QNBFS Daily Market Report February 21, 2019

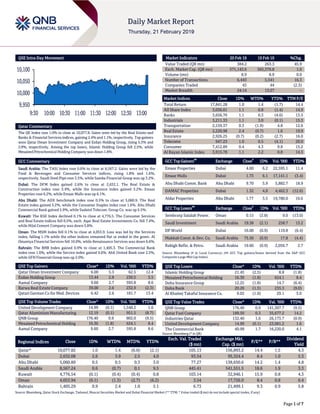

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QE Index rose 1.0% to close at 10,077.8. Gains were led by the Real Estate and Banks & Financial Services indices, gaining 2.4% and 1.1%, respectively. Top gainers were Qatar Oman Investment Company and Ezdan Holding Group, rising 5.3% and 2.8%, respectively. Among the top losers, Islamic Holding Group fell 2.5%, while Mesaieed Petrochemical Holding Company was down 1.8%. GCC Commentary Saudi Arabia: The TASI Index rose 0.6% to close at 8,567.2. Gains were led by the Food & Beverages and Consumer Services indices, rising 1.8% and 1.6%, respectively. Saudi Steel Pipe rose 3.5%, while Samba Financial Group was up 3.2%. Dubai: The DFM Index gained 2.6% to close at 2,632.1. The Real Estate & Construction index rose 5.4%, while the Insurance index gained 3.2%. Emaar Properties rose 6.2%, while Emaar Malls was up 6.1%. Abu Dhabi: The ADX benchmark index rose 0.5% to close at 5,060.9. The Real Estate index gained 3.2%, while the Consumer Staples index rose 1.6%. Abu Dhabi Commercial Bank gained 5.9%, while Sudatel Telecom. Group Co. was up 5.5%. Kuwait: The KSE Index declined 0.1% to close at 4,776.5. The Consumer Services and Real Estate indices fell 0.5%, each. Aqar Real Estate Investments Co. fell 7.4%, while Hilal Cement Company was down 5.8%. Oman: The MSM Index fell 0.1% to close at 4,053.9. Loss was led by the Services index, falling 1.1% while the other indices remained flat or ended in the green. Al Omaniya Financial Services fell 10.0%, while Renaissance Services was down 6.6%. Bahrain: The BHB Index gained 0.9% to close at 1,405.3. The Commercial Bank index rose 1.6%, while the Service index gained 0.6%. Ahli United Bank rose 2.5%, while GFH Financial Group was up 2.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Oman Investment Company 6.00 5.3 62.5 12.4 Ezdan Holding Group 13.44 2.8 230.5 3.5 Aamal Company 9.60 2.7 595.8 8.6 Barwa Real Estate Company 39.00 2.6 232.9 (2.3) Qatari German Co for Med. Devices 6.42 2.6 181.7 13.4 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% United Development Company 14.99 (0.1) 1,548.2 1.6 Qatar Aluminium Manufacturing 12.19 (0.1) 951.5 (8.7) QNB Group 176.40 0.9 802.0 (9.5) Mesaieed Petrochemical Holding 16.30 (1.8) 624.1 8.4 Aamal Company 9.60 2.7 595.8 8.6 Market Indicators 20 Feb 19 19 Feb 19 %Chg. Value Traded (QR mn) 384.2 263.3 45.9 Exch. Market Cap. (QR mn) 571,143.6 565,376.8 1.0 Volume (mn) 8.9 8.9 0.0 Number of Transactions 6,443 5,541 16.3 Companies Traded 43 44 (2.3) Market Breadth 24:14 13:27 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,841.28 1.0 1.4 (1.7) 14.4 All Share Index 3,036.01 1.1 0.8 (1.4) 14.9 Banks 3,656.70 1.1 0.3 (4.6) 13.5 Industrials 3,211.33 1.1 3.0 (0.1) 15.3 Transportation 2,159.37 0.3 (1.9) 4.8 12.6 Real Estate 2,220.98 2.4 (0.7) 1.6 19.9 Insurance 2,926.25 (0.7) (0.2) (2.7) 16.0 Telecoms 947.23 1.0 0.5 (4.1) 20.0 Consumer 7,412.89 0.4 4.3 9.8 15.2 Al Rayan Islamic Index 3,915.78 1.1 2.2 0.8 14.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Emaar Properties Dubai 4.60 6.2 22,595.1 11.4 Emaar Malls Dubai 1.73 6.1 17,141.1 (3.4) Abu Dhabi Comm. Bank Abu Dhabi 9.70 5.9 5,882.7 18.9 DAMAC Properties Dubai 1.32 4.8 4,462.3 (12.6) Aldar Properties Abu Dhabi 1.77 3.5 19,780.0 10.6 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Sembcorp Salalah Power. Oman 0.15 (3.8) 9.0 (13.0) Saudi Investment Saudi Arabia 19.38 (2.1) 258.7 13.2 DP World Dubai 16.00 (0.9) 119.8 (6.4) Makkah Const. & Dev. Co. Saudi Arabia 75.50 (0.9) 17.8 (4.4) Rabigh Refin. & Petro. Saudi Arabia 19.60 (0.9) 2,056.7 2.7 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 21.45 (2.5) 8.8 (1.8) Mesaieed Petrochemical Holding 16.30 (1.8) 624.1 8.4 Doha Insurance Group 12.25 (1.8) 14.7 (6.4) Doha Bank 20.20 (1.5) 235.3 (9.0) Al Khaleej Takaful Insurance Co. 9.02 (1.0) 29.1 5.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 176.40 0.9 141,307.7 (9.5) Qatar Fuel Company 189.50 0.3 35,677.2 14.2 Industries Qatar 132.40 1.6 26,173.7 (0.9) United Development Company 14.99 (0.1) 23,081.2 1.6 The Commercial Bank 40.99 1.7 16,220.0 4.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,077.82 1.0 1.4 (6.0) (2.1) 105.13 156,893.2 14.4 1.5 4.3 Dubai 2,632.08 2.6 3.9 2.5 4.0 93.54 95,324.4 8.4 1.0 5.3 Abu Dhabi 5,060.89 0.5 0.5 0.3 3.0 77.27 138,650.6 14.2 1.4 4.8 Saudi Arabia 8,567.24 0.6 (0.7) 0.1 9.5 445.41 541,551.5 18.6 1.9 3.3 Kuwait 4,776.54 (0.1) (0.4) (0.4) 0.8 103.14 32,946.1 15.9 0.8 4.3 Oman 4,053.94 (0.1) (1.3) (2.7) (6.2) 3.54 17,726.0 8.4 0.8 6.4 Bahrain 1,405.29 0.9 2.4 1.0 5.1 6.73 21,499.1 9.3 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,950 10,000 10,050 10,100 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE Index rose 1.0% to close at 10,077.8. The Real Estate and Banks & Financial Services indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatar Oman Investment Company and Ezdan Holding Group were the top gainers, rising 5.3% and 2.8%, respectively. Among the top losers, Islamic Holding Group fell 2.5%, while Mesaieed Petrochemical Holding Company was down 1.8%. Volume of shares traded on Wednesday rose marginally to 8.9mn from 8.9mn on Tuesday. Further, as compared to the 30-day moving average of 8.7mn, volume for the day was 1.5% higher. United Development Company and Qatar Aluminium Manufacturing Company were the most active stocks, contributing 17.4% and 10.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY National General Insurance Co. * Dubai AED 551.4 -3.5% – – 31.4 -15.2% Emirates Integrated Telecommunications Company* Dubai AED 13.4 3.2% 3.8 2.5% 1.8 2.4% Gulf Cement Co.* Abu Dhabi AED 475.7 -18.4% -49.1 N/A -33.0 N/A Al Ain Ahlia Insurance Co.* Abu Dhabi AED 1,514.4 9.1% – – 48.5 -3.3% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/20 US Mortgage Bankers Association MBA Mortgage Applications 15-February 3.6% – -6.9% 02/20 EU European Commission Consumer Confidence February -7.4 -7.7 -7.9 02/20 Germany German Federal Statistical Office PPI MoM January 0.4% -0.1% -0.4% 02/20 Germany German Federal Statistical Office PPI YoY January 2.6% 2.2% 2.7% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status MERS Al Meera Consumer Goods Company 24-Feb-19 3 Due QFLS Qatar Fuel Company 25-Feb-19 4 Due BRES Barwa Real Estate Company 25-Feb-19 4 Due QISI The Group Islamic Insurance Company 25-Feb-19 4 Due QNNS Qatar Navigation (Milaha) 25-Feb-19 4 Due QCFS Qatar Cinema & Film Distribution Company 26-Feb-19 5 Due MCCS Mannai Corporation 26-Feb-19 5 Due AHCS Aamal Company 27-Feb-19 6 Due QGRI Qatar General Insurance & Reinsurance Company 4-Mar-19 11 Due AKHI Al Khaleej Takaful Insurance Company 5-Mar-19 12 Due SIIS Salam International Investment Limited 6-Mar-19 13 Due DBIS Dlala Brokerage & Investment Holding Company 13-Mar-19 20 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 15.67% 52.37% (140,982,913.63) Qatari Institutions 22.91% 19.91% 11,542,882.48 Qatari 38.58% 72.28% (129,440,031.15) GCC Individuals 0.30% 0.57% (1,019,794.15) GCC Institutions 13.33% 2.63% 41,111,665.93 GCC 13.63% 3.20% 40,091,871.78 Non-Qatari Individuals 5.65% 6.27% (2,370,059.62) Non-Qatari Institutions 42.13% 18.26% 91,718,218.99 Non-Qatari 47.78% 24.53% 89,348,159.37

- 3. Page 3 of 7 News Qatar QOIS reports net loss of QR0.8mn in 4Q2018 – Qatar Oman Investment Company (QOIS) reported net loss of QR0.8mn in 4Q2018 as compared to net loss of QR1.2mn in 4Q2017 and QR0.3mn in 3Q2018. In FY2018, QOIS reported net profit of QR4.38mn as compared to QR9.33mn in FY2017. EPS amounted to QR0.14 in FY2018 as compared to QR0.30 in FY2017. The board of directors recommended a distribution of 3% of the share capital as a cash dividend to the shareholders for FY2018, i.e. QR0.30 for each share held. (QSE) QAMC to announce its results for December 2018 together with its full year 2019 results and hold its AGM and EGM on March 13 – Qatar Aluminium Manufacturing Company (QAMC), a company that owns 50% interest in Qatalum, a successful producer of primary aluminum and one of the largest aluminum smelters in the region, announced that the board of directors has decided to announce the results of the month December 2018 together with its full financial year 2019 as it is the view of the board that one month of operations is too short to report for substantial financial and operational information. The company has obtained the necessary no objection from the Ministry of Commerce and Industry to amend the company’s Articles of Association to have the first financial year of the company to end on December 31, 2019, and hence QAMC will be disclosing 13 months financial statements for year ending 2019. The first financial report of the company will be for four months ending March 31, 2019, and will be announced in April 2019. The board of directors will declare an interim dividend to the shareholders of the company along with its 1Q2019 disclosure. The interim dividend that will be declared will pertain to the six months period from July 1, 2018 to December 31, 2018, in line with the company’s IPO Prospectus and the founder’s economic rights waiver. QAMC will hold its Ordinary Annual General Assembly Meeting (AGM) on March 13, 2019, for the shareholders of the company, to listen to the Chairman’s message, approve the board’s recommendation for interim cash dividends along with the disclosure of the financial results for 1Q2019, and to appoint the external auditors for the financial year ending December 31, 2019. The company will also hold an Extraordinary General Assembly Meeting (EGM) on the same day to approve the amendments to the company’s Article of Association in order to have the first financial year ending on December 31, 2019, and amending the nominal value of the shares of the company to become QR1. (QSE) QIGD’s shareholders okay 7.5% cash dividend proposal – Qatari Investors Group’s (QIGD) shareholders have approved the company board of directors’ proposal to distribute a cash dividend of 7.5% of the share nominal value, which translates into QR0.75 per share. QIGD’s Chairman, Abdulla Nasser Al- Misnad presided over the company’s Ordinary and second Extraordinary General Assembly Meeting. He said despite the blockade on Qatar, the country could develop its market by giving a lot of thrust on self-sufficiency and self-reliance. The year 2018 was shaped by the difficult market situation in the GCC region, which is reflected in the group’s profit, he said. “While this made operating conditions challenging, it also increased our resolve to continue building on our track record of providing value to our shareholders and other stakeholders. We are doing so by implementing constant improvements across group entities and developing new opportunities,” Al-Misnad said. (Gulf-Times.com) Chairman: QIBK lays strong foundation for digital banking lead – Qatar Islamic Bank’s (QIBK) Chairman, Sheikh Jassim bin Hamad bin Jassim bin Jaber Al-Thani said, “Qatar outperformed its regional counterparts in 2018 despite the current political crisis, which the State managed to turn from a challenge to an opportunity for revival and positive initiatives. One evidence was the flow of foreign funds into the banking sector, and the strong performance of the securities markets. Amid all this, QIBK maintained its leading position as Qatar’s first and largest Islamic bank, with a market share of 42.3% of total Islamic assets.” He added, “In 2018, our bank laid the foundations for transformation into digital banking, taking the lead in the local market. Long hours of business design, IT development and organizational preparations were spent in cooperation with specialists from a highly qualified international consultancy firm.” QIBK’s shareholders have given approval to amend the bank’s Articles of Association to comply with the listing condition of dividing the book value per share to QR1 instead of QR10 as per instructions from the Qatar Financial Markets Authority. The approval was given during QIBK’s Extraordinary General Meeting. Article 6 of the bank’s Articles of Association was amended following which the company’s capital shall be QR2,362,932,000 divided into 2,362,932,000 shares, each share’s value being QR1. At the Ordinary Annual General Meeting, QIBK’s shareholders approved the board of directors’ proposal to distribute 50% cash dividends of the nominal value per share, which translates into QR5 per share. (Gulf- Times.com) BRES appoints Abdulla Alromaihi as a CEO of its subsidiary Waseef Company – Barwa Real Estate Company (BRES) announced the appointment of Abdulla Jobara S Alromaihi as a CEO of Waseef Company, a fully owned asset management subsidiary of BRES. The group also extended its gratitude to the former CEO for his effort in managing the company during his term and wished him success in his new assignments. (QSE) Qatar posts 42% YoY jump in 4Q2018 trade surplus to QR50.86bn – Faster expansion in exports, especially to Asia, and weakened imports helped Qatar register a 42% YoY growth in trade surplus to QR50.86bn during 4Q2018, according to official estimates. For the full year 2018, trade surplus swelled about 40% to QR191.44bn, according to figures released by the Planning and Statistics Authority. In 4Q2018, Qatar’s total exports (of domestic goods and re-exports) were QR79.7bn, which grew 16.4% on a yearly basis. Imports declined 11.6% to QR28.8bn. Asia was the principal destination of Qatar’s exports and the first origin of Qatar’s imports, representing 81.8% and 33.6% respectively; European Union (9.9% and 32.2%) and the GCC (3.8% and 1.8%). Exports to South Korea were at QR14.4bn (18.1% of total exports), Japan at QR13.7bn (17.2%), and China at QR10.1bn (12.6%). Imports from China were at QR3.6bn (12.5% of total imports), India at QR1.6bn (5.5%) and Japan at QR0.9bn (3%). Trade balance with Asia amounted to QR55.7bn,

- 4. Page 4 of 7 while total trade (exports plus imports) was QR75bn during the review period. (Gulf-Times.com) Container traffic rises at Qatar’s ports in January – Ports in Qatar have started the year on a positive note as container traffic has increased in January. According to data by Mwani Qatar, the ports handled 110,394 Twenty-Foot Equivalent Units (TEU) containers in the first month of this year, compared to 103,996 TEU containers in January 2018. Mwani Qatar manages Hamad Port, Doha Port and Ruwais Port in the country. These ports received 334 vessels in January this year. They handled 30,693 tons of building materials last month compared to 22,641 tons of aggregates in January 2018. The ports received 46,764 tons of general cargo, 5,749 vehicles and 71,896 heads of livestock, last month. Hamad Port, the largest port in the Middle East, led from the front as it occupied a lion’s share in monthly traffic. It handled 109,349 TEU containers and 5,534 vehicles in January. The ports have delivered an impressive performance last year with all round growth in all the segments. The ports achieved highest annual performance in containers, vessels and livestock segments in 2018. The ports received 4,781 vessels and handled 1.34mn TEU containers during the year. (Peninsula Qatar) EY: Qatar’s new tax laws to boost transparency, investment inflows – Qatar’s new tax laws are set to enhance transparency and encourage foreign inward investment into the country, while the unification of domestic withholding tax at a standard 5% will ease the reporting burden on taxpayers and reduce disputes with tax assessors, according to Ernst and Young (EY), a global consultant. In line with Qatar’s vision to diversify its sources of revenue and to adopt global taxation standards, the government recently introduced a new taxation law that reinforces the sovereign’s tax policy objective of offering a modern and transparent tax rules to encourage foreign inward investment into the country. “The new tax laws as drafted provide many opportunities for companies to effectively plan their operations in Qatar to minimize any tax leakages and meet the enhanced domestic and global tax reporting obligations. The full executive regulations are expected to be released in the near future,” according to Ahmed Eldessouky, Partner, Tax, EY. (Gulf-Times.com) International MBA: US mortgage requests rise as loan rates hold near 10- month low – US mortgage applications increased for the first time in five weeks as most home borrowing costs hovered near their lowest in 10 months, the Mortgage Bankers Association (MBA) stated. The Washington-based industry group stated its seasonally adjusted gauge of loan requests to buy a home and to refinance one rose 3.6% to 365.3 in the week ended February 15. The prior week’s reading was the lowest in a month. “Mortgage rates held steady on mixed economic news, as core inflation remained firm, while retail sales in December were much weaker than expected. However, overall application activity picked up over the week,” Joel Kan, MBA’s Associate Vice President of industry surveys and forecasts, said. Interest rates on 30-year fixed-rate mortgages with conforming loan balances of $484,350 or less ticked up to 4.66% from the prior week’s 4.65%, which was the lowest since March 2, 2018. (Reuters) CMS: US health spending to rise 5.5% per year over next decade – US health spending is expected to grow at an average rate of 5.5% every year from 2018 over the next decade and will reach nearly $6tn by 2027 as more people become eligible for Medicare, a government health agency stated. Rising income levels, better employment rate and more people enrolling for Medicare, the federal health insurance program for people aged 65 and above and the disabled, will cause healthcare spending to rise to 19.4% of the US economy by 2027, the Centers for Medicare & Medicaid Services (CMS) stated. In 2017, healthcare spending accounted for 17.9% of the country’s gross domestic product. Annual spending growth for Medicare is expected to average 7.4% over the 10-year period. That number exceeds spending projections for Medicaid - the government insurance program for low income Americans - and private health insurance plans, which are expected to average 5.5% and 4.8% respectively, over the same period. The CMS stated it expects Medicare enrollment growth to peak at 2.9% in 2019. (Reuters) US national debt hits record $22tn under President Trump – More massive than the US economy, the national debt hit a new record of $22tn under President Donald Trump but Republicans who traditionally rail against debt and deficits have remained mum. The sum of borrowing to cover chronic deficits as well as growing interest payments, this mountain of debt already stood at $19.95tn when Trump entered the White House, reaching the equivalent of US GDP for the first time since World War II. By comparison, France’s debt, which also is about the same as its GDP, amounted to a little more than EUR2.3tnin late September. The massive corporate tax cuts that Trump pushed for at the end of 2017, and the surge in spending, especially in defense, have increased the fiscal deficit for the world’s largest economy. Administration officials continue to argue that the tax cuts, which are expected to widen the deficit by $1.5tn over 10 years, will pay for themselves by boosting economic growth and thereby increasing tax revenues. However despite faster growth, the budget deficit climbed 17% to $779bn last year, the worst since 2012. According to the non-partisan Congressional Budget Office (CBO), the deficit is expected to widen further this year to $900bn. (Qatar Tribune) Fitch may cut UK's ‘AA’ debt rating on Brexit uncertainty – Fitch Ratings stated it may downgrade the UK’s ‘AA’ debt rating based on growing uncertainty about the negotiations between Britain and the European Union over the nation’s departure from the economic bloc next month. “Fitch believes that a ‘no-deal’ Brexit would lead to substantial disruption to UK economic and trade prospects, at least in the near term,” the rating agency stated. Fitch also stated it may lower its ‘AA’ rating on the Bank of England if it cuts the UK’s sovereign rating. (Reuters) CBI: UK’s manufacturers see stronger orders, average output growth – British factory orders picked up this month after dipping in January, and output is expected to be solid as Britain leaves the European Union, a survey from the Confederation of British Industry (CBI) showed. Although the CBI warned that Brexit talks were rapidly approaching crisis point, its data painted a more positive picture ahead of Brexit than many recent surveys of the sector. Official data last week showed the sector contracted by the biggest amount in over five years

- 5. Page 5 of 7 during the final three months of 2018. The CBI’s factory order book balance rose to +6 this month from January’s reading of -1, above all forecasts in a Reuters poll of economists and above the survey’s long-run average. Export order growth also strengthened, though manufacturers expected output growth to slow over the next three months from the above-average rates predicted in December and January. “UK manufacturing activity has moderated at the same time as headwinds from Brexit uncertainty and weaker global trading environments have grown,” CBI’s economist Anna Leach said. (Reuters) IMF likely to lower growth forecast for Germany – The International Monetary Fund (IMF) is likely to further lower its growth forecast for Germany, Die Zeit weekly newspaper paper quoted IMF’s Chief, Christine Lagarde as saying. Lagarde urged the German government to spend more money for projects like modernizing public infrastructure in order to bolster growth, the paper added. (Reuters) Japan’s manufacturing shrinks for first time since 2016 amid trade war – Japanese manufacturing activity contracted in February for the first time in two-and-a-half years as factories cut output amid shrinking domestic and export orders, a private business survey showed. The survey also showed business confidence in Japan soured for the first time in more than six years, highlighting the growing toll that the US-China trade war is inflicting on Asia’s export-reliant economies and global manufacturing. The Flash Markit/Nikkei Japan Manufacturing Purchasing Managers Index (PMI) fell to a seasonally adjusted 48.5 in February from a final 50.3 in January. The index fell below the 50 threshold that separates contraction from expansion for the first time since August 2016. The output component of the flash PMI index fell to a preliminary 47.0 from a final 54.4 in January to show the fastest contraction since May 2016. (Reuters) China will not change prudent monetary policy – China has not and will not change its prudent monetary policy and will not resort to flood-like stimulus, Premier Li Keqiang said. Market speculation is growing over whether authorities will take more aggressive policy steps after recent weak data. A central bank official reiterated Li’s comments on prudent monetary policy when interviewed by the Financial News, which is run by the central bank. The official added that the central bank will prevent risks from overly tight monetary conditions, as well as to promote reasonable growth in credit and social financing. (Reuters) Regional S&P: GCC lays groundwork for green finance – The green finance has the potential to play a bigger role in funding the region’s ambitious pipeline of green projects. The GCC region continues to make good progress toward green growth and transition to a low-carbon economy, setting new sustainabile infrastructure targets that are creating demand for capital and new green financial vehicles, S&P Global stated in a report. The GCC over the past few years has been investing in renewables, particularly solar power, and already hosts an active and growing renewables market. The International Renewable Energy Agency (IRENA) in its 2019 report expects that nearly 7 GW of new renewable power generation capacity is expected to come online by the early 2020s. These are all transactions that could be funded via green finance. (Peninsula Qatar) Saudi Electricity Company announces singing of SR15.2bn Murabah syndication loan – Saudi Electricity Company (SEC) has announced that it will sign a syndicated Murabaha facility agreement. The credit facility is valued at SR15.2bn and is for a period of 7 years. It is an unsecured credit facility and the purpose of this credit facility is for general corporate purpose including capital expenditure. The creditors for the facility include Al-Rajhi Banking & Investment Corporation, the National Commercial Bank (NCB), Saudi British Bank (SABB), Banque Saudi Fransi (BSFR), Samba Financial Group and Arab National Bank. (Tadawul) Saudi Aramco in talks on further Indian investments – Saudi Aramco is in talks on possible investments in Indian projects involving companies including Reliance Industries, operator of the world’s biggest refining complex, its CEO, Amin Nasser said. Major oil producers like Saudi Aramco are targeting Asia, where fuel demand is growing, as a stable outlet for their oil, and are splashing out on improvements in refining capacity there. Saudi Aramco and the Abu Dhabi National Oil Company (ADNOC) last year teamed up with state run Indian refiners in a plan to build 1.2mn barrels per day (bpd) refinery and petrochemical project in Maharashtra state. “We are looking at additional investment in India so we are in discussions with other companies as well, including Reliance,” he said. Saudi Arabia’s Energy Minister, Khalid Al-Falih said he wants Saudi Aramco and SABIC, the Kingdom’s petrochemical company, to be household names in India. (Reuters) Saudi Aramco will decide in the first half on financing SABIC buy – Saudi Aramco stated that it expects to decide by mid-2019 how to finance the acquisition of Saudi Arabian Basic Industries Corp (SABIC). “The decision on financing the SABIC acquisition is expected to be taken in the first half,” CEO of Saudi Aramco, Amin Nasser said. “We have internal resources, then of course there are banks and the bond market, which we are evaluating at the moment,” he added. (Reuters) Saudi Arabia’s Energy Minister hopes oil market will balance by April – Saudi Arabia’s Energy Minister, Khalid Al-Falih said that he hoped the oil market will be balanced by April and that there would be no gap in supplies due to US sanctions on OPEC members Iran and Venezuela. “We hope by April the market will be in balance,” he said, adding that the commitment to a global supply-cutting deal was “unquestionable”. (Reuters) Saudi Minister sees deal with Kuwait to resume oil output from Neutral Zone in 2019 – Saudi Arabia’s Energy Minister, Khalid Al-Falih said that the country expected to reach an agreement this year to resume oil output from the Neutral Zone it shares with Kuwait. “We hope in 2019 it will be resolved,” he said, when asked when Saudi Arabia and Kuwait could reach an agreement. “I am confident,” he said, referring to possibility of a resolution in 2019. Resuming production from the Neutral Zone’s oilfields could add up to 500,000 barrels per day each to the oil output of Saudi Arabia and Kuwait. The Saudi Arabia– Kuwaiti Neutral Zone, or Divided Zone, is an area of 5,770 square km between the borders of Saudi Arabia and Kuwait that was left undefined when the border was established by the Uqair Convention of December 2, 1922. (Reuters)

- 6. Page 6 of 7 Saudi Arabia will meet banks on export-credit finance plans – Saudi Arabia will soon discuss with international banks its plans to use export-credit agencies in other countries to help it finance infrastructure projects, sources said. Saudi Arabia has embarked on an ambitious economic transformation plan involving infrastructure projects worth billions of Dollars, in areas ranging from housing to transport. However, it has accumulated almost $60bn of debt in just over two years, and that has not included financing linked to the infrastructure projects. In January last year, the country’s debt-management office stated that it had asked banks to submit proposals for potential financing backed by export-credit agencies (ECAs). Those agencies offer loan guarantees and sometimes financing to encourage trade and lower the costs of international business. Some Saudi entities have already used such financing. Saudi Aramco, the state-owned oil company, last year signed a $2bn line of credit with UK Export Finance, the British ECA. (Reuters) Aramco Trading to open London office in overseas expansion – Saudi Aramco’s trading arm plans to open an office in London soon as it expands its international business, sources said. Aramco Trading Co. (ATC) also opened an office in the bunkering hub of Fujairah, UAE in December to trade oil products and hired two traders from Trafigura and PetroChina to run operations there, the sources said. “Last June, a trading office was inaugurated in Singapore, and last December (another) in Fujairah and very soon in London, just like any trading house,” sources added. (Reuters) DP World buys back Britain-based P&O Ferries for $421mn – DP World has bought back British ferry and shipping freight operator P&O Ferries for $421mn, more than a decade after it sold it. DP World acquired the British shipping and logistics company in 2006 but soon sold off some assets, including P&O Ferries to its major shareholder, state holding company Dubai World. DP World announced that it is buying the company, and a spokeswoman later told Reuters it had bought it back from Dubai World. Dubai World was at the heart of the Emirate’s financial crisis at the turn of the decade and was forced to restructure around $25bn of debt in 2011. DP World stated that the P&O Ferries deal is expected to be earnings accretive from the first full year of consolidation and meet its return targets. The transaction is expected to close in the first half of the year, it stated. DP World’s acquisition of P&O Ferries, which includes P&O Ferrymasters, is part of its efforts to expand beyond its core ports business. (Reuters) Dubai's ENOC partners with India's IOC to expand abroad – Dubai’s National Oil Company (ENOC) Group stated that it has formed an alliance with state-run Indian Oil Company (IOC) as part of the Dubai-based firm’s global expansion strategy. The partnership will expand ENOC’s “presence to over 180 ports in 28 countries to provide its customers with high-end marine lubricants and technical services,” the company stated. ENOC is wholly owned by the government of Dubai. (Reuters) GIC and ADIA will invest $550mn in Greenko in third capital injection – Singapore’s GIC Holdings and Abu Dhabi Investment Authority (ADIA) will invest $550mn of fresh primary capital in Greenko, Economic Times reported, citing sources. After this round, both funds will have put a total of $2bn; GIC is the largest shareholder with a 60% stake and putting in $1.4bn. Greenko’s enterprise value is now rising to $5.2bn along with $3.2bn debt. (Bloomberg) Shell signs gas development agreement with Oman Oil and Total – Shell has signed an accord with Oman oil ministry, Petroleum Development Oman, Oman Oil, and France’s Total. Shell agrees to spend and work for the areas of Block 6 natural gas project in Oman for 2019, the company stated. The agreement marks progress from the memorandum of understanding (MoU) that Shell and Total have signed with Oman in May to work on the gas project; the accord will integrate Shell and Oman Oil’s share of upstream gas project with planned gas-to-liquids plant in Oman. The last year’s agreement includes upstream development in Block 6, GTL plant and liquefied natural gas facilities. (Bloomberg) BARKA's net profit rises to $129.1mn in FY2018 – Al Baraka Banking Group (BARKA) recorded net profit of $129.1mn in FY2018 as compared to $129.0mn in FY2017. EPS came in at $0.0793 in FY2018 as compared to $0.0919 in FY2017. The company has declared a cash dividend of $0.03 per share. (Bahrain Bourse) Bahrain's Mumtalakat set to raise $600mn in Sukuk – Bahrain’s sovereign wealth fund Mumtalakat is set to raise $600mn in Sukuk, or Islamic bonds, with a 5.625% yield, a document issued by one of the banks leading the deal showed. Mumtalakat started marketing the notes earlier on Wednesday with an initial price guidance of around 6.25%. The Sukuk sale obtained orders of around $4bn. BNP Paribas, Citi, HSBC, National Bank of Bahrain (NBB) and Standard Chartered Bank have been hired to arrange the transaction. (Reuters) Ahli United Bank hires Citigroup as advisor for merger with KFH – Ahli United Bank-Bahrain, that is in talks to merge with Kuwait Finance House (KFH), has hired Citigroup to advise on the proposed transaction. The bank has also hired KPMG LLP and Linklaters LLP, it stated. The advisors will provide financial, legal and tax support as well as prepare due diligence studies. (Bloomberg) Bahrain plans to open its doors to cryptocurrency – Bahrain is planning to allow companies using cryptocurrency to work in the country on a trial basis, as it considers how to regulate them. Business Manager at Bahrain’s Economic Development Board, Dalal Buhejji said that she is confident that the central bank will issue regulation, without specifying a timeline. (Peninsula Qatar)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 QSEIndex S&PPanArab S&PGCC 0.6% 1.0% (0.1%) 0.9% (0.1%) 0.5% 2.6% (1.0%) 0.0% 1.0% 2.0% 3.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,338.48 (0.2) 1.3 4.4 MSCI World Index 2,083.64 0.4 0.8 10.6 Silver/Ounce 16.06 0.4 1.7 3.6 DJ Industrial 25,954.44 0.2 0.3 11.3 Crude Oil (Brent)/Barrel (FM Future) 67.08 0.9 1.3 24.7 S&P 500 2,784.70 0.2 0.3 11.1 Crude Oil (WTI)/Barrel (FM Future) 56.92 1.5 2.4 25.3 NASDAQ 100 7,489.07 0.0 0.2 12.9 Natural Gas (Henry Hub)/MMBtu 2.73 1.5 5.4 (16.0) STOXX 600 371.46 0.8 1.5 9.2 LPG Propane (Arab Gulf)/Ton 71.00 1.8 3.3 10.9 DAX 11,401.97 1.0 1.7 7.3 LPG Butane (Arab Gulf)/Ton 86.25 (1.1) (0.3) 24.1 FTSE 100 7,228.62 0.9 1.6 10.3 Euro 1.13 (0.0) 0.4 (1.1) CAC 40 5,195.95 0.8 1.7 9.0 Yen 110.85 0.2 0.3 1.1 Nikkei 21,431.49 0.5 2.4 6.8 GBP 1.31 (0.1) 1.2 2.3 MSCI EM 1,049.32 1.2 1.8 8.7 CHF 1.00 0.0 0.4 (1.9) SHANGHAI SE Composite 2,761.22 0.8 3.7 13.3 AUD 0.72 0.0 0.3 1.6 HANG SENG 28,514.05 1.0 2.2 10.1 USD Index 96.45 (0.1) (0.5) 0.3 BSE SENSEX 35,756.26 1.5 0.4 (2.7) RUB 65.64 (0.2) (1.0) (5.8) Bovespa 96,544.81 (1.4) (1.3) 14.4 BRL 0.27 (0.1) (0.7) 4.2 RTS 1,194.40 1.8 1.4 11.8 97.9 91.9 78.4