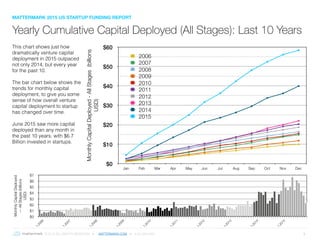

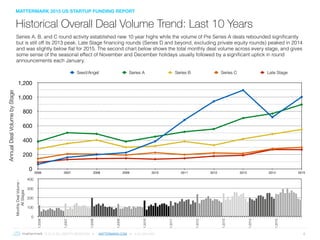

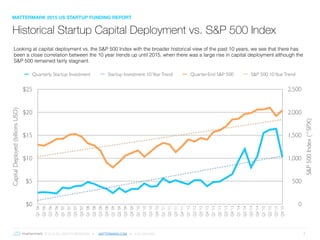

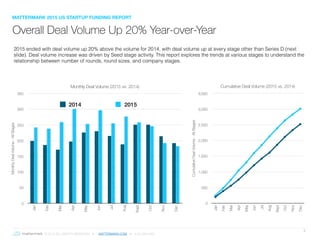

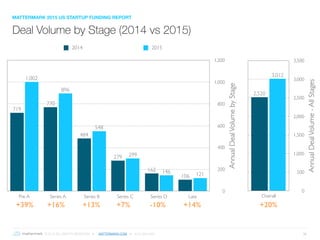

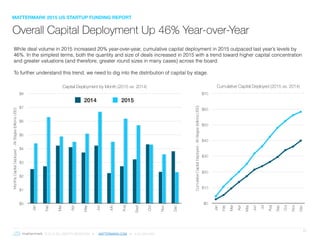

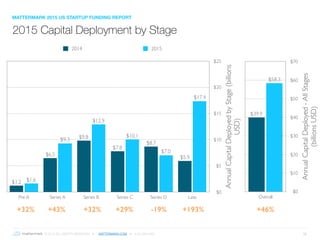

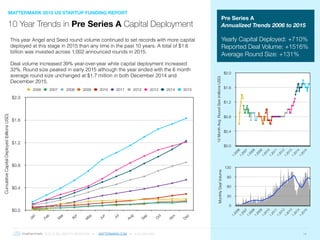

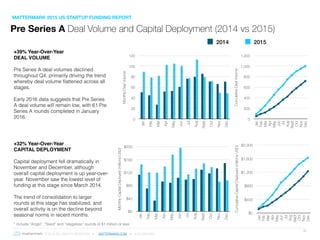

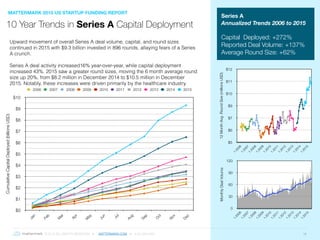

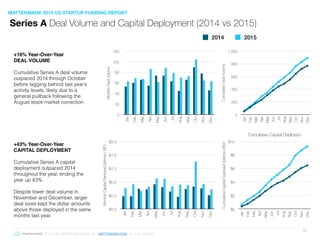

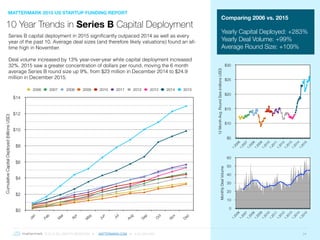

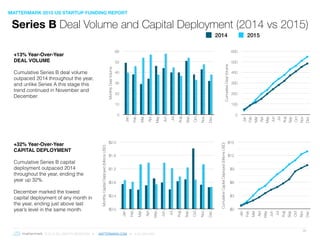

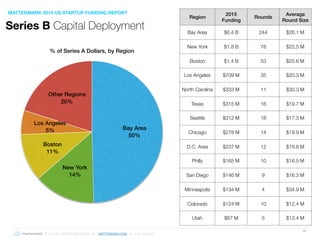

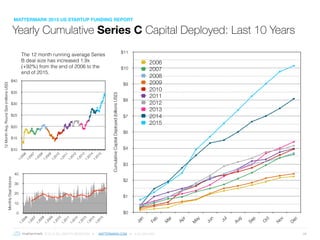

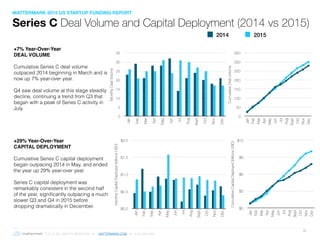

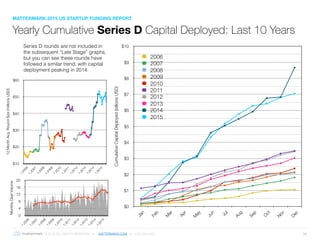

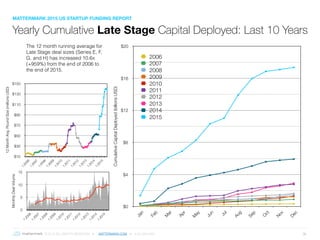

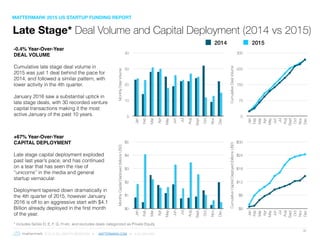

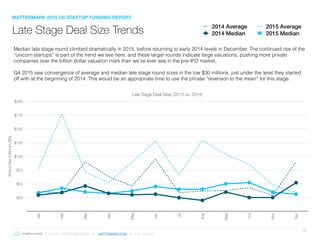

The Mattermark 2015 US Startup Funding Report analyzes venture funding trends for US startups from 2006 to 2015, highlighting a significant increase in venture capital deployment in 2015 compared to previous years. The report reveals that while overall deal volume rose by 20%, cumulative capital deployment surged by 46%, indicating a trend towards larger round sizes and greater valuations. It emphasizes the importance of understanding these trends for informed decision-making in fundraising and business strategies.