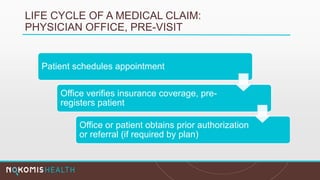

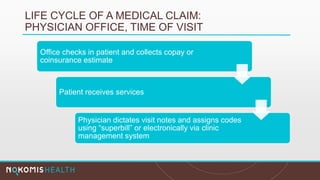

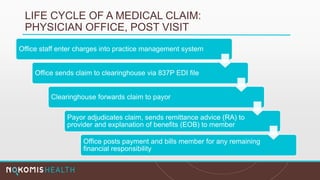

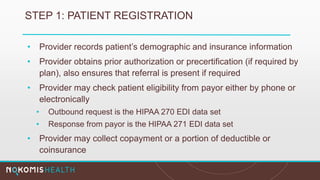

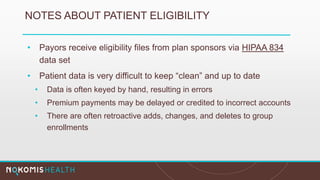

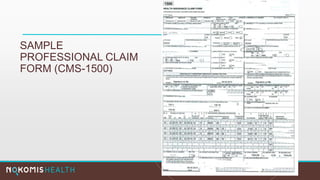

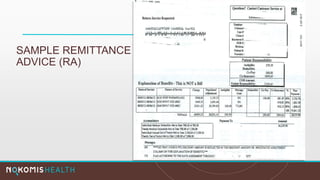

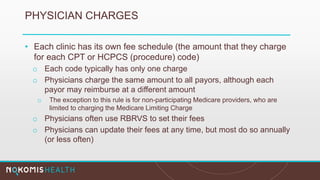

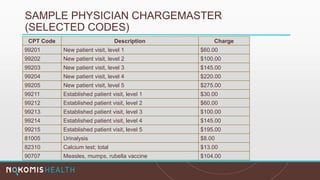

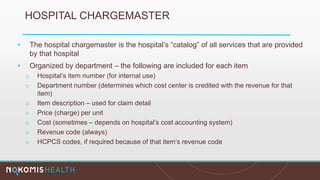

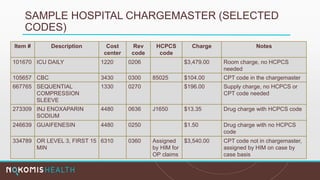

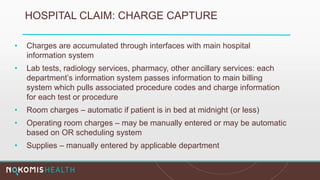

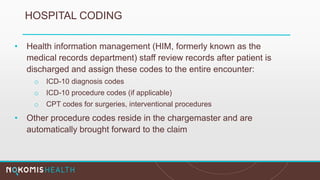

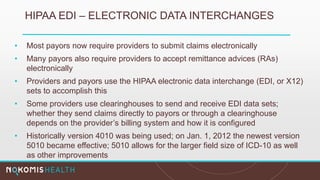

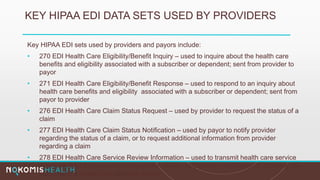

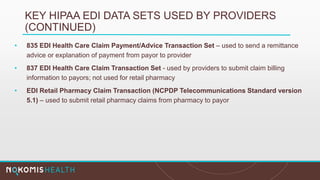

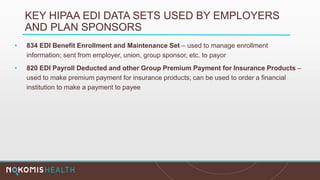

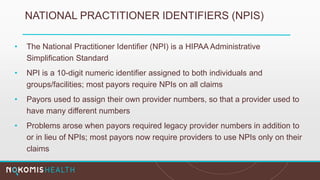

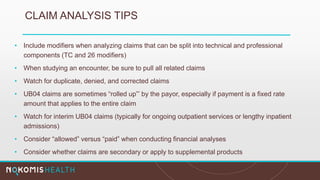

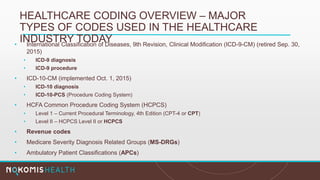

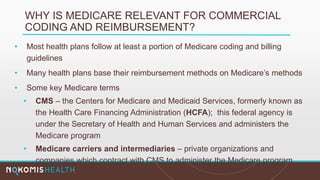

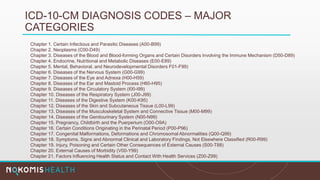

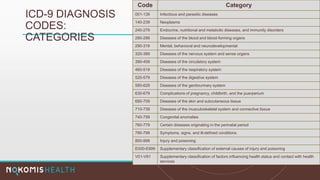

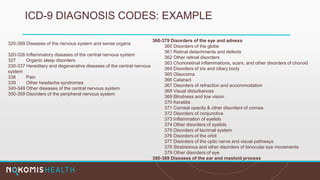

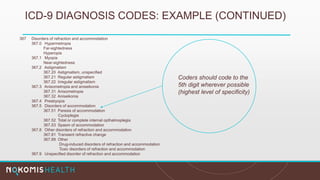

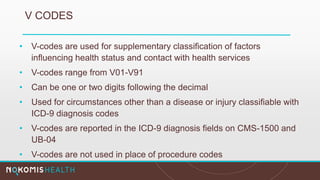

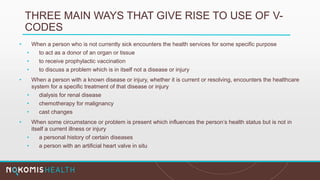

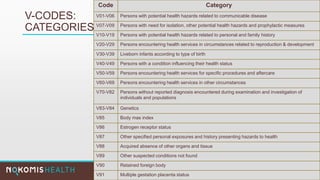

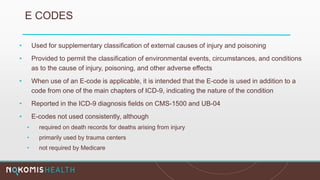

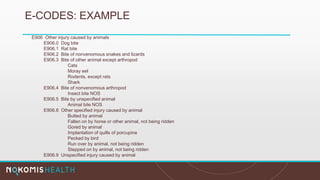

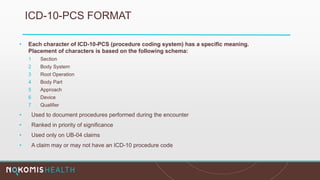

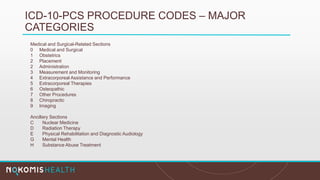

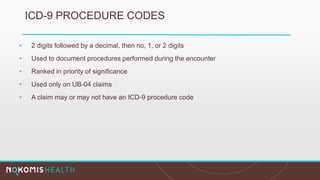

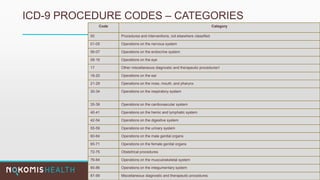

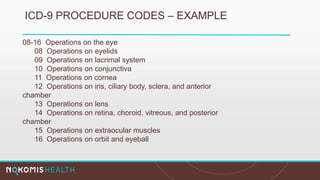

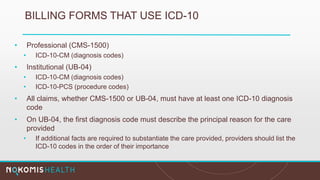

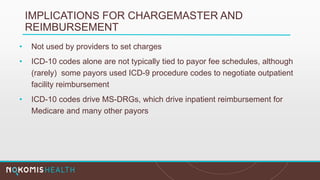

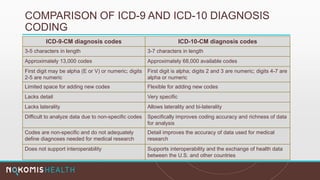

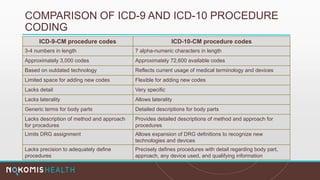

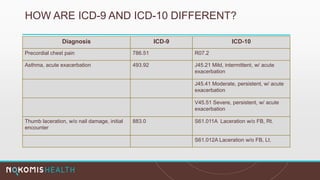

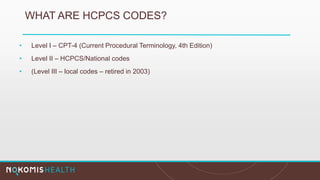

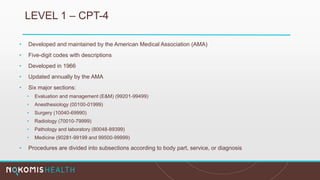

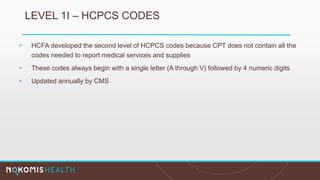

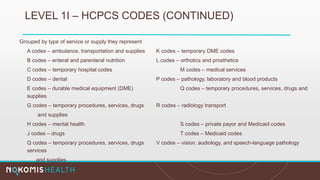

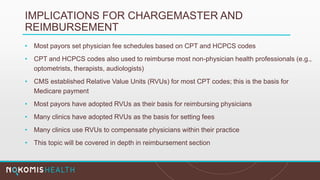

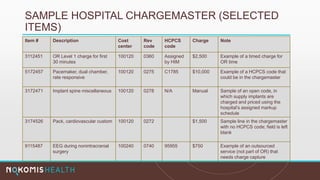

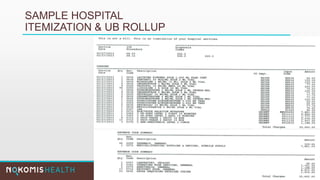

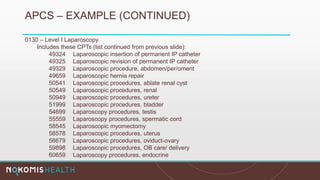

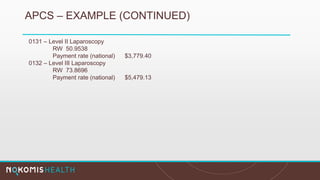

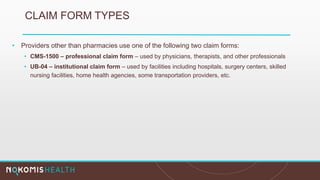

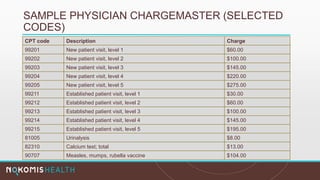

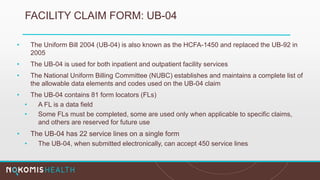

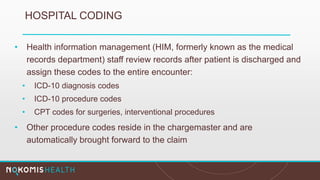

The document outlines the life cycle of a medical claim, detailing processes from patient registration through claim submission and payment by payors. It includes information on different claim forms like CMS-1500 and UB-04, the role of HIPAA EDI transactions, and the coding systems used in healthcare billing. Additionally, it discusses the challenges related to maintaining patient eligibility data, the methods of capturing charges, and the coding standards in the healthcare industry.