QNBFS Daily Market Report February 28, 2019

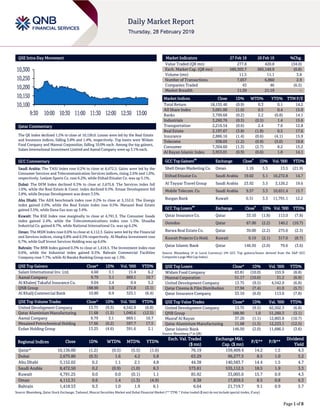

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index declined 1.2% to close at 10,136.0. Losses were led by the Real Estate and Insurance indices, falling 3.8% and 1.4%, respectively. Top losers were Widam Food Company and Mannai Corporation, falling 10.0% each. Among the top gainers, Salam International Investment Limited and Aamal Company were up 3.1% each. GCC Commentary Saudi Arabia: The TASI Index rose 0.2% to close at 8,472.5. Gains were led by the Consumer Services and Telecommunication Services indices, rising 2.6% and 1.0%, respectively. Leejam Sports Co. rose 6.2%, while Etihad Etisalat Co. was up 5.1%. Dubai: The DFM Index declined 0.3% to close at 2,675.8. The Services index fell 1.6%, while the Real Estate & Const. index declined 0.5%. Emaar Development fell 3.8%, while Deyaar Development was down 3.5%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 5,152.0. The Energy index gained 2.0%, while the Real Estate index rose 0.5%. Manazel Real Estate gained 3.5%, while Dana Gas was up 3.4%. Kuwait: The KSE Index rose marginally to close at 4,791.3. The Consumer Goods index gained 2.4%, while the Telecommunications index rose 1.5%. Shuaiba Industrial Co. gained 8.7%, while National International Co. was up 6.2%. Oman: The MSM Index rose 0.6% to close at 4,112.3. Gains were led by the Financial and Services indices, rising 0.8% and 0.5% respectively. Al Madina Investment rose 6.7%, while Gulf Invest Services Holding was up 6.6%. Bahrain: The BHB Index gained 0.3% to close at 1,418.5. The Investment index rose 0.6%, while the Industrial index gained 0.5%. Bahrain Commercial Facilities Company rose 7.7%, while Al Baraka Banking Group was up 1.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Salam International Inv. Ltd. 4.60 3.1 15.4 6.2 Aamal Company 9.79 3.1 869.1 10.7 Al Khaleej Takaful Insurance Co. 9.04 2.4 0.4 5.2 QNB Group 188.90 1.0 272.8 (3.1) Al Khalij Commercial Bank 10.80 0.9 325.1 (6.4) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% United Development Company 13.75 (9.5) 4,542.9 (6.8) Qatar Aluminium Manufacturing 11.68 (1.5) 1,040.6 (12.5) Aamal Company 9.79 3.1 869.1 10.7 Mesaieed Petrochemical Holding 17.66 (0.2) 597.7 17.5 Ezdan Holding Group 13.25 (4.6) 391.6 2.1 Market Indicators 27 Feb 19 26 Feb 19 %Chg. Value Traded (QR mn) 277.8 420.8 (34.0) Exch. Market Cap. (QR mn) 580,303.7 585,149.9 (0.8) Volume (mn) 11.5 11.1 3.8 Number of Transactions 7,057 6,860 2.9 Companies Traded 43 46 (6.5) Market Breadth 11:29 21:19 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,155.46 (0.9) 0.3 0.1 14.2 All Share Index 3,091.00 (1.0) 0.5 0.4 15.0 Banks 3,799.68 (0.2) 2.2 (0.8) 14.1 Industrials 3,260.76 (0.5) (0.5) 1.4 15.6 Transportation 2,216.54 (0.6) 2.4 7.6 12.8 Real Estate 2,197.67 (3.8) (1.8) 0.5 17.6 Insurance 2,886.16 (1.4) (0.6) (4.1) 15.9 Telecoms 938.05 (1.2) (0.9) (5.0) 19.8 Consumer 7,304.60 (1.3) (2.7) 8.2 15.2 Al Rayan Islamic Index 3,953.01 (0.9) (0.6) 1.8 14.1 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Shell Oman Marketing Co. Oman 1.16 5.5 13.5 (21.9) Etihad Etisalat Co. Saudi Arabia 19.02 5.1 10,272.8 14.7 Al Tayyar Travel Group Saudi Arabia 23.92 3.5 3,126.2 19.6 Mobile Telecom. Co. Saudi Arabia 9.57 3.3 10,651.4 15.7 Burgan Bank Kuwait 0.31 3.3 11,791.1 12.2 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Qatar Insurance Co. Qatar 33.10 (1.8) 113.0 (7.8) Ooredoo Qatar 67.00 (2.2) 140.2 (10.7) Barwa Real Estate Co. Qatar 39.00 (2.2) 275.6 (2.3) Kuwait Projects Co Hold. Kuwait 0.19 (2.1) 317.0 (8.7) Qatar Islamic Bank Qatar 146.50 (2.0) 79.6 (3.6) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Widam Food Company 63.81 (10.0) 155.9 (8.8) Mannai Corporation 51.17 (10.0) 31.2 (6.9) United Development Company 13.75 (9.5) 4,542.9 (6.8) Qatar Cinema & Film Distribution 17.94 (7.4) 41.0 (5.7) Qatar Insurance Company 33.10 (6.0) 113.0 (7.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% United Development Company 13.75 (9.5) 62,502.3 (6.8) QNB Group 188.90 1.0 51,260.3 (3.1) Masraf Al Rayan 37.20 (1.1) 12,803.8 (10.7) Qatar Aluminium Manufacturing 11.68 (1.5) 12,223.1 (12.5) Qatar Islamic Bank 146.50 (2.0) 11,686.5 (3.6) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,136.00 (1.2) (0.5) (5.5) (1.6) 76.19 159,409.4 14.2 1.5 4.3 Dubai 2,675.80 (0.3) 1.6 4.2 5.8 63.29 96,277.5 8.5 1.0 5.2 Abu Dhabi 5,152.02 0.2 1.1 2.1 4.8 44.38 140,583.7 14.4 1.5 4.7 Saudi Arabia 8,472.50 0.2 (0.9) (1.0) 8.3 573.81 535,112.5 18.5 1.9 3.3 Kuwait 4,791.25 0.0 0.0 (0.1) 1.1 85.92 33,005.0 15.7 0.9 4.3 Oman 4,112.31 0.6 1.4 (1.3) (4.9) 8.38 17,859.5 8.5 0.8 6.3 Bahrain 1,418.53 0.3 1.0 1.9 6.1 6.64 21,719.7 9.1 0.9 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,100 10,150 10,200 10,250 10,300 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index declined 1.2% to close at 10,136.0. The Real Estate and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Widam Food Company and Mannai Corporation were the top losers, falling 10.0% each. Among the top gainers, Salam International Investment Limited and Aamal Company were up 3.1% each. Volume of shares traded on Wednesday rose by 3.8% to 11.5mn from 11.1mn on Tuesday. Further, as compared to the 30-day moving average of 8.8mn, volume for the day was 30.6% higher. United Development Company and Qatar Aluminium Manufacturing Company were the most active stocks, contributing 39.5% and 9.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY AlTayyar Travel Holding Co. * Saudi Arabia SR 1,948.0 -7.5% 613.0 -24.1% -142.0 – Leejam Sports Co.* Saudi Arabia SR 800.0 9.2% 203.1 3.7% 180.1 3.4% Saudi Airlines Catering Co. * Saudi Arabia SR 2,035.8 4.3% 505.6 -5.6% 459.3 -4.7% Saudi Industrial Inv. Group * Saudi Arabia SR 8,930.0 21.3% 2,310.0 6.5% 865.0 -13.8% Gulf Cement Co.* Abu Dhabi AED 475.7 -18.4% – – -33.0 – Emirates Insurance Co.* Abu Dhabi AED 1,043.3 -3.2% – – 114.1 4.1% Nass Corporation* Bahrain BHD 182.8 5.4% – – 4.3 20.9% Bahrain Commercial Facilities Co. * Bahrain BHD 25.5 6.9% 46.3 8.3% 22.9 10.5% United Gulf Holding Company* Bahrain USD – – – – 18.6 313.3% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/27 US Mortgage Bankers Association MBA Mortgage Applications 22-February 5.3% – 3.6% 02/27 EU European Commission Economic Confidence February 106.1 106 106.3 02/27 EU European Commission Industrial Confidence February -0.4 0.1 0.6 02/27 EU European Commission Services Confidence February 12.1 10.9 11 02/27 EU European Commission Consumer Confidence February -7.4 -7.4 -7.4 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QGRI Qatar General Insurance & Reinsurance Company 4-Mar-19 4 Due AKHI Al Khaleej Takaful Insurance Company 5-Mar-19 5 Due SIIS Salam International Investment Limited 6-Mar-19 6 Due ERES Ezdan Holding Group 10-Mar-19 10 Due IGRD Investment Holding Group 12-Mar-19 12 Due DBIS Dlala Brokerage & Investment Holding Company 13-Mar-19 13 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 34.16% 28.48% 15,781,394.95 Qatari Institutions 22.98% 32.30% (25,894,723.05) Qatari 57.14% 60.78% (10,113,328.10) GCC Individuals 0.96% 0.58% 1,068,928.09 GCC Institutions 3.40% 5.12% (4,784,341.18) GCC 4.36% 5.70% (3,715,413.09) Non-Qatari Individuals 10.38% 9.65% 2,039,836.26 Non-Qatari Institutions 28.12% 23.87% 11,788,904.93 Non-Qatari 38.50% 33.52% 13,828,741.19

- 3. Page 3 of 8 News Qatar AHCS posts 26.4% YoY decrease but 1.4% QoQ increase in net profit in 4Q2018 – Aamal Company's (AHCS) net profit declined 26.4% YoY (but rose 1.4% on QoQ basis) to QR109.0mn in 4Q2018. The company's revenue came in at QR333.4mn in 4Q2018, which represents a decrease of 5.9% YoY. However, on QoQ basis, revenue rose 11.0%. EPS decreased to QR0.71 in FY2018 from QR0.80 in FY2017. In FY2018, AHCS reported net profit of QR445.3mn on revenue of QR1.29bn and recommended 6% cash dividend. Net underlying profit margin increased by 0.7 percentage points to 27% (2017: 26.3%), a company spokesman said. AHCS’ Chairman, HE Sheikh Faisal bin Qassim Al-Thani said, “While the year saw a decline in revenue and net profit compared to 2017, our performance was in line with expectations and impacted by pre-identified, short to medium- term factors.” AHCS continues to feel the impact of the reclassification of two business entities within the industrial manufacturing segment from subsidiaries to joint ventures, with a consequent change in their accounting presentation. This change will continue to impact the financial results until the first quarter of 2019, at which point the change will have fully annualized, he said. The industrial manufacturing division saw 60.4% and 39.5% decline in revenue and net profit, respectively, attributable to a change in accounting treatment for Senyar Industries and Advanced Pipes and Casts Company, both of which are now accounted for as joint ventures having both previously been consolidated as subsidiaries. Aside from this, 2018 was a year of heightened competition and increased market sensitivity towards price, AHCS stated, adding to mitigate these factors and maintain its competitive advantage, industrial manufacturing has identified several new opportunities for the incremental revenue streams and profitability. Trading and distribution segment saw 7.8% and 9.9% increase in net profit and revenue respectively, on Ebn Sina Medical – the largest business in the trading and distribution segment – which enjoyed a particularly successful year as it saw increases in both revenue and net profit. In response to the ongoing Qatar border blockade, it sourced pharmaceutical products directly from the countries of origin (Europe). The property segment reported an 8% fall in revenue and 10% in net profit. As a result of the ongoing upgrade and redevelopment work on Aamal’s flagship City Center Doha shopping mall in the West Bay, the subsidiary saw an 18% decline in net profit. Renovation work, which is progressing on schedule, is being undertaken to keep abreast of competition and cement its status as the country’s premier retail destination. Despite declining rents in the retail sector, Aamal Real Estate reported an 8% YoY increase in revenue and a 7% in net profit as it focused on expanding its residential portfolio through several acquisitions and completing the construction of 63 apartments. Revenues in the managed services segment increased marginally by 1.5%, net profit soared 17.1% with significant achievements across several subsidiaries. Aamal Services, which primarily serves the business sector and is the largest of the subsidiaries in this segment, saw an 11% fall in revenue, but a 58% jump in net profit. This significant increase in net profit is the result of a detailed expenditure review undertaken in early 2018, which led to the successful renegotiation of contract rates with suppliers. (QSE, Gulf- Times.com) BRES signs financing agreement worth QR800mn with a Qatari local bank – Barwa Real Estate Company (BRES) announced signing of a new financing agreement with a Qatari local bank worth QR800mn. The purpose of the agreement is to finance a part of the company’s capital expenditures during the year 2019. The new facility period is seven years from the date of the drawdown. It should be noted that there is no conflict of interest between the contracting parties to this agreement. (QSE) BRES to hold its AGM and EGM on March 20, 2019 – Barwa Real Estate Company’s (BRES) board of directors invited its shareholders to attend the Ordinary General Meeting (AGM) and Extraordinary General Assembly Meeting (EGM) of the company to be held on March 20, 2019. In case of lack of quorum, the next meeting will be held on March 27, 2019. (QSE) Qatar’s CPI edges down 0.3% YoY in 4Q2018 – Qatar’s consumer price index (CPI) decreased by 0.3% YoY in 4Q2018, according to data released by the Planning and Statistics Authority (PSA). PSA stated the overall CPI amounted to 108.5 points in 4Q2018, a decrease of 0.4% compared to 3Q2018. The index for food and beverages reached 101.4 points, an increase of 0.6% compared to the previous quarter, and a decrease of 2.8% YoY. The CPI of housing, water, electricity, gas and other fuels group reached 106.4 points, a decrease of 0.8% compared to the previous quarter, and 2.7% when compared to its corresponding quarter of 2017. (Qatar Tribune) QCB’s foreign exchange reserves at $49.3bn in December 2018 – Qatar Central Bank’s (QCB) foreign exchange reserves rose 1.8% MoM to reach $49.3bn in December 2018, equating to 8.8 months of import cover. Qatar’s bank assets growth was 1.8% YoY in January. QNB Group’s monthly report noted credit growth was 3.1% YoY in January. Bank deposit growth was down 1.7% YoY in January. Private sector, public sector and non-resident deposits declined 0.3%, 4.3% and 4.4% MoM, respectively, in January. Broad money supply (M2) declined 6.5% YoY in December. Interbank rates remained stable. Qatar’s real GDP growth accelerated in 3Q2018 on the back of stabilization in hydrocarbon output. Construction as well as finance & real estate led the way for 4.3% growth in non- hydrocarbon GDP over 3Q2018. Industrial production was broadly flat at 0.3% in December. The real estate price index is signaling prices are stabilizing. The fiscal account remained in surplus at 1.0% of GDP in 3Q2018. The trade balance was marginally up 0.8% YoY in January. The current account surplus has widened further in 3Q2018. Qatar’s Sovereign 5- year CDS Spreads remained stable at around 75 bps. QIBOR 3- month interest rates remained stable, while LIBOR 3-month interest rates declined. (Peninsula Qatar) UDCD eyes agriculture and industrial projects – United Development Company (UDCD), the developer of The Pearl- Qatar and Gewan Island, is studying plans to venture into the agriculture and industrial sectors in line with the country’s diversification plans. UDCD’s Chairman, Turki bin Mohamed Al-Khater said the company is looking for potential partners and experts in agriculture technologies, such as hydroponics,

- 4. Page 4 of 8 among others. The Chairman said, “We are also considering going into the agriculture type production, as well as industrial, but that’s still in the initial discussions. The facilities would be farms, as well as the production of some vegetables. But we are now trying to solicit some partner institutions for the proper technology to be used because we don’t want to go back 100 years ago. We are looking at people and countries that have experience in these fields; hopefully we could announce it at the proper time.” Al-Khater added, “UDCD’s business strategy remains focused on creating opportunities and partnerships, achieving growth, minimizing risks, and sustaining progress. UDCD also stands committed to the continued improvement of the community services that support The Pearl-Qatar, while nurturing developments and partnerships that further contribute to Qatar’s economic diversification, in line with Qatar National Vision 2030.” (Gulf-Times.com) Qatar looks to worldwide growth in LNG, says Al-Kaabi – Qatar is firm in its plans to expand its Liquefied Natural Gas (LNG) industry to global markets, according to HE the Minister of State for Energy Affairs, Saad bin Sherida Al-Kaabi. “Natural gas remains the cleanest and most environmentally friendly fossil fuel and it will dominate the future of energy,” Al-Kaabi said. Al-Kaabi, who is also President and CEO of Qatar Petroleum, visited GU-Q to discuss the future of Qatar’s energy sector, including the decision to withdraw from OPEC, and plans to increase annual capacity, explore untapped markets, and acquire new gas fields. “We are blessed to have a lot of gas and we are looking at worldwide growth and economic gains through increased capacity and a larger market share. We are in the right business,” Al-Kaabi pointed out. (Gulf-Times.com) Ooredoo accelerates 5G transformation with Artificial Intelligence in MENA and South East Asia – Ooredoo Group announced at the Mobile World Congress that it is accelerating its 5G network transformation across the MENA region and South East Asia with Artificial Intelligence (AI) solutions from P.I. Works. Following the successful deployment of P.I. Works’ Centralised Self-Organising Network (C-SON) solutions in Indonesia and Myanmar, which delivered strong results in optimizing network efficiency and costs in a short amount of time, Ooredoo Group has rolled out the technology across all operations. With the roll-out, hundreds of millions of Ooredoo customers in the company’s operations in Middle East, North Africa, and South East Asia are now experiencing significantly enhanced network coverage and connectivity, more advanced mobile apps, enhanced capacity during mega-events, and the enablement of 5G-based Internet of Things (IoT) innovations. Moreover, Ooredoo announced a new partnership with Google to become the MENA region’s first telecommunications company to launch a data plan management system. (Gulf- Times.com, Qatar Tribune) Al-Baker calls for increased liberalization of African aviation market – Qatar Airways group’s CEO, HE Akbar Al-Baker has highlighted the need for a global repositioning of Africa’s aviation industry as well as the changing political approach to aviation in the region at the Aviation Africa Summit & Exhibition, now taking place at Kigali, Rwanda. Speaking to an audience that included the President of the Republic of Rwanda, Paul Kagame as well as senior ministers, aviation industry executives and guests of honor, Al-Baker addressed the need for liberalization of aviation regulations in Africa to bring improved connectivity to travelers, as well as significant benefits in trade, tourism and employment. Al-Baker noted that although Africa makes up 16% of the world’s population, it only captures approximately 3.1% of the world’s air travelers. (Gulf- Times.com) Semi-government firms can process visas at centers abroad – The Visa Support Services Department at the General Directorate of Passports organized a seminar for semi- governmental companies to introduce their work visa procedures through Qatar Visa Centers abroad. During the seminar, Major General Abdullah Khalifa Al Mohannadi, Director of Visa Support Services Department, provided an explanation to the representatives of the semi-governmental companies about the Qatar Visa Center abroad and the procedures related to recruitment. He also said that the QVCs abroad, come within the framework of the keenness of Qatar to protect the rights of expatriates and facilitate their work procedures in a simplified and effective manner. (Peninsula Qatar) QETF discloses its financial statements for the year 2018 – Qatar Exchange Traded Fund (QETF) disclosed its financial statements for the period from February 12, 2018 to December 31, 2018. The statements showed that the net asset value as of December 31, 2018 amounted to QR364,278,852 representing QR101.93 per unit. In addition, QETF is expected to pay dividends during the second quarter of 2019. (QSE) Milaha to hold its AGM and EGM on March 18, 2019 – Qatar Navigation’s (Milaha) board of directors invited its shareholders to attend the AGM and EGM of the company to be held on March 18, 2019. In case of lack of quorum, the next meeting will be held on March 24, 2019. (QSE) Qatar Stock Exchange announces official holiday on March 3, 2019 – In implementation of the council of minister’s decision No.(33) of 2009 in respect to the state’s official holidays, considering the first Sunday of March every year as an official holiday to Qatar Central Bank, Banks and Financial Institution regulated by Qatar Central Bank and Qatar Financial Markets Authority and Qatar Stock Exchange.(QSE) International The global economy may have bottomed out already, Goldman says – The global economy may have already bottomed out, according to Goldman Sachs Group’s (Goldman) Chief Economist, Jan Hatzius. While growth remains soft, Goldman’s current activity indicator in February is slightly above the downwardly-revised December and January numbers. "Some green shoots are emerging that suggest that sequential growth will pick up from here," Hatzius and Sven Jari Stehn wrote in a note dated February 26. Still, the risk to Goldman’s global GDP forecast of 3.5% for 2019 is probably still on the downside. The case for a pickup from the current pace is strongest in the US as the drag from a tightening of financial conditions eases, according to Hatzius. Goldman also sees tentative signs of a turnaround in Chinese growth. That’s in line with Bloomberg’s snapshot of early indicators of activity. (Bloomberg) US goods trade deficit deteriorates; factory orders edge up – The US goods trade deficit widened sharply in December as slowing

- 5. Page 5 of 8 global demand and a strong Dollar weighed on exports, another sign that economic growth slowed in the fourth quarter. Other data from the Commerce Department showed new orders for US-made goods barely rose in December and business spending on equipment was much weaker than previously thought, pointing to a softening in manufacturing activity. The reports, which added to weak December data on retail sales and housing starts, could prompt economists to cut fourth-quarter GDP estimates. However some of the drag on growth from the goods trade gap and weak business spending on equipment could be offset by a strong increase in inventories in December. The goods trade deficit jumped 12.8% to $79.5bn in December, boosted also by an increase in imports. Exports fell 2.8% amid steep declines in shipments of foods, industrial supplies and capital goods. Imports increased 2.4% driven by food and capital and consumer goods. Retail inventories increased 0.9% in December after falling 0.4% in the prior month. In another report, the Commerce Department stated factory goods orders edged up 0.1% in December amid declining demand for machinery and electrical equipment, appliances and components. Data for November was revised slightly up to show factory orders falling 0.5% instead of the previously reported 0.6% drop. Economists polled by Reuters had forecasted factory orders rising 0.5% in December. (Reuters) US Trade Chief sees long-term China challenges, continued tariff threat – The US will need to maintain the threat of imposing tariffs on Chinese goods for years even if Washington and Beijing strike a deal to end a costly trade war, US Trade Representative, Robert Lighthizer told lawmakers. The US and China still have hard work ahead to secure a pact not only to end the dispute, but to ensure any agreements are met, the top US trade negotiator told the House Ways and Means Committee at a hearing on US-China issues. In his first public comments since President Donald Trump delayed a deadline to more than double tariffs on $200bn in Chinese goods, Lighthizer detailed a long road ahead to overhaul trade dealings between the world’s two biggest economies. “The reality is this is a challenge that will go on for a long, long time,” Lighthizer said. He earlier said he “is not foolish enough” to believe that a single negotiation will change the increasingly sour bilateral trade relationship. (Reuters) UK approved to rejoin $1.7tn WTO procurement deal – The UK won approval to remain in a key World Trade Organization (WTO) agreement that governs $1.7tn worth of annual public procurement opportunities. A group of 46 nations, including the US and Japan, has agreed to let Britain stay in the Government Procurement Agreement, according to a WTO statement. Maintaining membership ensures that UK-based contractors will retain their preferential access to foreign public procurement opportunities if Britain leaves the European Union without a withdrawal accord. It also ensures that the GPA’s signatories will continue to have access to the UK’s $89bn public procurement marketplace in the case of a no-deal Brexit. “The agreement is another huge step in the UK establishing itself as an independent WTO member, continuing to bang the drum for free trade and UK business,” British International Trade’s Secretary, Liam Fox said. (Bloomberg) UK’s consumer morale edges up from five-year low as Brexit uncertainty persists – British households are showing amazing stoicism as the country heads for Brexit, a market research company stated as its measure of consumer confidence edged up in February. The GfK consumer confidence index rose to -13 from -14 in January. Economists taking part in a Reuters poll had expected a slight fall to -15. January’s reading was the joint lowest since July 2013, but GfK stated consumer confidence was not showing the kind of slide seen after the June 2016 Brexit referendum or at the start of the global financial crisis a decade ago. (Reuters) Eurozone’s sentiment dips to new two-year low in February – Eurozone’s economic sentiment dipped for an eighth consecutive month to a new two-year low in February as managers in industry became more downbeat about inventories, order books and production expectations. Eurozone’s economic sentiment slipped to 106.1 points in February from an upwardly revised 106.3 in January, the European Commission stated, marking the lowest level since November 2016. Economists polled by Reuters had expected a slightly sharper decline to 106.0. The survey adds to evidence that economic prospects of the 19-member Eurozone for the start of 2019 are muted after only modest growth of 0.2% QoQ in the third and fourth quarters of 2018. Sentiment in industry fell for a third consecutive month to -0.4 points in February from 0.6 points in January, well below market expectations of 0.1. By contrast, sentiment in services, a sector which produces two thirds of the Eurozone GDP, picked up to 12.1 from 11.0 in January, against expectations that it would be unchanged, although the chief cause for the improvement was the past business situation. The mood of consumers also picked in February up to -7.4 after January’s -7.9, while sentiment in retail trade was less gloomy at -1.6 points in February from -2.1 in January. A separate business climate indicator, which helps point to the phase of the business cycle, was unchanged in February at 0.69, above the 0.60 average forecast in the Reuters poll. For January and February, this was the lowest reading since January 2017. (Reuters) Eurozone’s core inflation edges higher in January – Eurozone headline consumer inflation slowed slightly in January because of a sharp deceleration of energy price growth, but core inflation watched closely by the European Central Bank in policy decisions edged slightly higher, data showed. The European Union’s statistics office Eurostat stated consumer prices in the 19 countries sharing the Euro fell 1.0% MoM in January for a 1.4% YoY rise, in line with previous estimates and market expectations. Energy prices, which fell 0.9% on the month and were 2.7% higher than in January 2018, has slowed sharply from a 5.5% YoY growth in December and 9.1% increase in November. Eurostat stated the biggest upward push for consumer prices came from services, which contributed 0.7 percentage points to the overall YoY result, followed by food, alcohol and tobacco with 0.36 points and energy with 0.26 percentage points. (Reuters) Eurozone’s business lending growth slows sharply – Corporate lending growth in the Eurozone plunged last month, European Central Bank (ECB) data showed, giving policymakers yet another reason to provide banks with a fresh liquidity facility.

- 6. Page 6 of 8 Corporate lending expanded by 3.3% in January, well below December’s 3.9% reading and its post-crisis peak of 4.3% hit in September. Credit growth to households meanwhile held steady at 3.2%, the ECB data showed. The ECB last month warned that the growth outlook is deteriorating quickly, suggesting that the bloc’s biggest slowdown in half a decade may be longer and deeper than feared. The annual growth rate of the M3 measure of money supply, which often foreshadows future activity, slowed to 3.8% from 4.1% in December, below market expectations for 4.0%. (Reuters) Japan's factory output falls by most in a year as China demand slumps – Japan’s factory output posted the biggest decline in a year in January in a sign slowing Chinese demand and the Sino- US trade war were taking a toll on the country’s manufacturing sector, a major driver of economic growth. Adding to the gloom, retail sales in January fell short of economists’ forecast, slowing sharply from the previous month and dashing hopes that domestic demand may offset weakening external demand. The batch of weak data reinforces policymakers’ concerns that sluggish output will hit growth in the world’s third-largest economy, with exporters curbing shipments and manufacturers halting production as the Sino-US tariff war hits trade with China. The 3.7% fall in output, which closely tracks broader economic growth, was bigger than the median market forecast for a 2.5% drop and marked the third straight month of contraction. (Reuters) China’s February factory activity shrinks for third straight month, misses forecast – Factory activity in China shrank for the third straight month in February, with its official manufacturing gauge falling to a three-year low, highlighting deepening cracks in an economy facing persistently weak demand at home and abroad. The official Purchasing Manager’s Index (PMI) fell to 49.2 in February, data showed, the weakest level since February 2016. The 50-point index mark separates expansion from contraction on a monthly basis. Analysts surveyed by Reuters had forecasted the PMI to come in at 49.5, unchanged from January. Economic growth in China cooled to its weakest in almost three decades in 2018, and analysts expect a further softening in coming months before stimulus measures start to kick in. Many fear a sharper slowdown in the world’s second-biggest economy if current Sino-US trade talks fail and the dispute escalates. (Reuters) China's services activity cools in February – Growth in China’s services industry slowed in February after rebounding for two straight months, an official survey showed, and analysts expect further weakness this year as a slowing economy makes consumers more cautious about spending. The official non- manufacturing Purchasing Managers’ Index (PMI) fell to 54.3 in February from 54.7 in January, but still well above the 50-point mark that separates growth from contraction. The fast-growing services sector accounts for more than half of China’s economy, and has helped buffer the impact of slowing manufacturing. Factory activity has contracted for three straight months. However services activity softened late last year amid a cooling property market and faltering consumer demand for products from cars to mobile phones. (Reuters) Regional Saudi Aramco adds Goldman Sachs as book runner for planned bond – Saudi Aramco has added Goldman Sachs as a book runner for a planned bond which will help finance its purchase of a stake in Saudi Arabian Basic Industries Corp (SABIC), sources said. Saudi Aramco had already picked a group of banks including JPMorgan, Morgan Stanley, Citi, HSBC and Saudi Arabia’s National Commercial Bank (NCB) to help with the financing. JPMorgan and Morgan Stanley were appointed as joint global coordinators and, together with the other banks, joint book runners. (Reuters) Saudi Arabian bourse reforms small-cap market before index promotion – Saudi Arabian stock exchange (Tadawul) is making changes to its platform for trading in small- and medium-size companies, just before the country’s inclusion in major emerging-market benchmarks. The Tadawul aims to increase the number of listed companies in the segment and improve liquidity in trading, according to a statement. The changes include allowing companies to list without an initial public offering (IPO) and by reducing trade thresholds. Changes to Nomu, as the platform started in 2017 is known, are among reforms adopted by the $530bn bourse to better align itself with international markets and open up to foreign investors. FTSE Russell and MSCI Inc. had announced the inclusion of the Kingdom in their emerging-market benchmarks last year, with the upgrade happening over several tranches, starting next month. Investors and analysts expect billions of Dollars in inflows as a result. The changes to Nomu are expected in the first and second quarter. They include: i) Requirements for issuers to report financial earnings on a six-month basis instead of quarterly based reporting, ii) Developing a process for issuers to transition from the parallel market to the main market, increasing investor access by applying a minimum liquidity threshold, iii) Reducing trade thresholds and introducing the Nomu Capped Index, iv) Allowing closed-ended funds and real- estate investment trusts (REITs) to list on Nomu, and v) Introducing volatility guards and independent research. (Bloomberg) EDB sets final price guidance for debut Dollar bond – Emirates Development Bank (EDB), owned by the UAE federal government, has set the final price guidance for its $750mn Dollar bond issue at 98 basis points over mid swaps, a document issued by one of the banks leading the deal showed. Orders for the five-year senior unsecured bonds, EDB’s debut Dollar issue, totaled almost $3.5bn. Emirates NBD Capital and Standard Chartered Bank are coordinating the sale. EDB is rated ‘AA-’ (minus) by Fitch. The pricing for the issue has been revised from earlier guidance of around 130 basis points over mid- swaps. (Reuters) ADNOC and Korea's SK E&C to build world's largest oil storage facility – Abu Dhabi National Oil Company (ADNOC) has signed a deal with South Korea’s SK E&C to build the world’s largest underground oil storage facility, at a cost of $1.2bn, in the Emirate of Fujairah. Abu Dhabi’s Crown Prince, Mohammed bin Zayed Al-Nahyan said that the storage project will have a capacity of 42mn barrels. UAE’s Minister of State and ADNOC Group CEO, Sultan Ahmed Al Jaber said, “Developing this strategic oil storage mega facility will also support and further

- 7. Page 7 of 8 enable our broader trading ambitions, strengthening our ability to respond efficiently and competitively to the needs of our customers.” In January, ADNOC established a new trading venture with Italy’s ENI and Austria’s OMV that is expected to expand its trading markets. When complete in 2022, the ADNOC Fujairah Underground Storage facility will be able to store three different types of crude oil, providing ADNOC with increased flexibility to export crude through Fujairah’s Arabian Sea oil terminal, ADNOC stated. (Reuters) Aldar Investments acquires two properties in $327mn deal – Aldar Investments, a subsidiary of Aldar Properties, stated that it has acquired full ownership of Etihad Plaza and Etihad Airways Centre for $327mn. Three properties - Etihad Plaza, Etihad Airways Centre and Etihad Airways headquarters - had previously been held in three, fifty-fifty joint ventures between Aldar Properties and Etihad. Now, Etihad will take 100% ownership of Etihad Airways HQ, while the other two properties will be under the ownership of Aldar Investments, Aldar stated. As part of the deal, Aldar will assume existing debt within the Etihad Plaza and Etihad Airways Centre joint ventures in line with Aldar Investments’ debt policy to hold 35%-40% loan to value. The deal is expected to be completed in the second quarter of 2019. The deal adds 789 residential units, 17,940 square meters net leasable area (NLA) of office space and 11,000 square meters, NLA of retail space to Aldar Investments’ portfolio. The full ownership of these assets will enable Aldar Investments to recognize annualized annual net operating income of AED0.1bn, it stated. Aldar Investments also stated that it has appointed Jassem Busaibe as CEO of the company. (Reuters) Bahrain will reduce expenditure, increase revenue – Bahrain is looking at reducing expenditure while increasing revenues and will tap the market for financing needs on an opportunistic basis, the Finance Minister, Sheikh Salman bin Khalifa Al Khalifa said. He said that the Gulf Arab island state has a clear medium-term fiscal balance plan that it can support thanks to a five-year $10bn Gulf aid package. “We need to ensure three things: that there is a reduction of operational expenditure, an increase of revenues - non-oil revenues in particular - and ensuring all our spending on subsidies is directed towards citizens,” he said. The aid package pledged by Saudi Arabia, the UAE and Kuwait covers a major part of the financing requirement for the fiscal balance plan. “We will be going to the markets for the rest of that financing. We will be opportunistic,” he added. (Reuters) Bahrain sells BHD35mn 182-day bills; bid-cover at 4.49x – Bahrain sold BHD35mn of bills due on September 1, 2019. Investors offered to buy 4.49 times the amount of securities sold. The bills were sold at a price of 97.895, having a yield of 4.25% and will settle on March 3, 2019. (Bloomberg) Bahrain sells BHD100mn 364-day bills; bid-cover at 3.27x – Bahrain sold BHD100mn of bills due on February 27, 2020 on February 26. Investors offered to buy 3.27 times the amount of securities sold. The bills were sold at a price of 95.447, having a yield of 4.72% and will settle on February 28, 2019. (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 QSEIndex S&PPanArab S&PGCC 0.2% (1.2%) 0.0% 0.3% 0.6% 0.2% (0.3%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,319.85 (0.7) (0.6) 2.9 MSCI World Index 2,092.12 0.0 0.2 11.1 Silver/Ounce 15.74 (1.2) (1.1) 1.6 DJ Industrial 25,985.16 (0.3) (0.2) 11.4 Crude Oil (Brent)/Barrel (FM Future) 66.39 1.8 (1.1) 23.4 S&P 500 2,792.38 (0.1) (0.0) 11.4 Crude Oil (WTI)/Barrel (FM Future) 56.94 2.6 (0.6) 25.4 NASDAQ 100 7,554.51 0.1 0.4 13.9 Natural Gas (Henry Hub)/MMBtu 2.89 (3.0) 5.5 (11.1) STOXX 600 372.58 (0.4) 0.6 9.5 LPG Propane (Arab Gulf)/Ton 69.50 0.4 (3.1) 8.6 DAX 11,487.33 (0.6) 0.5 8.1 LPG Butane (Arab Gulf)/Ton 76.00 (2.6) (6.6) 9.4 FTSE 100 7,107.20 (0.2) 0.8 10.2 Euro 1.14 (0.2) 0.3 (0.8) CAC 40 5,225.35 (0.4) 0.4 9.7 Yen 111.00 0.4 0.3 1.2 Nikkei 21,556.51 0.3 0.3 7.2 GBP 1.33 0.4 2.0 4.4 MSCI EM 1,061.26 (0.3) 0.2 9.9 CHF 1.00 (0.2) (0.1) (2.0) SHANGHAI SE Composite 2,953.82 0.6 5.8 21.8 AUD 0.71 (0.7) 0.1 1.3 HANG SENG 28,757.44 (0.1) (0.2) 11.0 USD Index 96.15 0.2 (0.4) (0.0) BSE SENSEX 35,905.43 (0.4) (0.1) (2.5) RUB 65.78 0.1 0.6 (5.6) Bovespa 97,307.31 0.6 (0.4) 15.1 BRL 0.27 0.5 0.5 4.1 RTS 1,191.01 (0.2) (0.6) 11.4 98.1 91.9 78.8