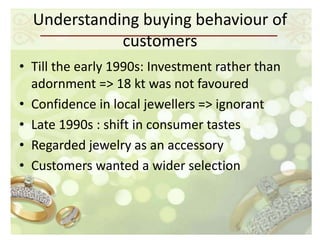

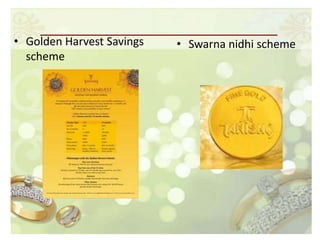

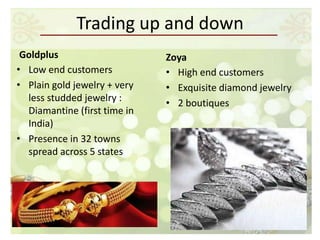

Group 1 consists of Pragathi, Subha, Jaideep, Preeti, and Gayatri, Afsal. The document provides an overview of Titan Company including its establishment in 1984, expansion into watches and jewelry in 1994, and the launch of its jewelry brand Tanishq. It discusses Titan's marketing mix of product, price, place, and promotion. It also covers Titan's customer services, segmentation and positioning strategies, and its turnaround story after an unsuccessful initial launch. Finally, it performs a SWOT analysis of Titan's strengths, weaknesses, opportunities, and threats.