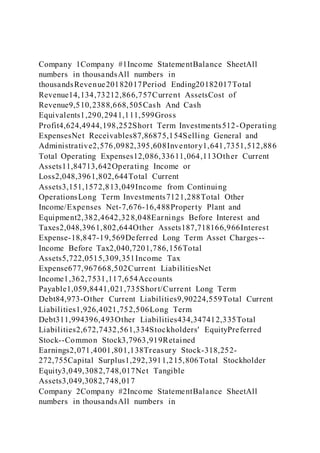

Company 1Company #1Income StatementBalance SheetAll numbers in tho

- 1. Company 1Company #1Income StatementBalance SheetAll numbers in thousandsAll numbers in thousandsRevenue20182017Period Ending20182017Total Revenue14,134,73212,866,757Current AssetsCost of Revenue9,510,2388,668,505Cash And Cash Equivalents1,290,2941,111,599Gross Profit4,624,4944,198,252Short Term Investments512-Operating ExpensesNet Receivables87,86875,154Selling General and Administrative2,576,0982,395,608Inventory1,641,7351,512,886 Total Operating Expenses12,086,33611,064,113Other Current Assets11,84713,642Operating Income or Loss2,048,3961,802,644Total Current Assets3,151,1572,813,049Income from Continuing OperationsLong Term Investments7121,288Total Other Income/Expenses Net-7,676-16,488Property Plant and Equipment2,382,4642,328,048Earnings Before Interest and Taxes2,048,3961,802,644Other Assets187,718166,966Interest Expense-18,847-19,569Deferred Long Term Asset Charges-- Income Before Tax2,040,7201,786,156Total Assets5,722,0515,309,351Income Tax Expense677,967668,502Current LiabilitiesNet Income1,362,7531,117,654Accounts Payable1,059,8441,021,735Short/Current Long Term Debt84,973-Other Current Liabilities9,90224,559Total Current Liabilities1,926,4021,752,506Long Term Debt311,994396,493Other Liabilities434,347412,335Total Liabilities2,672,7432,561,334Stockholders' EquityPreferred Stock--Common Stock3,7963,919Retained Earnings2,071,4001,801,138Treasury Stock-318,252- 272,755Capital Surplus1,292,3911,215,806Total Stockholder Equity3,049,3082,748,017Net Tangible Assets3,049,3082,748,017 Company 2Company #2Income StatementBalance SheetAll numbers in thousandsAll numbers in

- 2. thousandsRevenue20182017Period Ending20182017Total Revenue38,972,93435,864,664Current AssetsCost of Revenue27,831,17725,502,167Cash And Cash Equivalents3,030,2002,758,477Gross Profit11,141,75710,362,497Short Term Investments- 506,165Operating ExpensesNet Receivables860,000327,166Selling General and Administrative6,923,5646,375,071Inventory4,579,0004,187,243 Total Operating Expenses34,754,74131,877,238Other Current Assets-12,217Operating Income or Loss4,218,1933,987,426Total Current Assets8,469,2008,485,727Income from Continuing OperationsLong Term Investments--Total Other Income/Expenses Net-44,982-130,838Property Plant and Equipment5,255,2005,006,053Earnings Before Interest and Taxes4,218,1933,987,426Goodwill97,600100,069Interest Expense-8,860-64,295Intangible Assets-144,900Income Before Tax4,173,2113,856,588Other Assets504,000321,266Income Tax Expense1,113,4131,248,640Deferred Long Term Asset Charges- 6,558Net Income3,059,7982,607,948Total Assets14,326,00014,058,015Current LiabilitiesAccounts Payable2,644,1002,488,373Short/Current Long Term Debt-- Other Current Liabilities-1,429,136Total Current Liabilities5,531,3005,125,537Long Term Debt2,233,6002,230,607Other Liabilities1,512,5001,331,645Total Liabilities9,277,4008,909,706Stockholders' EquityPreferred Stock--Common Stock5,048,600628,009Retained Earnings- 4,962,159Treasury Stock--441,859Capital Surplus--Other Stockholder Equity--441,859Total Stockholder Equity5,048,6005,148,309Net Tangible Assets4,951,0004,903,340 Costing Methods Production costing methods not only impact the actual cost assigned to a product but can also have effects on how

- 3. inventory is valued, how transfer pricing is determined as well as tax implications. Let’s examine these issues:Transfer Prices and Taxes PRICES AND TAXES Transfer price is simply what one related entity charges another for a product. In other words what on division of a company charges another division for a product. While these types of transactions are eliminated during the consolidation process in preparing the audited financial statements, so they have no impact, there can still be tax consequences particular in multinational companies. Tax rates can vary from Country to Country so that these multinational companies have an incentive to show their profits in the Country with the lowest tax rate. TAX RATE EXAMPLES For example, Corporation A has two divisions, Division B and Division C. The tax rate in the Country where Division B is located is 25% and the tax rate where Division C is located is 50%. For simplicity sake, let's assume Corporation A makes and sells widgets and there are no laws or restrictions on transfer pricing. The selling price is $1,000 and the cost to make a widget is $600. Therefore the company makes a profit of $400 per widget. Widgets are produced in Division B and in sold by Division C and sold in the Country that division C is located. PROFITS AND TAXES If Division C "buys" the widgets from Division B for $900. Division B then sells them for $1,000 and reports a profit of $100 ($1,000 - $900) and pays tax of $50 ($100 x 50%). Division B reports a profit of $300 ($900 - $600) and pays tax of $75 ($300 x 25%). So the total tax paid in this example is $125 ($50 + $75) which is well below the $200 ($400 x 50%) they would have had to pay if the entire transaction would have taken place in Division C's home Country. For the Corporation in total there is no difference in the total amount of profit, just

- 4. the amount of tax paid. The above example is for illustrative purposes of how taxes could be manipulated by a multinational corporation and does not reflect reality. In the United States, the IRS takes a close look at transfer pricing policies in multinational corporations. Sec. 482 of the US Tax Code gives the IRS the authority to adjust taxable income between two related divisions to more accurately reflect the income earned by each division. The IRS will apply their standard to determine the true taxable income of a controlled division. Their standard basically tries to determine the transfer price of an open market transaction of unrelated companies.Inventory Costing The method in which inventory is costed affects how a production company’s inventoried is valued. Most companies use one of the following inventory costing methods: 1. First-In First-Out (FIFO) 2. Last-In First-Out (LIFO) 3. Weighted Average 4. Specific Identification These inventory costing methods determine the how the inventory is valued each time new inventory is added or taken out of the inventory pool. Production companies maintain three inventory accounts (pools): raw materials, work in process and finished goods. Costs will flow through these inventory accounts until the product is sold. The costs are then transferred from the balance sheet (credit to finished goods inventory) to the income statement (debit cost of goods sold) to match expenses with revenues (matching principle). First-In First-Out moves the oldest cost of inventory from one inventory account to the next or to cost of goods sold in the case of finished goods. This is the most common method used.

- 5. Last-In First-Out moves the newest cost of inventory from one inventory account to the next or to cost of goods sold in the case of finished goods. Average or Weighted Average essentially establishes a new average cost after every purchase. It is this average cost that is used when items are removed from inventory. Specific Identification assigns each inventory item a specific cost and when it is sold or used in production, the specific cost of the item is moved to the next inventory account or cost of goods sold, as appropriate. This method is used if you are producing items that are individually produced and they are expensive. Why is Cost Accounting Important? Any company that is required to have their financial statements audited by an independent accountant must comply with Generally Accepted Accounting Principles (GAAP) (IFRS outside of the US). This means that that ALL product costs will appear on the inventory line on the balance sheet until the product is actually sold and then transferred to the income statement as cost of goods sold to match expenses with revenues. Overview of Product Costing Methods Companies will use one or more product costing method to assign the appropriate costs to a manufactured product. Regardless of the method that is used, the goal is the same: To assign the appropriate amount of cost to a product using the best product costing method for that particular production and decision-making environment. There can be a substantial difference in cost depending on the method used, so management must be careful when choosing a method and what its intended use is. For example, a costing method intended for incremental analysis may not be appropriate for long-term

- 6. decision making. In addition, there are only certain methods that are approved to use in financial statement preparation. Deciding on the Method of Costing Choosing the best method really depends on the decision environment and whether the cost information is for external or internal reporting. External Reporting: · Absorption Costing: · GAAP · Variable Costing: · Not GAAP · Throughput Costing: · Not GAAP Internal Reporting · Absorption Costing · Used to save costs · Variable Costing · Used to evaluate performance and for decision making · Throughput Costing · Used for short-term capacity decisions Inventory Costs · Absorption Costing: · Direct materials · Direct labor · Variable overhead · Fixed overhead · Variable Costing: · Direct materials · Direct labor · Variable overhead · Variable SG&A expenses* · Throughput Costing · Direct materials

- 7. Period Costs (expensed when occurred) · Absorption Costing: · SG&A expenses · Variable Costing: · Fixed overhead · Fixed SG&A expenses · Throughput Costing: · Direct labor · Variable overhead · Fixed overhead · SG&A expenses External reporting means that the costing information is going to be used external to the company. Anytime financial information is released to the public, it must comply with U. S. GAAP. For external reporting, the only GAAP approved costing method is called absorption costing. This costing method requires that the product cost include ALL manufacturing costs. This basically means that product costs may be incurred in one period (when goods are produced) and recognized in another (when goods are sold). All other costs (non-product) are recognized when incurred and called period costs. Internal reporting means that the costing information is only going to be used within the company for decision-making process. Internal reports do not have to comply with U. S. GAAP and can be designed by management to suit the needs of the organization. For internal reporting, absorption, variable and throughput costing methods are often used. Costing Methods Absorption costing is where the product “absorbs” all manufacturing costs, both fixed and variable. Manufacturing costs are assigned to one of three inventory accounts (raw materials, work in process, finished goods) prior to the sale, and then transferred to the income statement (cost of goods sold)

- 8. upon sale to comply with the matching principle. All other costs, typically selling and administrative costs, are expensed in the period they are incurred and referred to as “period costs” since they do not benefit any future period. Absorption costing can be used for both internal and external reporting as it is the only method that is GAAP approved. Some companies use absorption costing for both internal and external reporting to save time and money by using just one method. Variable costing is where ALL costs are divided into fixed and variable categories and only variable costs are inventoried. Variable costing is often used by companies to hold production managers accountable for only the costs that they have some control over, applying the theory that a production manager cannot change or effect a fixed cost. Variable costing is typically used for short-term decision making. Keep in mind that a company still needs to cover their full costs to stay in business. Throughput costing is where only direct materials are inventoried. All other costs, direct labor, manufacturing overhead and period costs are expensed as incurred. Throughput costing is also used for short-term decisions. It can also be useful in making special order type decisions where there is extra factory capacity involved. Costing methodologies can produce significant variations in what we call total costs. Before a costing method is selected, we must fully understand what the information is going to be used for. Once we understand the use of the information, we can select a method that best fits our needs under that circumstance. Resource(s) Wiley GAAP 2019 : Interpretation and Application of Generally Accepted Accounting Principles Overview of Costing

- 9. A company needs to know the total cost of a product in order to determine if the product is profitable. Product costing also allows management to accomplish this objective. Determining the total cost of a product may seem fairly straightforward, and to some extent it is. However, there are certain types of costs that can complicate matters. For this reason, a company needs to categorize costs to assist with getting costs down to the product level. The two main cost categories are direct and indirect costs. Direct costs are those costs that are directly associated with a product. They are costs than can be easily measured. Sub categories of direct costs are direct materials and direct labor. Direct materials are the raw materials used to produce a product. We can measure how much was used in producing the product. If we can measure how much was used, we can easily determine the cost of the direct materials that were used in production. Direct labor is the cost of the workers that directly worked on the product. We can also measure how much time they spent working on the product. If we can measure the time they spent, then we can easily calculate how much the direct labor costs were. Indirect cost represents costs that were incurred in the production process but are not easily traced to a specific product. With direct materials and direct labor, we can see a link between the cost and product. Indirect costs are not easily measured at the product level, but we can intuitively see that they are a necessary cost in the production. For example, a factory supervisor may oversee the production process of many products but they do not “touch” the individual product. We cannot measure their time spent on individual products, just their overall time on the process. However, these costs were necessary in the production of the product. Most companies use an allocation process to distribute the indirect costs, rather than

- 10. an exact measurement as with direct costs. Most Common Production Costing Methods Now that we understand the importance of product costing and a few of the costing terms and categories, let’s look at two common production costing methods: Job Costing and Process Costing. Job Costing Job costing is most often used when the units of production are not identical or are commonly "different" from each other. Since the individual units of production are not same, we are required to accumulate the costs associated with each job. Companies that usually use job costing are custom home builders, automotive repair shops, accountants and lawyers. Process Costing Process costing, on the other hand, is used when the output consists of virtually identical items that are made in large quantities. Costs are accumulated in "batches" as the products are produced and then allocated to the individual products themselves. Process costing of most often used by soda makers, cookie bakers, aluminum foil manufacturers and oil refiners. Regardless of the whether a company uses job costing or process costing, the goal is still the same. “Push” all production costs down to the product level so that management can tell if a product is profitable or not. Other uses of product cost information include: setting a sales price, determining product mix and determining a transfer price to another division. Bottom of Form Company 1Company #1Income StatementBalance SheetAll numbers in thousandsAll numbers in thousandsRevenue20182017Period Ending20182017Total

- 11. Revenue14,134,73212,866,757Current AssetsCost of Revenue9,510,2388,668,505Cash And Cash Equivalents1,290,2941,111,599Gross Profit4,624,4944,198,252Short Term Investments512-Operating ExpensesNet Receivables87,86875,154Selling General and Administrative2,576,0982,395,608Inventory1,641,7351,512,886 Total Operating Expenses12,086,33611,064,113Other Current Assets11,84713,642Operating Income or Loss2,048,3961,802,644Total Current Assets3,151,1572,813,049Income from Continuing OperationsLong Term Investments7121,288Total Other Income/Expenses Net-7,676-16,488Property Plant and Equipment2,382,4642,328,048Earnings Before Interest and Taxes2,048,3961,802,644Other Assets187,718166,966Interest Expense-18,847-19,569Deferred Long Term Asset Charges-- Income Before Tax2,040,7201,786,156Total Assets5,722,0515,309,351Income Tax Expense677,967668,502Current LiabilitiesNet Income1,362,7531,117,654Accounts Payable1,059,8441,021,735Short/Current Long Term Debt84,973-Other Current Liabilities9,90224,559Total Current Liabilities1,926,4021,752,506Long Term Debt311,994396,493Other Liabilities434,347412,335Total Liabilities2,672,7432,561,334Stockholders' EquityPreferred Stock--Common Stock3,7963,919Retained Earnings2,071,4001,801,138Treasury Stock-318,252- 272,755Capital Surplus1,292,3911,215,806Total Stockholder Equity3,049,3082,748,017Net Tangible Assets3,049,3082,748,017 Company 2Company #2Income StatementBalance SheetAll numbers in thousandsAll numbers in thousandsRevenue20182017Period Ending20182017Total Revenue38,972,93435,864,664Current AssetsCost of Revenue27,831,17725,502,167Cash And Cash Equivalents3,030,2002,758,477Gross Profit11,141,75710,362,497Short Term Investments-

- 12. 506,165Operating ExpensesNet Receivables860,000327,166Selling General and Administrative6,923,5646,375,071Inventory4,579,0004,187,243 Total Operating Expenses34,754,74131,877,238Other Current Assets-12,217Operating Income or Loss4,218,1933,987,426Total Current Assets8,469,2008,485,727Income from Continuing OperationsLong Term Investments--Total Other Income/Expenses Net-44,982-130,838Property Plant and Equipment5,255,2005,006,053Earnings Before Interest and Taxes4,218,1933,987,426Goodwill97,600100,069Interest Expense-8,860-64,295Intangible Assets-144,900Income Before Tax4,173,2113,856,588Other Assets504,000321,266Income Tax Expense1,113,4131,248,640Deferred Long Term Asset Charges- 6,558Net Income3,059,7982,607,948Total Assets14,326,00014,058,015Current LiabilitiesAccounts Payable2,644,1002,488,373Short/Current Long Term Debt-- Other Current Liabilities-1,429,136Total Current Liabilities5,531,3005,125,537Long Term Debt2,233,6002,230,607Other Liabilities1,512,5001,331,645Total Liabilities9,277,4008,909,706Stockholders' EquityPreferred Stock--Common Stock5,048,600628,009Retained Earnings- 4,962,159Treasury Stock--441,859Capital Surplus--Other Stockholder Equity--441,859Total Stockholder Equity5,048,6005,148,309Net Tangible Assets4,951,0004,903,340 IS Vertical AnalysisIncome Statement Vertical AnalysisCOMPANY 1COMPANY 220182017201820172018201720182017RevenuePercent Percent Percent Percent Total Revenue (BASE NUMBER)14,134,73212,866,757100.00%100.00%38,972,93435 ,864,664100.00%100.00%Cost of Revenue 9,510,2388,668,50527,831,17725,502,167Gross Profit 4,624,4944,198,25211,141,75710,362,497Operating ExpensesSelling General and Administrative

- 13. 2,576,0982,395,6086,923,5646,375,071Total Operating Expenses 12,086,33611,064,11334,754,74131,877,238Operating Income or Loss 2,048,3961,802,6444,218,1933,987,426Income from Continuing Operations Total Other Income/Expenses Net - 7,676-16,488-44,982-130,838Earnings Before Interest and Taxes 2,048,3961,802,6444,218,1933,987,426Interest Expense - 18,847-19,569-8,860-64,295Income Before Tax 2,040,7201,786,1564,173,2113,856,588Income Tax Expense 677,967668,5021,113,4131,248,640Net Income1,362,7531,117,6543,059,7982,607,948 IS Horizontal AnalysisIncome Statement Horizontal AnalysisCOMPANY 1COMPANY 220182017$ CHANGE % CHANGE 20182017$ CHANGE % CHANGE RevenueTotal Revenue14,134,73212,866,75738,972,93435,864,664Cost of Revenue9,510,2388,668,50527,831,17725,502,167Gross Profit4,624,4944,198,25211,141,75710,362,497Operating ExpensesSelling General and Administrative2,576,0982,395,6086,923,5646,375,071Total Operating Expenses12,086,33611,064,11334,754,74131,877,238Operating Income or Loss2,048,3961,802,6444,218,1933,987,426Income from Continuing OperationsTotal Other Income/Expenses Net- 7,676-16,488-44,982-130,838Earnings Before Interest and Taxes2,048,3961,802,6444,218,1933,987,426Interest Expense- 18,847-19,569-8,860-64,295Income Before Tax2,040,7201,786,1564,173,2113,856,588Income Tax Expense677,967668,5021,113,4131,248,640Net Income1,362,7531,117,6543,059,7982,607,948 BS Vertical AnalysisBalance Sheet Vertical AnalysisCompany #1Company #2Period Ending20182017201820172018201720182017Current AssetsPERCENT PERCENT PERCENT PERCENT Cash And Cash Equivalents1,290,2941,111,5993,030,2002,758,477Short Term Investments51200506,165Net Receivables87,86875,154860,000327,166Inventory1,641,7351,5 12,8864,579,0004,187,243Other Current

- 14. Assets11,84713,642012,217Total Current Assets3,151,1572,813,0498,469,2008,485, 727Long Term Investments7121,28800Property Plant and Equipment2,382,4642,328,0485,255,2005,006,053Goodwill0097 ,600100,069Intangible Assets000144,900Other Assets187,718166,966504,000321,266Deferred Long Term Asset Charges0006,558Total Assets (BASE NUMBER)5,722,0515,309,351100.00%100.00%14,326,00014,0 58,015100.00%100.00%Current LiabilitiesAccounts Payable1,059,8441,021,7352,644,1002,488,373Short/Current Long Term Debt84,973000Other Current Liabilities9,90224,55901,429,136Total Current Liabilities1,926,4021,752,5065,531,3005,125,537Long Term Debt311,994396,4932,233,6002,230,607Other Liabilities434,347412,3351,512,5001,331,645Total Liabilities2,672,7432,561,3349,277,4008,909,706Stockholders' EquityPreferred Stock0000Common Stock3,7963,9195,048,600628,009Retained Earnings2,071,4001,801,13804,962,159Treasury Stock-318,252- 272,7550-441,859Capital Surplus1,292,3911,215,80600Other Stockholder Equity000-441,859Total Stockholder Equity3,049,3082,748,0175,048,6005,148,309Net Tangible Assets3,049,3082,748,0174,951,0004,903,340 BS Horizontal AnalysisBalance Sheet Horizontal AnalysisCOMPANY 1COMPANY 2Period Ending20182017$ CHANGE % CHANGE 20182017$ CHANGE % CHANGE Current AssetsCash And Cash Equivalents1,290,2941,111,5993,030,2002,758,477Short Term Investments51200506,165Net Receivables87,86875,154860,000327,166Inventory1,641,7351,5 12,8864,579,0004,187,243Other Current Assets11,84713,642012,217Total Current Assets3,151,1572,813,0498,469,2008,485,727Long Term Investments7121,28800Property Plant and Equipment2,382,4642,328,0485,255,2005,006,053Goodwill0097 ,600100,069Intangible Assets000144,900Other

- 15. Assets187,718166,966504,000321,266Deferred Long Term Asset Charges0006,558Total Assets5,722,0515,309,35114,326,00014,058,015Current LiabilitiesAccounts Payable1,059,8441,021,7352,644,1002,488,373Short/Current Long Term Debt84,973000Other Current Liabilities9,90224,55901,429,136Total Current Liabilities1,926,4021,752,5065,531,3005,125,537Long Term Debt311,994396,4932,233,6002,230,607Other Liabilities434,347412,3351,512,5001,331,645Total Liabilities2,672,7432,561,3349,277,4008,909,706Stockholders' EquityPreferred Stock0000Common Stock3,7963,9195,048,600628,009Retained Earnings2,071,4001,801,13804,962,159Treasury Stock-318,252- 272,7550-441,859Capital Surplus1,292,3911,215,80600Other Stockholder Equity000-441,859Total Stockholder Equity3,049,3082,748,0175,048,6005,148,309Net Tangible Assets3,049,3082,748,0174,951,0004,903,340