ITC Q1FY15 results in line with estimates; buy - HDFC Sec

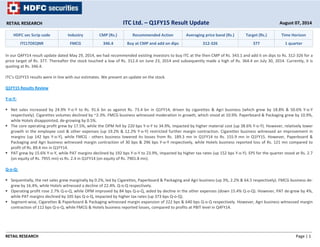

- 1. RETAIL RESEARCH Page | 1 HDFC sec Scrip code Industry CMP (Rs.) Recommended Action Averaging price band (Rs.) Target (Rs.) Time Horizon ITCLTDEQNR FMCG 346.4 Buy at CMP and add on dips 312‐326 377 1 quarter In our Q4FY14 result update dated May 29, 2014, we had recommended existing investors to buy ITC at the then CMP of Rs. 343.1 and add it on dips to Rs. 312‐326 for a price target of Rs. 377. Thereafter the stock touched a low of Rs. 312.4 on June 23, 2014 and subsequently made a high of Rs. 364.4 on July 30, 2014. Currently, it is quoting at Rs. 346.4. ITC’s Q1FY15 results were in line with our estimates. We present an update on the stock. Q1FY15 Results Review Y‐o‐Y: Net sales increased by 24.9% Y‐o‐Y to Rs. 91.6 bn as against Rs. 73.4 bn in Q1FY14, driven by cigarettes & Agri business (which grew by 18.8% & 50.6% Y‐o‐Y respectively). Cigarettes volumes declined by ~2‐3%. FMCG business witnessed moderation in growth, which stood at 10.9%. Paperboard & Packaging grew by 10.9%, while Hotels disappointed, de‐growing by 0.5%. The core operating profit grew by 17.5%, while the OPM fell by 220 bps Y‐o‐Y to 34.9%, impacted by higher material cost (up 38.6% Y‐o‐Y). However, relatively lower growth in the employee cost & other expenses (up 19.2% & 12.2% Y‐o‐Y) restricted further margin contraction. Cigarettes business witnessed an improvement in margins (up 142 bps Y‐o‐Y), while FMCG ‐ others business lowered its losses from Rs. 189.3 mn in Q1FY14 to Rs. 155.9 mn in Q1FY15. However, Paperboard & Packaging and Agri business witnessed margin contraction of 30 bps & 296 bps Y‐o‐Y respectively, while Hotels business reported loss of Rs. 121 mn compared to profit of Rs. 89.4 mn in Q1FY14. PAT grew by 15.6% Y‐o‐Y, while PAT margins declined by 192 bps Y‐o‐Y to 23.9%, impacted by higher tax rates (up 152 bps Y‐o‐Y). EPS for the quarter stood at Rs. 2.7 (on equity of Rs. 7955 mn) vs Rs. 2.4 in Q1FY14 (on equity of Rs. 7901.8 mn). Q‐o‐Q: Sequentially, the net sales grew marginally by 0.2%, led by Cigarettes, Paperboard & Packaging and Agri business (up 3%, 2.2% & 64.5 respectively). FMCG business de‐ grew by 16.4%, while Hotels witnessed a decline of 22.4%. Q‐o‐Q respectively. Operating profit rose 2.7% Q‐o‐Q, while OPM improved by 84 bps Q‐o‐Q, aided by decline in the other expenses (down 15.4% Q‐o‐Q). However, PAT de‐grew by 4%, while PAT margins declined by 105 bps Q‐o‐Q, impacted by higher tax rates (up 373 bps Q‐o‐Q). Segment‐wise, Cigarettes & Paperboard & Packaging witnessed margin expansion of 222 bps & 640 bps Q‐o‐Q respectively. However, Agri business witnessed margin contraction of 112 bps Q‐o‐Q, while FMCG & Hotels business reported losses, compared to profits at PBIT level in Q4FY14. RETAIL RESEARCH August 07, 2014ITC Ltd. – Q1FY15 Result Update

- 2. RETAIL RESEARCH Page | 2 Quarterly Financials: (Rs. in Million) Particulars Q1FY15 Q1FY14 VAR [%] Q4FY14 VAR [%] Remarks Net Sales 91644.2 73385.2 24.9 91451.4 0.2 Y‐o‐Y growth was driven by cigarettes & Agri business (which grew by 18.8% & 50.6% Y‐o‐Y respectively). Cigarettes volumes declined by ~2‐3%. FMCG business witnessed moderation in growth, which stood at 10.9%. Paperboard & Packaging grew by 10.9%, while Hotels disappointed, de‐growing by 0.5%. Total Expenditure 59707.0 46193.9 29.3 60351.3 ‐1.1 Raw Material Consumed 26606.2 21882.7 21.6 27078.9 ‐1.7 Material Cost / Net Sales (including stock adjustment & finished goods purchased) increased by 431 bps Y‐o‐Y & 109 bps Q‐o‐Q.to 43.4% in Q4FY14. Stock Adjustment ‐6038.6 ‐1846.8 227.0 1503.5 ‐501.6 Finished Goods Purchased 19208 8653.7 122.0 10113.8 89.9 Employee Expenses 5086.6 4268.7 19.2 4108.1 23.8 Other Expenses 14844.8 13235.6 12.2 17547 ‐15.4 Operating Profit 31937.2 27191.3 17.5 31100.1 2.7 Other Income 3184.2 2753.6 15.6 3600.9 ‐11.6 PBIDT 35121.4 29944.9 17.3 34701.0 1.2 Interest 151.5 169.5 ‐10.6 95.3 59.0 PBDT 34969.9 29775.4 17.4 34605.7 1.1 Depreciation 2313.2 2153 7.4 2378.3 ‐2.7 PBT 32656.7 27622.4 18.2 32227.4 1.3 Tax (incl. FBT & DT) 10792.8 8709.1 23.9 9447.3 14.2 The effective tax rate on PBT increased by 152 bps Y‐o‐Y & 373 bps Q‐o‐Q to 33.1% PAT 21863.9 18913.3 15.6 22780.1 ‐4.0 Y‐o‐Y PAT growth was impacted by lower operating profit growth and higher effective tax rate. EPS 2.7 2.4 14.8 2.9 ‐4.0 Equity 7955 7901.8 0.7 7953.2 0.0 Face Value 1 1 0.0 1 0.0 OPM (%) 34.9 37.1 ‐5.9 34.0 2.5 Y‐o‐Y margin contraction was on account of higher material cost. PATM (%) 23.9 25.8 ‐7.4 24.9 ‐4.2 (Source: Company, HDFC Sec) Segmental Results: (Rs. in Million) Particulars Q1FY15 Q1FY14 VAR [%] Q4FY14 VAR [%] Remarks Revenue (Net) FMCG Cigarettes 42010.6 35373.9 18.8 40787.8 3.0 The volumes declined by ~2‐3% due to steep price hikes undertaken by the company. It was the fifth straight quarter of volume decline. However, value growth at 18.8% was the highest since Q3FY10, largely due to steep price hikes and improved mix. FMCG Others 19346.1 17446.6 10.9 23145.1 ‐16.4 FMCG business witnessed moderation in growth, impacted by slowdown in consumption expenditure and high base of last year. Volume growth stood in high single digits in biscuits & noodles categories (compared to double digit growth in earlier

- 3. RETAIL RESEARCH Page | 3 quarters). While Packaged Foods & deodorants grew by, slowdown was witnessed in apparels, matches & soaps. Paper Boards, Paper & Packaging 12884.8 11631.4 10.8 12612 2.2 Growth was driven by improved capacity utilisation of recent investments. Agri Business 32960.6 21889.8 50.6 20042.4 64.5 Robust Y‐o‐Y & Q‐o‐Q growth in Agri Business revenues was driven by trading opportunities in wheat, soya and coffee. Hotels 2486.9 2498.6 ‐0.5 3205.1 ‐22.4 Growth was impacted by adverse demand‐supply dynamics (weak demand and high inventory levels) Total 109689.0 88840.3 23.5 99792.4 9.9 Less: Inter Segment Revenue 18044.8 15455.1 16.8 8341 116.3 Net sales/inc. from Operations 91644.2 73385.2 24.9 91451.4 0.2 Segment Results FMCG Cigarettes 27217.5 22417.2 21.4 25519.4 6.7 FMCG Others ‐155.9 ‐189.3 ‐17.6 430.9 ‐136.2 After two consecutive quarters of profits (in Q3 & Q4 of FY14), the segment reported losses at PBIT level (possibly due to increased investments in brands) However, on Y‐o‐Y basis, the losses were lower during the quarter. Paper Boards, Paper & Packaging 2749 2516.0 9.3 1884.1 45.9 Agri Business 2024.5 1993.1 1.6 1454.8 39.2 Hotels ‐120.9 89.4 ‐235.2 598.5 ‐120.2 The segment reported loss during the quarter due to change in the depreciation policy (additional depreciation charge of Rs. 143 mn due to revision in useful life of fixed assets in accordance with Companies Act, 2013). Adjusted for this, the business reported marginal profit of Rs. 22 mn in Q1FY15 Total 31714.2 26826.4 18.2 29887.7 6.1 Interest ‐151.5 ‐169.5 ‐10.6 ‐95.3 59.0 Other un‐allocable expenditure net off un‐allocable income 1094.0 965.5 13.3 2435.0 ‐55.1 Total Profit Before Tax 32656.7 27622.4 18.2 32227.4 1.3 Net EBITM (%) FMCG – cigarettes 64.8 63.4 142 bps 62.6 222 bps Margin expansion on Y‐o‐Y & Q‐o‐Q basis was driven by steep price hikes. FMCG ‐ others ‐0.8 ‐1.1 ‐ 1.9 ‐ Paperboards, paper & packaging 21.3 21.6 ‐30 bps 14.9 640 bps The business margins declined on Y‐o‐Y basis due to higher input cost. However, sequentially, the margins improved, led by improved mix, higher utilizations, and change in method of charging depreciation, which had a positive impact. Agri‐business 6.1 9.1 ‐296 bps 7.3 ‐112 bps Segment margins declined due to deterioration in mix and lower leaf tobacco sales). Hotels ‐4.9 3.6 ‐ 18.7 ‐ Total 28.9 30.2 ‐128 bps 29.9 ‐104 bps Capital Employed

- 4. RETAIL RESEARCH Page | 4 FMCG Cigarettes 50874.6 46563.3 9.3 57054.8 ‐10.8 FMCG Others 39417.4 30093.5 31.0 33835.3 16.5 Paper Boards, Paper & Packaging 54540.9 49866.1 9.4 53190.8 2.5 Agri Business 22990.3 17389.5 32.2 20524.4 12.0 Hotels 36484.6 35054.6 4.1 36253.9 0.6 Total Capital Employed 204307.8 178967.0 14.2 200859.2 1.7 (Source: Company, HDFC Sec) Other highlights / developments: • The Scheme of Arrangement between Wimco Limited (‘Wimco’) and the Company became effective on 27th June, 2014 on filing of the Order of the Hon’ble High Court with the respective Registrar of Companies. The Scheme, with effect from 1st April 2013, provided for the demerger of the Non Engineering Business of Wimco into the Company. The results for the quarter ended 30th June, 2014 reflect the effect of the Scheme. Pavan Poplar Limited and Prag Agro Farm Limited have become direct subsidiaries of the Company with effect from 27th June, 2014, consequent upon the Scheme becoming effective. • ITC is planning to enter new business segments such as fruit juice, tea, coffee and chocolates, among others. For years, there has been speculation about ITC launching dairy products and beverages, but this is the first time the company’s chairman announced it to shareholders. • Unlike earlier quarters, ITC did not provide with gross sales figures in this quarter. Conclusion & Recommendation: ITC’s Q1FY15 results (Y‐o‐Y) were in line with our estimates. Cigarettes volumes declined for fifth straight quarter by ~2‐3%. However, this was on expected lines. Steep price hikes initiated supported the overall growth, which remained in high double digits. Infact it was the highest value growth reported since Q3FY10. Growth in the FMCG business continued to moderate (more of less on expected lines), impacted by slowdown in consumption expenditure. Sharp rise in Agri business revenue growth (driven by trading opportunities in wheat, soya and coffee) was a positive surprise. Growth in Paperboard & Packaging was below our expectations, but still decent, while Hotels continued to disappoint with a revenue de‐growth. We were disappointed with the overall margin contraction on Y‐o‐Y basis (impacted by input cost inflation). Leaving cigarettes (which witnessed margin improvement led by price hikes) and FMCG business (which managed to lower its losses on Y‐o‐Y basis), all the other segments witnessed margin contraction. In the recently held FY15 Union Budget, the government hiked the excise duty on cigarettes by 11‐72% (72% on cigarettes of length not exceeding 65 mm and to 11‐21% hike for cigarettes of other lengths). For ITC, weightage average hike was ~21‐22%. The company has increased prices in some of its brands and packs by 4‐23% and is expected to take a further round of price increases in H2FY15 to neutralize the impact of excise hikes. While the below 64 mm cigarettes is gaining traction, its growth could be impacted post sharp excise hikes in this category. We would monitor the pricing action by ITC in this category in the coming quarters. Post the third straight year of steep hike in excise duty on cigarettes, we expect the cigarettes volume growth to remain subdued and decline in FY15 by around 4‐5%. However, price hikes would support the overall value growth & margins. Non‐Cigarettes FMCG business has been clearly witnessing moderation in revenue growth over the last few quarters, in line with the industry slowdown. We expect this to persist in near term. However, we expect recovery from Q2/Q3 of FY15, as we expect the economic growth & spending power to improve. The segment has managed

- 5. RETAIL RESEARCH Page | 5 to breakeven at EBIT level during FY14. Though in Q1, it reported losses, it could end the year FY15 in positive at PBIT level (improvement expected at gradual pace). Packaged foods, personal care and stationery businesses would be the key growth drivers of the business. We feel the hotel business revenue growth could continue to remain subdued until there is a meaningful improvement in domestic travel & tourism industry, which could be possible only if the global environment improves. As regards the Agri business, the growth in revenue & profits would improve (Growth in Q1FY15 was substantial high due to change in mix and is expected to normalize, but would still continue to be healthy) due to scaling up of operations at the recently commissioned state‐of‐the art green leaf tobacco threshing plant in Mysore, resulting in better quality and supply chain efficiencies. The Paper Board & Packaging business has started to witness some improvement in the product mix and volumes on the back of commissioning of 1 lac tpa new facility at Bhadrachalam (total capacity to increase to 5.5 lacs tpa). We expect better growth in revenues from this segment in the coming quarters. However, the business margins continue to be under pressure in near to medium term on the back of higher input cost. ITC has resorted to captive sourcing of wood through plantations. However, the same would be effective by FY16, post which we expect some stability / improvement in margins. We feel ITC is on track to meet our FY15 & FY16 estimates. Hence we are keeping them unchanged. At CMP, the stock trades at 23.9xFY16. While the downside in the stock price is limited from current levels, sharp rerating is unlikely to happen until we see a meaningful recovery in the cigarettes volume growth and FMCG & Hotels business. However, in the current FMCG industry scenario, ITC continues to remain one of our most preferred picks amongst the FMCG companies, given its diversified business portfolio. We are maintaining our price target at Rs. 377 (valuing the stock at 26xFY16E EPS). We feel investors could buy this stock at current levels and add it on dips to Rs. 312‐ 326 (21.5‐22.5xFY16E EPS) band for our price target over the next quarter. Financial Estimations: (Rs. in Million) Particulars FY11 FY12 FY13 FY14 FY15E FY16E Net Sales 211675.8 247984.3 296055.8 328825.6 378004.1 438484.8 Operating Profit 71213.1 84995.9 103324.2 119408.9 137593.5 160485.4 Net Profit 49876.1 61623.7 74183.9 86522.61 99037.1 115321.5 Equity 7738.1 7818.4 7901.8 7953.2 7955.0 7955.0 EPS (Rs.) 6.4 7.9 9.4 10.9 12.4 14.5 OPM (%) 33.6 34.3 34.9 36.3 36.4 36.6 PATM (%) 23.6 24.8 25.1 26.3 26.2 26.3 PE 53.7 43.9 36.9 31.8 27.8 23.9 (Source: Company, HDFC Sec Estimates)

- 6. RETAIL RESEARCH Page | 6 Analyst: Mehernosh K. Panthaki – IT, FMCG & Midcaps; Email ID: mehernosh.panthaki@hdfcsec.com RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients