britain after the British vote to leave the European Union (EU). The Commission forecast that Britain will be hit harder after the June 23 vote to leave the EU. It said that the cumulative negative impact for British GDP would be between 1% and 2.5% by 2017. The Commission has previously forecast British economic expansion in 2016 and 2017 of 1.8% and 1.9% respectively. Moscovici said that the Eurozone is likely to see its growth cut between 0.2% and 0.5% by 2017 because of the referendum vote. In May, the Commission forecast Eurozone growth in 2016 of 1.6% and in 2017 of 1.8%. (Reuters) Deutsche Bank Chief Economist calls for €150bn in EU bank bailout – According to sources, Deutsche Bank's Chief Economist, David Folkerts-Landau urged the European Union to set up a €150bn rescue fund to recapitalize European banks. Folkerts-Landau said, European banks were threatened by a slow, long-term downward spiral and faced with €2tn in non-performing loans, adding that the European Central Bank's negative deposit rates and low share prices made it hard for banks to acquire capital on their own. Folkerts-Landau added that particular attention had to be paid to Italy, where banks had €350bn in bad loans and debt ratios were on the rise. (Reuters) IMF: Italy faces 'monumental challenge', cuts growth outlook – The International Monetary Fund (IMF) said Italy's economy will grow by less than 1% in 2016 and only marginally faster in 2017, cutting its previous forecasts as a result of Britain's decision to leave the European Union. The outcome of last month's referendum in Britain has heightened volatility on financial markets and increased downside risks for Italy. The IMF said Eurozone's third-

- 4. Page 4 of 5 largest economy is now seen growing at "just under 1 % in 2016 and at about 1 percent in 2017". Its previous projections, at the end of May, were for growth of 1.1% in 2016 and 1.25% in 2017. (Reuters) Japan orders new stimulus package after election win – Japanese Prime Minister Shinzo Abe ordered a new round of fiscal stimulus spending after a crushing election victory over the weekend as evidence mounted the corporate sector is floundering due to weak demand. An unexpected decline in machinery orders shows the economy needs something to overcome consistently weak corporate investment. However, economists worry that Abe's focus on public works spending will not tackle the structural issues around a declining population and workforce. More public works also increases pressure on the Bank of Japan to keep interest rates low and the yen weak to make sure stimulus spending will gain traction. The government was ready to spend more than $100bn. (Reuters) Regional CAREEM invests $100mn in R&D amid global expansion – CAREEM, the region’s leading app-based car service, announced new research & development (R&D) strategy plans for global expansion. CAREEM will invest $100mn in R&D over the next five years, which includes growing its team in the UAE and Pakistan, and opening new R&D centers in Egypt and Germany. The investment will accelerate innovation in transportation-related technology infrastructure for the region and keep CAREEM at the forefront of this dynamic new industry. (GulfBase.com) Rising counterfeit spare parts take toll on Saudi Arabia’s economy – According to sources, Saudi the automotive industry has confirmed that the sector has suffered approximately SR2bn in losses due to the dramatic increase in counterfeit spare parts in the local market. This worrying proliferation of fraud and counterfeiting negatively impacts not only the automotive sector, but also the economy and the consumer. (GulfBase.com) CASHU plans expansion in Saudi Arabia – CASHU, one of the leading players in the online payment industry in the Middle East and North Africa (MENA), announced its intention to drive further expansion in the Kingdom of Saudi Arabia and introducing new products via strategic partnerships with key local Saudi financial entities within the next two months. (Bloomberg) UAB successfully closes $150mn syndicated term loan facility – Bank ABC, Commerzbank Aktiengesellschaft, Filiale Luxemburg (Commerzbank) and Emirates NBD Capital Limited and/or its affiliates, have successfully closed a $150mn Syndicated Term Loan Facility on behalf of United Arab Bank (UAB). The facility, which carries a tenor of two years and margin of 175bps over LIBOR, will be used for general corporate purposes and refinancing of an existing syndicated facility. (GulfBase.com) Dubai private sector boosts market sentiments – According to sources, Dubai's non-oil private sector showed an uptick in activity during June. The monthly index at 54.6 was at its highest since August 2015, helped along by gains for travel and tourism, wholesale and retail categories. Wholesale and retail was the best performing sub-sector monitored by the survey in June (headline index at 58.2), followed by travel and tourism (54.1). But, again contrary to popular perceptions the survey pointed to only a modest upturn in construction sector business conditions (51.5). (GulfBase.com) MAG 5 signs up Fujairah National Construction Company as main contractor for boulevard project – MAG 5 Property Development (MAG 5 PD), a real-estate company based in the UAE, has signed up Fujairah National Construction Company as the main contractor for its boulevard project at Dubai South. MAG 5 PD is a joint venture between MAG Property Development and MBM Holding, a Dubai-based Royal Family office and investment holding company. (GulfBase.com) 1MDB agrees to request for arbitration filed by IPIC – Malaysian state-owned fund 1Malaysia Development Berhad (1MDB) said that it had agreed to a request for arbitration filed by Abu Dhabi's International Petroleum Investment Company (IPIC) and its subsidiary, Aabar Investments. IPIC, in a submission to the London Court of International Arbitration, is claiming about $6.5bn from 1MDB and the Malaysia's finance ministry after a debt restructuring agreement between the companies went sour. (Reuters) Moody’s: Merger of NBAD, FGB credit positive – According to Moody’s, the merger of National Bank of Abu Dhabi (NBAD) and First Gulf Bank (FGB) to create the Middle East’s largest bank by assets is credit positive for both and the combined entity will have a pro-forma net interest margin of about 2.1%, up from approximately 1.8% in 1Q2016. Profit in the next three years will also benefit from revenue synergies through cross-selling opportunities, pricing optimization, and cost efficiencies stemming from economies of scale and the consolidation of the branch networks of the two banks. (Bloomberg) S&P affirms Mubadala, IPIC credit ratings – S&P Global Ratings has affirmed its long- and short-term issuer credit rating on Mubadala and International Petroleum Investment Company (IPIC), the two sovereign wealth funds that are being merged for synergies. The ratings agency affirmed 'AA' long-term and 'A-1+' short-term issuer credit ratings on Mubadala Development, which is Abu Dhabi's principal agent for diversifying the domestic economy away from hydrocarbon revenues. The outlook is stable. The agency also affirmed its 'AA/A-1+' long- and short-term local and foreign currency issuer credit ratings on IPIC. The outlook is stable. (Bloomberg) Meysan Partners advises NBK on latest rights issue – Meysan Partners, the Kuwait based corporate law firm, has advised National Bank of Kuwait (NBK), on the issuance of new shares representing circa KD137mn. The latest issuance will enhance the bank's capital base and is in line with Basel III guidelines. (Bloomberg) OAB appoints Deputy CEO – Oman Arab Bank (OAB) has appointed Mr Rashad bin Ali Al-Musafir as its Deputy Chief Executive Officer (CEO), effective from August 14, 2016. (GulfBase.com)

- 5. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 QSEIndex S&PPan Arab S&PGCC 0.2% 1.4% (0.3%) 0.3% 0.1% (0.6%) 0.2% (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,355.35 (0.8) (0.8) 27.7 MSCI World Index 1,676.15 0.8 0.8 0.8 Silver/Ounce 20.29 0.0 0.0 46.4 DJ Industrial 18,226.93 0.4 0.4 4.6 Crude Oil (Brent)/Barrel (FM Future) 46.25 (1.1) (1.1) 24.1 S&P 500 2,137.16 0.3 0.3 4.6 Crude Oil (WTI)/Barrel (FM Future) 44.76 (1.4) (1.4) 20.8 NASDAQ 100 4,988.64 0.6 0.6 (0.4) Natural Gas (Henry Hub)/MMBtu 2.85 2.8 2.8 23.0 STOXX 600 332.72 1.6 1.6 (7.5) LPG Propane (Arab Gulf)/Ton 49.38 (0.3) (0.3) 26.2 DAX 9,833.41 2.1 2.1 (7.3) LPG Butane (Arab Gulf)/Ton 56.50 (2.6) (2.6) (1.7) FTSE 100 6,682.86 1.4 1.4 (5.8) Euro 1.11 0.1 0.1 1.8 CAC 40 4,264.53 1.7 1.7 (6.5) Yen 102.80 2.2 2.2 (14.5) Nikkei 15,708.82 1.7 1.7 (3.1) GBP 1.30 0.3 0.3 (11.8) MSCI EM 846.73 2.2 2.2 6.6 CHF 1.02 0.0 0.0 2.0 SHANGHAI SE Composite 2,994.92 0.1 0.1 (18.0) AUD 0.75 (0.5) (0.5) 3.4 HANG SENG 20,880.50 1.5 1.5 (4.8) USD Index 96.57 0.3 0.3 (2.1) BSE SENSEX 27,626.69 1.9 1.9 4.4 RUB 64.24 0.6 0.6 (11.4) Bovespa 53,960.11 0.9 0.9 48.8 BRL 0.30 (0.2) (0.2) 19.7 RTS 941.35 0.7 0.7 24.3 120.1 97.1 96.4