QNBFS Daily Market Report June 19, 2017

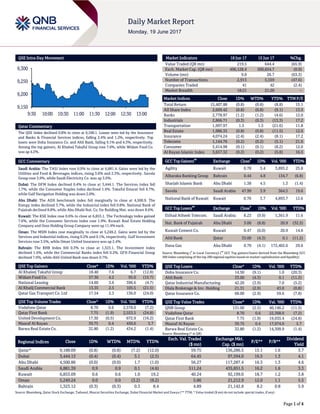

- 1. Page 1 of 4 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.8% to close at 9,188.1. Losses were led by the Insurance and Banks & Financial Services indices, falling 2.4% and 1.2%, respectively. Top losers were Doha Insurance Co. and Ahli Bank, falling 9.1% and 4.3%, respectively. Among the top gainers, Al Khaleej Takaful Group rose 7.6%, while Widam Food Co. was up 4.2%. GCC Commentary Saudi Arabia: The TASI Index rose 0.9% to close at 6,881.4. Gains were led by the Utilities and Food & Beverages indices, rising 3.6% and 2.3%, respectively. Savola Group rose 3.9%, while Saudi Electricity Co. was up 3.6%. Dubai: The DFM Index declined 0.4% to close at 3,444.1. The Services index fell 1.7%, while the Consumer Staples index declined 1.4%. Takaful Emarat fell 6.7%, while Gulf Navigation Holding was down 2.0%. Abu Dhabi: The ADX benchmark index fell marginally to close at 4,500.9. The Energy index declined 3.7%, while the Industrial index fell 0.8%. National Bank of Fujairah declined 8.8%, while Abu Dhabi Nat. Co. for Building Mat. was down 8.6%. Kuwait: The KSE Index rose 0.6% to close at 6,853.1. The Technology index gained 7.6%, while the Consumer Services index rose 1.9%. Kuwait Real Estate Holding Company and Osos Holding Group Company were up 11.4% each. Oman: The MSM Index rose marginally to close at 5,249.2. Gains were led by the Services and Industrial indices, rising 0.2% and 0.1%, respectively. Gulf Investment Services rose 3.5%, while Oman United Insurance was up 2.4%. Bahrain: The BHB Index fell 0.3% to close at 1,323.1. The Investment index declined 1.4%, while the Commercial Banks index fell 0.2%. GFH Financial Group declined 7.0%, while Ahli United Bank was down 0.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Group 18.40 7.6 6.7 (12.8) Widam Food Co. 57.30 4.2 95.0 (15.7) National Leasing 14.60 3.6 396.6 (4.7) Al Khalij Commercial Bank 13.35 2.5 105.5 (21.5) Qatar Gas Transport Co. Ltd 17.54 2.3 136.0 (24.0) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.70 0.6 2,578.0 (7.2) Qatar First Bank 7.75 (1.9) 2,553.5 (24.8) United Development Co. 17.30 (0.5) 672.9 (16.2) Masraf Al Rayan 39.75 0.4 450.6 5.7 Barwa Real Estate Co. 32.80 (1.2) 434.2 (1.4) Market Indicators 18 Jun 17 15 Jun 17 %Chg. Value Traded (QR mn) 219.5 644.4 (65.9) Exch. Market Cap. (QR mn) 496,128.4 500,654.7 (0.9) Volume (mn) 9.8 26.7 (63.3) Number of Transactions 2,913 5,559 (47.6) Companies Traded 41 42 (2.4) Market Breadth 18:21 21:20 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,407.88 (0.8) (0.8) (8.8) 15.1 All Share Index 2,609.42 (0.8) (0.8) (9.1) 13.5 Banks 2,778.97 (1.2) (1.2) (4.6) 12.0 Industrials 2,866.71 (0.3) (0.3) (13.3) 17.2 Transportation 1,997.97 1.5 1.5 (21.6) 11.8 Real Estate 1,986.35 (0.8) (0.8) (11.5) 12.6 Insurance 4,074.24 (2.4) (2.4) (8.1) 17.2 Telecoms 1,144.76 (0.2) (0.2) (5.1) 21.6 Consumer 5,414.98 (0.1) (0.1) (8.2) 12.0 Al Rayan Islamic Index 3,657.32 (0.2) (0.2) (5.8) 16.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Agility Kuwait 0.78 5.4 3,895.2 25.8 Albaraka Banking Group Bahrain 0.44 4.8 134.7 (6.8) Sharjah Islamic Bank Abu Dhabi 1.38 4.5 1.3 (1.4) Savola Saudi Arabia 47.99 3.9 364.5 19.6 National Bank of Kuwait Kuwait 0.70 3.7 4,893.7 12.6 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Etihad Atheeb Telecom. Saudi Arabia 8.23 (9.9) 1,361.9 11.6 Nat. Bank of Fujairah Abu Dhabi 3.00 (8.8) 20.9 (32.5) Kuwait Cement Co. Kuwait 0.47 (6.0) 20.9 14.6 Ahli Bank Qatar 33.00 (4.3) 0.1 (11.2) Dana Gas Abu Dhabi 0.70 (4.1) 172,402.6 29.6 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Doha Insurance Co. 14.50 (9.1) 1.0 (20.3) Ahli Bank 33.00 (4.3) 0.1 (11.2) Qatar Industrial Manufacturing 42.20 (3.9) 7.0 (5.2) Dlala Brokerage & Inv. Holding 21.31 (2.9) 43.0 (0.8) Qatar Insurance Co. 68.00 (2.9) 59.6 (7.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 131.00 (2.5) 40,146.2 (11.5) Vodafone Qatar 8.70 0.6 22,368.0 (7.2) Qatar First Bank 7.75 (1.9) 19,935.4 (24.8) Masraf Al Rayan 39.75 0.4 17,974.0 5.7 Barwa Real Estate Co. 32.80 (1.2) 14,309.9 (1.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,188.09 (0.8) (0.8) (7.2) (12.0) 59.75 136,286.5 15.1 1.6 3.7 Dubai 3,444.13 (0.4) (0.4) 3.1 (2.5) 64.45 97,594.0 16.5 1.3 4.1 Abu Dhabi 4,500.86 (0.0) (0.0) 1.7 (1.0) 56.27 117,287.4 16.3 1.3 4.6 Saudi Arabia 6,881.39 0.9 0.9 0.1 (4.6) 511.24 435,851.5 16.2 1.6 3.3 Kuwait 6,853.09 0.6 0.6 1.0 19.2 40.24 92,199.0 18.7 1.2 3.8 Oman 5,249.24 0.0 0.0 (3.2) (9.2) 5.86 21,212.9 12.0 1.1 5.5 Bahrain 1,323.12 (0.3) (0.3) 0.3 8.4 4.89 21,142.8 8.2 0.8 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,150 9,200 9,250 9,300 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 4 Qatar Market Commentary The QSE Index declined 0.8% to close at 9,188.1. The Insurance and Banks & Financial Services indices led the losses. The index fell on the back of selling pressure from GCC and non-Qatari shareholders despite buying support from Qatari shareholders. Doha Insurance Co. and Ahli Bank were the top losers, falling 9.1% and 4.3%, respectively. Among the top gainers, Al Khaleej Takaful Group rose 7.6%, while Widam Food Co. was up 4.2%. Volume of shares traded on Sunday fell by 63.3% to 9.8mn from 26.7mn on Thursday. Further, as compared to the 30-day moving average of 12.9mn, volume for the day was 23.9% lower. Vodafone Qatar and Qatar First Bank were the most active stocks, contributing 26.3% and 26.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) News Qatar QP CEO: Qatar would not cut its gas supplies to UAE – Qatar Petroleum (QP) CEO said that Qatar will not cut off gas supplies to the UAE despite a diplomatic dispute and a “force majeure” clause in its contract. CEO Saad Al-Kaabi said that although there was a “force majeure” clause in the agreement on the Dolphin gas pipeline, which links Qatar’s giant North Field with the UAE, Qatar would not stop supplies for other reasons. The Dolphin gas pipeline links Qatar with the UAE and Oman and pumps around 2bn cubic feet of gas per day to the UAE. (Gulf- Times.com) Opportunity to boost sales of local products – Demand for Qatari products will continue even after the ongoing economic blockade on the country is over, with local farms and food manufacturers transforming the crisis into an opportunity to boost sales and expand to wider markets. Qatari businessman Farhan Al-Sayed said, “They will be encouraged to produce more to keep up with the growing market demand. Those who are in the industry will definitely find a market, which could help their businesses grow and expand.” (Gulf-Times.com) Minister: Economy strong enough to withstand crisis – HE the Minister of Economy and Commerce Sheikh Ahmed bin Jassim bin Mohamed Al-Thani has said that the Qatari economy is strong enough to withstand any shock or crisis because of its diversification, competitiveness and strong position. The minister said the blockade imposed by some Gulf countries against Qatar was surprising and unjustified, but was dealt with quickly. HE the minister said all the infrastructure projects and the work related to World Cup 2022 are going as planned. (Gulf-Times.com) More global liners expected to call on Hamad Port – A further improvement in cargo movement to and from Qatar is expected in the coming days as new maritime services are launched and global shipping firms ramp up operations. Now, cargo traffic at Hamad Port is expected to see further improvement as the parties concerned, port officials and shipping companies, look to seal new transport deals that will help improve direct services to and from Qatar. More global liners are reportedly keen to call on Hamad Port, looking to utilize its infrastructural facilities. (Gulf-Times.com) KCBK board announces meeting results – The Board of Directors of Al Khalij Commercial Bank (KCBK) concluded its meeting held on June 15, 2017. The board discussed and approved a number of items related to regular activities, projects and business of the bank and considered certain actions to protect the bank from the consequences of the recent regional developments. (QSE) International Japan's May exports rise at fastest in two years, set to sustain growth – Japan's exports surged in May by the fastest in more than two years on bigger shipments of cars and steel, an encouraging sign that robust overseas demand will support economic growth. The 14.9% annual increase in exports in May was below the median estimate of 16.1% annual increase but was nonetheless the biggest rise since January 2015. Exports are likely to continue rising at a steady clip as overseas economies show increasing signs of strength, which should help Japan's economy extend its recent run of solid expansion. Japan's exports to the United States rose 11.6% YoY in May, the fastest increase since July 2015, due to an increase of shipments of autos and auto parts. (Reuters) China's MoM home price growth remains robust in May – Prices in China's sizzling property market kept pace in May with the previous month, indicating resilient demand despite the imposition of tougher official measures to curb surging prices. Average new home prices in China's 70 major cities rose 0.7% MoM in May, in line with April. Compared with a year ago, new home prices rose 10.4% in May, easing from a 10.7% gain in April. (Reuters) Regional BAML: US continue to import Mideast crude at fastest rate since 2013 – The combined production in Saudi Arabia, Iran, Iraq, Kuwait and Qatar decreased by 820,000 barrels per day (bpd) sequentially between 3Q2016 and 1Q2017, the Bank of America Merrill Lynch (BAML) has said in its ‘Global Energy Weekly’ report. However, total exports actually increased by 250,000 bpd over the timeframe. The decrease in production and exports between 3Q2016 and 1Q2017 was more aligned, it said. Against BAML’s initial expectations, global crude oil supply is still plentiful after six months of joint OPEC and non- Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 43.99% 48.70% (10,334,458.14) Qatari Institutions 35.70% 13.52% 48,681,172.45 Qatari 79.69% 62.22% 38,346,714.31 GCC Individuals 0.90% 1.25% (766,391.15) GCC Institutions 0.31% 4.44% (9,058,991.70) GCC 1.21% 5.69% (9,825,382.85) Non-Qatari Individuals 13.64% 11.57% 4,544,945.53 Non-Qatari Institutions 5.46% 20.53% (33,066,276.99) Non-Qatari 19.10% 32.10% (28,521,331.46)

- 3. Page 3 of 4 OPEC output cuts. High inventory levels continue to weigh on the oil market and are preventing a price recovery. (Gulf- Times.com) Saudi Arabia’s public finances seen stabilizing by 2020 – The launch of the Fiscal Balance 2020 Program in 2H2017, the MSCI EM watch list announcement in mid-June and a possible Saudi Aramco IPO in 2018 are likely to mark the start of a fundamental transformation of Saudi Arabia’s economy and public finance, according to analysts at Bank of America Merrill Lynch. Analysts say that although fiscal targets are unlikely to be met, the program will help narrow fiscal imbalances to mid- single digits by 2020. (GulfBase.com) KSA private wealth expected to be the highest in the GCC over the next five years – Private wealth growth in the Kingdom of Saudi Arabia witnessed a slight increase in 2016 (3.1%). It continues to rank as the country with the highest private wealth in the GCC, according to The Boston Consulting Group (BCG). In Saudi Arabia, the growth of private wealth was driven primarily by equities. In 2016, the amount of wealth held in equities increased by 6.2%, in comparison to cash and deposits at 1.7% and bonds at 0.9%. KSA’s private wealth expected to be the highest in the GCC over the next five years. (GulfBase.com) Arab National Bank announces distribution of dividend for 1H2017 – The Board of Directors of Arab National Bank has recommended distribution of cash dividend to the shareholders for 1H2017 with total amount of cash dividend to be distributed being SR550mn and with dividend per share of SR0.55. (Tadawul) Mubadala in talks to buy stake in hotel group from 1MDB- linked Low – UAE state fund Mubadala Development Co. is in talks with the US Department of Justice for approval to buy the rest of the partially-owned Viceroy Hotel Group from Jho Low, a financier linked by prosecutors to Malaysia's 1MDB corruption scandal. (Reuters) DSI initiates 75% capital reduction – Drake & Scull International’s (DSI) CEO, Wael Allan said that the initial projected timeline of the capital restructuring program has been deferred by a period of one month. The firm now expects to complete the exercise by the end of 3Q2017. At the same time the company has advanced with the capital restructuring program and proceeds with the final preparations to initiate the 75% capital reduction. Despite the short-term challenges, the company is well positioned to benefit from its leadership position in the MEP sector and to secure profitable projects in the UAE market in the near future. (GulfBase.com) Abu Dhabi’s inflation drops to 2.0% in May – Abu Dhabi’s consumer inflation declined to 2.0% YoY in May 2017 (vs. 2.4% YoY in April 2017). On monthly basis, inflation stood at -0.1% in May 2017 (vs.-0.4% in April 2017). (Reuters) NMDC approves AED100mn subscription in Arabtec shares – National Marine Dredging Company (NMDC) said it has approved subscription to 100mn shares in Arabtec Holding with a total value of AED100mn. The subscription was for shares in Arabtec’s AED1.5bn rights issue launched in May. (GulfBase.com) Dana Gas gets injunction from English court blocking claims on $700mn Sukuk – Dana Gas said it had obtained an injunction from the English High Court of Justice in London restraining holders of its $700mn of Sukuk from taking any hostile action against the company in relation to the Islamic bonds. Last week, the company obtained similar injunctions from the Sharjah Federal Court of First Instance in the UAE and from the Commercial Division of the High Court of Justice in the British Virgin Islands. The Abu Dhabi-listed energy company announced last week that its outstanding Sukuk were not Shari’ah-compliant and were therefore unlawful and unenforceable in the UAE. The company said it would therefore halt coupon payments on the Sukuk, and proposed to its creditors exchanging the Sukuk for new Islamic bonds with lower profit distributions. (Reuters) Bank Nizwa receives Moody’s investment grade rating – Bank Nizwa was assigned a first-time rating of ‘Baa3’ by Moody’s, reflecting the bank’s top quality assets and operating margins. The rating accorded following a comprehensive long and short- term assessment of the bank’s local and foreign currency deposits, allowing it to also receive a ‘B1’ Baseline Credit Assessment (BCA). The achievement recognizes Bank Nizwa’s strong foundation as a solid Islamic financial institution underpinned by tailored products and services that continue to meet the needs of customers across the Sultanate. Moody’s rating also reflects Bank Nizwa’s strong performance and the increasing penetration of Shari’ah-compliant banking assets in Oman. As a result, the bank was also given Counterparty Risk Assessment of ‘Baa2’. The bank’s success has been driven by its continued ability to grow its local assets in a sustainable manner that supports its overall success and feeds into the development of Oman’s Islamic finance sector. (GulfBase.com) Sahara Hospitality’s net profit came in flat YoY at OMR1.3mn in 1H2017 – Oman's Sahara Hospitality net income remained flat YoY at OMR1.3mn in 1H2017. Total revenue in 1H2017 stood at OMR6.4mn as compared to OMR6.2mn a year ago. (Reuters) IIRA maintains ratings of Bahrain Islamic Bank – Islamic International Rating Agency (IIRA) reaffirmed ratings of Bahrain Islamic Bank at ‘BBB/A2’ on the national scale and ‘BBB-/A3’ on the international scale. The rating assessment of Bahrain Islamic Bank derives strength from recent positive developments that the bank has posted with improving profitability and asset quality indicators over the past couple of years. However, the bank’s rating outlook is constrained by the macroeconomic environment and tougher industry conditions facing banks in the Gulf, which may have a restrictive effect on growth whilst also implying increased systemic risks. As such, given the presence of external, regional concerns, the outlook on international scale ratings is assessed as ‘Negative’. (GulfBase.com)

- 4. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 4 of 4 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 70.0 90.0 110.0 130.0 150.0 170.0 May-13 May-14 May-15 May-16 May-17 QSE Index S&P Pan Arab S&P GCC 0.9% (0.8%) 0.6% (0.3%) 0.0% (0.0%) (0.4%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,253.65 (0.0) (1.0) 8.8 MSCI World Index 1,923.24 0.4 0.0 9.8 Silver/Ounce 16.69 (0.3) (3.0) 4.9 DJ Industrial 21,384.28 0.1 0.5 8.2 Crude Oil (Brent)/Barrel (FM Future) 47.37 1.0 (1.6) (16.6) S&P 500 2,433.15 0.0 0.1 8.7 Crude Oil (WTI)/Barrel (FM Future) 44.74 0.6 (2.4) (16.7) NASDAQ 100 6,151.76 (0.2) (0.9) 14.3 Natural Gas (Henry Hub)/MMBtu 2.97 1.6 (0.2) (19.4) STOXX 600 388.60 1.0 (0.5) 14.1 LPG Propane (Arab Gulf)/Ton 59.13 0.2 (0.8) (18.0) DAX 12,752.73 0.8 (0.6) 17.8 LPG Butane (Arab Gulf)/Ton 66.50 0.4 0.2 (43.1) FTSE 100 7,463.54 0.8 (0.5) 8.2 Euro 1.12 0.5 0.0 6.5 CAC 40 5,263.31 1.3 (0.8) 14.8 Yen 110.88 (0.0) 0.5 (5.2) Nikkei 19,943.26 0.7 (0.7) 9.8 GBP 1.28 0.2 0.3 3.6 MSCI EM 1,003.12 (0.1) (1.5) 16.3 CHF 1.03 0.2 (0.4) 4.6 SHANGHAI SE Composite 3,123.17 (0.2) (1.2) 2.7 AUD 0.76 0.6 1.2 5.7 HANG SENG 25,626.49 0.3 (1.6) 15.8 USD Index 97.16 (0.3) (0.1) (4.9) BSE SENSEX 31,056.40 0.2 (0.8) 23.0 RUB 57.63 (0.4) 1.0 (6.3) Bovespa 61,626.41 (0.8) (1.4) 1.0 BRL 0.30 (0.6) 0.1 (1.2) RTS 994.38 0.2 (4.5) (13.7) 106.0 97.9 95.9