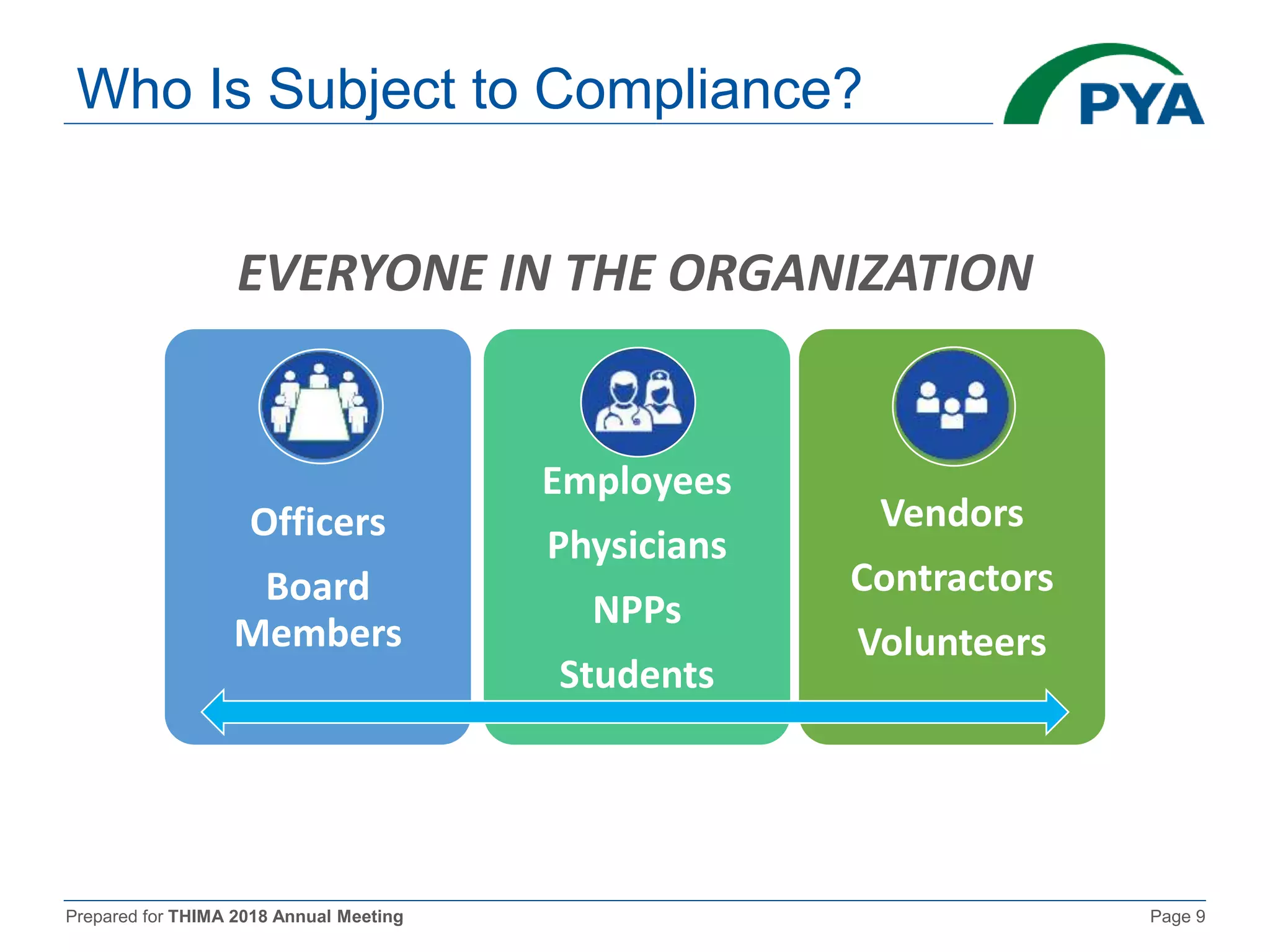

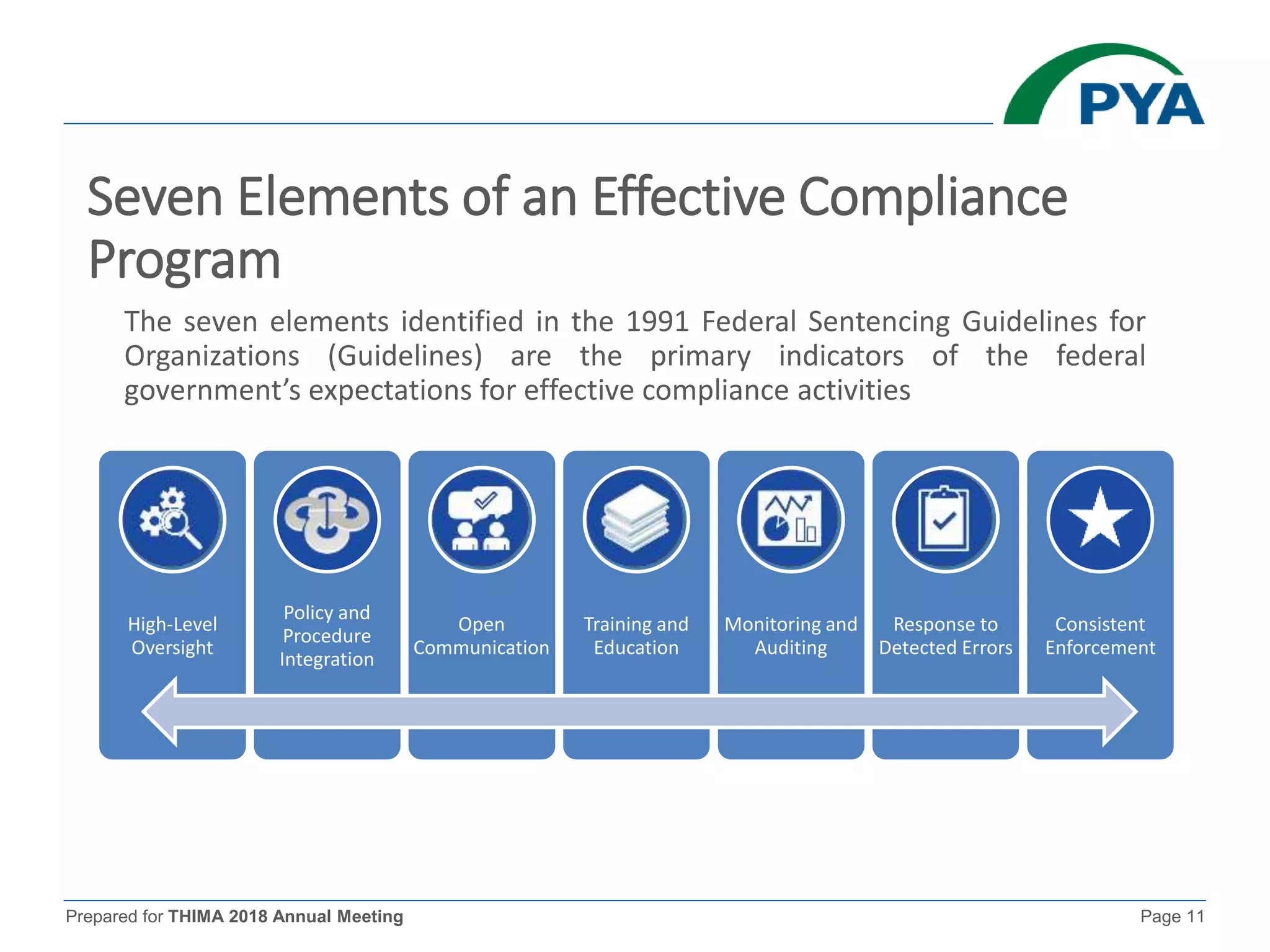

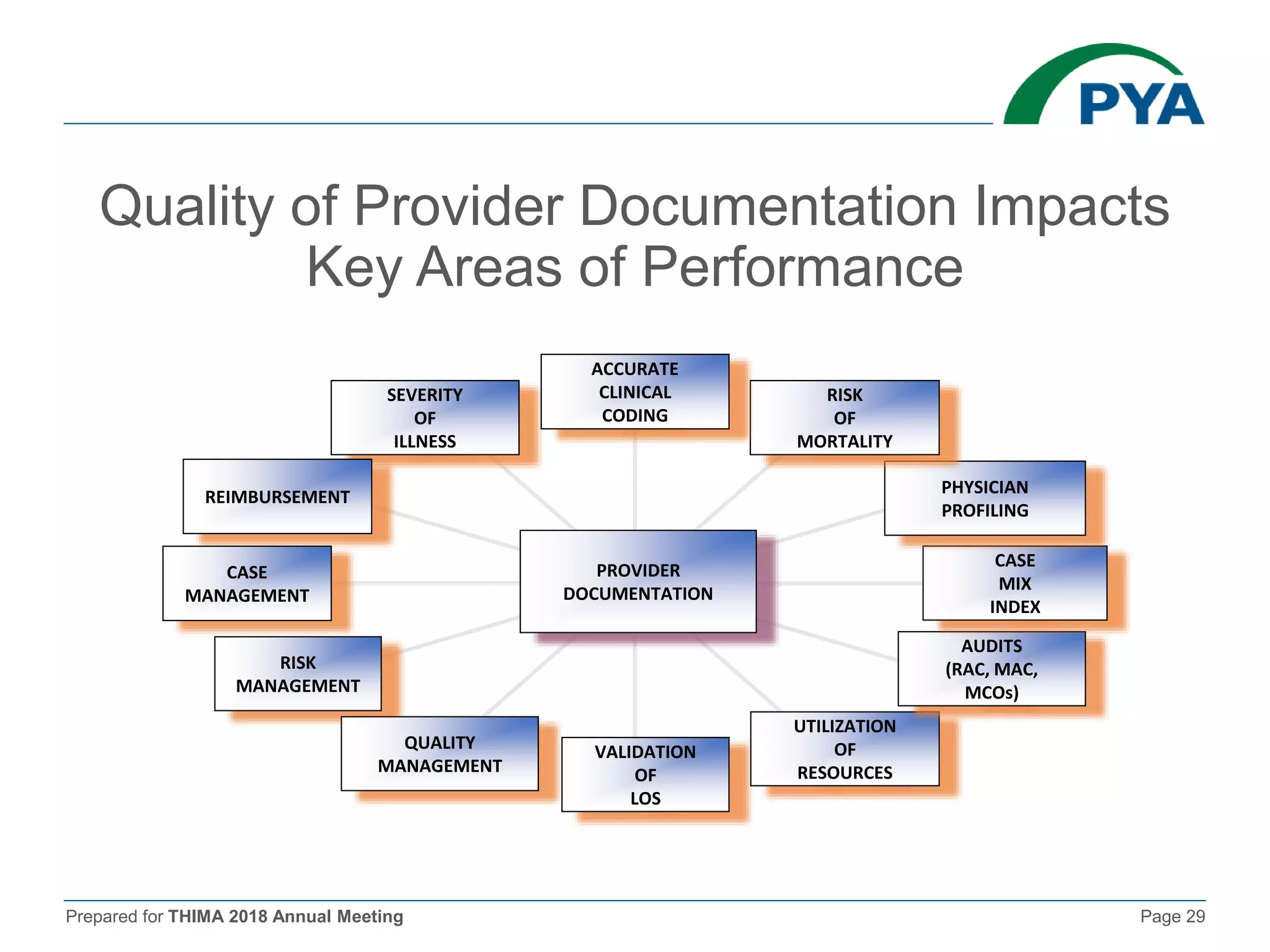

The document prepared for the THIMA 2018 annual meeting discusses the importance of compliance in healthcare and the role of Health Information Management (HIM) in supporting an effective compliance program. It outlines the seven essential elements of a robust compliance program, emphasizes the benefits of compliance in preventing fraud and improving patient care, and highlights regulatory requirements such as the Patient Protection and Affordable Care Act. The presentation also addresses specific compliance challenges and reimbursement guidelines related to non-physician providers in the Medicare system.