UNIT-3.pptx

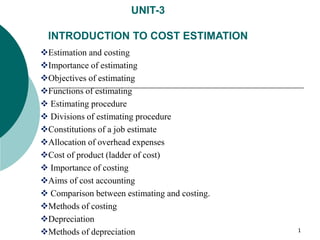

- 1. UNIT-3 INTRODUCTION TO COST ESTIMATION Estimation and costing Importance of estimating Objectives of estimating Functions of estimating Estimating procedure Divisions of estimating procedure Constitutions of a job estimate Allocation of overhead expenses Cost of product (ladder of cost) Importance of costing Aims of cost accounting Comparison between estimating and costing. Methods of costing Depreciation Methods of depreciation 1

- 2. ESTIMATION Estimating is the calculation of the costs which are expected to be incurred in manufacturing a component in advance before the component is actually manufactured. Cost estimation is a probable cost of the product that should be calculated before start of manufacturing. Probable cost Expected cost 2

- 3. COSTING Costing may be defined as a system of accounts which systematically and accurately records every expenditure in order to determine the cost of a product after knowing the different expenses incurred in various department. Costing or Cost accounting is an actual cost of the product after adding all the expenses incurred in the manufacturing processes. Actual cost Exact cost after adding all the expenses 3

- 4. IMPORTANCE OF ESTIMATING Over estimation Under estimation Realistic estimation 4

- 5. OBJECTIVES OF ESTIMATION Establish the manufacturing and selling policies of a product. Verify the quotations submitted by the vendors. Check whether a proposed product can be manufactured and marketed profitably. Make or buy decisions. Determining the most economical methods and process for making a product. Improve the designs which may reduce the cost of production. Establish a standard of performance at the start of project. For taking feasibility studies on possible new products. To assist in long term financial planning. Preparing a production budget. To set a standard estimate of costs. Determine how much must be invested in plants, equipments and tooling. 5

- 6. FUNCTIONS OF ESTIMATING Estimating are required to deal with an enquiry prior to acceptance of a new contract. i.e. to submit tenders. Estimates are required for furnishing a basis for the cost control of manufacture. To find the cost of parts to be purchased from outside vendors. To find the cost of equipment, machinery, tools, jigs and fixtures etc. required to be purchased to make the product. To decide about the profit to be charged, taking into consideration other manufacturers of same product in the market. To fix the selling price of the product. To maintain records of previous estimating activities of the company for future references. To decide the most economical method of making the product. To submit cost estimates with the competent authority for further action. 6

- 8. 1. Material Cost Material cost consists of the cost of materials which are used in the manufacture of product. Direct Material Cost It is the cost of those materials which are directly used for the manufacture of the product. The procedure for calculating the direct material cost is as follows: • Study the drawing carefully and break up the component into simple geometric shapes (cubes, prisms, cylinders etc.). • Calculate the volume of each component after adding necessary machining allowances. • Add the volumes of all the simple components to get the total volume of the product. • Product of total volume and density which gives the weight of the material. • Find the material cost by multiplying the cost per unit weight. Indirect Material Cost In addition to direct materials a number of other materials are necessary to help in the conversion of direct materials into final shape. Materials include oils, general tools, greases, sand papers, coolants, cotton waste etc. The cost associated with indirect materials is called indirect material cost. Depending upon the product manufactured, the same may be direct materials for one concern and indirect materials for others. 8

- 9. 2. Labour Cost It is the expenditure made on the salaries, wages, overtime, bonuses, etc. of the employees of the enterprise. • Direct Labour Cost Direct labour is one who actually works and processes the materials to convert it into the final shape. Examples: operating lathes, milling machines or welders, or assemblers in assembly shop. Determination of Direct Labour Cost For calculating time required for a particular job following considerations should be taken into account: i. Setup time , ii. Operation time. iii. Handling time. iv. Machining time. v. Tear down time vi. Miscellaneous allowances: Personal allowance., Fatigue allowance, Tool sharpening and changing allowance, Checking allowance, Oiling and cleaning, Filling coolant in reservoirs, Disposing of scraps and surplus stocks. • Indirect Labour Cost Indirect labour is one who is not directly employed in the manufacturing of the product but his services are used in some indirect manner. The indirect labour includes supervisors, foreman, storekeeper, gatekeeper, maintenance, staff, crane driver etc. The cost associated with indirect labour is called indirect labour cost. 9

- 10. 3. Expenses Other than the material and labour cost •Direct Expenses For example, hire of special tools and equipment, cost of special jigs and fixtures or some special patterns and its maintenance cost, costs of layouts, designs and drawings or experimental work on a particular job etc. •Indirect Expenses (Overheads) These are known as overhead charges, burden or on cost. All the expenses over and above prime cost are indirect expenses. These can be further classified as i.Factory expenses / Production expenses ii. Administrative expenses. iii. Selling expenses. iv. Distribution expenses. •Factory expenses •Rent, rates and insurance chargeable against the works. •Indirect labour example: supervision such as salaries of foreman, supervisors, factory manager etc. •Consumable stores and all forms of indirect material such as cotton waste, grease, oil, etc., •Depreciation, maintenance and repair of buildings, plant, machine tools etc., 10

- 11. •Power such as steam, gas, electricity, hydraulic or compressed air, internal transport, etc., i.Cost of preparing tenders and estimates. ii.Expenses of making blocks and posters. iii.Sales stock storage charges. •Distribution expenses These are the expenses which are paid for the distribution of the product. •Finished stock storages. •Lost of packing. •Loading, unloading charges, freight and warfare. •Expenses of transportation and vehicles. •Salaries of dispatch clerks and labourers. (ii) Administrative expenses These expenses include all the expenses on managerial or ad ministerial staff for the planning and policy making work. Some examples of administrative expenses are: •Salaries of directors and managing directors. •Salaries of cost, finance and secretary office staff including clerks and peons. 11

- 12. •Expenses of direct amenities like telephone, coolers and other modern equipments. •Travelling expenses for attending meetings etc. Charges for electric consumption for light, heating and cooling. •Stationary, auditing expenses. •Insurance of building and employees, repairs, maintenance and depreciation of building and furniture. (iii) Selling expenses These consist of the expenditures spent towards securing orders, and finding or retaining markets for the products manufactured. Following is the list of selling expenses: i.Advertising and publicity expenses. ii.Salaries of the sales department staff including sales manager, salesman etc. iii.Travelling expenses of sales engineers. 12

- 13. CONSTITUTIONS OF A JOB ESTIMATE The various constitutions of estimating the cost of a product may be sub- divided as under. 1. Design time 2. Drafting time 3. Methods studies, time studies, planning and production time 4. Design, procurement and manufacture of special pattern, cores, core boxes, flasks, tools, dies, jigs and fixtures etc. 5. Experimental work 6. Material cost 7. Labour cost 8. Overheads expenses 13

- 14. ESTIMATING PROCEDURE The total procedure is considered to have three stages: i. Fixing of design, accuracy and Finish. ii. Proper working of estimating department. iii. Obtaining a delivery promises from the progress department in view of existing loan on the shop. Main items to be considered in order of sequence are as follows: 1. Price list: prepare the list of all the components. 2. Make or Buy: To decide which components should be made in the factory itself and which should be procured from the market? 3. Material cost: Determination of the material cost either at market or at a forecast price. 4. Labour cost: Determination of labour cost of each operation from performance rates and wage rates, including manufacturing, assembly and testing. 14

- 15. 5. Prime cost: Material and labour costs. 6. Factory Overheads: Determination of factory on cost or expenses and general overhead charges. 7. Package and delivery charges: Determination of package and delivery charges and also insurance chargers if necessary. 8. Total cost: To calculate the total cost. 9. Standard profit: To decide standard profit and adding this into total cost so as to fix the sales price. 10. Discount: To decide discount allowed to the distributors. 11. Time of delivery: Determination of time of delivery in collaboration with the progress department. 12. Approval of management: When the estimate is complete, it is entered into the ‘Estimate Form’ and submitted to the directors and sales department for dispatch of the quotation or tender. 15

- 16. Description……………… Date………………….. Quantity…………………. Enquiry No…………. Drawing No……………… Customer……………. Description Total Cost in Rs. Cost of each item in Rs. 1. Material No.of components (……….) (…………) 2. Operation labour Overhead (a) (b) Total cost: (Factory cost) 3. Office and administrative Expenses Total: (Production cost) 4. Selling expenses (a) Packing and Carriage (b) Advertisement and Publicity (c) Other allied expenses Total: (Ultimate cost) 5. Profit Total: (Selling price) 6. Discount Total: (Catalogue price) Delivery date: Estimated by……… Estimate Form 16

- 17. ALLOCATION OF OVERHEAD EXPENSES The different methods of allocation of overheads are as follows: •By percentage. •By hourly rate. •By unit rate. (i) By Percentage. a) By percentage on prime cost. b) By Percentage on Direct labour. c) By Percentage on direct material. (ii) By hourly rate. This method is further divided into three categories. By man-hour rate. By machine-hour rate. Combination of machine-hour and man-hour method. (iii) Unit ate Rate per Unit manufactured = 17

- 18. COST OF PRODUCT (LADDER OF COST) The different components of cost and their relations are summarized below: •Prime cost, Factory cost or Works cost •Production cost or Manufacturing cost •Total or Gross cost •Selling Price •Market Price or Catalogue Price Prime cost = Direct material cost + Direct labour cost + Direct expenses. Factory cost = prime cost + factory expenses. Production cost = Factory cost + Administrative expenses Total cost = Manufacturing cost + selling and distribution expenses. Selling price = Total cost + Profit = Total cost – Loss Making price (or) Catalogue price: Some percentage of discounts allowed to the distributors of product is added into the selling price and the result obtained is called the market price. 18

- 19. Discount Market Price or Catalogue Price Profit Selling Price Selling and distribution Expenses Total cost or Ultimate cost Administrative Expenses Production cost or Manufacturing cost Factory Expenses Factory cost or Works Cost Direct Material cost Prime Cost Direct Labour cost Direct Expenses LADDER OF COST 19

- 20. AIMS OF COST ACCOUNTING The main aims and objects of cost accounting are: •Advance cost determination. •Budget preparation •Economy in production •Selling price •Output Targets •Reduction in wastages •Comparison with estimate •Profit and Loss •Selling price change •Discount Provisions •Legal provisions •Pricing of new product 20

- 21. METHODS OF COSTING •Job costing or order costing. This method is concerned with finding the cost of each individual job or contract. It is suitable for industries such as ship building, machine manufacturing, fabrication, building contracts etc., •Batch costing. It is a form of job costing instead of costing each components separately, each batch of components is taken together and treat as a job. •Process costing. This method is employed when a standard product is being made which involves a number of distinct processes performed in a definite sequence. In oil refining, chemical manufacture, paper making, flour milling, and cement manufacturing etc., this method is used. •Departmental costing. In big industries like steel industry or automobile industry each department is producing independently one or more components. •Operation costing. This method is used in firms providing utility services. example: Transport services, water services, electricity boards an railways etc. •Unit cost method. This method adopted by the firms, which supply a uniform product rather than a variety of products ach as mines, quarries etc., •Multiple cost method. This method is used in firms which manufacture variety of standardized products, having no relation to one another in cost, quality and the type of process, etc. 21

- 22. DEPRECIATION: Depreciation represents the loss in value of the capital sunk in building plant, machinery and other equipment due to usual deterioration taking place in the life of these assets. CAUSES OF DEPRECIATION i. By wear and tear ii. Physical Decay iii. Deferred maintenance and neglect iv. Accidents v. Inadequacy vi. Depreciation by obsolescence 22

- 23. METHODS OF DEPRECIATION 1. The straight line method. This method consists in writing off each year an equal proportion of the cost of the unit to reduce it to its salvage or residual value at the end of its life. If Vo = Original value Vs= Salvage value n= No of years of life Then the depreciation provided each year = (Vo – Vs /n) 2. Annuity method. In this method a fixed depreciation right from first year to machine’s life is realised such that it may be equal to the difference of cost of the machine together with a fixed interest on the successive reduced value. Let V = Value of the Machine n = life time of machine in years r = Rate of interest D = Fixed charge for the annuity 23

- 24. 3. Sinking fund method. This method consists of providing depreciation by means of fixed periodic charges which, aggregated with compound interest over the life of the asset, would equal the cost of that asset less a salvage value, if any, at the end of the estimated life of the unit. Let D= depreciation amount to be set aside each year Vo = original value of the unit Vs = scrap or residual value r = rate of interest n = no of years of useful life of the unit 4. Reducing balance method. This method consists in deducting depreciation at a fixed percentage of the value remaining from the previous period, sufficient to reduce the unit to its salvage value at the end of its useful life. Where P = the constant percentage required to write off the unit in nth year. 24

- 25. 5. Sum of year’s digit method. The method of providing for depreciation by means of differing periodic rates computed according the following formula. 6. Production and service output method. This method is for providing depreciation by a fixed rate per unit of production calculated by dividing the value of asset by the estimated number of units to be produced during its life. where, k = Total units of work carried out. 7. Machine hour method. In this method, the rate of depreciation is calculated by considering the total number of hours a machine runs in a year. The life of a machine is estimated on the basis of its service period. Total number of hours are calculated, the rate per hour is fixed that will reduce the machine or unit to its residual value at the end of its life. 25

- 26. 26 Problems: 3.1. The catalogue price of a certain gadget is Rs. 1,050, the discount allowed to distributors being 20 percent. Data collected for a certain period shows that the selling price and factory cost are equal. The relation between material cost, labour cost and factory on cost (overhead expenses) are in the ratio 1: 2: 3. If the labour cost is Rs. 200, what profit is being made on the gadget? 3.2. Calculate the selling price per unit from the following data: Direct material cost = Rs. 8,000 Direct labour cost = 60 percent of direct material cost Direct expenses = 5 percent of direct labour cost Factory expenses = 120 percent of direct labour cost Administrative expenses = 80 percent direct labour cost Sales and distribution expenses = 10 percent of direct labour cost Profit = 8 percent of total cost No. of pieces produced = 200 3.3 : An electric fan is available in the market at a catalogue price of Rs. 1500. The discount allowed to the distributor is 12 percent. Administrative and sales overheads are 80 percent of factory cost. The direct material cost, direct labour cost and factory overheads are in the ratio of 1 : 3 : 2 respectively. If the direct labour cost is Rs. 300 and the central excise duty 10 percent of the selling price, determine the company’s profit on each item.

- 27. 27 3.4.From the following data for a sewing machine manufacturer, prepare a statement showing prime cost, Works/factory cost, production cost, total cost and profit. Value of stock of material as on 1-04-2003 - Rs. 26,000 Material purchased - Rs.2,74,000 Wages to labour - Rs.1,20,000 Depreciation of plant and machinery - Rs.8,000 Depreciation of office equipment - Rs.2,000 Rent, taxes and insurance of factory - Rs.16,000 General administrative expenses - Rs.3,400 Water, power and telephone bills of factory - Rs.9,600 Water, lighting and telephone bills of office - Rs.2,500 Material transportation in factory - Rs.2,000 Insurance and rent of office building - Rs.2,000 Direct expenses - Rs.5,000 Commission and pay of salesman - Rs.10,500 Repair and maintenance of plant - Rs.1,000 Works Manager salary - Rs.30,000 Salary of office staff - Rs.60,000 Value of stock of material as on 31-03-2004 - Rs.36,000 Sale of products - Rs.6,36,000

- 28. 28