Weekly momentum stock pick: Sell Tata Motors between CMP & Rs575

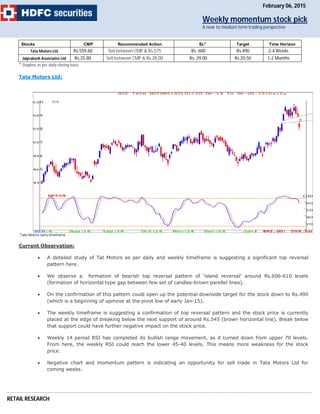

- 1. RETAIL RESEARCH Stocks CMP Recommended Action SL* Target Time Horizon Tata Motors Ltd Rs.559.60 Sell between CMP & Rs.575 Rs. 600 Rs.490 2-4 Weeks Jaiprakash Associates Ltd Rs.25.80 Sell between CMP & Rs.28.00 Rs. 29.00 Rs.20.50 1-2 Months * Stoploss as per daily closing basis. Tata Motors Ltd: Tata Motors daily timeframe Current Observation: A detailed study of Tat Motors as per daily and weekly timeframe is suggesting a significant top reversal pattern here. We observe a formation of bearish top reversal pattern of 'island reversal' around Rs.606-610 levels (formation of horizontal type gap between few set of candles-brown parellel lines). On the confirmation of this pattern could open up the potential downside target for the stock down to Rs.490 (which is a beginning of upmove at the pivot low of early Jan-15). The weekly timeframe is suggesting a confirmation of top reversal pattern and the stock price is currently placed at the edge of breaking below the next support of around Rs.545 (brown horizontal line). Break below that support could have further negative impact on the stock price. Weekly 14 period RSI has completed its bullish range movement, as it turned down from upper 70 levels. From here, the weekly RSI could reach the lower 45-40 levels. This means more weakness for the stock price. Negative chart and momentum pattern is indicating an opportunity for sell trade in Tata Motors Ltd for coming weeks. Weekly momentum stock pick A near to medium term trading perspective February 06, 2015

- 2. RETAIL RESEARCH Technical Research Analyst: Nagaraj Shetti (H5101) RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd. Disclosure by Research Analyst: Research Analyst or his relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its Associate does not have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest. Any holding in stock - No Disclosure by Research Entity: HDFC Securities Ltd. may have received any compensation/benefits from the subject company, may have managed public offering of securities for the subject company in the past 12 months. Further, Associates of the Company may have financial interest from the subject company in the normal course of Business. The subject company may have been our client during twelve months preceding the date of distribution of the Research report. Research analyst has not served as an officer, director or employee of the subject company. Research entity has not been engaged in market making activity for the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research Report.