QNBFS Daily Market Report March 6, 2017

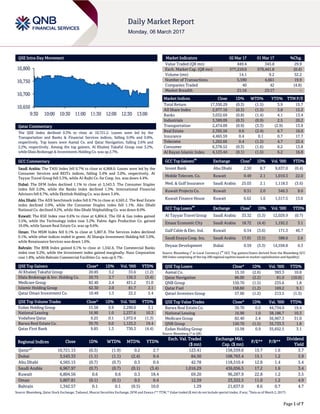

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.3% to close at 10,721.2. Losses were led by the Transportation and Banks & Financial Services indices, falling 0.9% and 0.8%, respectively. Top losers were Aamal Co. and Qatar Navigation, falling 2.6% and 2.2%, respectively. Among the top gainers, Al Khaleej Takaful Group rose 3.2%, while Dlala Brokerage & Investments Holding Co. was up 2.7%. GCC Commentary Saudi Arabia: The TASI Index fell 0.7% to close at 6,968.0. Losses were led by the Consumer Services and REITs indices, falling 3.4% and 3.0%, respectively. Al Tayyar Travel Group fell 5.3%, while Al-Rajhi Co. for Coop. Ins. was down 4.4%. Dubai: The DFM Index declined 1.1% to close at 3,543.3. The Consumer Staples index fell 2.0%, while the Banks index declined 1.3%. International Financial Advisors fell 6.7%, while Ekttitab Holding Co. was down 3.4%. Abu Dhabi: The ADX benchmark index fell 0.7% to close at 4,565.2. The Real Estate index declined 2.0%, while the Consumer Staples index fell 1.1%. Abu Dhabi National Co. declined 9.2%, while Abu Dhabi Shipbuilding Co. was down 8.0%. Kuwait: The KSE Index rose 0.6% to close at 6,804.6. The Oil & Gas index gained 3.5%, while the Technology index rose 3.2%. Palms Agro Production Co. gained 10.0%, while Sanam Real Estate Co. was up 9.6%. Oman: The MSM Index fell 0.1% to close at 5,807.8. The Services index declined 0.1%, while other indices ended in green. Al Sharqia Investment Holding fell 3.0%, while Renaissance Services was down 1.6%. Bahrain: The BHB Index gained 0.1% to close at 1,342.6. The Commercial Banks index rose 0.2%, while the Investment index gained marginally. Nass Corporation rose 1.8%, while Bahrain Commercial Facilities Co. was up 0.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Group 20.85 3.2 33.6 (1.2) Dlala Brokerage & Inv. Holding Co. 20.75 2.7 136.3 (3.4) Medicare Group 82.40 2.4 451.2 31.0 Islamic Holding Group 62.30 2.0 81.7 2.1 Qatar Oman Investment Co. 10.49 1.5 22.2 5.4 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 15.58 0.9 2,290.0 3.1 National Leasing 16.90 1.0 2,237.6 10.3 Vodafone Qatar 9.25 0.1 1,972.4 (1.3) Barwa Real Estate Co. 39.70 0.0 1,125.2 19.4 Qatar First Bank 9.85 1.3 730.3 (4.4) Market Indicators 02 Mar 17 01 Mar 17 %Chg. Value Traded (QR mn) 449.4 345.8 29.9 Exch. Market Cap. (QR mn) 577,210.0 579,441.8 (0.4) Volume (mn) 14.1 9.2 52.2 Number of Transactions 5,590 4,661 19.9 Companies Traded 40 42 (4.8) Market Breadth 21:16 23:17 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,550.29 (0.3) (1.5) 3.9 15.7 All Share Index 2,977.16 (0.3) (1.5) 3.8 15.2 Banks 3,032.69 (0.8) (1.4) 4.1 13.4 Industrials 3,389.09 (0.3) (0.9) 2.5 20.2 Transportation 2,474.09 (0.9) (3.3) (2.9) 13.9 Real Estate 2,395.56 0.6 (2.4) 6.7 16.0 Insurance 4,465.59 0.4 0.1 0.7 17.7 Telecoms 1,262.66 0.4 (1.2) 4.7 22.4 Consumer 6,378.52 (0.3) (1.6) 8.2 13.8 Al Rayan Islamic Index 4,123.44 (0.1) (1.5) 6.2 16.8 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Invest Bank Abu Dhabi 2.50 8.7 9,637.0 (0.4) Mobile Telecom. Co. Kuwait 0.49 2.1 1,010.3 22.0 Med. & Gulf Insurance Saudi Arabia 25.03 2.1 1,118.3 (3.6) Kuwait Projects Co. Kuwait 0.51 2.0 546.3 8.0 Kuwait Finance House Kuwait 0.62 1.6 1,517.5 13.0 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Al Tayyar Travel Group Saudi Arabia 33.32 (5.3) 12,029.9 (0.7) Emaar Economic City Saudi Arabia 18.72 (4.4) 1,192.2 3.1 Gulf Cable & Elec. Ind. Kuwait 0.54 (3.6) 171.3 46.7 Saudi Enaya Coop. Ins. Saudi Arabia 17.01 (3.5) 588.6 2.6 Deyaar Development Dubai 0.59 (3.3) 14,558.8 0.3 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Aamal Co. 15.10 (2.6) 383.3 10.8 Qatar Navigation 86.00 (2.2) 81.0 (10.0) QNB Group 150.70 (1.5) 235.6 1.8 Qatar Fuel 158.60 (1.2) 169.2 9.1 Qatari Investors Group 57.60 (1.2) 213.5 (1.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Co. 39.70 0.0 44,734.0 19.4 National Leasing 16.90 1.0 38,186.7 10.3 Medicare Group 82.40 2.4 36,967.3 31.0 QNB Group 150.70 (1.5) 35,733.3 1.8 Ezdan Holding Group 15.58 0.9 35,652.5 3.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar*# 10,721.15 (0.3) (1.9) 0.2 2.7 123.41 158,559.6 15.7 1.6 3.7 Dubai 3,543.33 (1.1) (1.1) (2.4) 0.4 84.50 108,763.4 15.1 1.2 3.9 Abu Dhabi 4,565.15 (0.7) (0.7) 0.3 0.4 42.78 118,510.4 12.8 1.4 5.4 Saudi Arabia 6,967.97 (0.7) (0.7) (0.1) (3.4) 1,016.29 436,056.5 17.2 1.6 3.4 Kuwait 6,804.56 0.6 0.6 0.3 18.4 69.20 96,287.9 22.8 1.2 3.5 Oman 5,807.81 (0.1) (0.1) 0.5 0.4 12.59 23,322.5 11.0 1.2 4.9 Bahrain 1,342.57 0.1 0.1 (0.5) 10.0 1.29 21,637.0 8.6 0.7 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, DFM and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of March 2, 2017) 10,650 10,700 10,750 10,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.3% to close at 10,721.2. The Transportation and Banks & Financial Services indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Aamal Co. and Qatar Navigation were the top losers, falling 2.6% and 2.2%, respectively. Among the top gainers, Al Khaleej Takaful Group rose 3.2%, while Dlala Brokerage & Investments Holding Co. was up 2.7%. Volume of shares traded on Thursday rose by 52.2% to 14.1mn from 9.2mn on Wednesday. Further, as compared to the 30-day moving average of 9.4mn, volume for the day was 49.2% higher. Ezdan Holding Group and National Leasing were the most active stocks, contributing 16.3% and 15.9% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 2016 % Change YoY Operating Profit (mn) 2016 % Change YoY Net Profit (mn) 2016 % Change YoY Saudi Airlines Catering Co.* Saudi Arabia SR – – – – 541.1 -22.5% Jazan Development Co.* Saudi Arabia SR – – 11.3 -30.6% 6.1 -72.4% United Cooperative Assurance Co.* Saudi Arabia SR 819.6 -35.6% 1.3 -86.3% 99.8 N/A Wataniya Insurance Co.* Saudi Arabia SR 507.7 -2.1% – – 1.7 92.5% Saudi Paper Manufacturing Co.* Saudi Arabia SR – – -25.6 N/A -67.5 N/A Al-Ahlia Insurance Co.* Saudi Arabia SR 167.1 -35.6% – – 0.4 N/A AXA Cooperative Insurance Co.* Saudi Arabia SR 1,154.0 2.3% – – 8.9 17.2% Ras Al Khaimah Poultry & Feeding* Abu Dhabi AED 35.5 -45.2% – – 11.3 -49.9% Source: Company data, DFM, ADX, MSM, TADAWUL (*FY2016) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/02 US Department of Labor Initial Jobless Claims 25-February 223k 245k 242k 03/02 US Department of Labor Continuing Claims 18-February 2,066k 2,060k 2,063k 03/03 US Markit Markit US Services PMI February 53.8 54 53.9 03/03 US Markit Markit US Composite PMI February 54.1 – 54.3 03/02 EU Eurostat PPI MoM January 0.7% 0.7% 0.8% 03/02 EU Eurostat PPI YoY January 3.5% 3.2% 1.6% 03/02 EU Eurostat Unemployment Rate January 9.6% 9.6% 9.6% 03/02 EU Eurostat CPI Estimate YoY February 2.0% 2.0% 1.8% 03/02 EU Eurostat CPI Core YoY February 0.9% 0.9% 0.9% 03/03 France Markit Markit France Services PMI February 56.4 56.7 56.7 03/03 France Markit Markit France Composite PMI February 55.9 56.2 56.2 03/03 Japan ESRI Consumer Confidence Index February 43.1 43.5 43.2 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of board meeting No. of days remaining Status MRDS Mazaya Qatar 14-Mar-17 8 Due QFBQ Qatar First Bank 14-Mar-17 8 Due AKHI Al Khaleej Takaful Insurance 14-Mar-17 8 Due AHCS Aamal Company 15-Mar-17 9 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 34.44% 39.11% (20,965,229.97) Qatari Institutions 22.75% 29.69% (31,166,158.00) Qatari 57.19% 68.80% (52,131,387.97) GCC Individuals 1.48% 1.36% 527,971.97 GCC Institutions 2.84% 8.68% (26,254,401.90) GCC 4.32% 10.04% (25,726,429.93) Non-Qatari Individuals 7.75% 8.99% (5,596,725.64) Non-Qatari Institutions 30.74% 12.17% 83,454,543.54 Non-Qatari 38.49% 21.16% 77,857,817.90

- 3. Page 3 of 7 News Qatar QSE announces trading suspension in the shares of DHBK on March 6 – Qatar Stock Exchange (QSE) announced trading suspension of the shares of Doha Bank (DHBK) on March 6, 2017 due to its AGM and EGM being held on the day. (QSE) QSE announces trading suspension in the shares of QFLS on March 6 – Qatar Stock Exchange (QSE) announced trading suspension of the shares of Qatar Fuel Company (QFLS) on March 6, 2017 due to its AGM and EGM being held on the day. (QSE) QSE announces trading suspension in the shares of QEWS on March 6 – Qatar Stock Exchange (QSE) announced trading suspension of the shares of Qatar Electricity and Water Company (QEWS) on March 6, 2017 due to its AGM and EGM being held on the day. (QSE) QSE announces trading suspension in the shares of MPHC on March 6 – Qatar Stock Exchange (QSE) announced trading suspension of the shares of Mesaieed Petrochemical Holding Company (MPHC) on March 6, 2017 due to its AGM and EGM being held on the day. (QSE) QCSD deposited the bonus shares of QNCD – Qatar Central Securities Depository (QCSD) has deposited the bonus shares of Qatar National Cement Company (QNCD). The new capital is QR653,528,940 and the new total shares is 65,352,894. The bonus shares will be available for trading starting from March 6, 2017. (QSE) QNCD’s AGM & EGM endorses items listed on its agenda and approves the distribution of 40% cash dividend – Qatar National Cement Company (QNCD) announced the resolutions of Annual General Assembly and Extraordinary General Assembly Meeting (AGM & EGM) held on March 1, 2017 and approved a distribution of 40% from the company’s share capital as cash dividends for 2016. The EGM has approved a distribution of 10% from the company’s share capital as bonus shares, one free share for each ten shares held for the year 2016. (QSE) Qatar within FTSE global equity index series – As per announcement made by FTSE on March 1, 2017, “Treatment of Qatar within FTSE Global Equity Index Series”, 20 of the 22 companies selected in September 2016 will see their investibility weights doubled. The companies are Al Meera Consumer Goods Company, Barwa Real Estate, Commercial Bank of Qatar, Doha Bank, Ezdan Holding Group, Gulf International Services, Industries Qatar, Masraf Al Rayan, Medicare Group, Ooredoo, Qatar Electricity & Water Company, Qatar Gas Transport Company, Qatar Insurance, Qatar International Islamic Bank, Qatar Islamic Bank, QNB Group, Qatar Navigation, Salam International Investment Ltd, United Development Company and Vodafone Qatar. 2 of the 22 (Aamal and Qatari Investors Group) will remain with the same investibility weights. The changes to the FTSE Secondary Emerging Market index will be on March 20, 2017. (QSE) MARK’s board of directors announces the opening of candidacy to fill seven seats – Masraf Al Ryan (MARK) board of directors announced the opening of candidacy to fill seven seats for three years (2017-2019). Applications will be received starting from March 6, 2017 to March 20, 2017. (Peninsula Qatar) BRES eyes investment opportunities to ensure profitable revenue growth – Barwa Real Estate Company (BRES) will keep exploring investment opportunities to ensure profitable revenues and said its low-cost warehousing projects Mustawdaat as well as Phase I of Madinat Al Mawater are slated to be completed by this year. The company has also initiated steps to develop an integrated residential and commercial project in Saudi Arabia. Highlighting that the company has laid out a five-year business plan (2016-20), Barwa Chairman Salah bin Ghanim Nasser al-Ali said, “The group will continue to analyze available investment opportunities in light of our business plan in order to achieve sustainable growth and ensure profitable revenues for our shareholders.” On its future plan, the chairman, in the board of directors’ report, said it would include the construction and operationalizing the Mustawdaat project and Phase I of the Madinat Al Mawater. (Gulf-Times.com) QFLS to open 15 new fuel stations this year – Qatar Fuel (QFLS), which currently has 56 gasoline stations in operation in the country, plans to open another 15 new gasoline stations this year and is also in talks with the government to get approval for 40 more additional land plots, the company's CEO Ibrahim Jaham al Kuwari said. He said the company would like to open more fuel stations subject to getting land allotment from the government. The 15 new gasoline stations are in par with the company's aim to have a total of 100 gasoline stations in the country by 2020, Ibrahim said, adding that the vision of the company is to become the region’s leading petroleum products and related services marketing company. (Qatar Tribune) Qatar & Canada to boost bilateral investments – Qatar and Canada discussed issues related to further enhancing bilateral investment. François-Philippe Champagne, Minister of International Trade of Canada, met with Minister of Energy and Industry HE Dr Mohammed bin Saleh Al Sada and Minister of Economy and Commerce, HE Sheikh Ahmed bin Jassim Al Thani. During his first official visit to Qatar, the Canadian Minister also met Akbar Al Baker, Chief Executive of Qatar Airways. The Minister and his counterparts touched on priority issues such as potential opportunities for increased collaboration between Canadian companies and Qatar private and public sectors in key areas including energy, transportation, infrastructure, education and health. “The Minister’s visit confirms that Canada enjoys a strong and growing bilateral relationship with Qatar that is reinforced by commercial ties between the two countries” said Adrian Norfolk, Ambassador of Canada to Qatar. (Peninsula Qatar) Ooredoo builds position as regional IoT leader – Ooredoo announced the expansion of its Managed Connectivity Platform to Qatar, taking the number of countries covered by the service to four, alongside Indonesia, Tunisia and Kuwait. In expanding the service to major markets, Ooredoo is positioning itself as a leading regional IoT player, and the company is in discussion with a number of global leaders looking to use its network during this week’s Mobile World Congress. (Peninsula Qatar) Qatar least affected by recession, economic headwinds – Qatar, among other petroleum states, is still the least affected by

- 4. Page 4 of 7 economic headwinds caused by the global recession, SAK Holding Group revealed in its monthly real estate report. Qatar’s resiliency, according to the report, was due to government efforts and continued spending on major infrastructure projects, particularly those related to the FIFA World Cup games in 2022. In the real estate sector, the report said, “Concerned authorities are wisely managing the real estate file, which slowed down the severity of the crisis, cut losses short, promoted confidence and optimism in the real estate sector, and bringing about a quick recovery…this confirms that real estate investors’ appetite is fine.” The report said this was corroborated by a QNB Group report, which stressed that government investment is still attracting manpower to Qatar, reinforces the need to provide several services and increase the overall demand in the economy. (Gulf- Times.com) Qatar plans to double income from tourism – Qatar is planning to almost double its tourism income over the next few years as visitor numbers grow with the country hosting the 2022 FIFA World Cup. The Qatar Tourism Authority (QTA) predicts the tourism sector's total economic contribution will reach QR81.2bn (or 7.3% of GDP by 2026, up from QR48.5bn in 2015). In 2015, investment in travel and tourism activity comprised 2.2% of the country's total spending, which is expected to rise by 8.6% per year to 2026. The introduction of new demand drivers is seen as vital to supporting the continued rise in leisure spending, which is expected to reach QR44.9bn in 2026, while business travel spending is expected to rise to QR17.5bn in 2026, according to a report in The National. Experiential travel, the main theme of this year's Arabian Travel Market (ATM), is driving tourism growth in Qatar, as the country works towards its 2030 vision to welcome 10mn visitors a year and generate $17.8bn in tourism receipts. (Qatar Tribune) New arbitration law to enhance Qatar’s investment climate – The new arbitration law will help enhance the investment climate of Qatar, which is poised to transform itself into a regional hub for arbitration, an official of the Qatar International Centre for Conciliation & Arbitration (QICCA) said. QICCA board member Sheikh Thani bin Ali bin Saud AZ al- Thani said the state recently approved Arbitration Law No 2 of 2017 “to govern arbitrations where the seat of the arbitration is Qatar.” “At Qatar Chamber, we are working a lot on the problems of trading or commercial companies so this is a very important accomplishment from legislators in Qatar to improve the country’s arbitration and investment climate,” Sheikh Thani told Gulf Times. He explained that the new law is largely based on the Uncitral Arbitration Model Law, as revised in 2006. The Uncitral website states that Uncitral has been recognized as the core legal body of the United Nations system in the field of international trade law. (Gulf-Times.com) International Eurozone private sector business growth near 6-year high – Eurozone private sector business activity rose at its quickest pace in nearly six years in February, accelerating across all major economies with job creation reaching its fastest in almost a decade, surveys showed. The data, which came alongside news that Eurozone inflation had just surpassed the European Central Bank's target, could pose a challenge to policymakers in how to explain leaving monetary policy unchanged even as the economy picks up sharply. IHS Markit's final composite Purchasing Managers' Index - seen as a good overall growth indicator - rose sharply to 56.0 in February from 54.4 in the previous month. It has not been higher since April 2011 and was unchanged from a flash estimate. While separate official data showed German retail sales unexpectedly dropped in January, the PMIs showed that February private sector services activity in Europe's four largest economies Germany, France, Italy and Spain all improved. (Reuters) UK manufacturers enjoy post-Brexit surge in orders – Britain's factories are growing at their fastest pace in more than three years, helped by the fall in the value of the pound after the Brexit vote and a recovery in core markets in Europe, a survey showed. The survey, by manufacturing lobby group EEF and consultancy BDO, added to signs that British factories are enjoying a growth spurt, something that Brexit supporters said would be one of the early benefits of leaving the European Union. However, many economists say the revival is unlikely to offset fully the impact on the economy of slower consumer spending as sterling's fall pushes up inflation. Manufacturing accounts for about 10 percent of Britain's economy. (Reuters) UK economy's strong growth since Brexit vote starts to slow – Britain's unexpectedly strong economic growth since last June's Brexit vote may be starting to fade as inflation picks up, according to a major business survey that chimed with notes of caution from several top companies. Slowing consumer spending started to hurt services companies in February, an unpromising signal for the economy ahead of Britain's divorce with the European Union, Markit/CIPS UK Services Purchasing Managers' Index (PMI) showed. As finance minister Philip Hammond puts the final touches on his first annual budget on March 8, the survey is likely to reinforce his sense that Britain's strong growth since last year's vote to leave the EU will fade this year. The services PMI fell to a five-month low of 53.3 from 54.5 in January and suggested the economy is now expanding at a quarterly pace of around 0.4% - much slower than the 0.7% expansion during the fourth quarter of 2016. Sterling slid to a seven-week low against the dollar after the PMI was published; prompting investors to discount further the chance of the Bank of England raising record low interest rates any time soon. (Reuters) PMI: German services sector growth strengthens in February – Growth in Germany's services sector accelerated in February after weakening to a four-month low at the start of the year, a survey showed on Friday, suggesting Europe's largest economy will post healthy growth in the first quarter. Markit's final services index rose to 54.4 from 53.4 in January, helped by a sharper increase in new business in post and telecommunications as well as transport and storage. Markit's final composite Purchasing Managers' Index (PMI), which tracks the activity in manufacturing and services that together account for more than two-thirds of the economy, rose to 56.1 from 54.8 in January to reach a 34-month high. Markit's final PMI for manufacturing showed growth had accelerated at the strongest rate in nearly six years in February. It said the results suggest manufacturing would contribute to overall growth in the first quarter. Results suggest that the services sector, which

- 5. Page 5 of 7 is not traditionally a German strength, would also make a contribution to growth. Services providers recorded the strongest expansion in new work since February 2016 after three months of slowing growth. (Reuters) PMI: French private sector grows at fastest pace since May 2011 – Activity in the French private sector picked up in February to expand at a pace not seen since 2011, helped by a recovery in the hotel and restaurant business that had been hit by declining tourism, a survey showed. Data compiler IHS Markit said its purchasing managers index for services rose in February to 56.4 from 54.1 in January, slightly lower than a preliminary reading of 56.7. The index rose further away from the 50-point threshold dividing an expansion in activity from a contraction. (Reuters) Regional Saudi Arabia tourism authority to loan SR397mn in 2017 – Saudi Arabia’s Commission for Tourism and National Heritage has set aside SR397mn for 2017 to support a new lending program for hospitality and tourism projects. The announcement may be a sign that the Saudi Arabia government is unlocking funding for its National Transformation Program (NTP), a set of ambitious development targets announced in June that has been slow to get off the ground amid a fiscal crunch. According to the NTP, which aims to develop new private sectors and diversify the Saudi Arabia economy beyond oil, the tourism lending program will total SR3bn over five years. So far, the Commission has received 40 requests for funding from investors working on hotel and tourism projects, of which 8 totaling SR424mn have been sent to the Ministry of Finance for approval. The Commission is still reviewing a further 11 requests totaling SR190mn. (Gulf-Times.com) Stringent regulation transforms Saudi Arabia insurance market – According to S&P Global Ratings, in the decade since Saudi Arabia’s Cooperative Insurance Law came into full force, the Kingdom has turned what was an unregulated industry into the largest non-life and health insurance market in the Gulf Cooperation Council (GCC) region, and the most actively regulated insurance market in the Middle East. Domestic gross premium written (GPW) for 2016 are estimated at SR35.8bn, based on the sector's most recent results. In a report, S&P Global Ratings observed that the sector’s remarkable progress owes much to its principal regulator, the Saudi Arabian Monetary Agency (SAMA), which has regularly introduced new initiatives over the past decade. (GulfBase.com) Saudi Arabia leads Gulf realty investors in Turkey – Investors from the Kingdom of Saudi Arabia have emerged as the largest GCC real estate investor in Turkey and the third largest among foreign investors. Saudi Arabian investors made 1,327 transactions and purchased 564,000 square meter of real estate space in 9M2016. Arab visitors now make up the bulk of foreign real estate acquisitions in Turkey, despite the economic and political uncertainty of 2016. To amplify and facilitate investment from the GCC into Turkey, the organizers of Cityscape Turkey, will create a specialized GCC Hosted Investor Program, at the Cityscape Turkey, for interested investors to benefit from pre-arranged meetings with leading developers and brokers participating at this year’s show. (GulfBase.com) Moody’s: UAE regulatory credit changes positive for insurers – According to the Moody’s, UAE insurers will likely see a medium-term improvement in their credit profiles as the sector adjusts to financial regulations introduced in February 2015 and overcomes initial compliance hurdles. Mohammed Ali Londe, analyst at Moody’s said, “UAE’s new financial regulations should, in the medium term, underpin insurers’ profitability as well as their capitalization, asset quality and reserve adequacy. At the same time, price competition may ease as increased regulatory costs trigger industry consolidation and price hardening. Additional costs associated with the new regulations may prompt consolidation of smaller insurers, or encourage them to focus on business lines that yield adequate returns.” Profitability for UAE insurers’ remains under short- term pressure as new actuarial reserve-setting and reporting requirements will drive continued technical reserve strengthening in 2016 and 2017. Asset quality will also likely improve for insurers, as the new rules will over time limit insurers’ traditionally high exposure to riskier assets such as equities and property. In addition, Moody’s expects solvency to improve overall as the regulations set capital requirements tailored to the specific risks borne by each company. (GulfBase.com) Dubai Exports to venture into new markets in 2017 – DUBAI Exports, the export promotion agency of the Department of Economic Development (DED), is all set to take major strides in connecting Dubai trade to new markets across Africa, Central Asia, Europe and South America in 2017 after achieving outstanding success in its market outreach and capability building programs in 2016. In 2016, Dubai Exports joined 16 trade missions along with local and federal government entities, organized 402 business match-making sessions and received over 209 service requests from member companies in addition to 80 requests from importers through its overseas trade offices (OTOs). The OTOs also attracted 823 international buyers from across six countries. Overall, 2016 reinforced the role of Dubai Exports in enabling local companies to establish contacts with importers overseas and export to new markets as well as in driving exports and re-exports through Dubai. (GulfBase.com) Damac awards Business Bay tower contract – Damac Properties has awarded a contract worth AED200mn for implementing the main works at its residential project Merano Tower in Business Bay, Dubai. Following the completion of the substructure works at Merano Tower, the awarded contract covers the project’s main works package. The contract has been awarded to Commodore Contracting Company. (GulfBase.com) Dubai SME, RAKBank sign SME financing MoU – Dubai SME has signed a Memorandum of Understanding (MoU) with RAKBank to allow its eligible members preferential interest rates and discounted fees. The MoU will also allow eligible Dubai-based SMEs access to RAKBank’s business banking products. Abdul Baset Al Janahi, CEO of Dubai SME, said the MoU was the latest in a series of such partnerships we continue to create after identifying a gap that existed in our SME landscape in terms of mobilising resources to overcome challenges and sustain growth. RAKBank CEO Peter England said, “We are pleased to have partnered with Dubai SME, as the

- 6. Page 6 of 7 MoU ultimately means providing Dubai based SMEs with the financial support they need to grow in today’s challenging economic situation.” (GulfBase.com) Dubai Financial Market launches platform to trade ETFs – Dubai Financial Market (DFM) launched a trading platform for exchange-traded funds (ETFs) in an effort to encourage the listing of more such funds by improving liquidity. The market currently lists just one ETF, Afkar Capital's S&P UAE UCITS fund, which invests on the Abu Dhabi Securities Exchange and NASDAQ Dubai as well as DFM itself. The new platform, which DFM described as the region's first of its kind, aims to make trading smoother and more efficient. (Reuters) Dubai lender Emirates NBD to IPO Islamic REIT fund – Emirates NBD (ENBD) plans to offer shares in its Islamic real estate investment trust and list them on the Nasdaq Dubai exchange. ENBD REIT said it expects to raise about $100mn to $125mn from the offering and plans to use its proceeds to fund acquisitions of real estate assets. The trust's current portfolio consists of seven properties in the commercial and residential sectors which are all located in Dubai. (Reuters) CEO: Etisalat to invest more than AED3bn in 2017 – Etisalat plans to invest more than AED3bn in 2017 to develop infrastructure and expand mobile and fiber optic networks across UAE. Saleh Al Abdooli, CEO of Etisalat Group, said, “These investments will improve coverage across the country as well as prepare the network towards the deployment and requirements of 5G technologies.” He also added that the Etisalat network today is one of the widest, fastest and most advanced networks in the region. This is mainly due to the continuous investments made in the last few years amounting to more than AED28bn. (GulfBase.com) Abu Dhabi's Mubadala sells part stake in AMD for $613mn – Abu Dhabi investment fund Mubadala Development Co. sold nearly a third of its stake in Advanced Micro Devices (AMD), booking a tiny gain on its investments in the micro chip maker. Mubadala sold 45mn shares in AMD for around $613mn while retaining 97mn shares in the company. Mubadala paid $608mn in November 2007 when it bought the shares. Mubadala spokesman Brian Lott said, "In line with our strategy as a long- term investor, from time to time we will monetize assets that have significantly increased in value." (Reuters) Business environment in Oman gets major boost from e- services – According to the Ministry of Commerce and Industry (MoCI), more than 193,000 commercial transactions were carried out through the online service in 2016, 448.6% increase on 2015. New company registrations, amendments to commercial names and import license applications were among the procedures completed. One of the major developments for prospective foreign investors in Oman in 2016 was the removal in October of the proof of capital requirement, which mandated that new businesses provide a bank statement demonstrating a minimum of $390,000 within the first sixth months of operation. (GulfBase.com) Investcorp acquires 3i’s debt management business – Bahrain- based alternative investment fund Investcorp said it has completed the acquisition and integration of “3iDM,” the debt management business of 3i Group. The business, now recognized as Investcorp Credit Management (ICM), adds $11bn of assets under management, bringing the total to $21.4bn. The ICM is a leading global credit investment platform, managing funds which invest primarily in senior secured corporate debt issued by mid and large-cap corporate in Western Europe and the US. (GulfBase.com) Gulf Finance House shareholders proposes higher cash dividend – Gulf Finance House (GFH) said its shareholders have proposed to increase the cash dividends to 12%. Earlier the board had recommended a distribution of 10% cash dividends for a total sum of $59.8mn as well as approval to distribute 10% bonus shares. The shareholders also approved the proposed board recommendation to increase the authorized capital to $2.5bn and endorsing GFH’s new strategy. The new strategy is to acquire financial institutions, infrastructure investments, and investment assets by way of swapping the shares of the investors and shareholders of the target companies with GFH shares through issuance of new shares by increasing the issued and paid up capital from $597.99mn up to $1.49bn. (GulfBase.com)

- 7. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank Q.P.S.C. (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of March 2, 2017) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 QSE Index S&P Pan Arab S&P GCC (0.7%) (0.3%) 0.6% 0.1% (0.1%) (0.7%) (1.1%)(1.4%) (0.7%) 0.0% 0.7% SaudiArabia Qatar# Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,234.55 0.0 (1.8) 7.1 MSCI World Index 1,848.98 0.0 0.4 5.6 Silver/Ounce 17.98 1.2 (2.1) 13.0 DJ Industrial 21,005.71 0.0 0.9 6.3 Crude Oil (Brent)/Barrel (FM Future) 55.90 1.5 (0.2) (1.6) S&P 500 2,383.12 0.1 0.7 6.4 Crude Oil (WTI)/Barrel (FM Future) 53.33 1.4 (1.2) (0.7) NASDAQ 100 5,870.75 0.2 0.4 9.1 Natural Gas (Henry Hub)/MMBtu 2.50 (3.2) 0.8 (32.0) STOXX 600 375.23 0.4 1.3 4.0 LPG Propane (Arab Gulf)/Ton 61.25 2.1 (6.5) (15.1) DAX 12,027.36 0.3 1.8 4.9 LPG Butane (Arab Gulf)/Ton 67.75 2.1 (28.1) (42.0) FTSE 100 7,374.26 (0.2) 0.1 2.5 Euro 1.06 1.1 0.6 1.0 CAC 40 4,995.13 1.2 3.0 2.9 Yen 114.04 (0.3) 1.7 (2.5) Nikkei 19,469.17 (0.4) (1.0) 3.8 GBP 1.23 0.2 (1.4) (0.4) MSCI EM 931.07 (0.6) (1.3) 8.0 CHF 0.99 0.6 0.0 1.1 SHANGHAI SE Composite 3,218.31 (0.6) (1.6) 4.2 AUD 0.76 0.3 (1.0) 5.4 HANG SENG 23,552.72 (0.8) (1.8) 6.9 USD Index 101.54 (0.6) 0.4 (0.7) BSE SENSEX 28,832.45 0.0 (0.4) 10.2 RUB 58.24 (1.1) (0.3) (5.4) Bovespa 66,785.53 1.6 (0.9) 14.9 BRL 0.32 1.3 (0.2) 4.4 RTS 1,108.26 0.8 (1.8) (3.8) 122.9 102.1 100.5